Question 1:

Question 2:

Question 3:

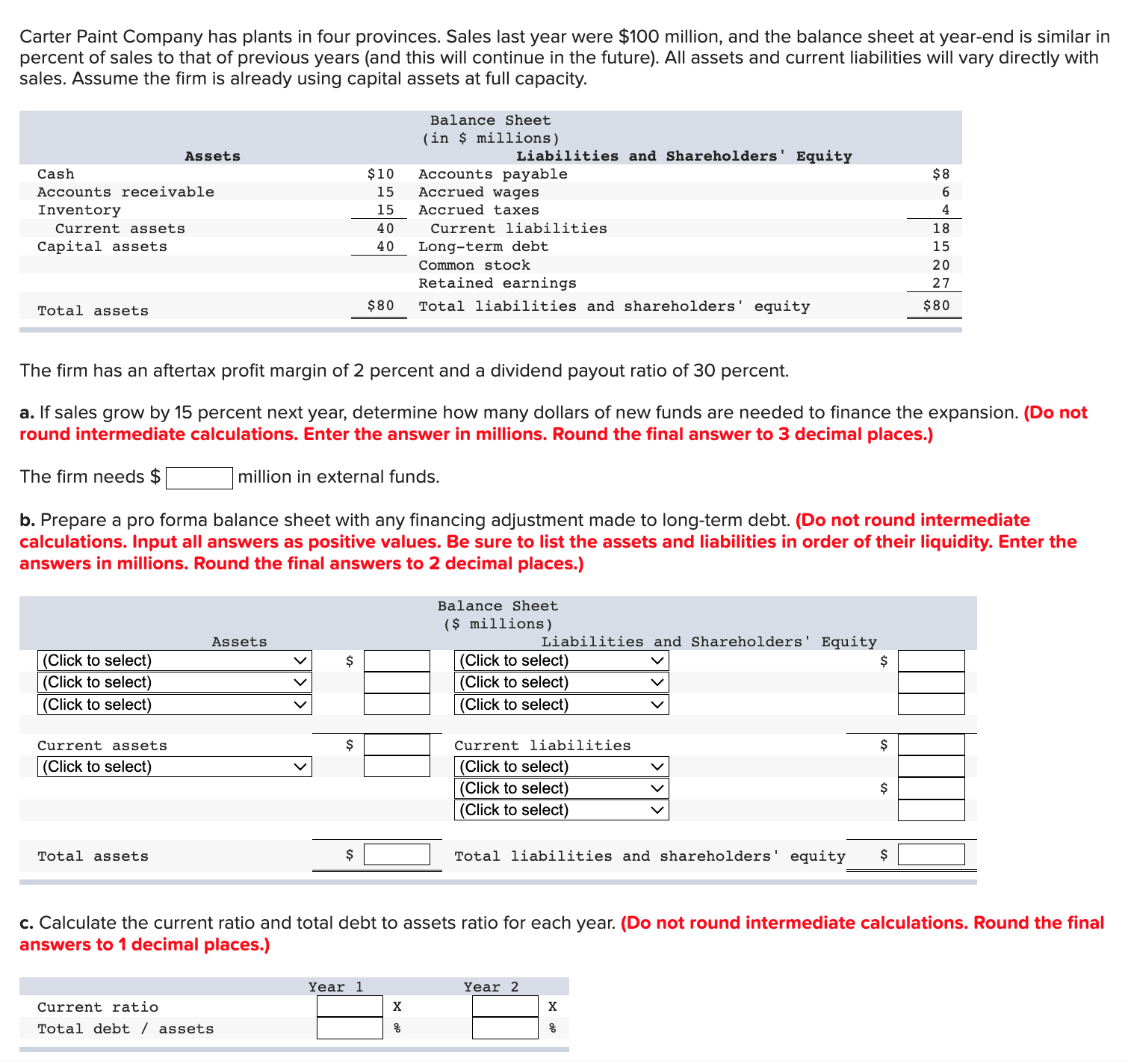

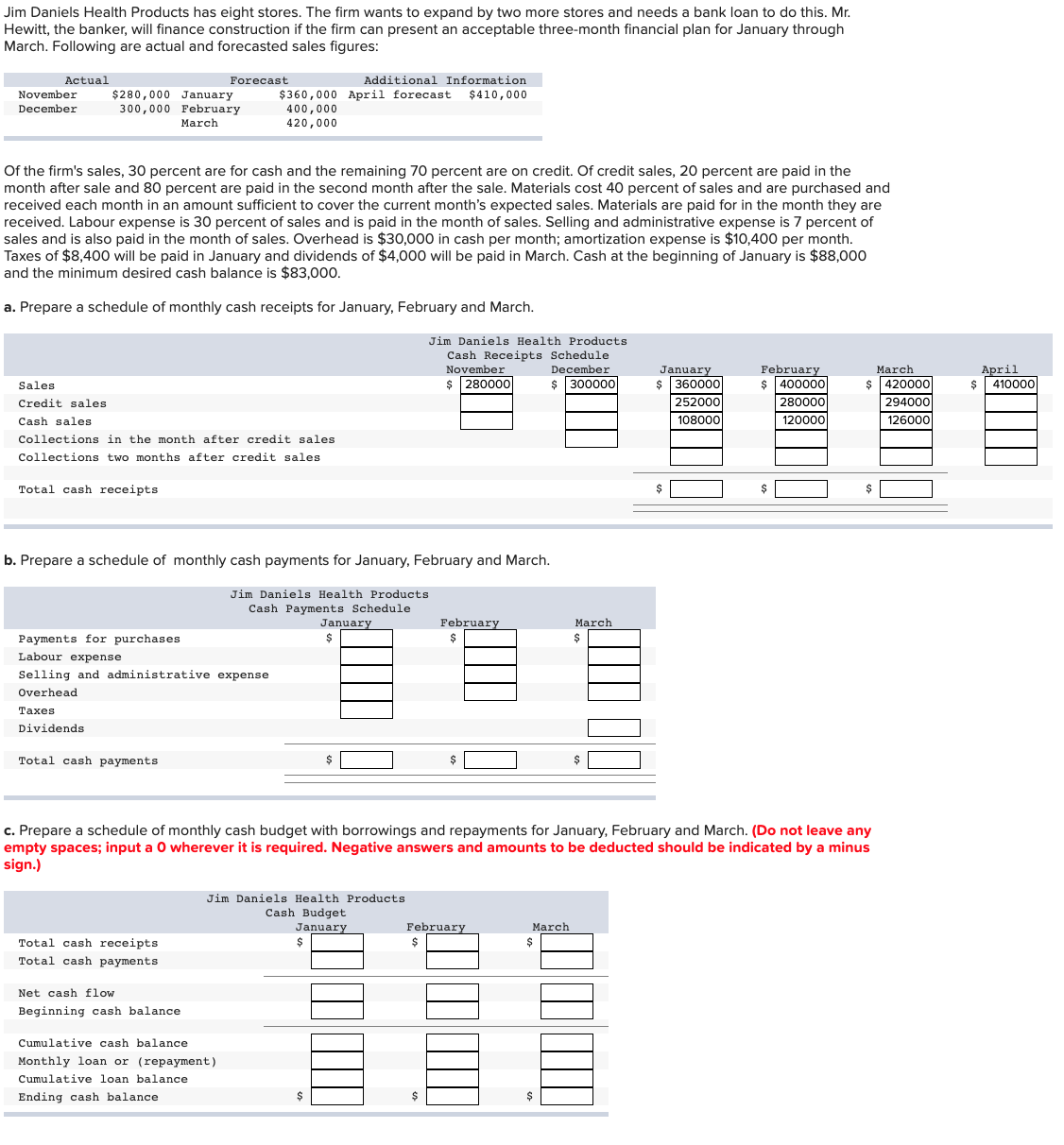

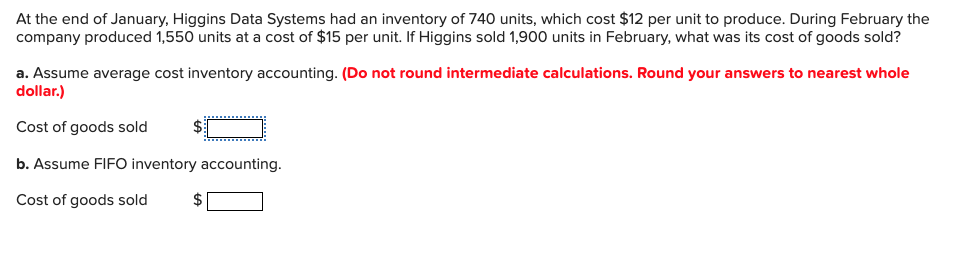

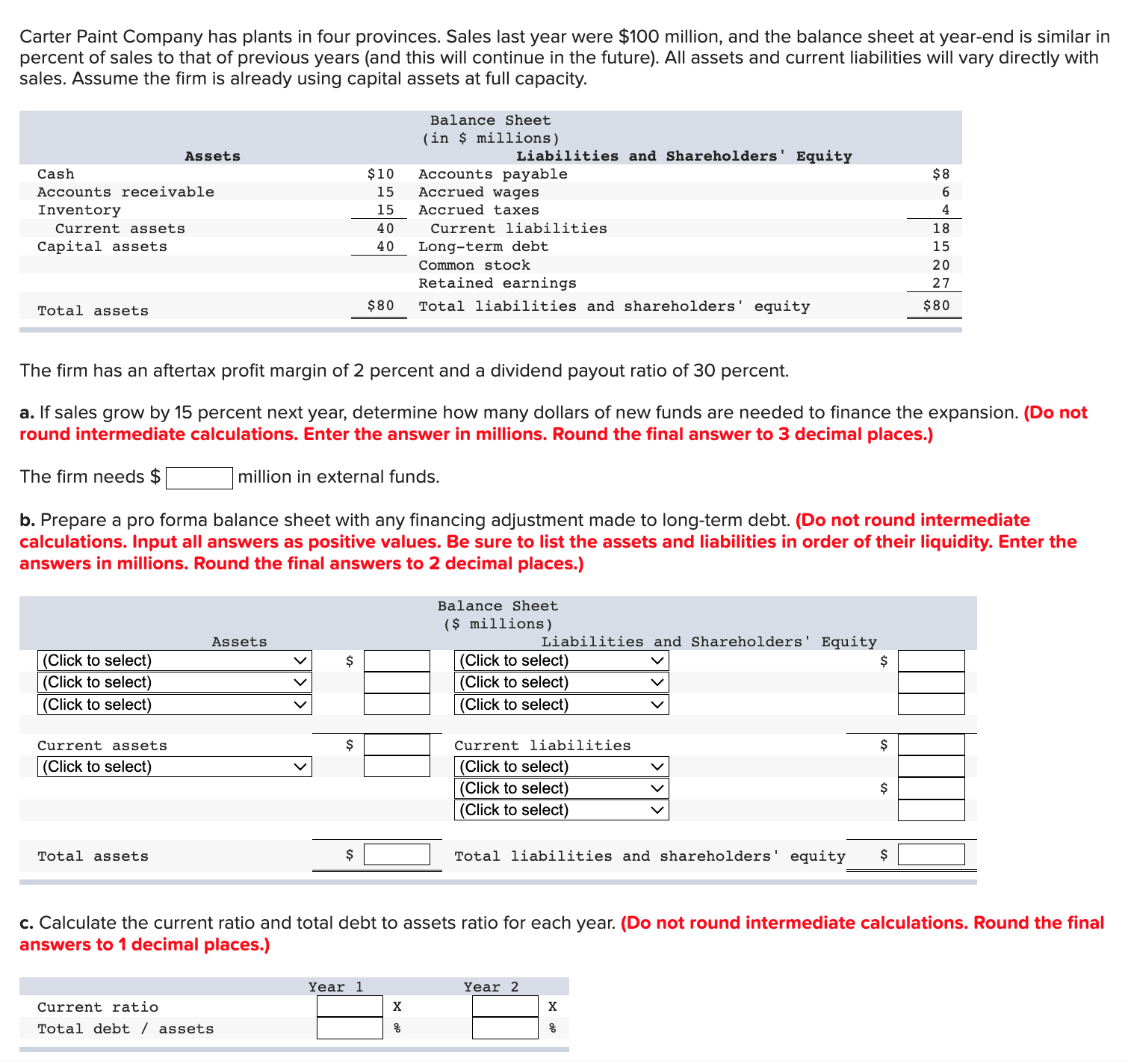

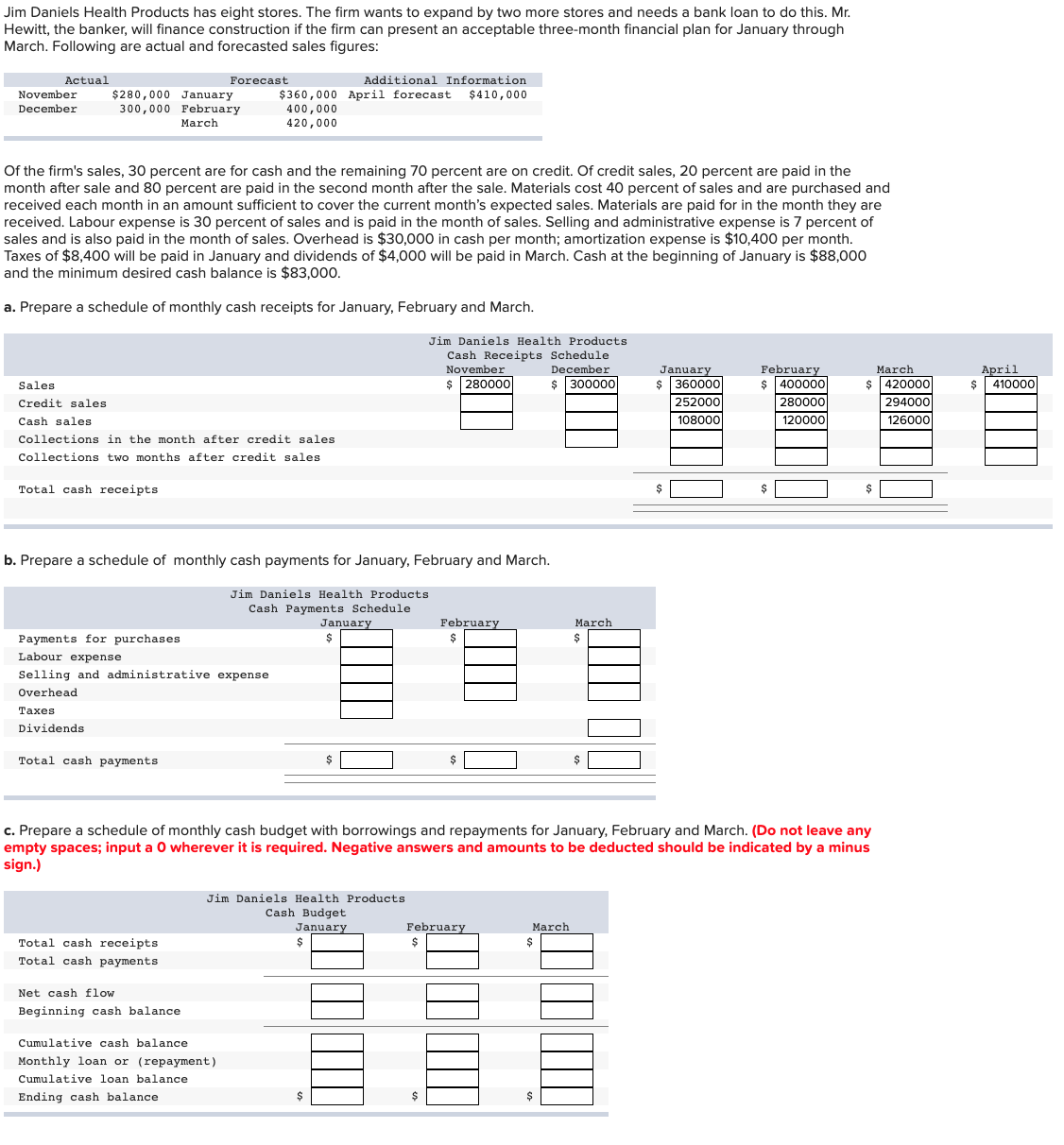

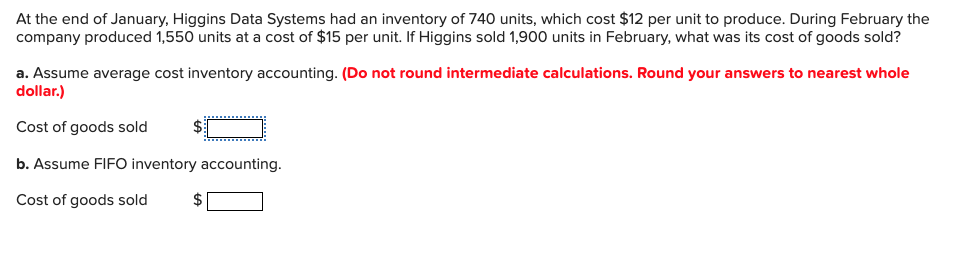

Carter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet at year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. The firm has an aftertax profit margin of 2 percent and a dividend payout ratio of 30 percent. a. If sales grow by 15 percent next year, determine how many dollars of new funds are needed to finance the expansion. (Do not round