Question 1

Question 2

Question 3

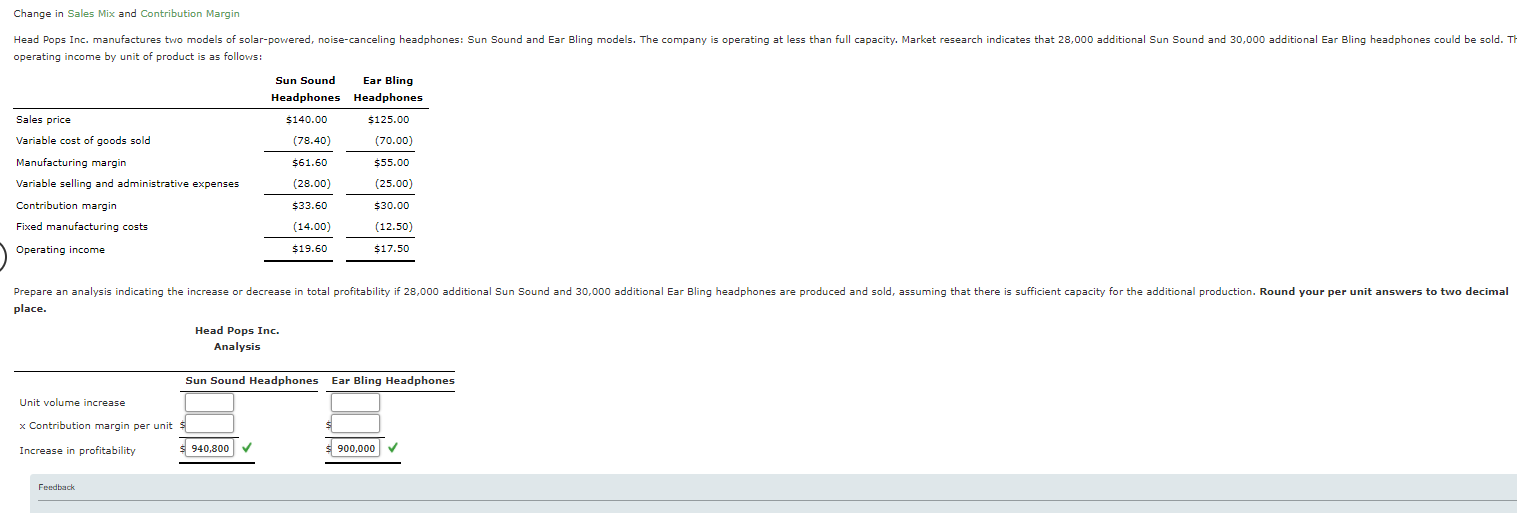

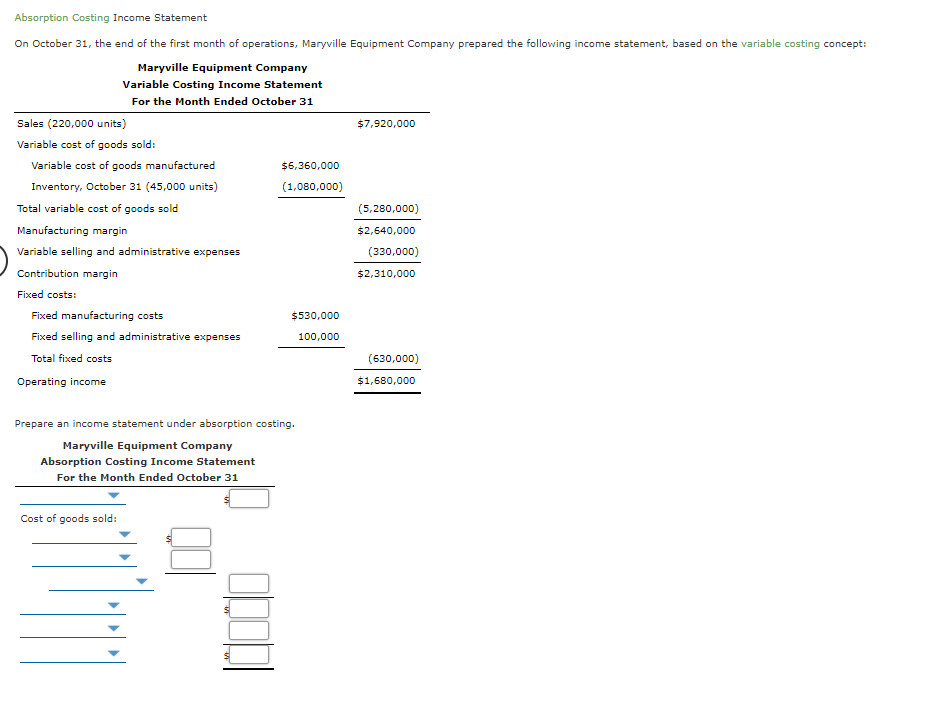

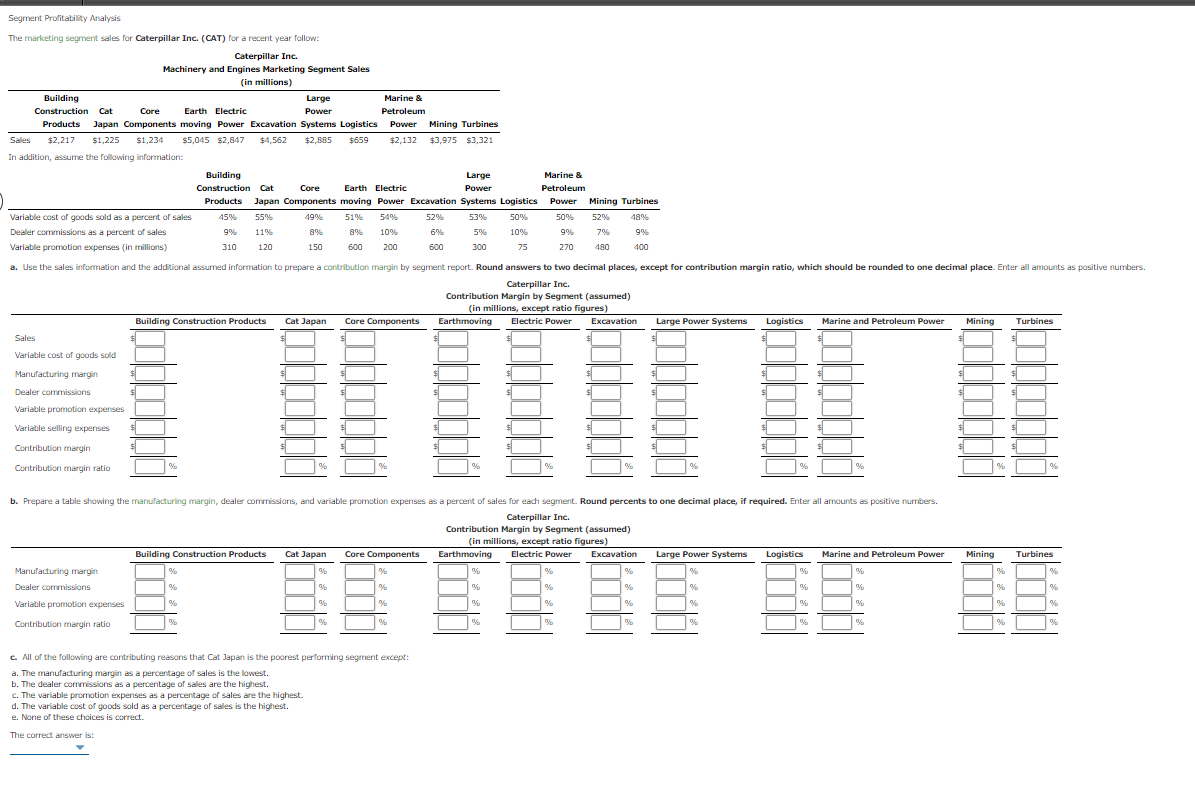

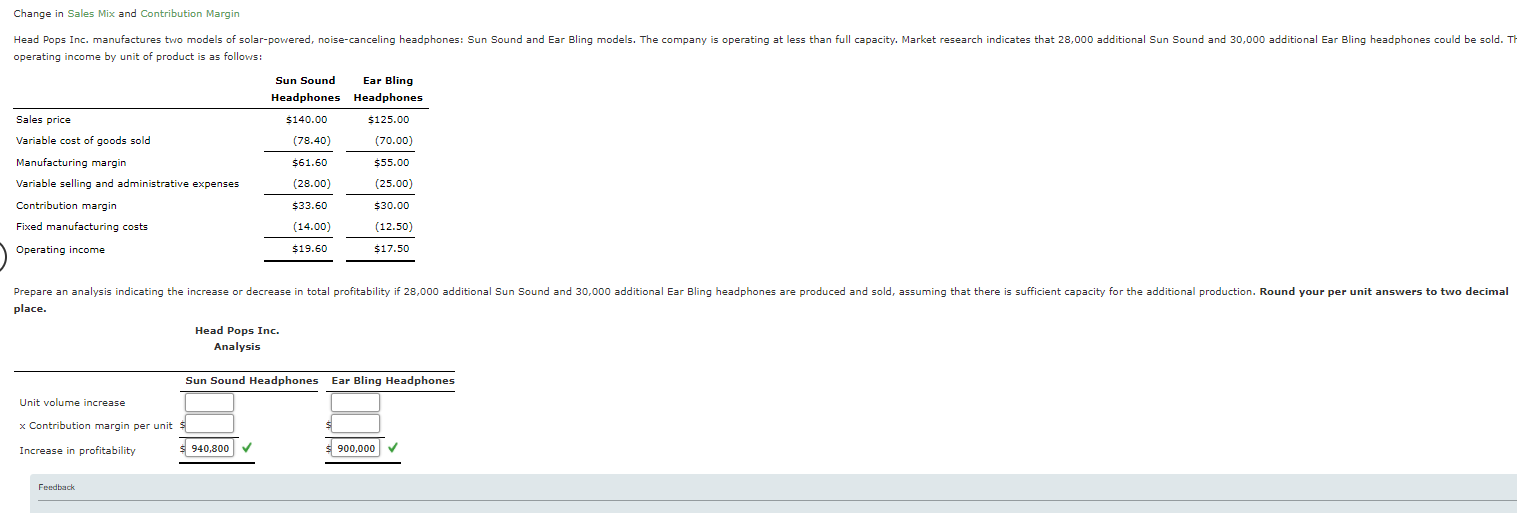

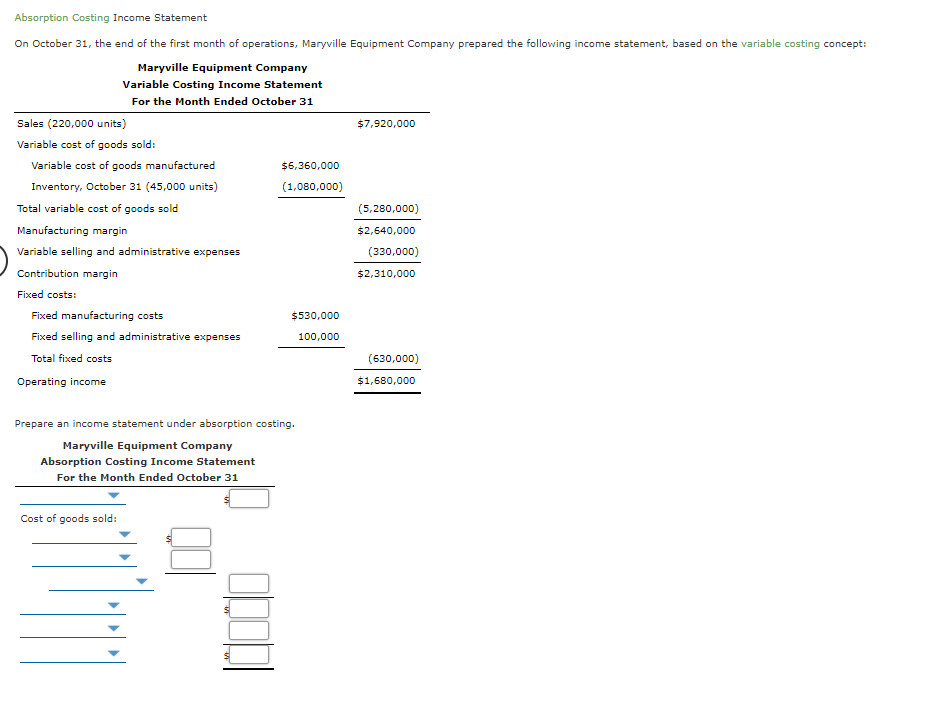

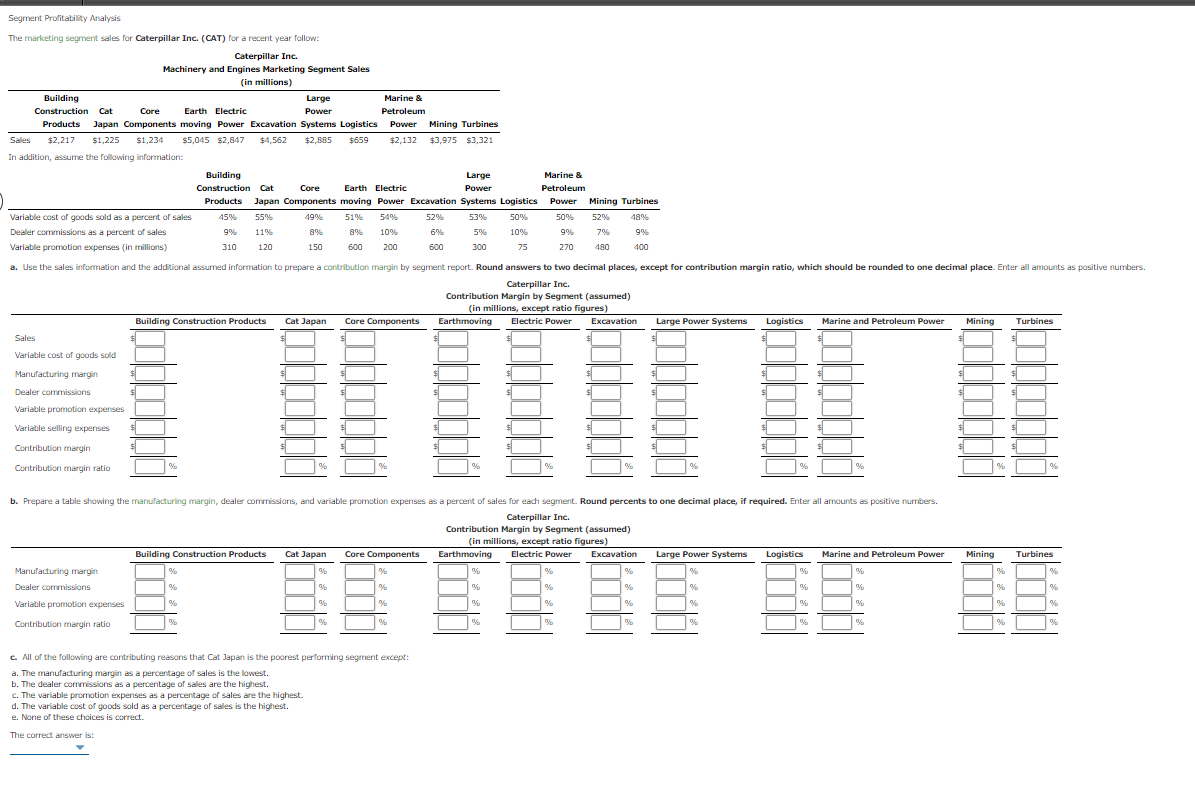

Change in Sales Mix and Contribution Margin Head Pops Inc. manufactures two models of solar-powered, noise-canceling headphones: Sun Sound and Ear Bling models. The company is operating at less than full capacity. Market research indicates that 28,000 additional Sun Sound and 30,000 additional Ear Bling headphones could be sold. Th operating income by unit of product is as follows: Sun Sound Ear Bling Headphones Headphones Sales price $140.00 $125.00 Variable cost of goods sold (78.40) (70.00) Manufacturing margin $61.60 $55.00 Variable selling and administrative expenses (28.00) (25.00) Contribution margin $33.60 $30.00 Fixed manufacturing costs (14.00) (12.50) Operating income $19.60 $17.50 Prepare an analysis