QUESTION 1.  QUESTION 2.

QUESTION 2.  QUESTION 3.

QUESTION 3.

QUESTION 4.

QUESTION 4.  QUESTION 5.

QUESTION 5.

QUESTION 6.

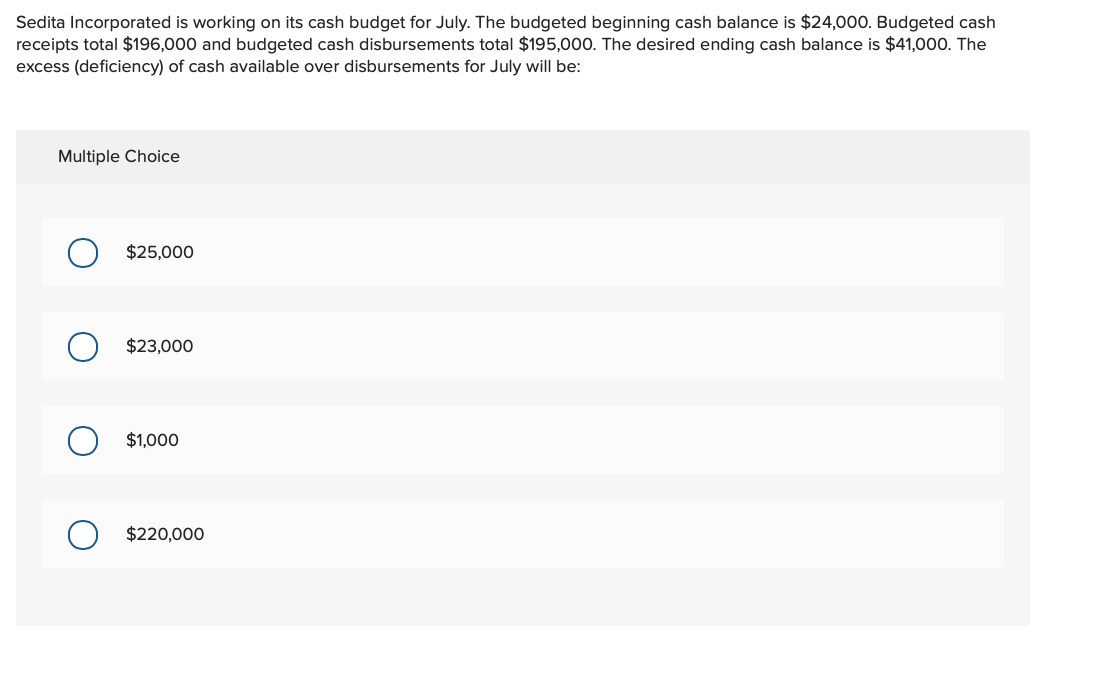

