Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: question 2: 3 4 5 Tesla, a vehicle manufacturer, incurs the following costs. (1) Classify each cost as either a product or a

Question 1:

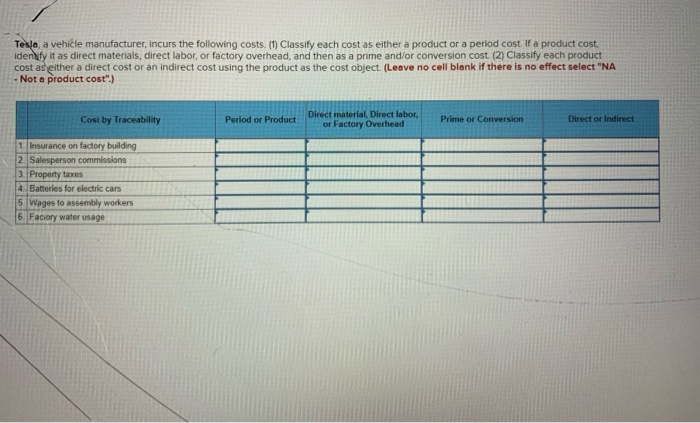

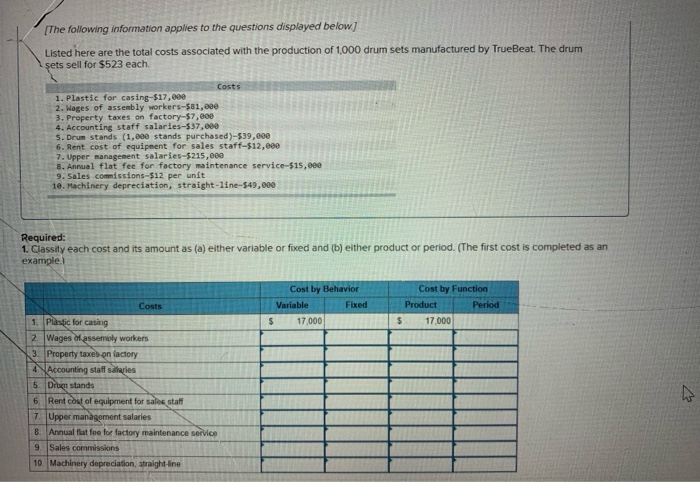

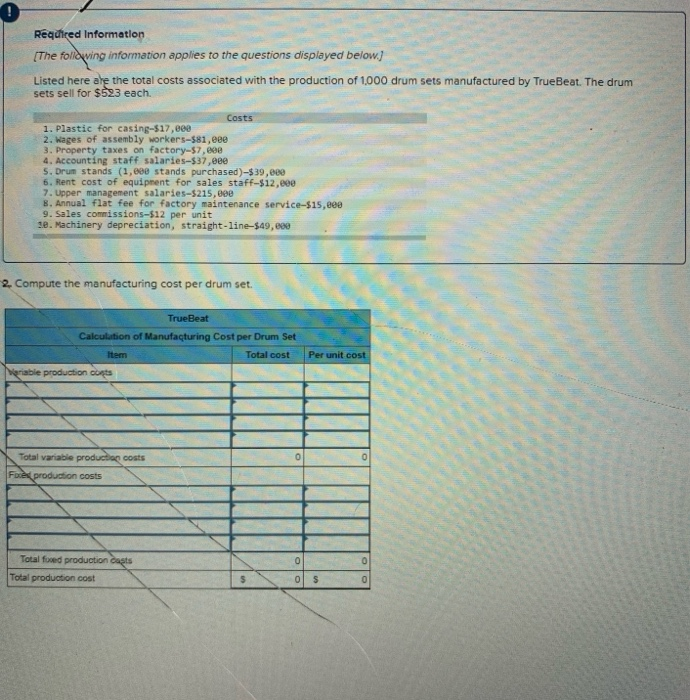

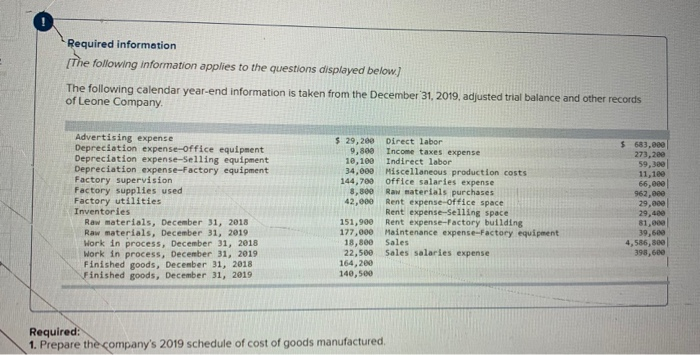

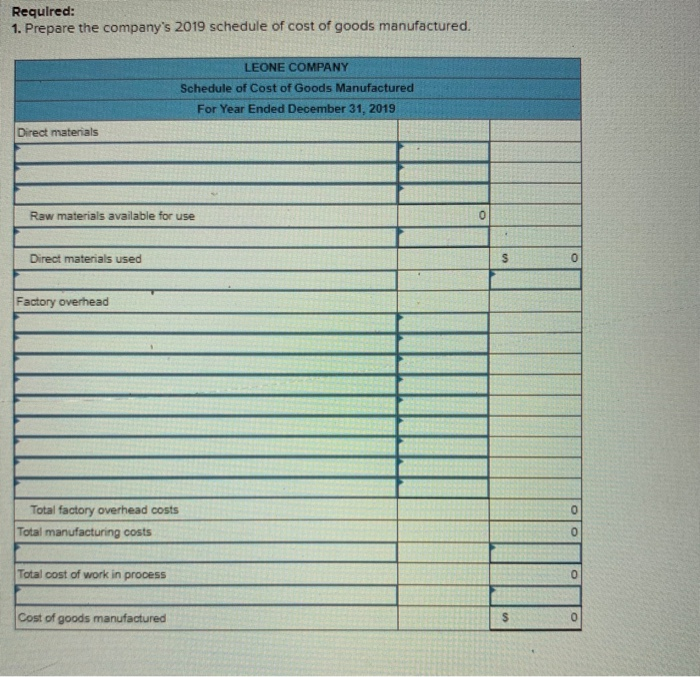

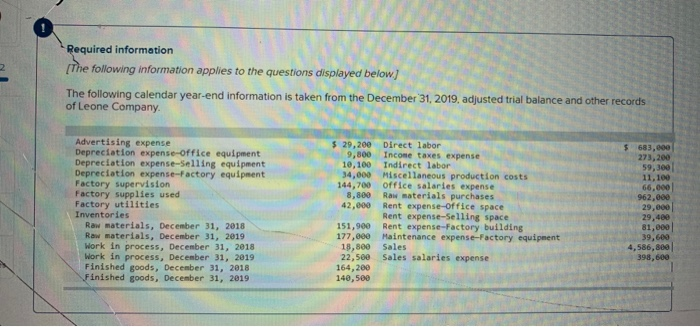

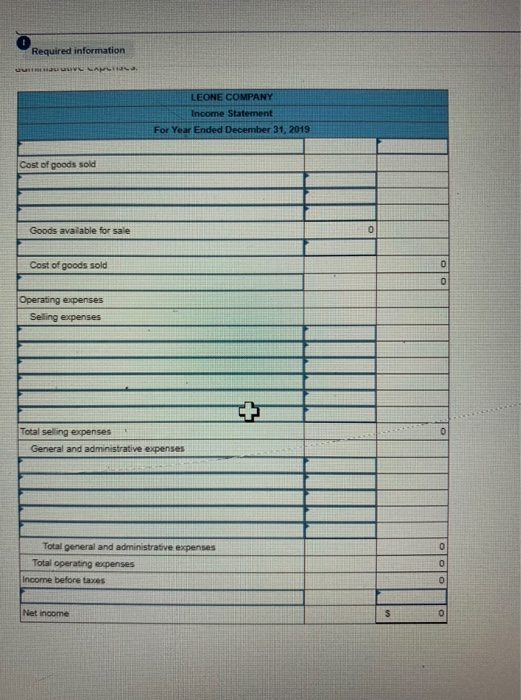

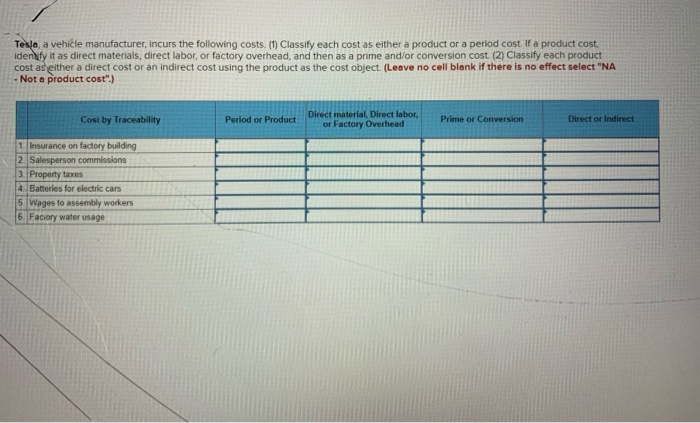

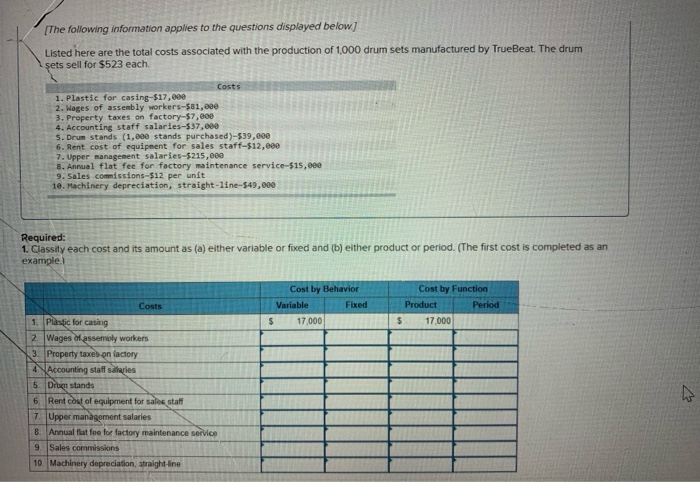

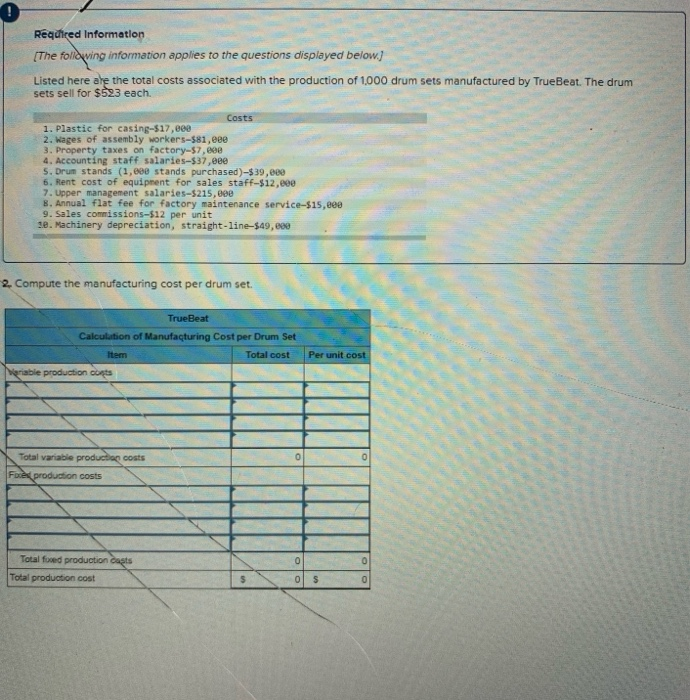

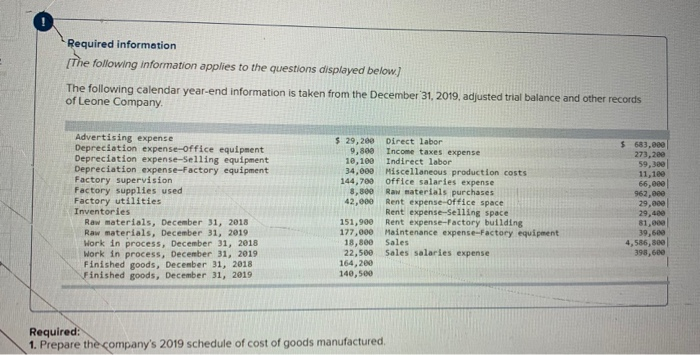

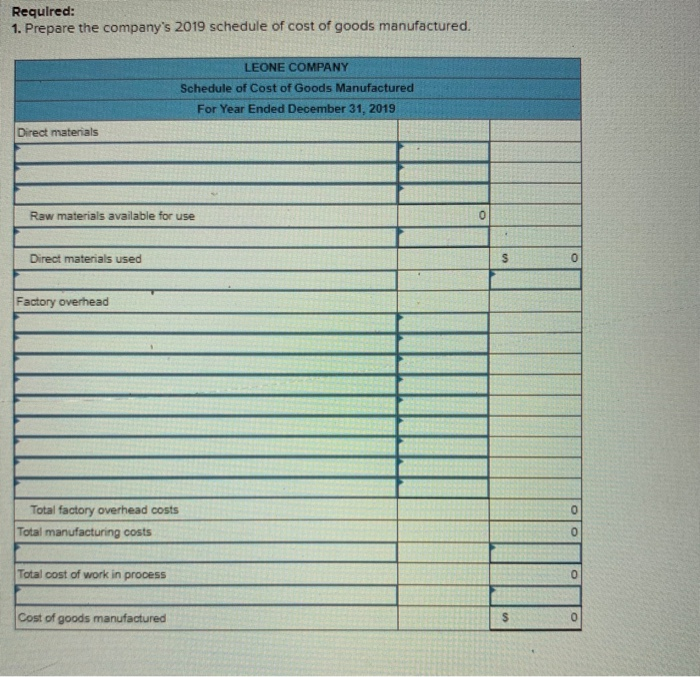

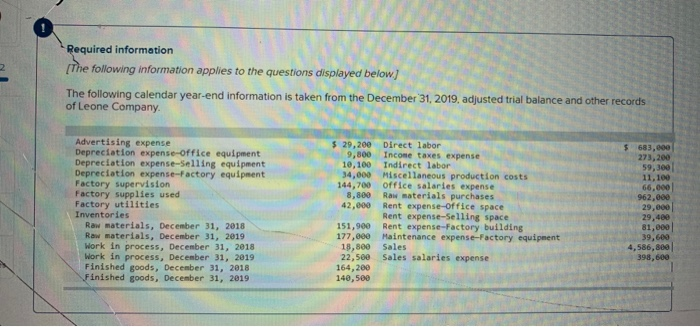

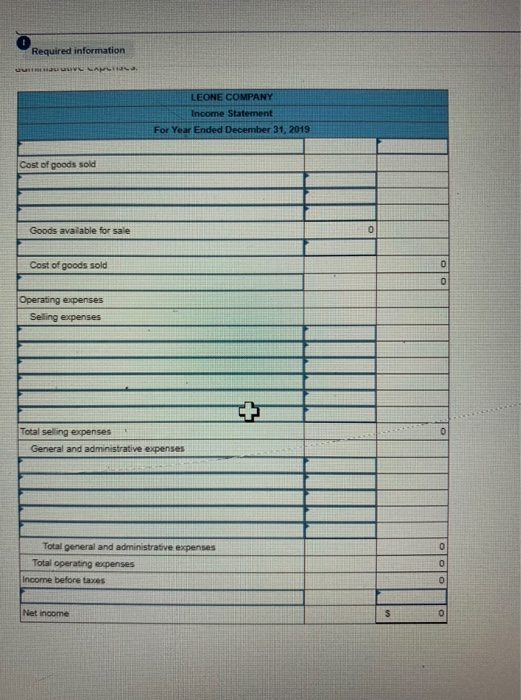

Tesla, a vehicle manufacturer, incurs the following costs. (1) Classify each cost as either a product or a period cost. If a product cost, iden fy it as direct materials, direct labor, or factory overhead, and then as a prime and/or conversion cost. (2) Classify each product cost as either a direct cost or an indirect cost using the product as the cost object. (Leave no cell blank if there is no effect select "NA - Not a product