Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1 question 2 question 3 question 4 Flint Ltd. had beginning inventory of 51 units that cost $100 each. During September, the company purchased

question 1

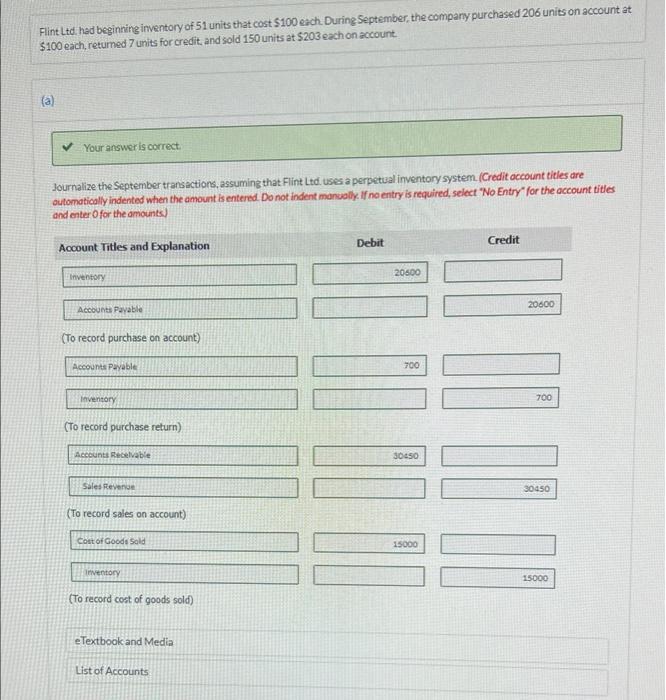

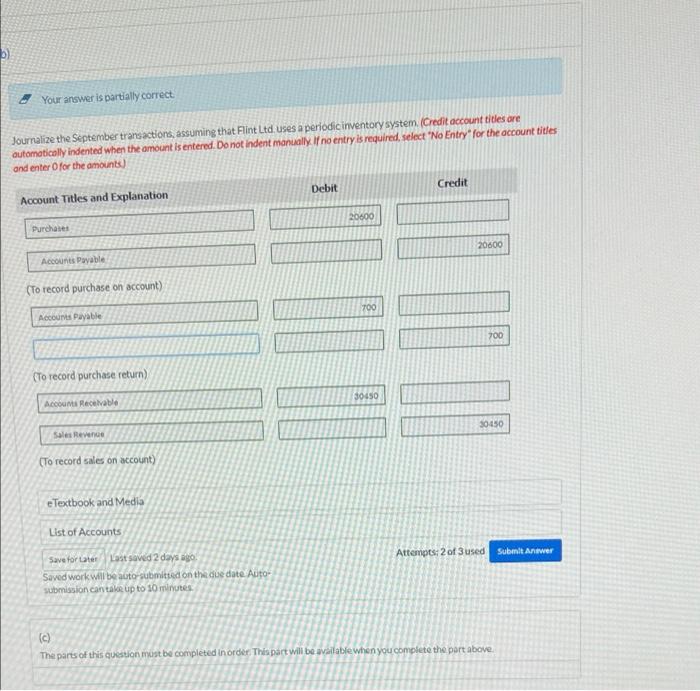

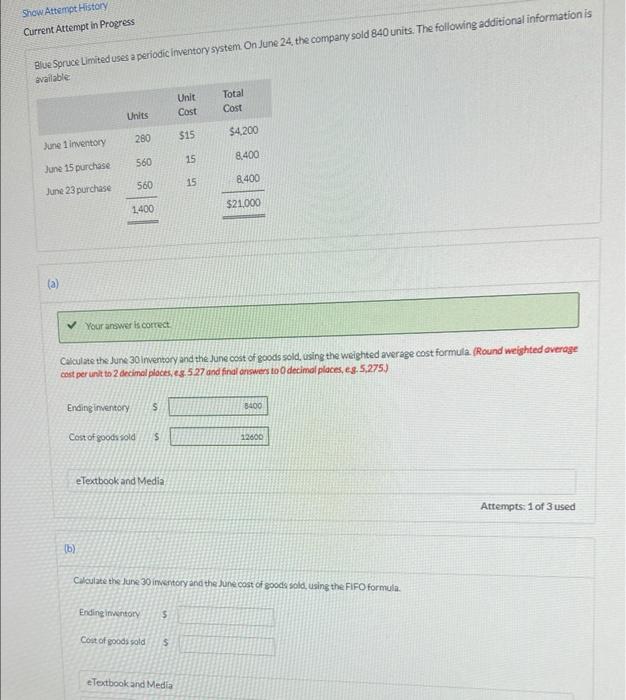

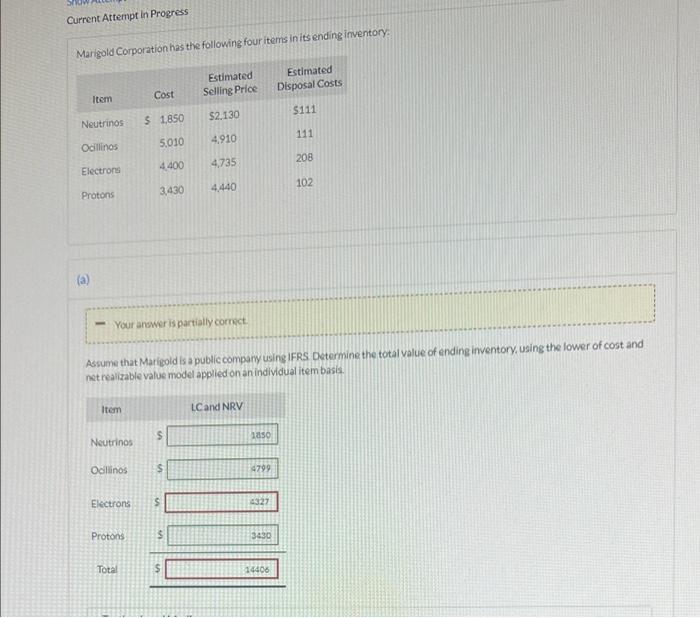

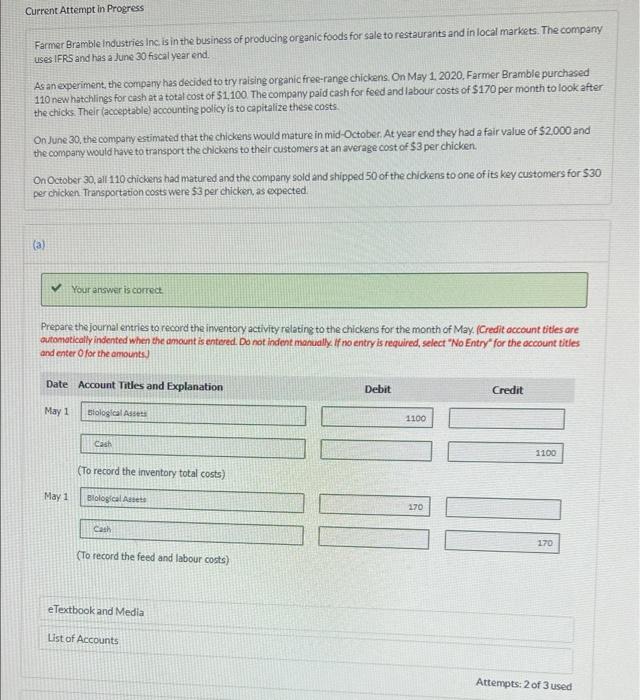

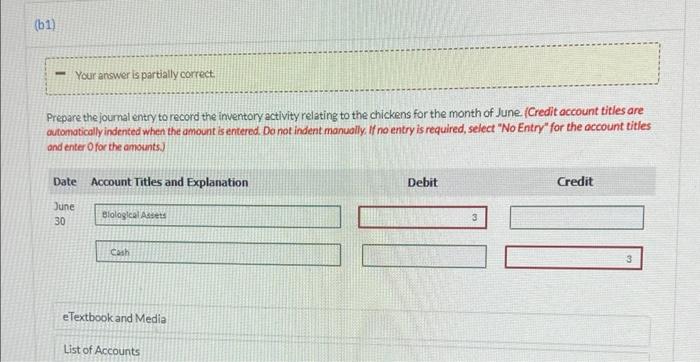

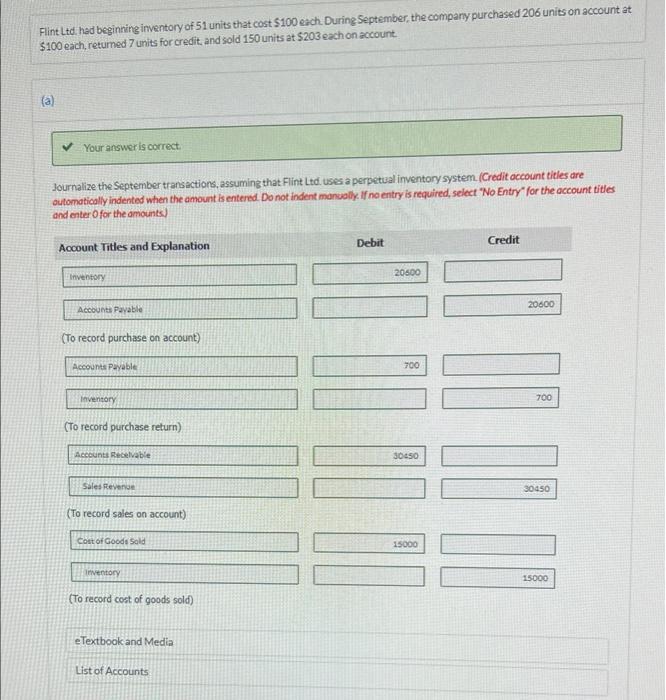

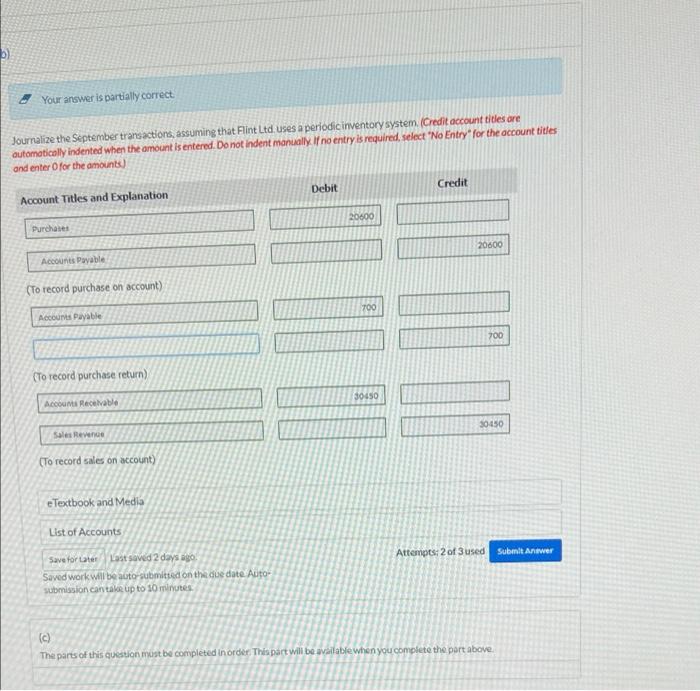

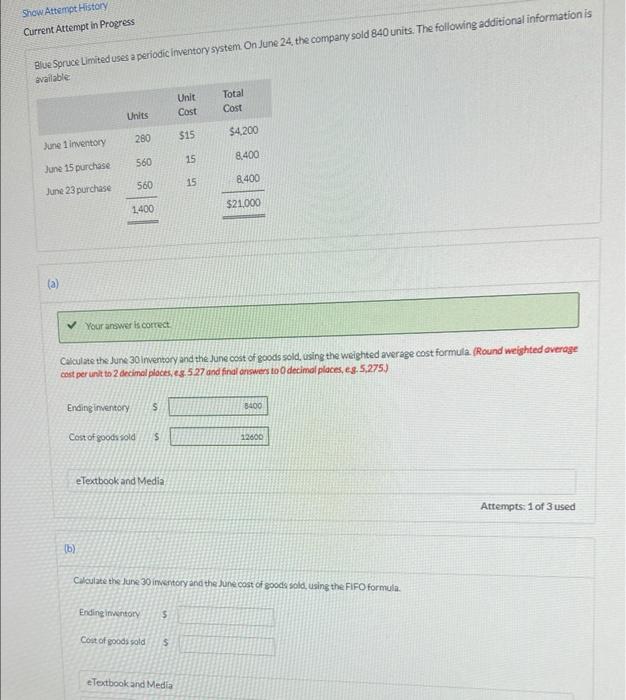

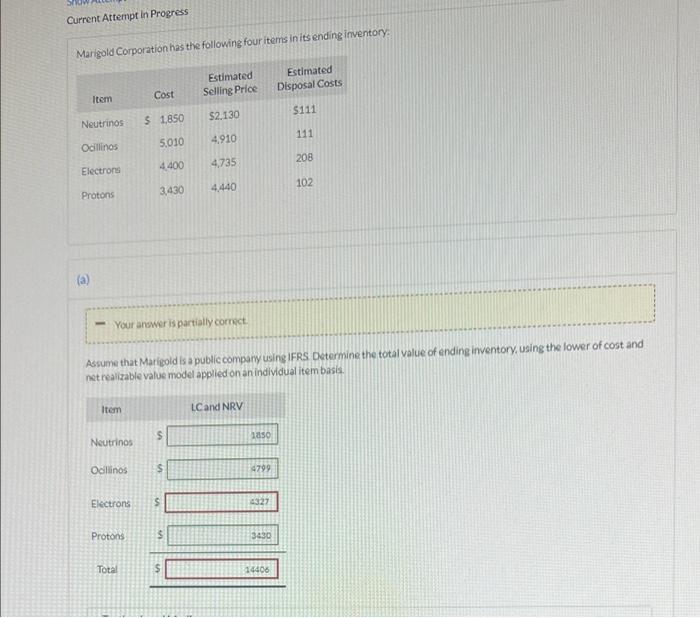

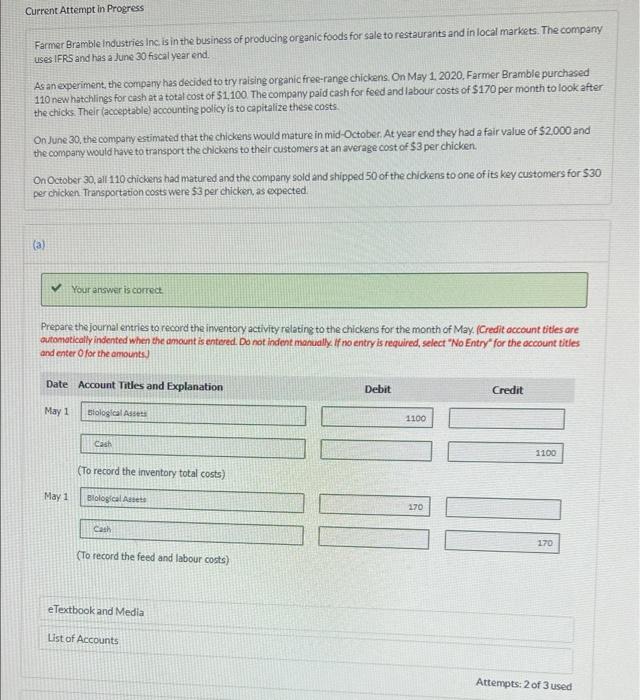

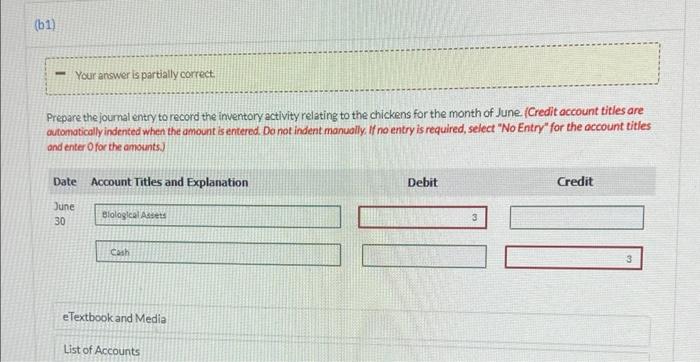

Flint Ltd. had beginning inventory of 51 units that cost $100 each. During September, the company purchased 206 units on account at $100 each, returned 7 units for credit, and sold 150 units at $203 each on account () Your answer is correct Journalize the September transactions, assuming that Flint Ltd. uses a perpetual inventory system. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Debit Credit Account Titles and Explanation 20600 Inventory 20600 Accounts Payable (To record purchase on account) Accounts Payable 700 Inventory 700 (To record purchase return) Accounts Recevable 30450 Sales Revenge 30450 OL 01 (To record sales on account) Cost of Goods Sold 15000 Inventory 25000 (To record cost of goods sold) eTextbook and Media List of Accounts Your answer is partially correct Journalize the September transactions, assuming that Flint Ltd. uses a periodicinventory system (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Credit Debit Account Titles and Explanation 20600 Purchase 20600 Accounts Payable 1 (To record purchase on account) 700 Accounts Payable 700 (To record purchase return) SOCSO Accounts Receivable 30450 Sales Revenge (To record sales on account) e Textbook and Media List of Accounts Attempes: 2 of 3 used Submit Antwer Save forter Last saved 2 days ago Saved work will be auto-submitted on the due date Auto submission can take up to 10 minutes (0) The parts of this question must be completed in order. This part will be available when you complete the part above Show Attempt History Current Attempt in Progress Blue Spruce Limited uses a periodic inventory system. On June 24, the company sold 840 units. The following additional information is available Total Unit Cost Cost Units 280 $15 $4200 June 1 inventory 560 15 8.400 June 15 purchase 560 15 8 400 June 23 purchase 1,400 $21.000 Your answer is correct Calculate the June 30 Inventory and the June cost of goods sold, using the weighted average cost formula (Round weighted average cost per unit to 2 decimal places, e3.527 and final answers to decimal places, 68.5,275) Ending inventory S 3400 Cost of goods sold $ 2600 eTextbook and Media Attempts: 1 of 3 used (6) Calculate the June 30 inventory and the June cost of goods sold, using the FIFO formula Ending inventory 5 Cost of goods sold $ e Textbook and Media Current Attempt in Progress Marigold Corporation has the following four items in its ending inventory: Estimated Selling Price Estimated Disposal Costs Item Cost $111 Neutrinos $2.130 $ 1,850 111 Odlinos 5.010 4910 4,735 208 Electrons 4400 4440 102 Protons 3430 (a) - Your answer is partially correct. Assume that Marigold is a public company using IFRS Determine the total value of ending