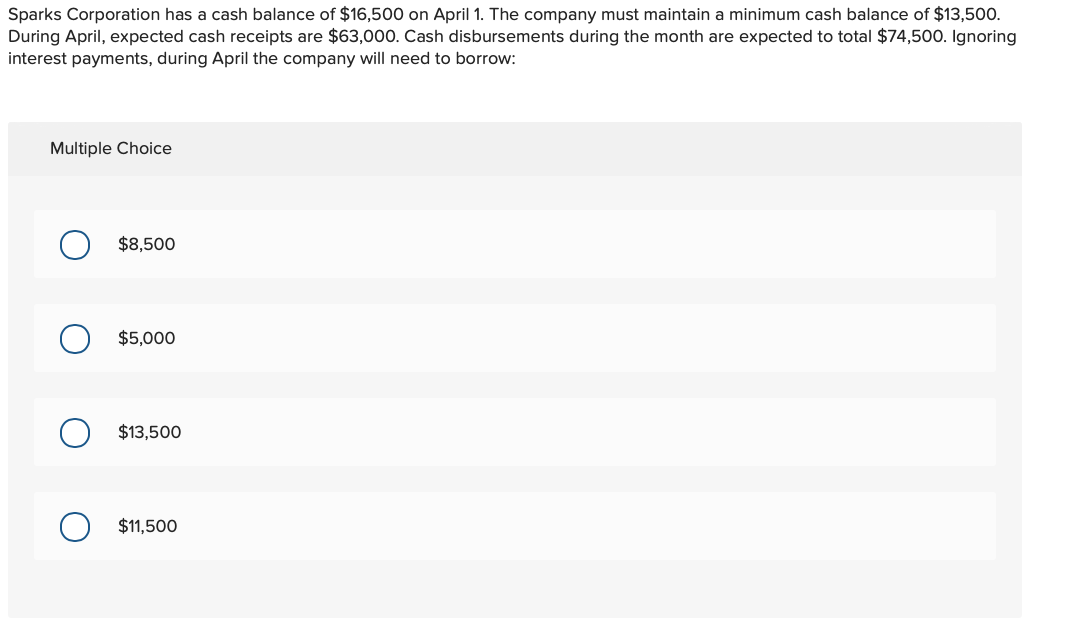

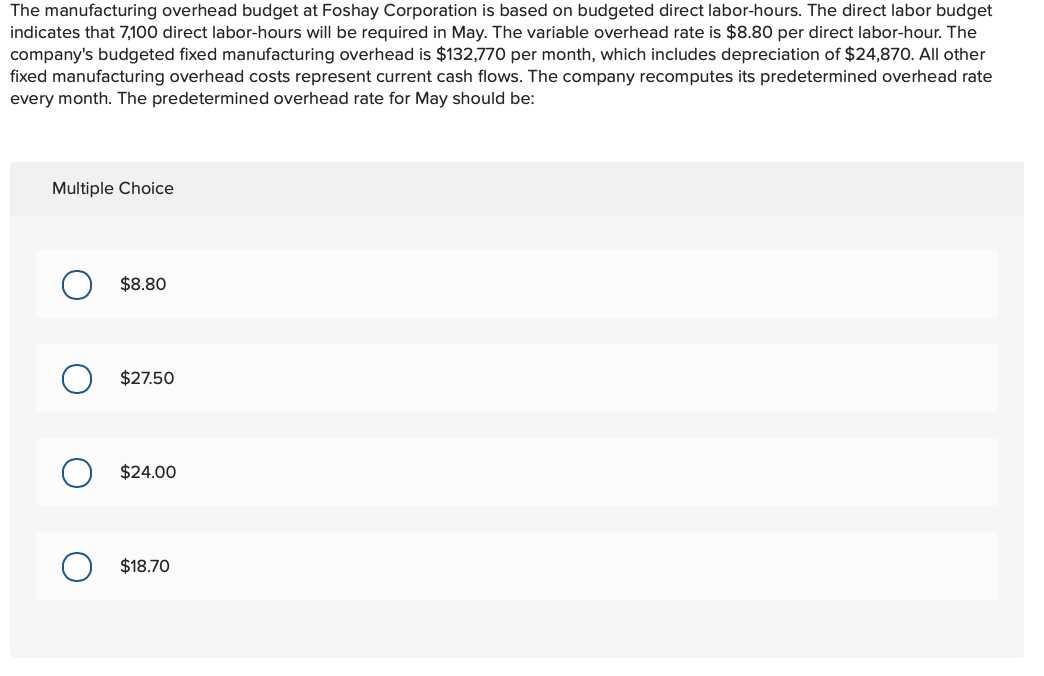