cost") Period or Product Direct material, Direct labor or Factory Overhead Prime or Conversion Direct or indirect Cost by Traceability 1. Insurance on factory building 2. Salesperson commissions 3. Property taxes 4. Batteries for electric cars 5 Wages to assembly workers 6. Facilory water usage [The following information applies to the questions displayed below] Listed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum ets sell for $523 each Costs 1. Plastic for casing-$17,000 2. Wages of assembly workers-581,000 3. Property taxes on factory-$7,000 4. Accounting staff salaries-$37.000 5. Drum stands (1,000 stands purchased)-539,000 6. Rent cost of equipment for sales staff-$12,000 7. Upper management salaries-$215,000 8. Annual flat fee for factory maintenance service-515,000 9. Sales commissions-$12 per unit 10. Machinery depreciation, straight-line-$49,000 Required: 1. Classily each cost and its amount as (a) either variable or fixed and (b) either product or period. (The first cost is completed as an example: Cost by Behavior Variable Fixed 17,000 Cost by Function Product Period 17.000 $ $ Costs 1. Plastic for casing 2. Wages of assembly workers 3. Property taxes on factory Accounting staff salaries 5. Drum stands 6. Rent cost of equipment for sale staff 7 Upper management salaries 8. Annual flat foe for factory maintenance service 9 Sales commissions 10. Machinery depreciation, straight-line Required Information (The following information applies to the questions displayed below) Listed here are the total costs associated with the production of 1.000 drum sets manufactured by TrueBeat. The drum sets sell for $623 each. Costs 1. Plastic for casing-$17,888 2. Wages of assembly workers-581, eee 3. Property taxes on factory-57, eee 4. Accounting staff salaries-$37,eee 5. Drum stands (1,000 stands purchased)-$ 39,629 6. Rent cost of equipment for sales staff-$12,000 7. Upper management salaries-$215,000 8. Annual flat fee for factory maintenance service-$15,000 9. Sales commissions-$12 per unit 3. Machinery depreciation, straight-line-$49,800 2. Compute the manufacturing cost per drum set. TrueBeat Calculation of Manufacturing Cost per Drum Set Item Total cost priable production corts Per unit cost 0 Total variable production costs Forex production costs 0 0 Total food production costs Total production cost 0 $ Required information [The following information applies to the questions displayed