question 1

question 2

question 3

question 4

1

2

3

4

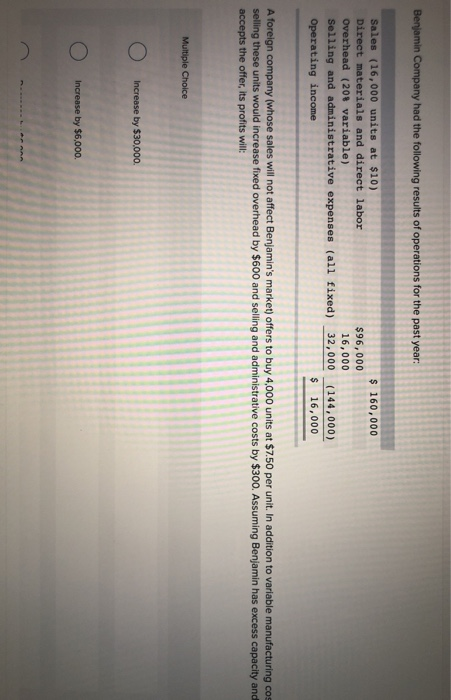

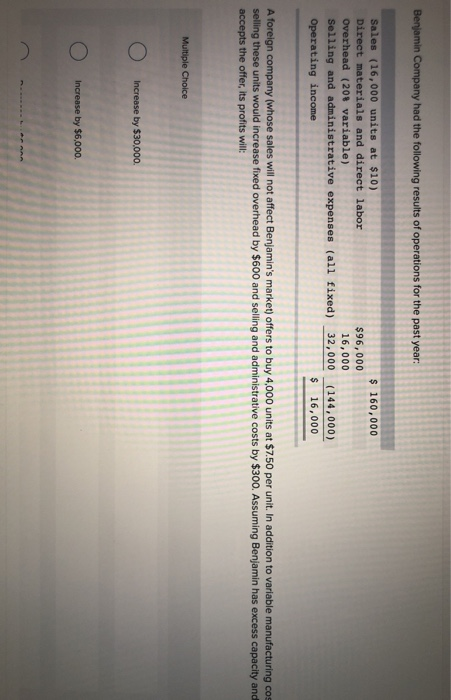

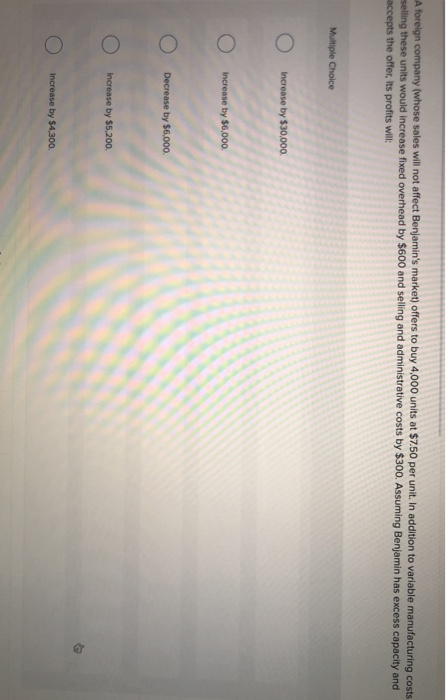

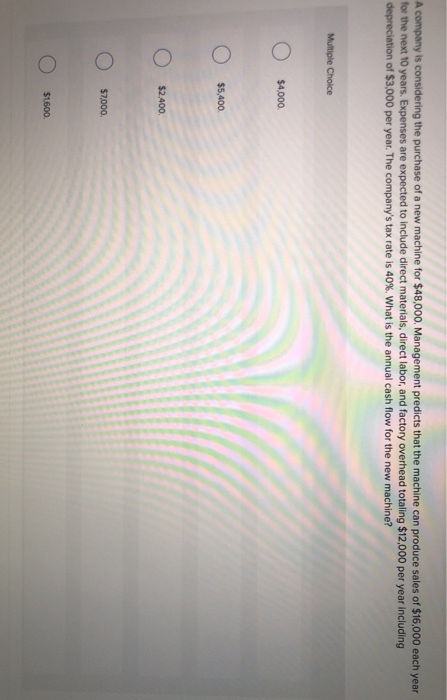

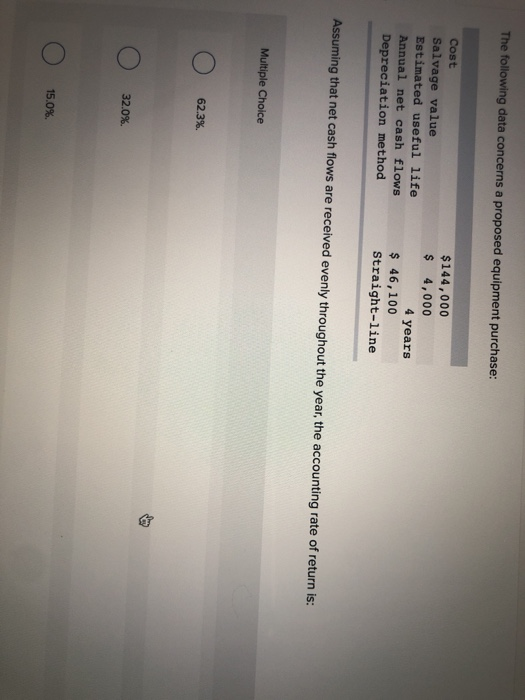

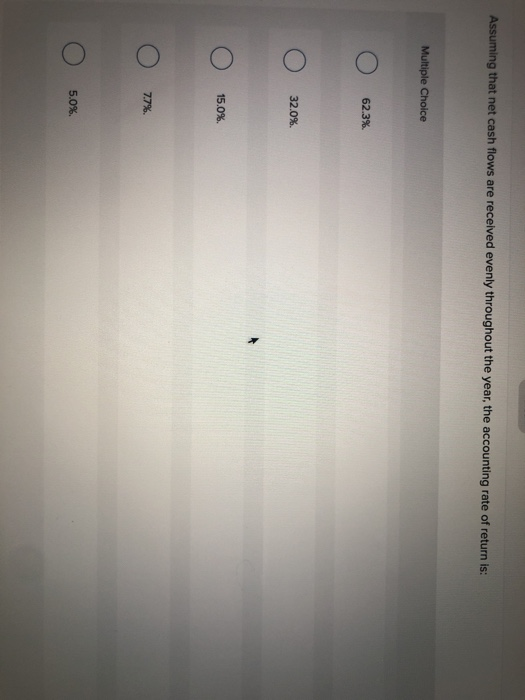

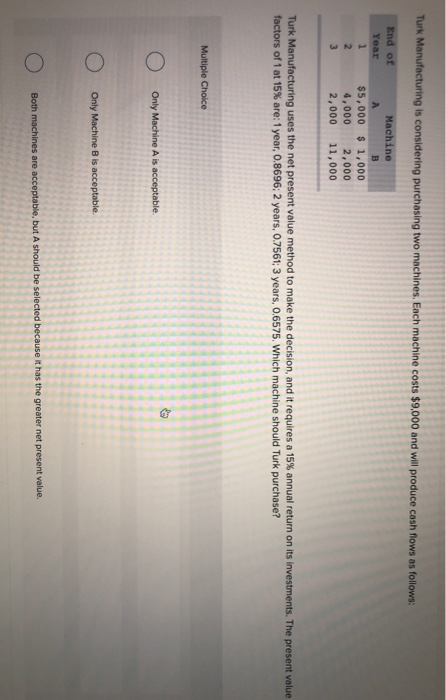

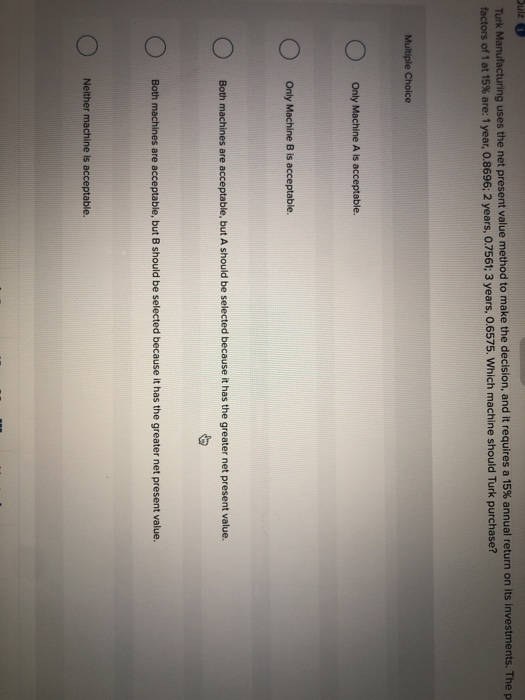

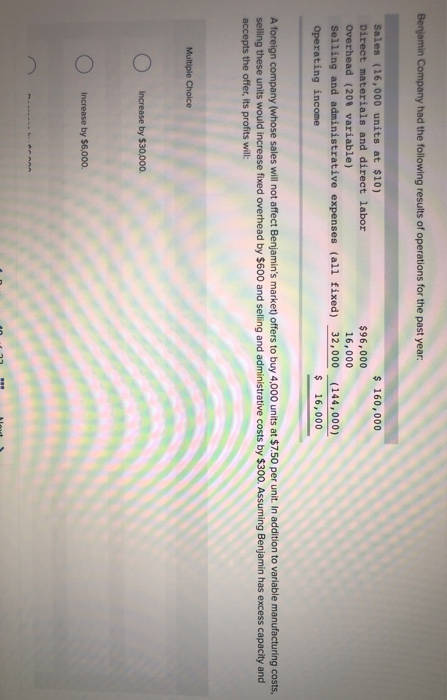

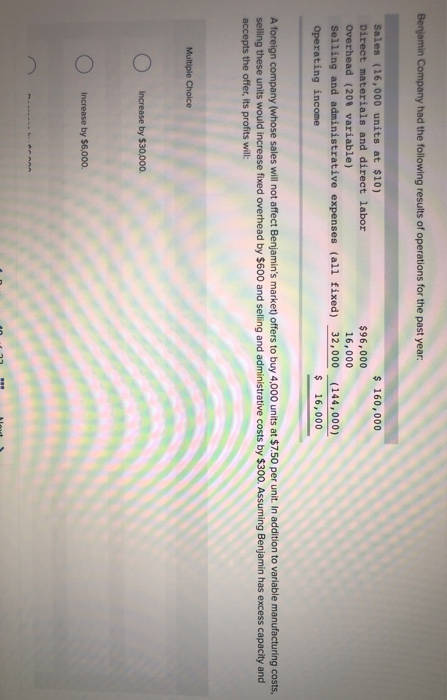

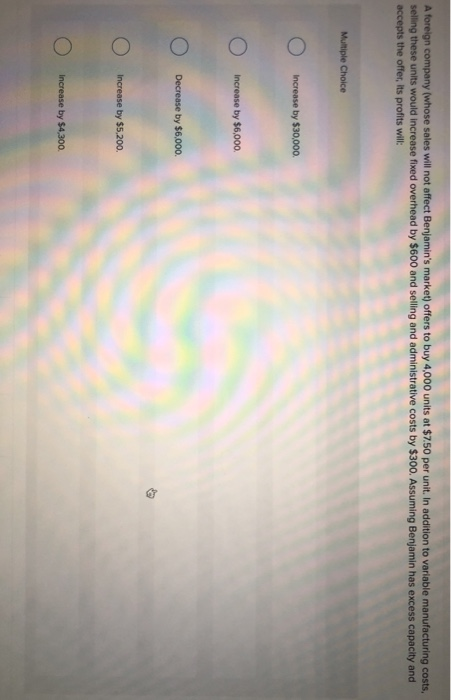

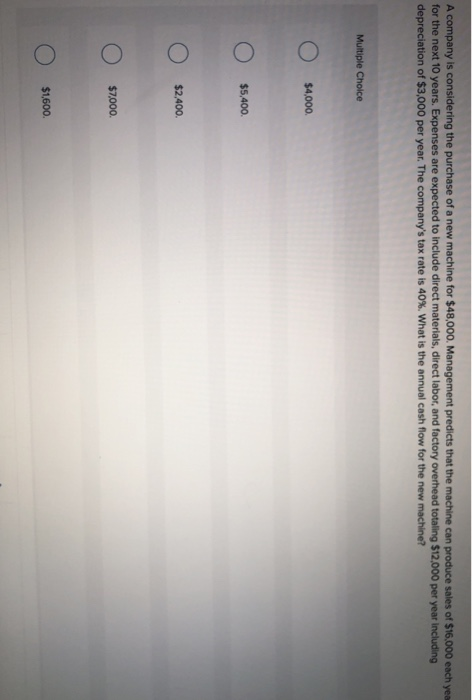

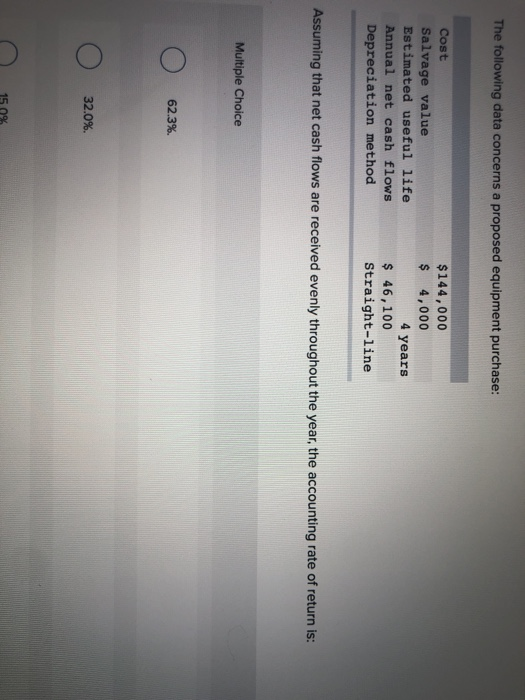

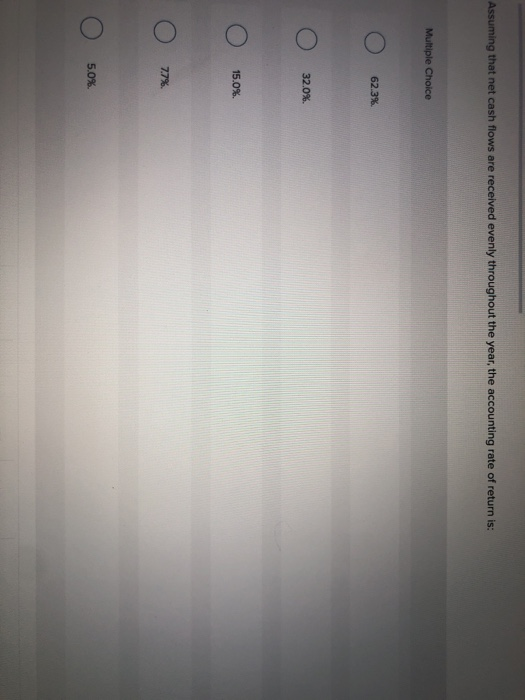

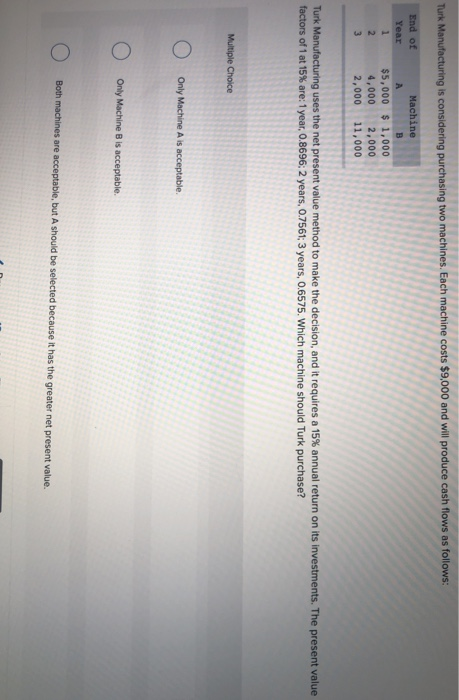

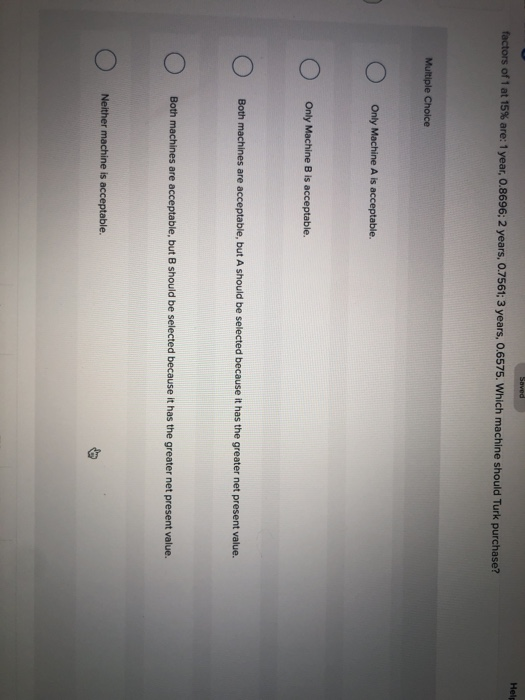

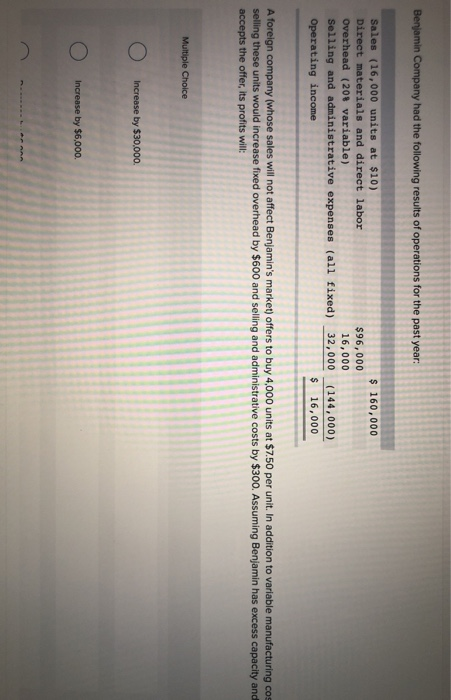

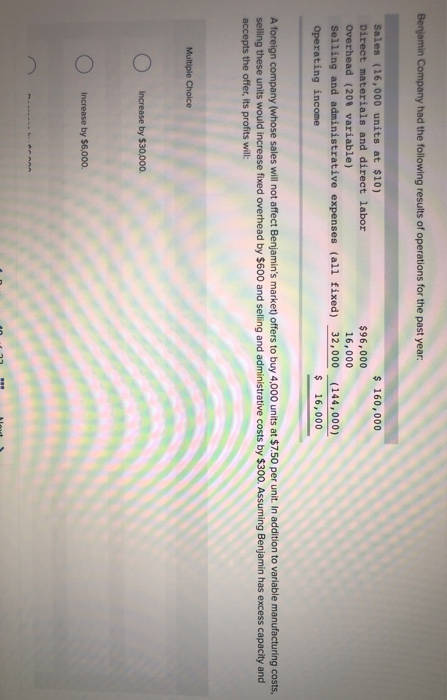

