Answered step by step

Verified Expert Solution

Question

1 Approved Answer

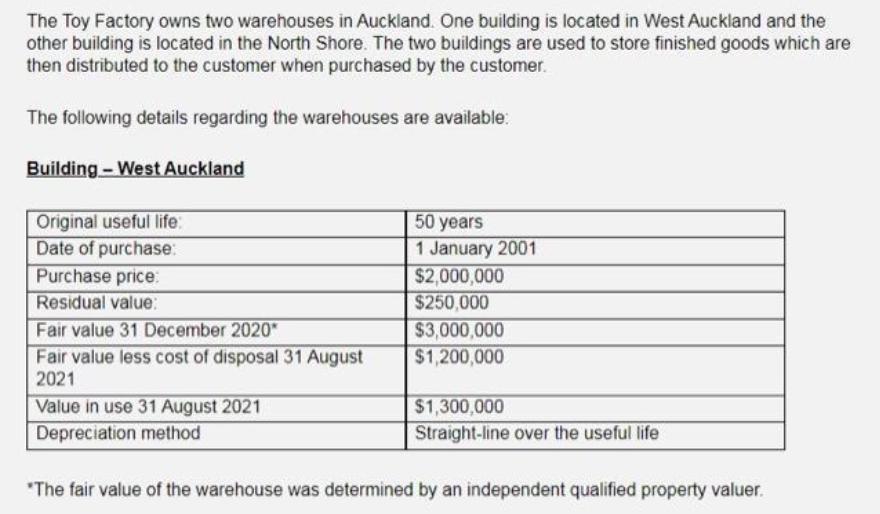

The Toy Factory owns two warehouses in Auckland. One building is located in West Auckland and the other building is located in the North

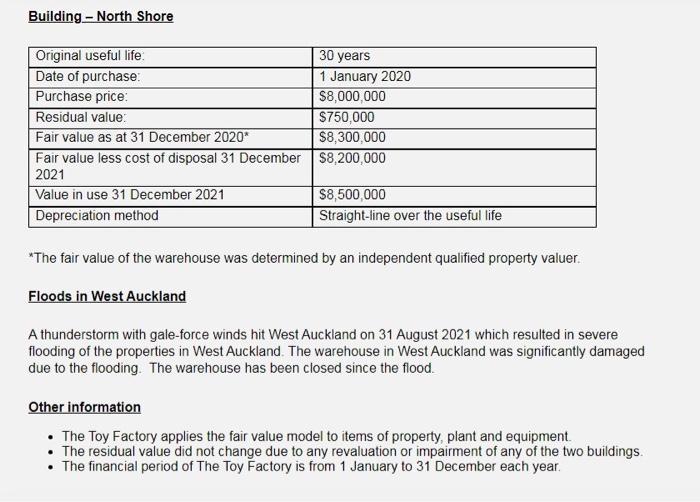

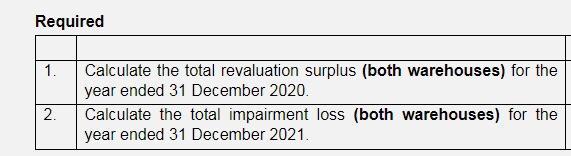

The Toy Factory owns two warehouses in Auckland. One building is located in West Auckland and the other building is located in the North Shore. The two buildings are used to store finished goods which are then distributed to the customer when purchased by the customer. The following details regarding the warehouses are available: Building - West Auckland Original useful life: Date of purchase: Purchase price: 50 years 1 January 2001 $2,000,000 $250,000 Residual value: Fair value 31 December 2020 Fair value less cost of disposal 31 August 2021 $3,000,000 $1,200,000 Value in use 31 August 2021 Depreciation method $1,300,000 Straight-line over the useful life "The fair value of the warehouse was determined by an independent qualified property valuer. Building - North Shore Original useful life. Date of purchase: Purchase price: Residual value: Fair value as at 31 December 2020* Fair value less cost of disposal 31 December S8,200,000 2021 30 years 1 January 2020 S8,000,000 S750,000 S8,300,000 Value in use 31 December 2021 Depreciation method $8,500,000 Straight-line over the useful life *The fair value of the warehouse was determined by an independent qualified property valuer. Floods in West Auckland A thunderstorm with gale-force winds hit West Auckland on 31 August 2021 which resulted in severe flooding of the properties in West Auckland. The warehouse in West Auckland was significantly damaged due to the flooding. The warehouse has been closed since the flood. Other information The Toy Factory applies the fair value model to items of property, plant and equipment. The residual value did not change due to any revaluation or impairment of any of the two buildings. The financial period of The Toy Factory is from 1 January to 31 December each year. Required 1. Calculate the total revaluation surplus (both warehouses) for the year ended 31 December 2020. 2. Calculate the total impairment loss (both warehouses) for the year ended 31 December 2021.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution I Caleulation ob Tatal Reualuation Surplus ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started