below.) The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Inventories Raw materials, December 31, 2018 Raw materials, December 31, 2019 Work in process, December 31, 2018 Work in process, December 31, 2019 Finished goods, December 31, 2018 Finished goods, December 31, 2019 $ 29, 200 Direct labor 9,800 Income taxes expense 10,100 Indirect labor 34,000 Miscellaneous production costs 144,700 office salaries expense 8,800 Raw materials purchases 42,000 Rent expense-office space Rent expense-selling space 151,900 Rent expense-Factory building 177,000 Maintenance expense-Factory equipment 18,800 Sales 22,500 Sales salaries expense 164,200 140,500 $ 683,000 273,200 59,300 11,100 66,000 962,00 29.000 29,400 81,000 39,600 4,586,500 398,600 Required: 1. Prepare the company's 2019 schedule of cost of goods manufactured Required: 1. Prepare the company's 2019 schedule of cost of goods manufactured. LEONE COMPANY Schedule of Cost of Goods Manufactured For Year Ended December 31, 2019 Direct materials Raw materials available for use 0 Direct materials used S 0 Factory overhead 0 Total factory overhead costs Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured S 0 Required information [The following information applies to the questions displayed below) The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Inventories Raw materials, December 31, 2018 Raw materials, December 31, 2019 Work in process, December 31, 2018 Work in process, December 31, 2019 Finished goods, December 31, 2018 Finished goods, December 31, 2019 $ 29, 200 Direct labor 9,800 Income taxes expense 10,100 Indirect labor 34,000 Miscellaneous production costs 144,700 office salaries expense 8,800 Raw materials purchases 42,000 Rent expense-office space Rent expense-selling space 151,900 Rent expense-Factory building 177,000 Maintenance expense-Factory equipment 18,800 Sales 22,500 Sales salaries expense 164,200 148,500 $ 683,000 273,200 59,300 11,100 66,000 962,000 29,000 29,400 81,000 39,600 4,586,800 398,600 Required information UNA. LEONE COMPANY Income Statement For Year Ended December 31, 2019 Cost of goods sold Goods available for sale 0 Cost of goods sold 0 0 Operating expenses Selling expenses 0 Total selling expenses General and administrative expenses 0 Total general and administrative expenses Total operating expenses Income before taxes 0 0 Net income 0

question 2:

3

4

5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started