indicating the increase or decrease in total profitability if 28,000 additional Sun Sound and 30,000 additional Ear Bling headphones are produced and sold, assuming that there is sufficient capacity for the additional production. Round your per unit answers to two decimal place. Head Pops Inc. Analysis Sun Sound Headphones Ear Bling Headphones Unit volume increase x Contribution margin per units Increase in profitability 940,800 s 900,000 Feedback Absorption Costing Income Statement On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Maryville Equipment Company Variable Costing Income Statement For the Month Ended October 31 Sales (220,000 units) $7,920,000 Variable cost of goods sold: Variable cost of goods manufactured $6,360,000 Inventory, October 31 (45,000 units) (1,080,000) Total variable cost of goods sold (5,280,000) Manufacturing margin $2,640,000 Variable selling and administrative expenses (330,000) Contribution margin $2,310,000 Fixed costs: Fixed manufacturing costs $530,000 Fixed selling and administrative expenses 100,000 Total fixed costs (630,000) Operating income $1,680,000 Prepare an income statement under absorption costing. Maryville Equipment Company Absorption Costing Income Statement For the Month Ended October 31 Cost of goods sold: Segment Profitability Analysis The marketing segment sales for Caterpillar Inc. (CAT) for a recent year follow: Caterpillar Inc. Machinery and Engines Marketing Segment Sales (in millions) Building Large Marine & Construction Cat Core Earth Electric Power Petroleum Products Japan Components moving Power Excavation Systems Logistics Power Mining Turbines Sales $2,217 $1,225 $1,234 $5,045 $2,847 $4,562 $2,885 $659 $2,132 $3,975 $3.321 In addition, assume the following information: Building Large Marine & Construction Cat Core Earth Electric Power Petroleum Products Japan Components moving Power Excavation Systems Logistics Power Mining Turbines Variable cost of goods sold as a percent of sales 45% 55% 49% 51% 54% 52% 53% 