Question 1

Prepare all the journal entries required to account for the lease of the delivery truck in the accounting records of Balemi Ltd, for the year ended 28 February 2022.

The journal entry relating to the current year depreciation expense for the delivery truck is not required. Journal narrations and dates are required for all journals.

Ignore tax.

Using the balance sheet method calculate the deferred tax balance (extract) in the accounting records of Eggs Aplenty Ltd as of 28 February 2022.

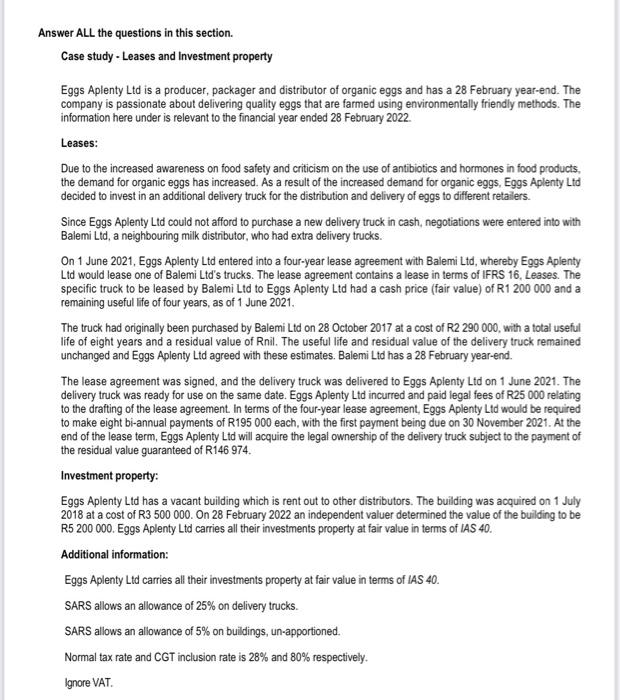

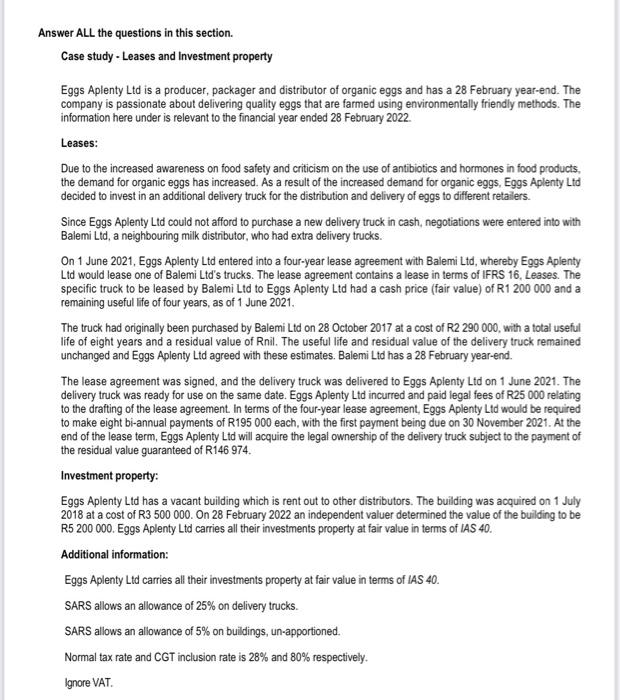

iswer ALL the questions in this section. Case study - Leases and Investment property Eggs Aplenty Ltd is a producer, packager and distributor of organic eggs and has a 28 February year-end. The company is passionate about delivering quality eggs that are farmed using environmentally friendly methods. The information here under is relevant to the financial year ended 28 February 2022. Leases: Due to the increased awareness on food safety and criticism on the use of antibiotics and hormones in food products, the demand for organic eggs has increased. As a result of the increased demand for organic eggs, Eggs Aplenty Ltd decided to invest in an additional delivery truck for the distribution and delivery of eggs to different retailers. Since Eggs Aplenty Ltd could not afford to purchase a new delivery truck in cash, negotiations were entered into with Balemi Lid, a neighbouring milk distributor, who had extra delivery trucks. On 1 June 2021, Eggs Aplenty Ltd entered into a four-year lease agreement with Balemi Ltd, whereby Eggs Aplenty Ltd would lease one of Balemi Ltd's trucks. The lease agreement contains a lease in terms of IFRS 16, Leases. The specific truck to be leased by Balemi Ltd to Eggs Aplenty Ltd had a cash price (fair value) of R1 200000 and a remaining useful life of four years, as of 1 June 2021. The truck had originally been purchased by Balemi Ltd on 28 October 2017 at a cost of R2 290000 , with a total useful life of eight years and a residual value of Rnil. The useful life and residual value of the delivery truck remained unchanged and Eggs Aplenty Ltd agreed with these estimates. Balemi Ltd has a 28 February year-end. The lease agreement was signed, and the delivery truck was delivered to Eggs Aplenty Ltd on 1 June 2021. The delivery truck was ready for use on the same date. Eggs Aplenty Ltd incurred and paid legal fees of R25 000 relating to the drafting of the lease agreement. In terms of the four-year lease agreement, Eggs Aplenty Ltd would be required to make eight bi-annual payments of R195 000 each, with the first payment being due on 30 November 2021. At the end of the lease term, Eggs Aplenty Ltd will acquire the legal ownership of the delivery truck subject to the payment of the residual value guaranteed of R146 974 . Investment property: Eggs Aplenty Ltd has a vacant building which is rent out to other distributors. The building was acquired on 1 July 2018 at a cost of R3 500000 . On 28 February 2022 an independent valuer determined the value of the building to be R5 200 000. Eggs Aplenty Ltd carries all their investments property at fair value in terms of IAS 40. Additional information: Eggs Aplenty Ltd carries all their investments property at fair value in terms of IAS 40. SARS allows an allowance of 25% on delivery trucks. SARS allows an allowance of 5% on buildings, un-apportioned. Normal tax rate and CGT inclusion rate is 28% and 80% respectively. lgnore VAT