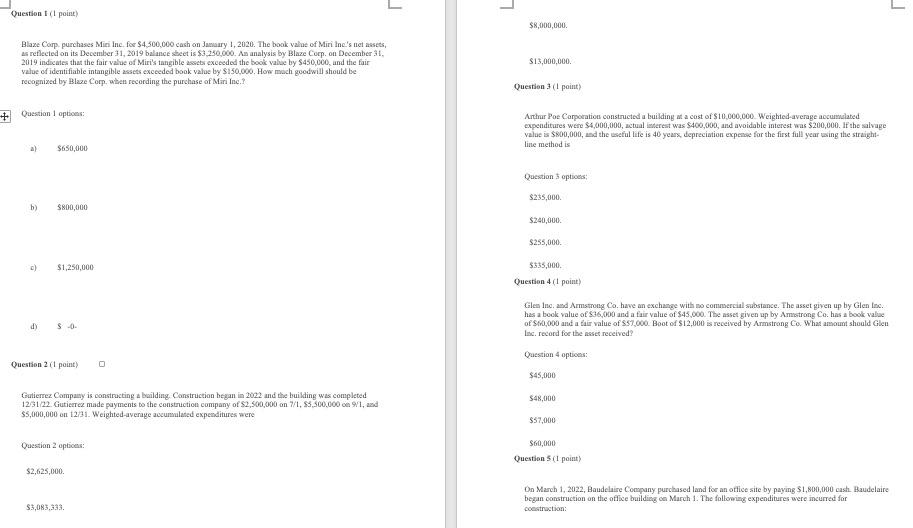

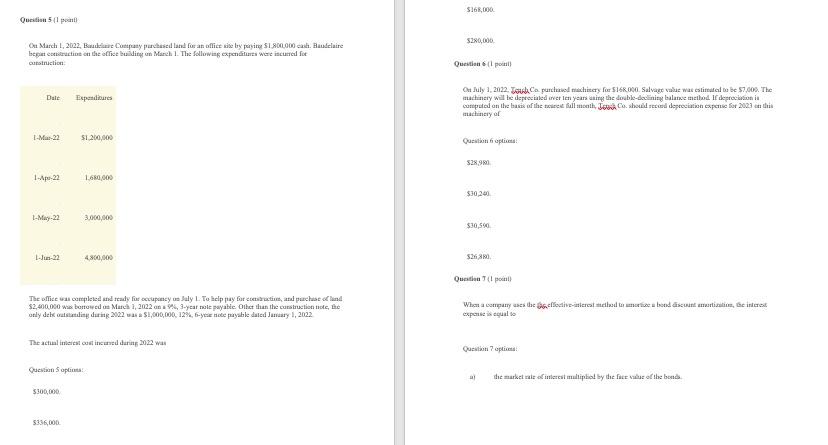

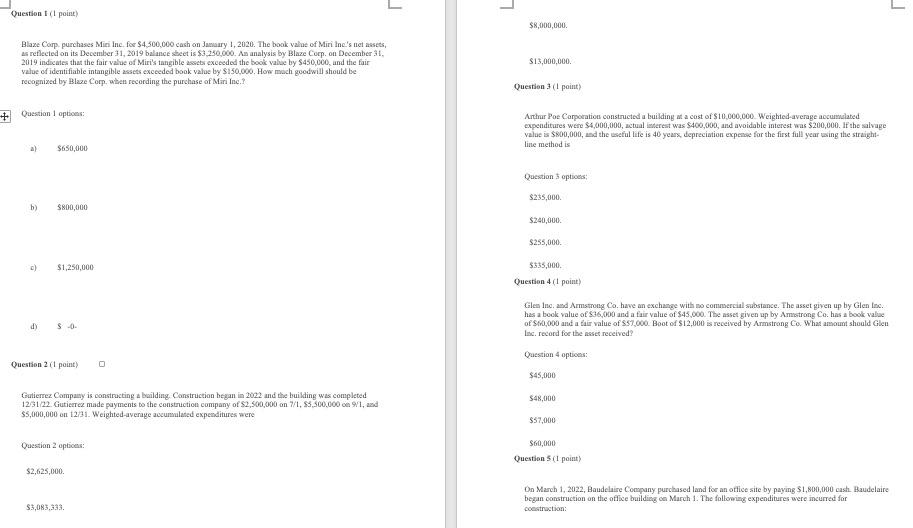

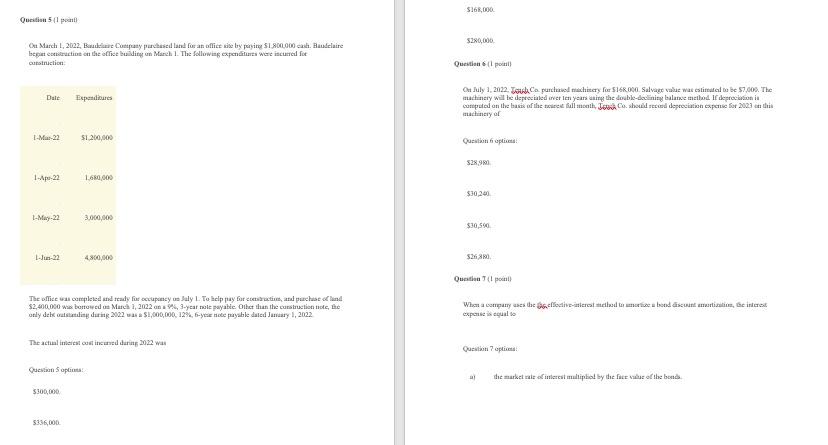

Question 1 ( point) $8,000,000 Blaze Corp purchases Miri Inc. for $4,500,000 cash on January 1, 2020. The book value of Miri Inc.'s net assets, As reflected on its December 31, 2019 balance sheet is $3,250,000. An analysis by Bluze Corp. on December 31 2019 indicates that the fair value of Mini's tangible assets exceeded the book value by $450,000, and the fair value of identifiable intangible assets exceeded book value by $150,000. How much goodwill should be recognized by Blaze Corp, when recording the purchase of Miri Inc. $13,000,000 Question point + Question options Arthur Poe Corporations constructed a building at a cost of $10,000,000 Weighted average accumlated expenditures were $4,000,000, actual underest was $400,000, and avoidable interest was $200,000. If the salvage value is $800,000, and the useful life is 40 years, depreciation expense for the first full year wing the straight line method is a) $650,000 Question options $235,000. b) S800,000 $240,000. $255,000. c) $1,250,000 $335,000 Question 4 (1 point) dy SO Glen Inc. and Armstrong Co. have an exchange with no commercial substance. The asset given up by Glen Inc. has a book value of 536,000 and a fair value of $45.000. The asset given up by Armstrong Co. has a book value of $10,000 and a fair value of $59.000. Boot of $12.000 is received by Armstrong Co. What amount should Glen lac. record for these received Question 4 options: Question 2 point) $45,000 $48,000 Gutierrez Company is constructing a building Construction began in 2022 and the building was completed 123122. Cutierez made payments to the construction company of $2,500,000 on 7/1.5.500.000 91, and $5,000,000 on 12/31. Weighted average accumulated expenditures were $57,000 Question 2 option $60,000 Questions point) $2,625,000. On March 1, 2022, Baudelaire Company purchased land for an ottice site by paying $1,800,000 cash Baudelaire began construction on the office building on March 1. The following expenditures were incurred for coastraction: S3,083,333 $16,000 