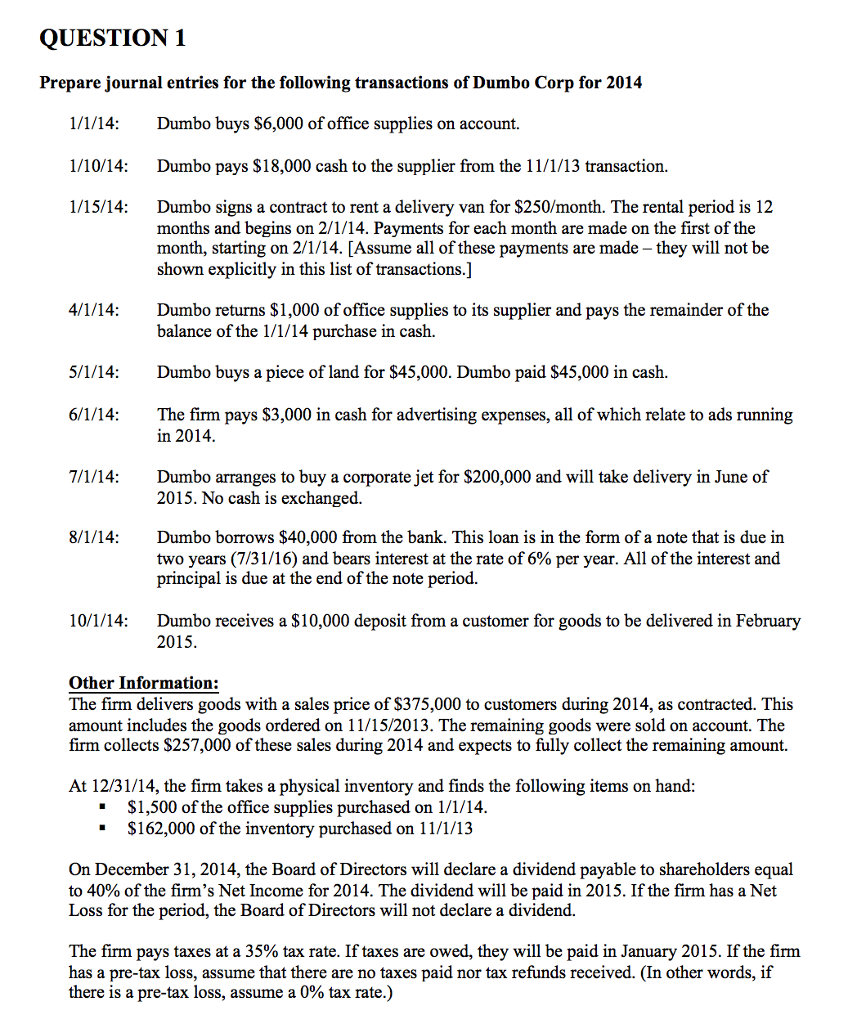

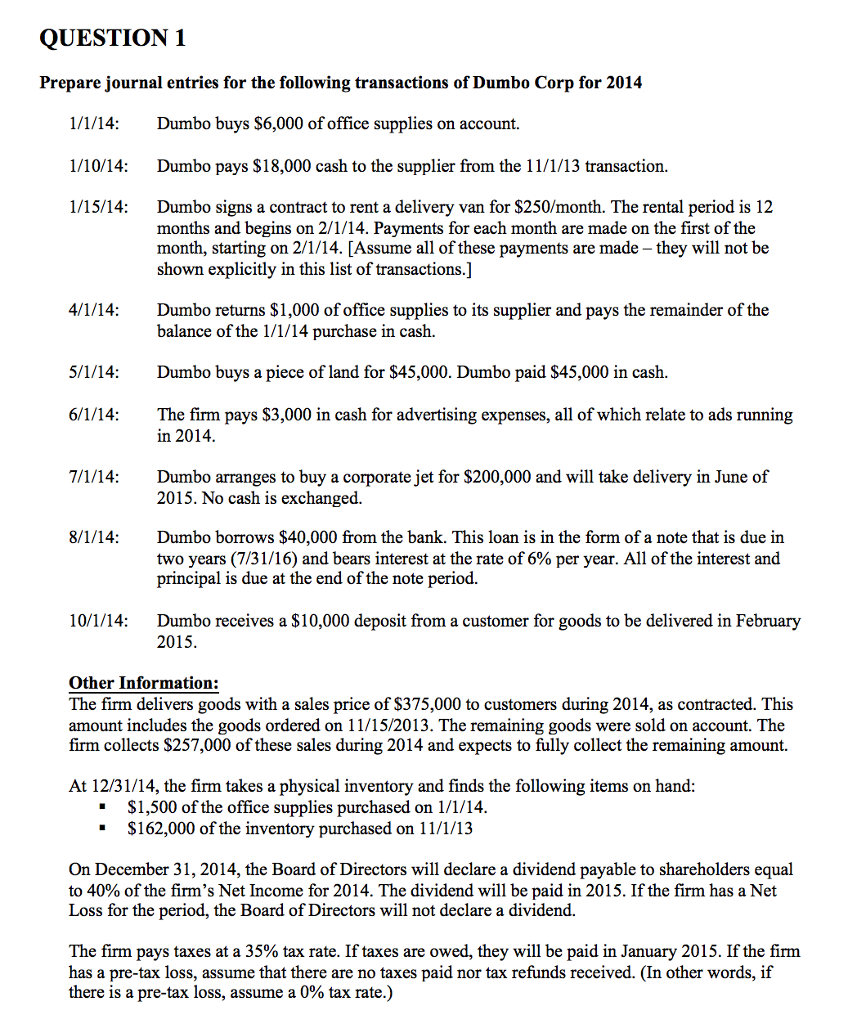

QUESTION 1 Prepare journal entries for the following transactions of Dumbo Corp for 2014 1/1/14:Dumbo buys $6,000 of office supplies on account. 1/10/14:Dumbo pays $18,000 cash to the supplier from the 11/1/13 transaction. 1/15/14:Dumbo signs a contract to rent a delivery van for S250/month. The rental period is 12 months and begins on 2/1/14. Payments for each month are made on the first of the month, starting on 2/1/14. [Assume all of these payments are made - they will not be shown explicitly in this list of transactions.] 4/1/14:Dumbo returns $1,000 of office supplies to its supplier and pays the remainder of the balance of the 1/1/14 purchase in cash. 5/1/14:Dumbo buys a piece of land for $45,000. Dumbo paid $45,000 in cash. 6/1/14:The firm pays $3,000 in cash for advertising expenses, all of which relate to ads running in 2014 7/1/14:Dumbo arranges to buy a corporate jet for $200,000 and will take delivery in June of 2015. No cash is exchanged. 8/1/14:Dumbo borrows $40,000 from the bank. This loan is in the form of a note that is due in two years (7/31/16) and bears interest at the rate of 6% per year. All of the interest and principal is due at the end of the note period. 10/1/14:Dumbo receives a $10,000 deposit from a customer for goods to be delivered in February 2015 Other Information: The firm delivers goods with a sales price of S375,000 to customers during 2014, as contracted. This amount includes the goods ordered on 11/15/2013. The remaining goods were sold on account. The firm collects $257,000 of these sales during 2014 and expects to fully collect the remaining amount. At 12/31/14, the firm takes a physical inventory and finds the following items on hand $1,500 of the office supplies purchased on 1/1/14 $162,000 of the inventory purchased on 11/1/13 * - On December 31, 2014, the Board of Directors will declare a dividend payable to shareholders equal to 40% of the firm's Net Income for 2014, The dividend will be paid in 2015. If the firm has a Net Loss for the period, the Board of Directors will not declare a dividend. The firm pays taxes at a 35% tax rate. If taxes are owed, they will be paid in January 2015 . If the firm has a pre-tax loss, assume that there are no taxes paid nor tax refunds received. (In other words, if there is a pre-tax loss, assume a 0% tax rate.)