Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Provide any 4 issues that a manager must consider in implementing an activity-based costing system. Question 2 Discuss the advantages of having

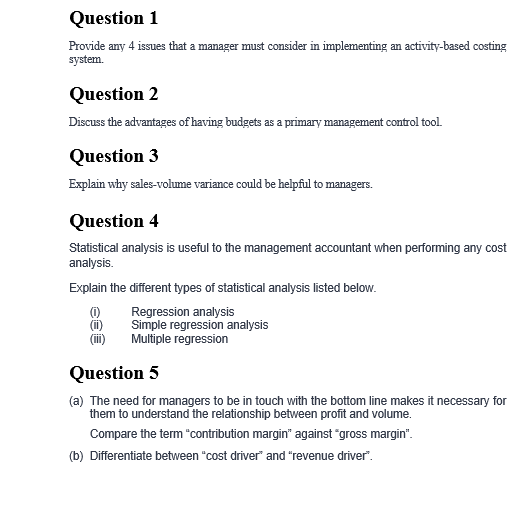

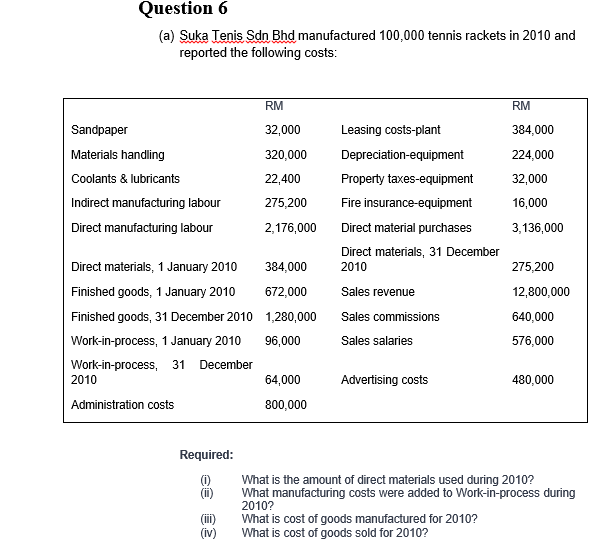

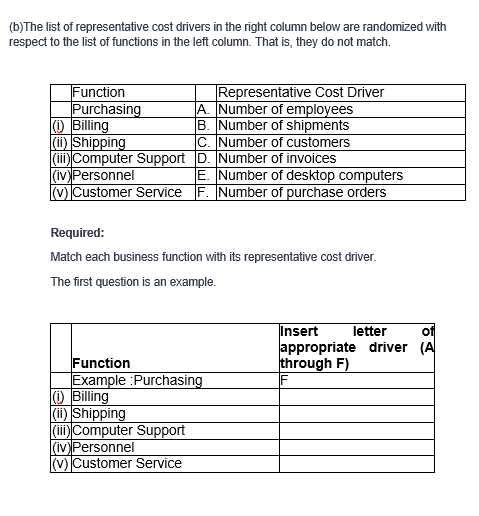

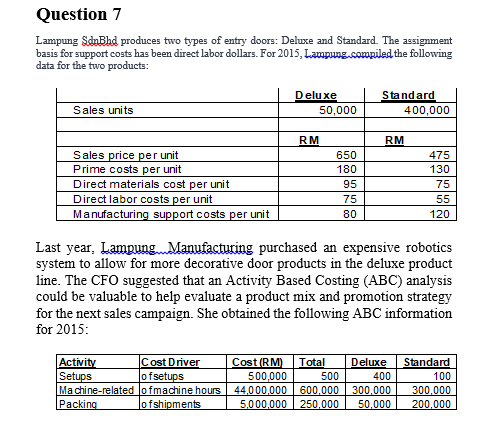

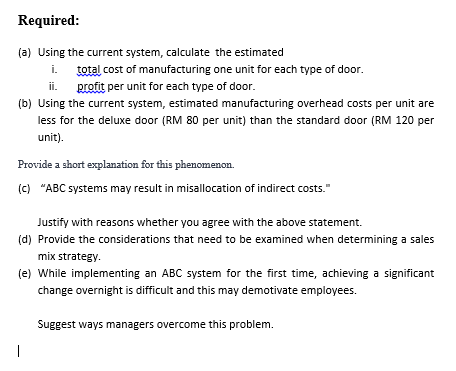

Question 1 Provide any 4 issues that a manager must consider in implementing an activity-based costing system. Question 2 Discuss the advantages of having budgets as a primary management control tool. Question 3 Explain why sales-volume variance could be helpful to managers. Question 4 Statistical analysis is useful to the management accountant when performing any cost analysis. Explain the different types of statistical analysis listed below. (i) Regression analysis (ii) Simple regression analysis Multiple regression Question 5 (a) The need for managers to be in touch with the bottom line makes it necessary for them to understand the relationship between profit and volume. Compare the term "contribution margin" against "gross margin". (b) Differentiate between "cost driver" and "revenue driver". Question 6 (a) Suka Tenis Sdn Bhd manufactured 100,000 tennis rackets in 2010 and reported the following costs: RM RM Sandpaper 32,000 Leasing costs-plant 384,000 Materials handling 320,000 Depreciation-equipment 224,000 Coolants & lubricants 22,400 Property taxes-equipment 32,000 Indirect manufacturing labour 275,200 Fire insurance-equipment 16,000 Direct manufacturing labour 2,176,000 Direct material purchases 3,136,000 Direct materials, 31 December Direct materials, 1 January 2010 384,000 2010 275,200 Finished goods, 1 January 2010 Finished goods, 31 December 2010 672,000 Sales revenue 12,800,000 1,280,000 Sales commissions 640,000 Work-in-process, 1 January 2010 Work-in-process, 31 December 96,000 Sales salaries 576,000 2010 64,000 Advertising costs 480,000 Administration costs 800,000 Required: (i) (ii) (iii) What is the amount of direct materials used during 2010? What manufacturing costs were added to Work-in-process during 2010? What is cost of goods manufactured for 2010? (iv) What is cost of goods sold for 2010? (b)The list of representative cost drivers