Que 51 pont $280,000 On March 1, 2022, Bad Cpany purchased land for an oflict sie by paying 1.200.000 cl. Baudelaire legat construction on the office building on March 1. The following expenditures were incurred for utstriction Question pointill Dalt Expenditures Outluly 2012. Joule. Ca puncto matery for $16.000. Salvage value was estimated to be 57,000. The nachinery will be depreciated arvelen years asing the double-declining balanse mod If leprecation in competed on the basis of the tree fall math, Josshole spectation expense for 2023 on this stacionaryo L-Mar-22 $1,200,000 Questa pe 5289 1-Apr-22 1.680,000 $30,200 1-May-22 3,000,000 $30,500 L-22 52 4.800,000 Questa poml) The office was completed and teady for setupys July L. To help pay for it, anul pacuse lind $2.000.000 wa bontowed us March 1, 2022 en 3-year role payable Other than the construction to the usly dels casting during 2022 was 1,000,000. 12., 6-year nede payable dated January 1, 2002 When a company este effective interested teretoebrood ascultati, Ge interest gul t The actual interacticed during 2022 Questo Questi Solita the market rate oneres multiphol by the face value of the bonds $300,000 Question 1 ( point) $8,000,000 Blaze Corp purchases Miri Inc. for $4,500,000 cash on January 1, 2020. The book value of Miri Inc.'s net assets, As reflected on its December 31, 2019 balance sheet is $3,250,000. An analysis by Bluze Corp. on December 31 2019 indicates that the fair value of Mini's tangible assets exceeded the book value by $450,000, and the fair value of identifiable intangible assets exceeded book value by $150,000. How much goodwill should be recognized by Blaze Corp, when recording the purchase of Miri Inc. $13,000,000 Question point + Question options Arthur Poe Corporations constructed a building at a cost of $10,000,000 Weighted average accumlated expenditures were $4,000,000, actual underest was $400,000, and avoidable interest was $200,000. If the salvage value is $800,000, and the useful life is 40 years, depreciation expense for the first full year wing the straight line method is a) $650,000 Question options $235,000. b) S800,000 $240,000. $255,000. c) $1,250,000 $335,000 