Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a balance sheet and an income statement. Would you be so kind to ensure that you include this account (i.e., Accounts Payable with a

Prepare a balance sheet and an income statement.

Would you be so kind to ensure that you include this account (i.e., “Accounts Payable” with a trial balance value of $123,000,000) into the initial list of trial balance accounts along with the value noted.

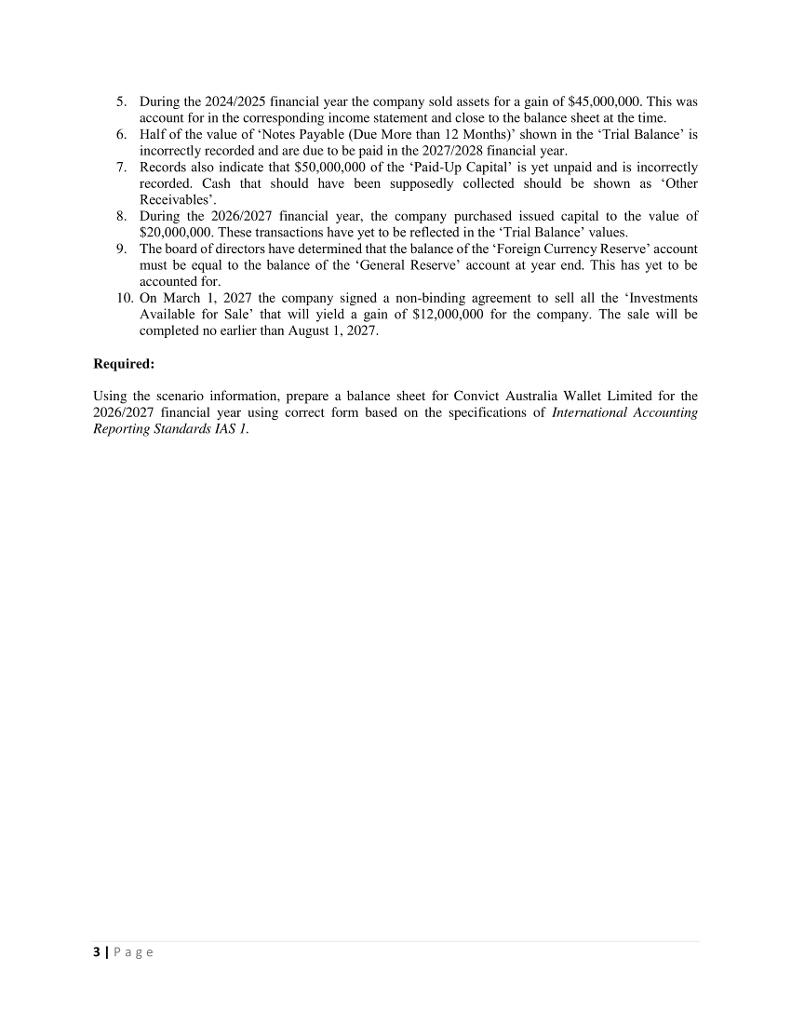

Question 1: Preparing a Balance Sheet Convict Australia Wallet Limited is a wholesaler of luxury brand wallets and watches. The company set up an office in Perth in 2022 and have established a strong distribution network throughout the Australia and South-East Asia. The financial year of the company is from April 1 to March 31. Due to an unexpected accident involving the company's regular accountant, you have been engaged to prepare the 2026/2027 financial year (that is, April 1, 2026 to March 31, 2027) for Convict Australia Wallet Limited. After examining the notes of the company's regular accountant, you have discovered the following initial of accounts and trial balance amounts have been registered. Account Name Accounts Receivable Accumulated Depreciation Associate Investment Bank Loans Cash Copyright Foreign Currency Reserve. Gain on Sale of Land General Reserve Goodwill Income Tax Expense Inventory Investments Available for Sale Land Long-Term Bonds (Due More than 12 Months) Long-Term Investment (Held to Maturity) Long-Term Pension Obligations Notes Payable (Due More than 12 Months) Paid-Up Capital Patents Property, Plant and Equipment Retained Earnings Sales Revenue Short-Term Marketable Securities Wages and Salaries Trial Balance Value $41,000,000.00 $95,000,000.00 $111,000,000.00 $145,000,000.00 $126,500,000.00 12000 $2,500,000.00 $50,000,000.00 $14,000,000.00 $75,000,000.00 $10,500,000.00 $12,650,000.00 2 | Page $111,000,000.00 $25,000,000.00 $360,000,000.00 $75,000,000.00 $25,000,000.00 $14,000,000.00 $39,000,000.00 $255,000,000.00 $1,500,000.00 $180,000,000.00 $145,000,000.00 $256,000,000.00 $22,000,000.00 $42,500,000.00 The following key information has already been prepared by the regular accountant. 1. A review of the 'Goodwill' account indicated an amount of goodwill to the value of $1,500,000 had been impaired. This impairment had yet to be reduced from the 'Goodwill' account balance, or the 'Retained Earnings'. 2. The value of 'Property, Plant and Equipment' is shown in the accounts at the historical value. The annual depreciation of $18,000,000 has yet to be deducted for the 2026/2027 financial year. 3. The value of 'Inventory as shown in the Trial Balance is at cost. The net realizable value of inventory is indicated to be $145,000,000. 4. Expenses (e.g., insurance) for the 2027/2028 financial year to the amount of $2,200,000 were prepaid using cash 2 days prior to the end of the 2026/2027 financial year. This amount has yet to be shown in the trial balance values nor deducted from the cash account.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Ugly Face Surgary Income Statement For the period ending June 30 2025 Sales Revenue Facial ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started