Benjamin Company had the following results of operations for the past year: 160,000 Sales (16,000 units at $10) Direct materials and direct labor overhead (20% variable) Selling and administrative expenses (all fixed) 32,000 (144,000) $96,000 16,000 s 16,000 A foreign company (whose sales will not affect Benjamin's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing cos selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. Assuming Benjamin has excess capacity and accepts the offer, its profits wil: Increase by $30,000 Increase by $6,000. A foreign company (whose sales will not affect Benjamin's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. Assuming Benjamin has excess capacity and accepts the offer, its profits will: increase by $5,200 Increase by $4,300. A company is considering the purchase of a new machine for $48,000. Management predicts that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $12,000 per year including of $3,000 per year. The company's tax rate is 40%, what is the annual cash flow for the new machine? Multiple Choice $7,000. The following data concerns a proposed equipment purchase: $144,000 4,000 Cost Salvage value Estimated useful life Annual net cash flows Depreciation method 4 years 46,100 Straight-line Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is: Multiple Choice 62.3%. 32.0%. 15.0%. Assuming that net cash flows are received evenly throughout the year, the accounting rate of r eturn is: 62.3%. 32.0%. 15.0%. 77%. 5.0%. Turk Manufacturing is considering purchasing two machines. E and will produce cash flows as follows: Machine $5,000 1,000 4,000 2,000 2,000 11,000 Turk Manufacturing