in the right column below are randomized with respect to the list of functions in the left column. That is, they do not match. Function Purchasing (i) Billing (ii) Shipping (iii) Computer Support (iv) Personnel (V) Customer Service Required: Representative Cost Driver A. Number of employees B. Number of shipments C. Number of customers D. Number of invoices E. Number of desktop computers F. Number of purchase orders Match each business function with its representative cost driver. The first question is an example. Function Example :Purchasing (i) Billing (ii) Shipping (iii) Computer Support (iv)Personnel (v) Customer Service Insert letter of appropriate driver (A through F) Question 7 Lampung Sdn Bhd produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs has been direct labor dollars. For 2015, Lampung.compiled the following data for the two products: Sales units Sales price per unit Prime costs per unit Direct materials cost per unit Direct labor costs per unit Deluxe Standard 50,000 400,000 RM RM 650 475 180 130 95 75 75 55 80 120 Manufacturing support costs per unit Last year, Lampung Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an Activity Based Costing (ABC) analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information for 2015: Activity Cost Driver Setups ofsetups Cost (RM) 500,000 Total Deluxe Standard 500 Machine-related lofmachine hours 44,000,000 600,000 400 300,000 100 300,000 Packing of shipments 5,000,000 250,000 50,000 200,000 | Required: (a) Using the current system, calculate the estimated i. total cost of manufacturing one unit for each type of door. ii. profit per unit for each type of door. (b) Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door (RM 80 per unit) than the standard door (RM 120 per unit). Provide a short explanation for this phenomenon. (c) "ABC systems may result in misallocation of indirect costs." Justify with reasons whether you agree with the above statement. (d) Provide the considerations that need to be examined when determining a sales mix strategy. (e) While implementing an ABC system for the first time, achieving a significant change overnight is difficult and this may demotivate employees. Suggest ways managers overcome this problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started