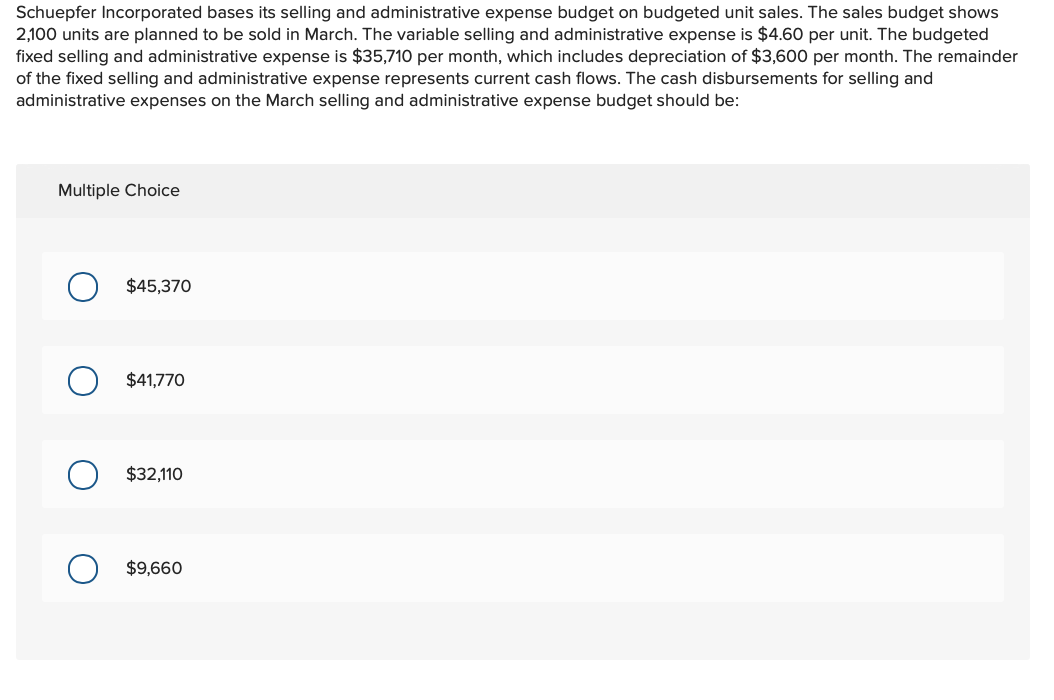

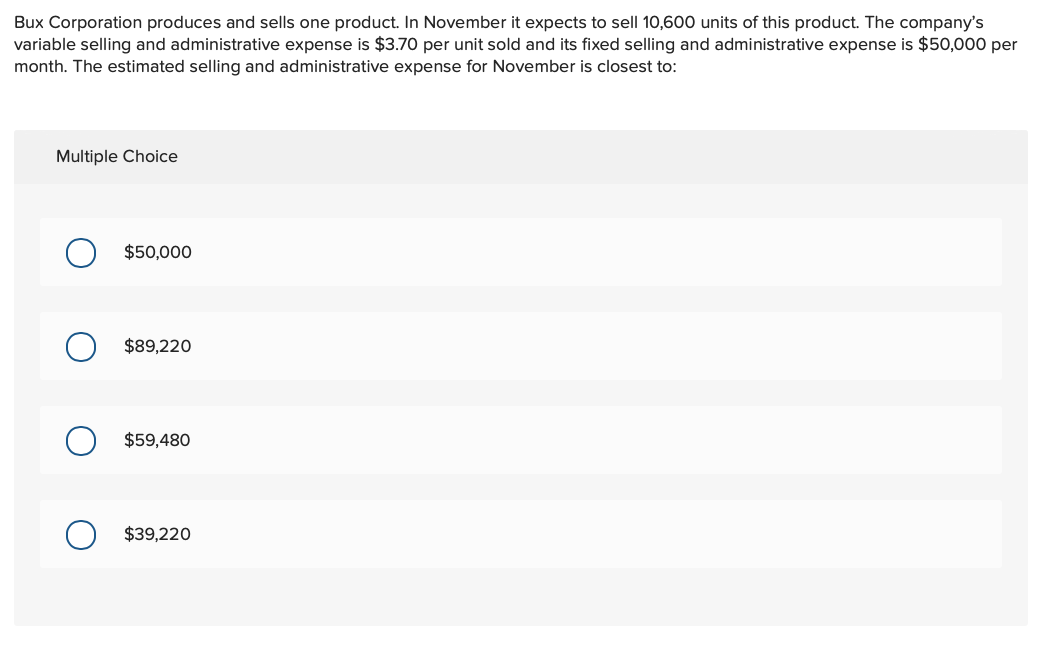