inventory, using the lower of cost and net realizable value model applied on an individual item basis. Item LC and NRV S aso Neutrinos Ocilinos $ 4799 Electrons S 327 Protons $ 3430 Total $ 14406 Current Attempt in Progress Farmer Bramble Industries Inc is in the business of producing organic foods for sale to restaurants and in local markets. The company uses IFRS and has a June 30 fiscal year end. As an experiment, the company has decided to try raising organic free-range chickens. On May 1, 2020, Farmer Bramble purchased 110 new hatchlings for cash at a total cost of 51100 The company paid cash for feed and labour costs of $170 per month to look after the chicks. Their acceptable) accounting policy is to capitalize these costs. On June 30, the company estimated that the chickens would mature in mid-October. At year end they had a fair value of $2.000 and the company would have to transport the chickens to their customers at an average cost of $3 per chicken. On October 30, all 110 chickens had matured and the company sold and shipped 50 of the chickens to one of its key customers for $30 per chicken Transportation costs were $3 per chicken, as expected (a) Your answer is correct Prepare the journal entries to record the inventory activity relating to the chickens for the month of May. (Credit account tities are automatically indented when the amount is entered. Do not indent manually . If no entry is required, select "No Entry for the account titles and enter for the amounts Date Account Titles and Explanation Debit Credit May 1 Biological Assets 1100 Cash 1100 (To record the inventory total costs) May 1 Biological Asset 170 Cash 170 (To record the feed and labour costs) eTextbook and Media List of Accounts Attempts: 2 of 3 used (61) Your answer is partially correct. Prepare the journal entry to record the inventory activity relating to the chickens for the month of June (Credit account titles are automatically indented when the amount is entered. Do not indent manually. I no entry is required, select "No Entry" for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit June 30 Biological Assets 3 Cash e Textbook and Media List of Accounts

question 2

question 3

question 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started