Question

Question 1 Polly Inc., a US company, is planning to set up a branch in Hong Kong to sell certain products of the Polly

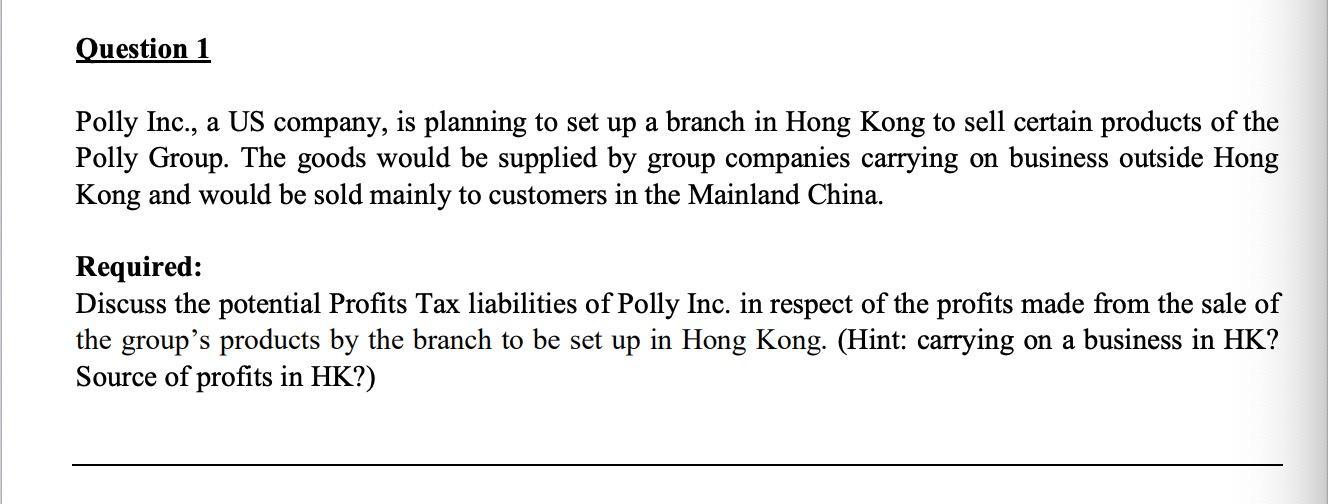

Question 1 Polly Inc., a US company, is planning to set up a branch in Hong Kong to sell certain products of the Polly Group. The goods would be supplied by group companies carrying on business outside Hong Kong and would be sold mainly to customers in the Mainland China. Required: Discuss the potential Profits Tax liabilities of Polly Inc. in respect of the profits made from the sale of the group's products by the branch to be set up in Hong Kong. (Hint: carrying on a business in HK? Source of profits in HK?)

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Polly Inc a US company is planning to set up a branch in Hong Kong to sell certain products of the Polly Group The goods would be supplied ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Financial Management

Authors: James Van Horne, John Wachowicz

13th Revised Edition

978-0273713630, 273713639

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App