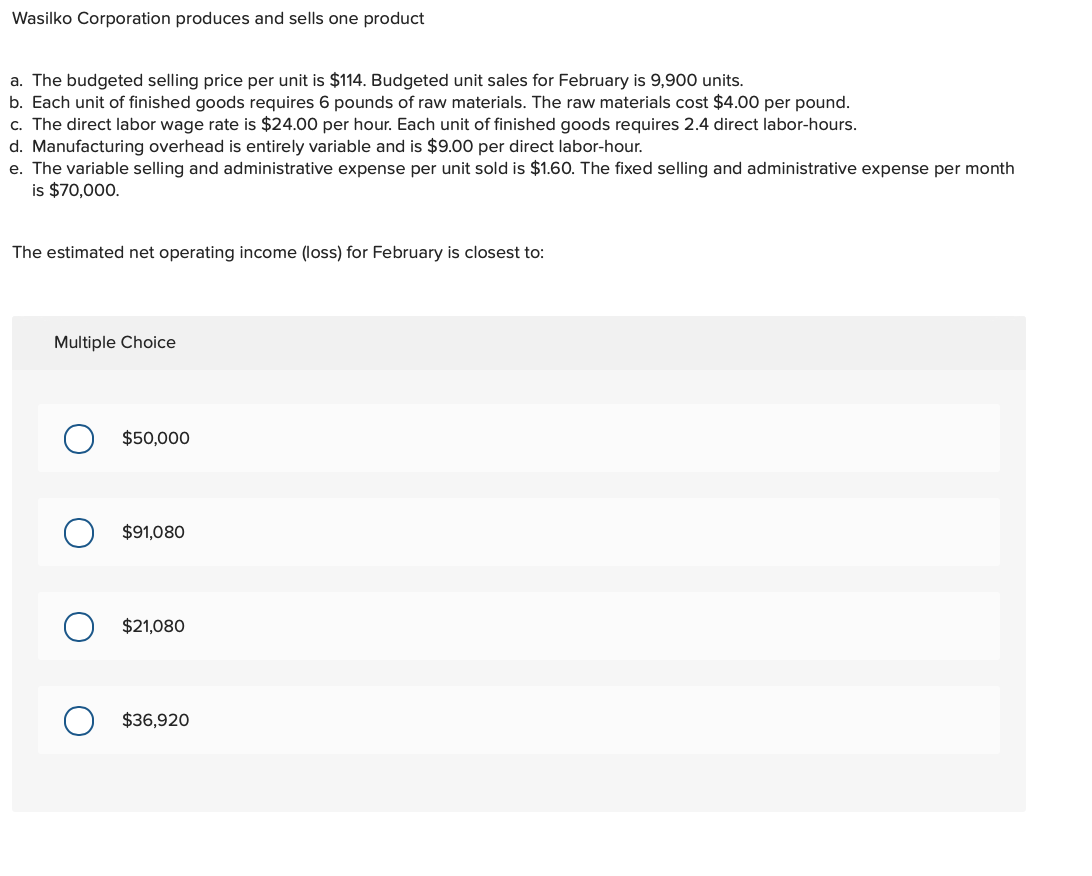

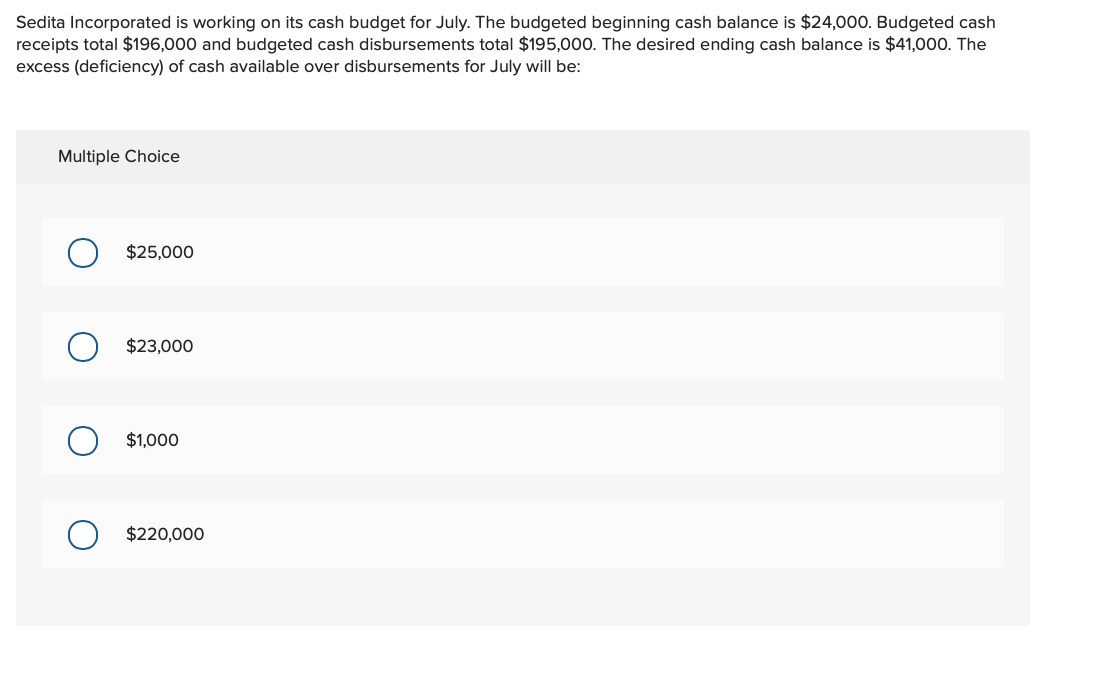

