QUESTION 1:

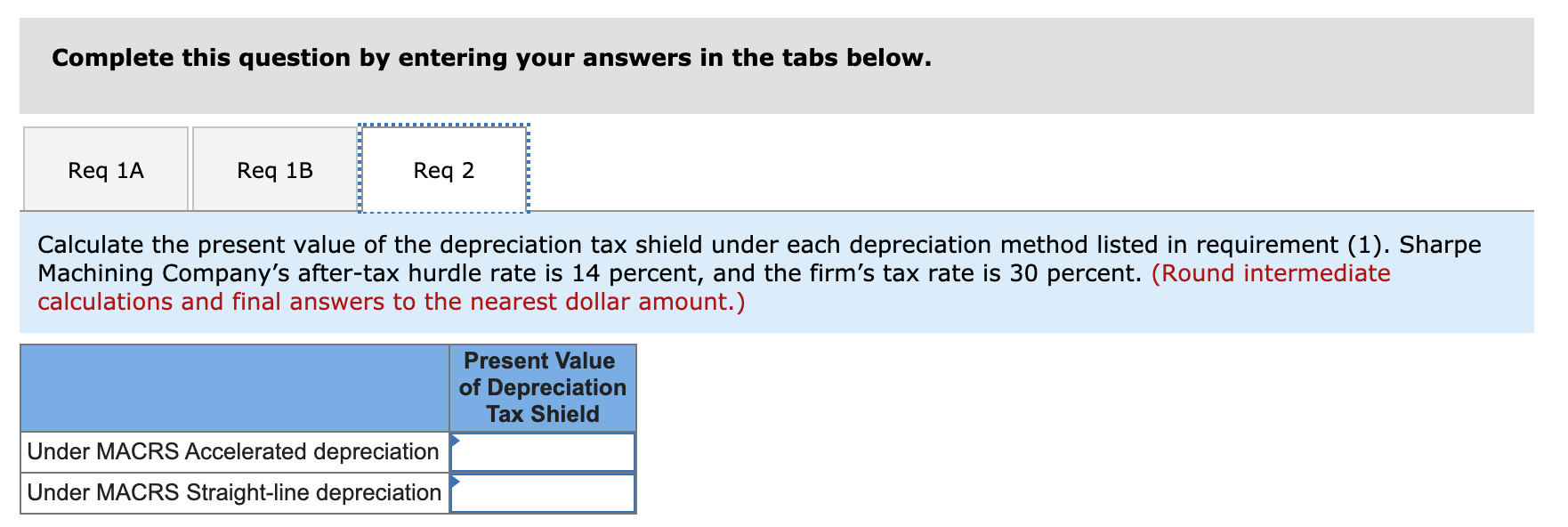

QUESTION 2: I have the answers for 1A and 1B, I need help with 2

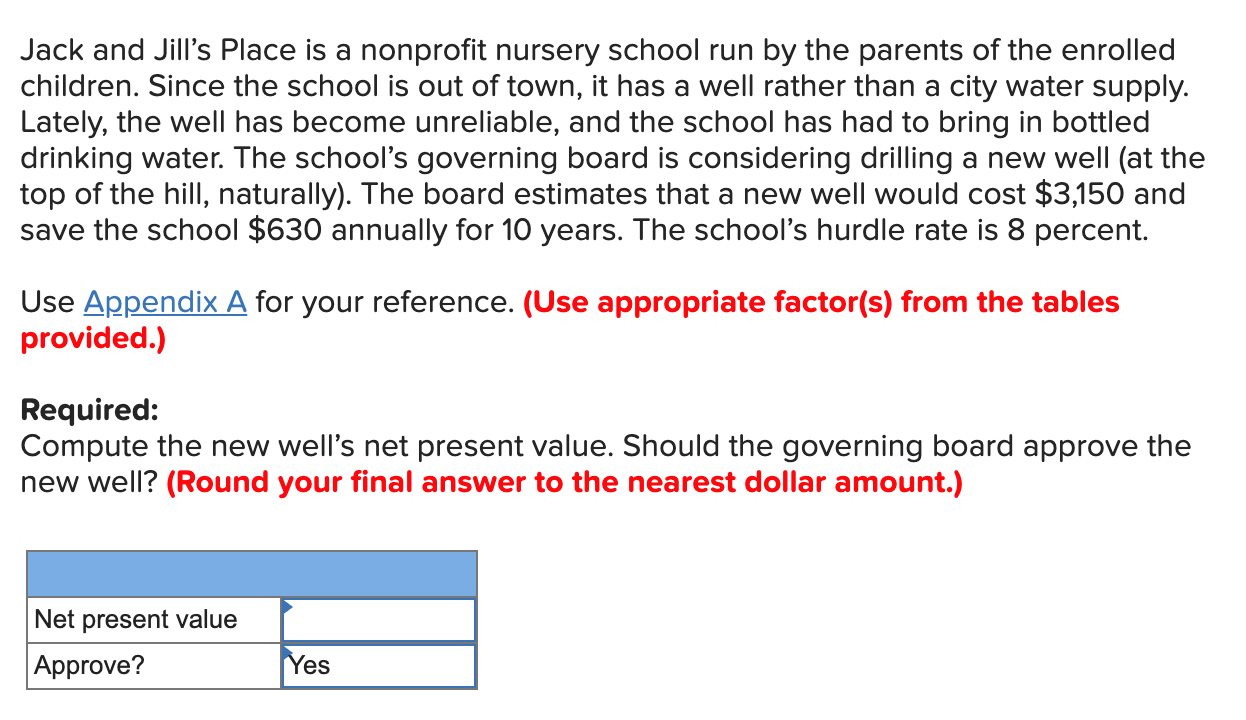

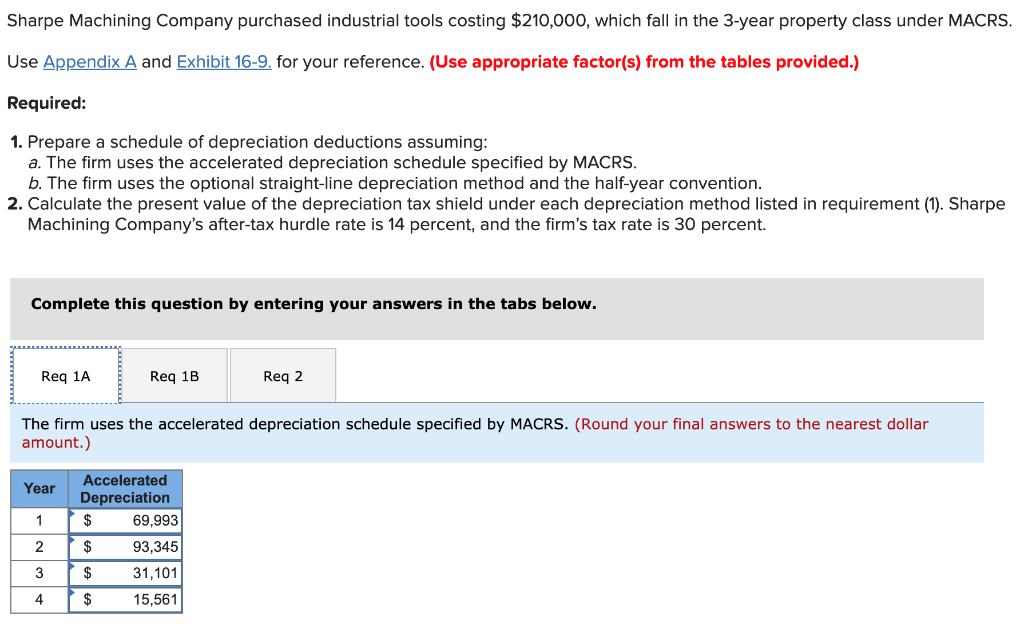

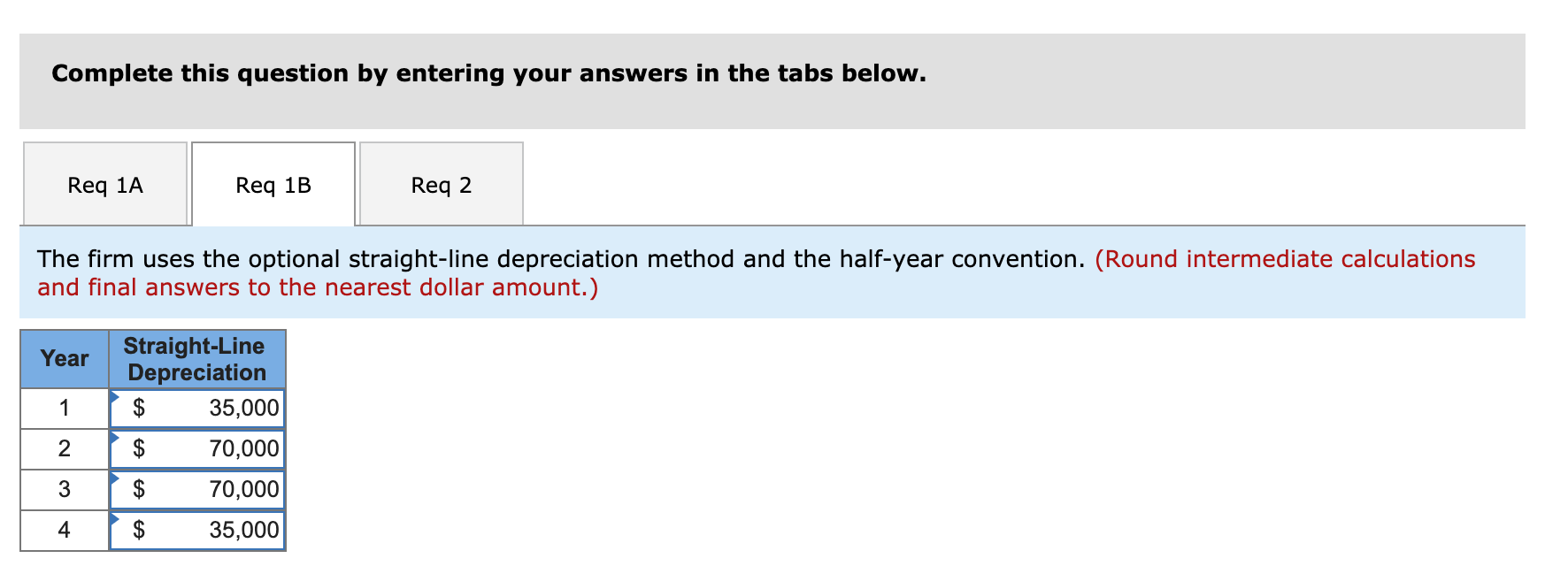

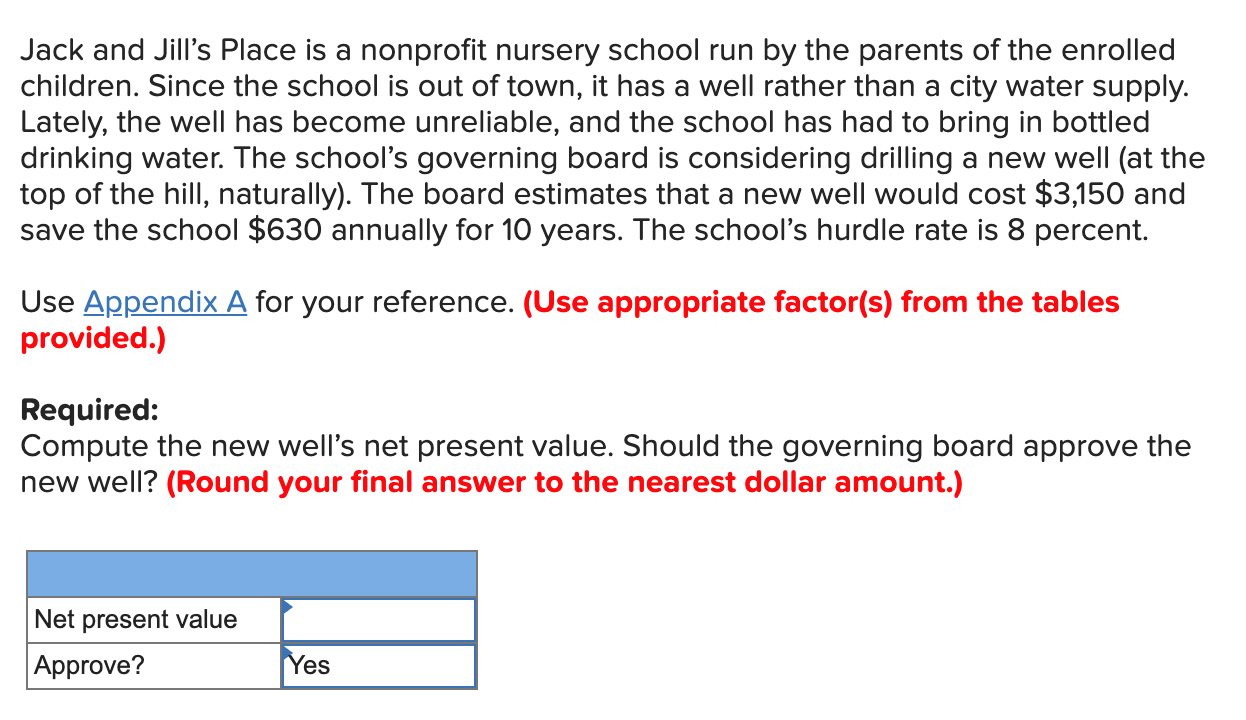

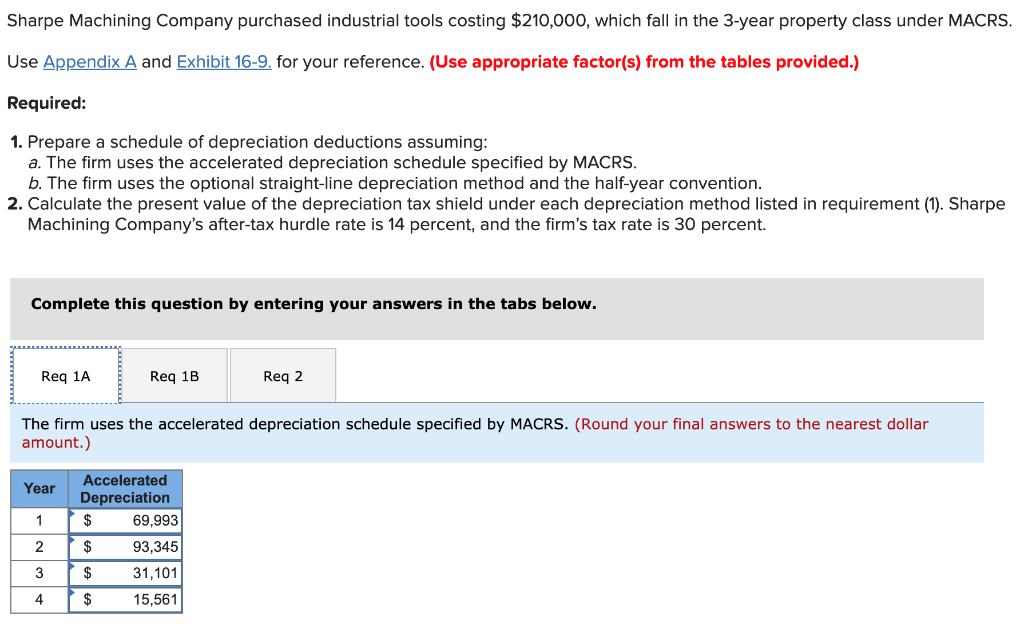

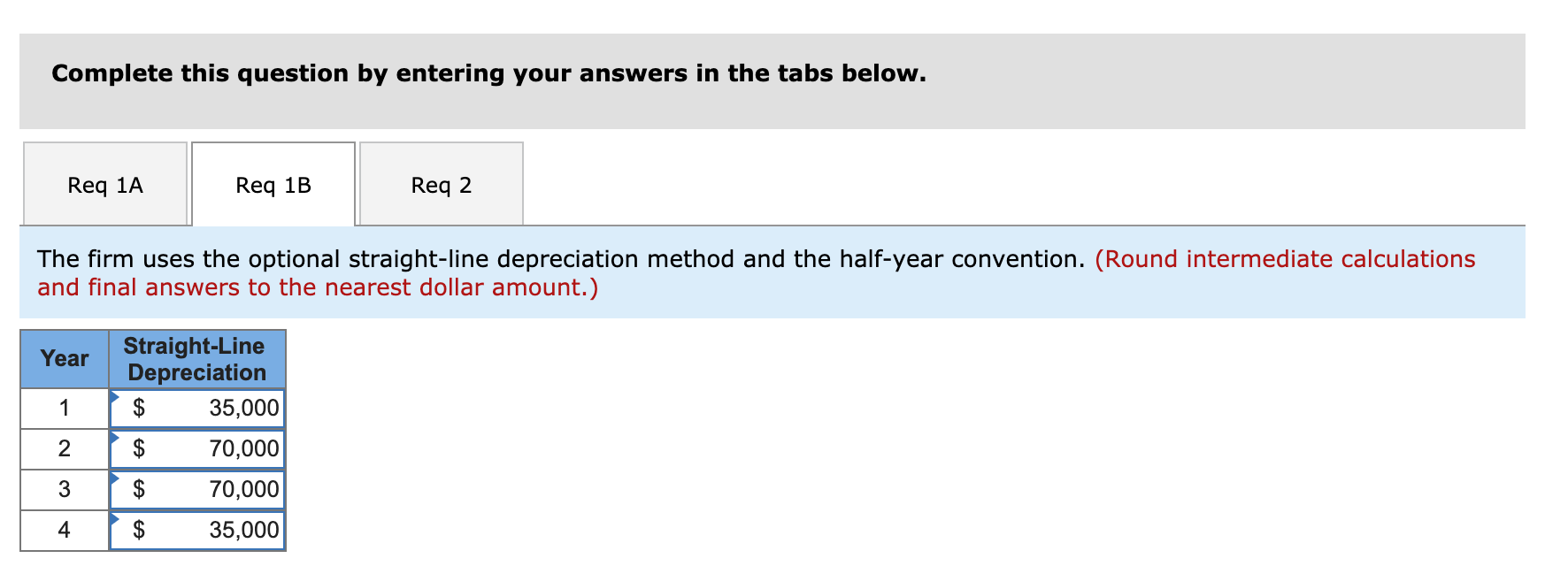

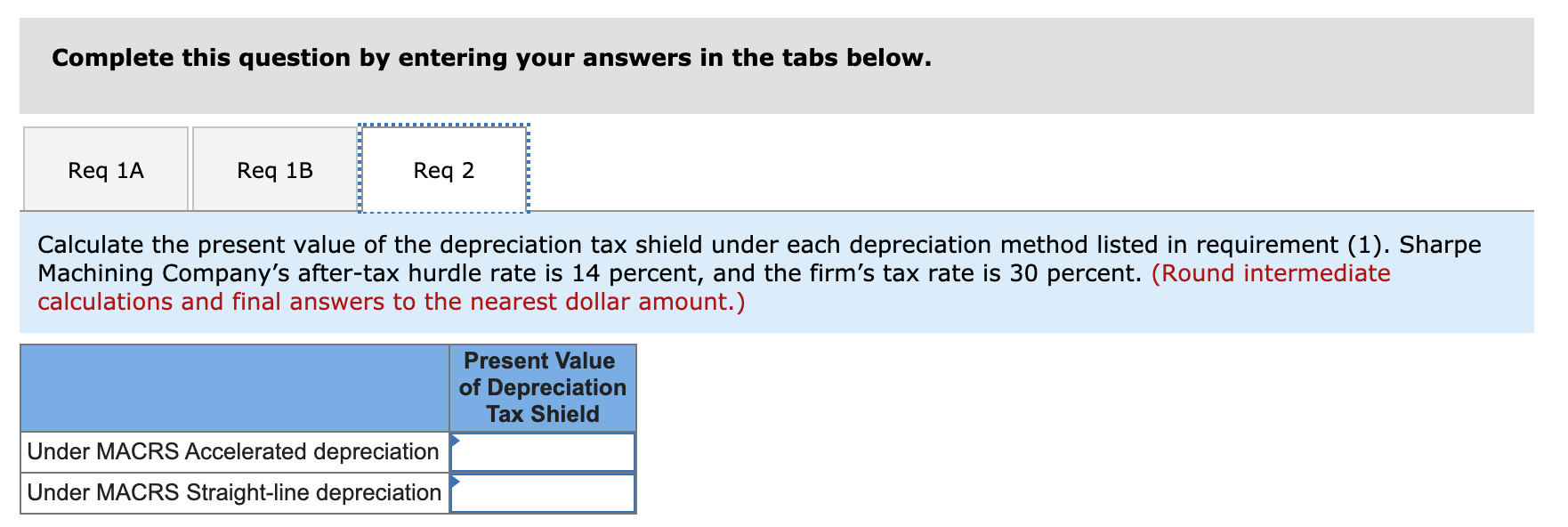

Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water. The school's