uses the net present value method to make the decision, and it requires a 15% annual return on its investments. The present value factors of 1 at 15% are: 1 year, 0.8696; 2 years, 07561; 3 years, 0.6575, which machine should Turk purchase? Multiple Choice Both machines are acceptable, but A should be selected because it has the greater net present value. 160,000 $96,000 16,000 Direct materials and direct labor $16,000 selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. Assuming Benjamin has excess capacity and $5,400 $7000. The following data concerns a proposed equipment purchase: $144,000 $ 4,000 Cost Salvage value Estimated useful life Annual net cash flows Depreciation method 4 years s 46,100 straight-line Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is: Multiple Choice 62.3%. 32.0%. 150% d evenly throughout the year, the accounting rate of return is: 62.3%. 32.0%. 15.0%. 77%. 5.0%. Turk Manufacturing is considering purchasing two machines. Each machine costs $9,000 and will produce cash flows as follows: End of $5,000 1,000 4,000 2,000 2,000 11,000 Turk Manufacturing uses the net present value method to make the decision, and it requires a 15% annual return on its investments. The present value factors of 1 at 15% are: 1 year, O.8696: 2 years, O7561; 3 years, 0.6575, which machine should Turk purchase? Only Maschine B is acceptable. Both machines are acceptable, but A should be selected because it has the greater net present value. of 1 at 15% are: 1 year, 0.8696; 2 years, o.7561; 3 years, 0.6575, which m Both machines are acceptable, but A should be selected because it has the greater net present value