Question 4 (1 point) dy SO Glen Inc. and Armstrong Co. have an exchange with no commercial substance. The asset given up by Glen Inc. has a book value of 536,000 and a fair value of $45.000. The asset given up by Armstrong Co. has a book value of $10,000 and a fair value of $59.000. Boot of $12.000 is received by Armstrong Co. What amount should Glen lac. record for these received Question 4 options: Question 2 point) $45,000 $48,000 Gutierrez Company is constructing a building Construction began in 2022 and the building was completed 123122. Cutierez made payments to the construction company of $2,500,000 on 7/1.5.500.000 91, and $5,000,000 on 12/31. Weighted average accumulated expenditures were $57,000 Question 2 option $60,000 Questions point) $2,625,000. On March 1, 2022, Baudelaire Company purchased land for an ottice site by paying $1,800,000 cash Baudelaire began construction on the office building on March 1. The following expenditures were incurred for coastraction: S3,083,333 $16,000 Que 51 pont $280,000 On March 1, 2022, Bad Cpany purchased land for an oflict sie by paying 1.200.000 cl. Baudelaire legat construction on the office building on March 1. The following expenditures were incurred for utstriction Question pointill Dalt Expenditures Outluly 2012. Joule. Ca puncto matery for $16.000. Salvage value was estimated to be 57,000. The nachinery will be depreciated arvelen years asing the double-declining balanse mod If leprecation in competed on the basis of the tree fall math, Josshole spectation expense for 2023 on this stacionaryo L-Mar-22 $1,200,000 Questa pe 5289 1-Apr-22 1.680,000 $30,200 1-May-22 3,000,000 $30,500 L-22 52 4.800,000 Questa poml) The office was completed and teady for setupys July L. To help pay for it, anul pacuse lind $2.000.000 wa bontowed us March 1, 2022 en 3-year role payable Other than the construction to the usly dels casting during 2022 was 1,000,000. 12., 6-year nede payable dated January 1, 2002 When a company este effective interested teretoebrood ascultati, Ge interest gul t The actual interacticed during 2022 Questo Questi Solita the market rate oneres multiphol by the face value of the bonds $300,000