governing board is considering drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,150 and save the school $630 annually for 10 years. The school's hurdle rate is 8 percent. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the new well's net present value. Should the governing board approve the new well? (Round your final answer to the nearest dollar amount.) Net present value Approve? Yes Sharpe Machining Company purchased industrial tools costing $210,000, which fall in the 3-year property class under MACRS. Use Appendix A and Exhibit 16-9. for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare a schedule of depreciation deductions assuming: a. The firm uses the accelerated depreciation schedule specified by MACRS. b. The firm uses the optional straight-line depreciation method and the half-year convention. 2. Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 14 percent, and the firm's tax rate is 30 percent. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2 The firm uses the accelerated depreciation schedule specified by MACRS. (Round your final answers to the nearest dollar amount.) Year 1 Accelerated Depreciation $ 69,993 $ 93,345 $ 31,101 2 3 4 $ 15,561 Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 The firm uses the optional straight-line depreciation method and the half-year convention. (Round intermediate calculations and final answers to the nearest dollar amount.) Year 1 Straight-Line Depreciation $ 35,000 $ 70,000 $ 70,000 $ 35,000 2 3 4 Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Calculate the present value of the depreciation tax shield under each depreciation method listed in requirement (1). Sharpe Machining Company's after-tax hurdle rate is 14 percent, and the firm's tax rate is 30 percent. (Round intermediate calculations and final answers to the nearest dollar amount.) Present Value of Depreciation Tax Shield Under MACRS Accelerated depreciation Under MACRS Straight-line depreciation