50% 50% 52% 48% Dealer commissions as a percent of sales 9% 11% 8% 896 10% 6% 5% 10% 9% 796 99% Variable promotion expenses (in millions) 310 120 150 600 200 600 300 75 270 480 400 a. Use the sales information and the additional assumed information to prepare a contribution margin by segment report. Round answers to two decimal places, except for contribution margin ratio, which should be rounded to one decimal place. Enter all amounts as positive numbers. Caterpillar Inc. Contribution Margin by Segment (assumed) (in millions, except ratio figures) Building Construction Products Cat Japan Core Components Earthmoving Large Power Systems Logistics Mining Electric Power Excavation Marine and Petroleum Power Turbines Sales Variable cost of goods sold Manufacturing margin s $ Dealer commissions Variable promotion expenses Variable selling expenses Contribution margin $ Contribution margin ratio % 9 % b. Prepare a table showing the manufacturing margin, dealer commissions, and variable promotion expenses as a percent of sales for each segment. Round percents to one decimal place, if required. Enter all amounts as positive numbers. Caterpillar Inc. Contribution Margin by Segment (assumed) (in millions, except ratio figures) Earthmoving Electric Power Excavation Building Construction Products Cat Japan Core Components Large Power Systems Logistics Marine and Petroleum Power Mining Turbines Manufacturing margin 9 % % % % % % Dealer commissions % 9 % % % % % Variable promotion expenses % % % % % % % Contribution margin ratio % % 90 % 9 % % % 96 c. All of the following are contributing reasons that Cat Japan is the poorest performing segment except: a. The manufacturing margin as a percentage of sales is the lowest. b. The dealer commissions as a percentage of sales are the highest. c. The variable promotion expenses as a percentage of sales are the highest d. The variable cost of goods sold as a percentage of sales is the highest e. None of these choices is correct. The correct answer is