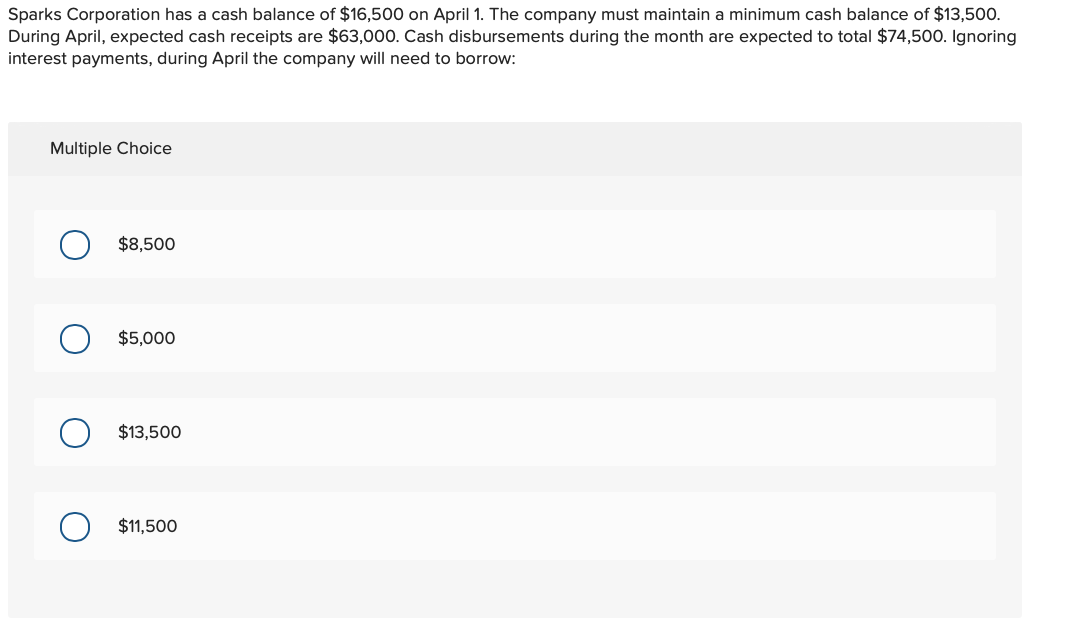

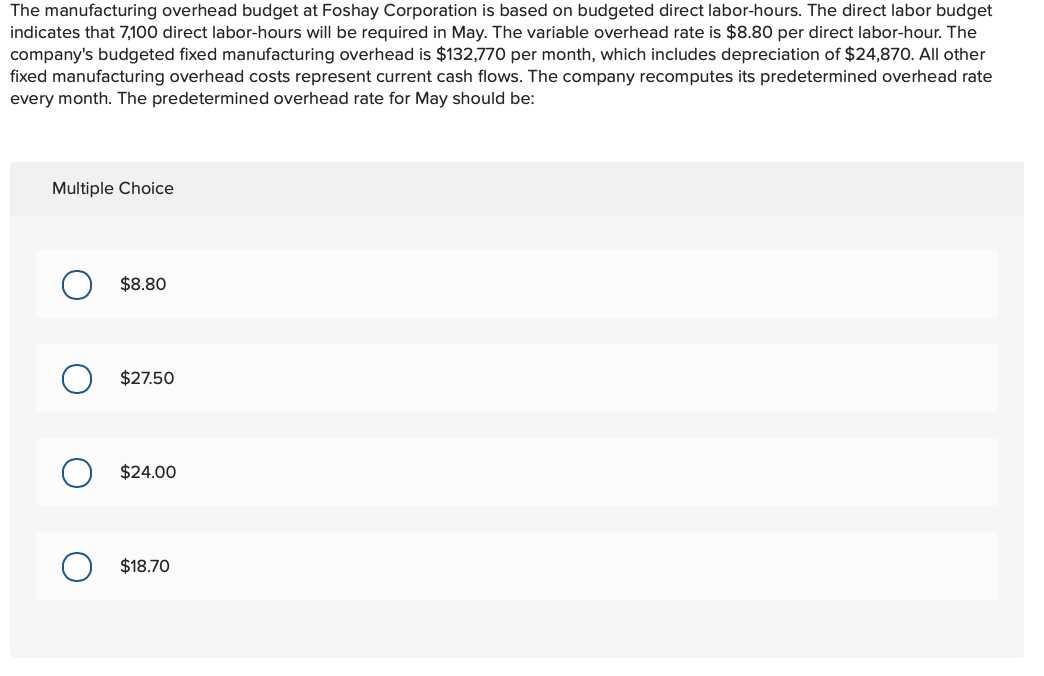