intermediate calculations. Enter the answer in millions. Round the final answer to 3 decimal places.) The firm needs $ million in external funds. b. Prepare a pro forma balance sheet with any financing adjustment made to long-term debt. (Do not round intermediate calculations. Input all answers as positive values. Be sure to list the assets and liabilities in order of their liquidity. Enter the answers in millions. Round the final answers to 2 decimal places.) c. Calculate the current ratio and total debt to assets ratio for each year. (Do not round intermediate calculations. Round the final answers to 1 decimal places.) Jim Daniels Health Products has eight stores. The firm wants to expand by two more stores and needs a bank loan to do this. Mr. Hewitt, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. Following are actual and forecasted sales figures: Of the firm's sales, 30 percent are for cash and the remaining 70 percent are on credit. Of credit sales, 20 percent are paid in the month after sale and 80 percent are paid in the second month after the sale. Materials cost 40 percent of sales and are purchased and received each month in an amount sufficient to cover the current month's expected sales. Materials are paid for in the month they are received. Labour expense is 30 percent of sales and is paid in the month of sales. Selling and administrative expense is 7 percent of sales and is also paid in the month of sales. Overhead is $30,000 in cash per month; amortization expense is $10,400 per month. Taxes of $8,400 will be paid in January and dividends of $4,000 will be paid in March. Cash at the beginning of January is $88,000 and the minimum desired cash balance is $83,000. a. Prepare a schedule of monthly cash receipts for January, February and March. b. Prepare a schedule of monthly cash payments for January, February and March. c. Prepare a schedule of monthly cash budget with borrowings and repayments for January, February and March. (Do not leave any empty spaces; input a 0 wherever it is required. Negative answers and amounts to be deducted should be indicated by a minus sign.) At the end of January, Higgins Data Systems had an inventory of 740 units, which cost $12 per unit to produce. During February the company produced 1,550 units at a cost of $15 per unit. If Higgins sold 1,900 units in February, what was its cost of goods sold? a. Assume average cost inventory accounting. (Do not round intermediate calculations. Round your answers to nearest whole dollar.) Cost of goods sold $ b. Assume FIFO inventory accounting. Cost of goods sold $