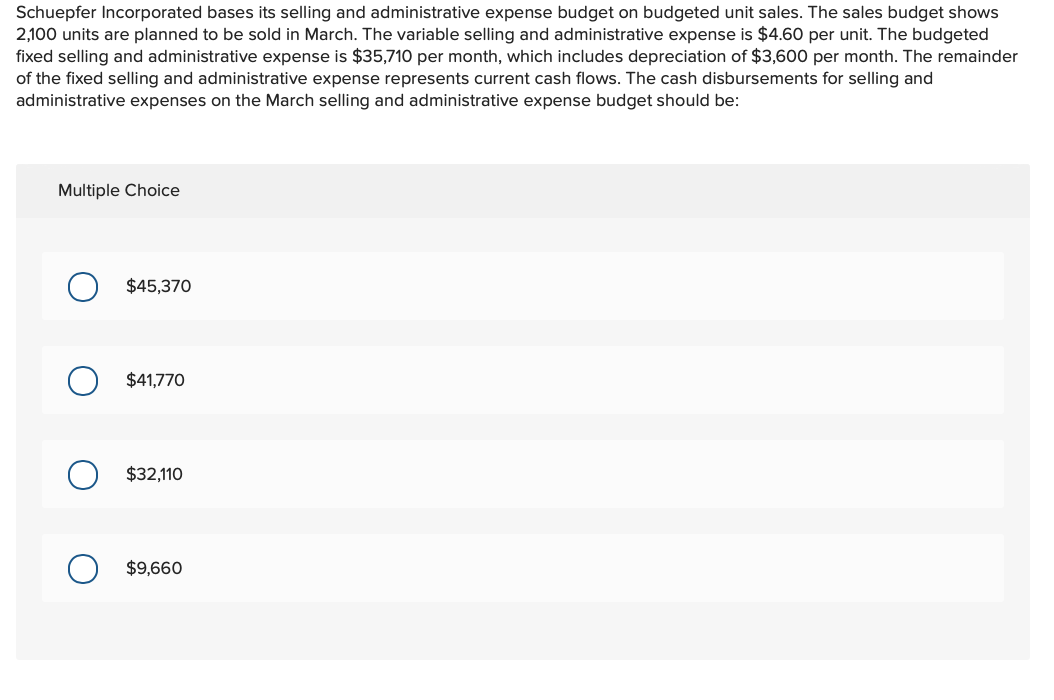

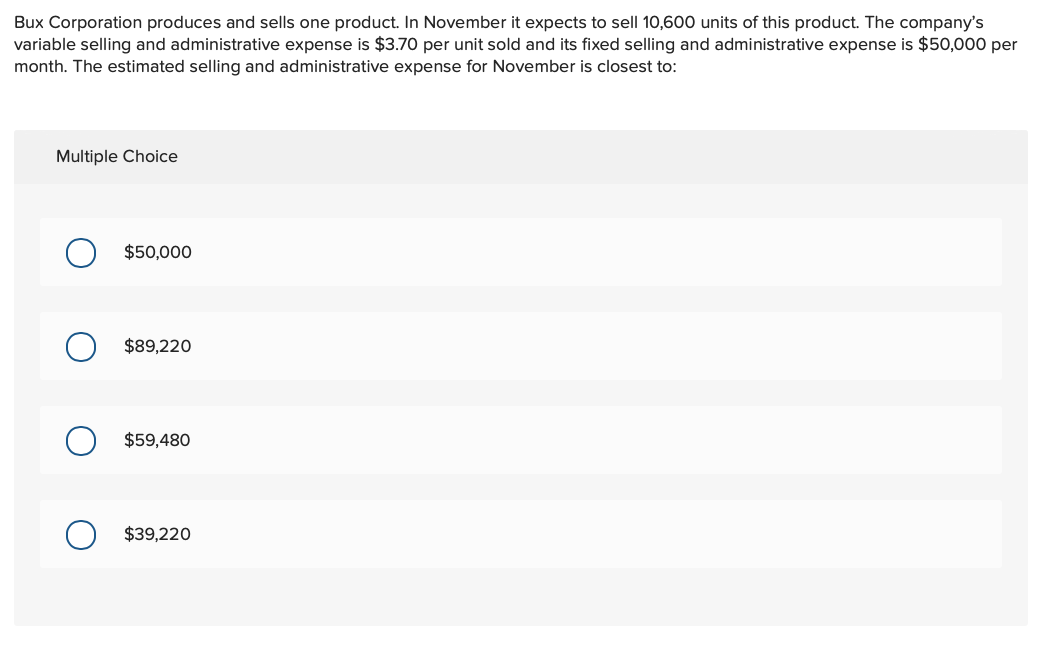

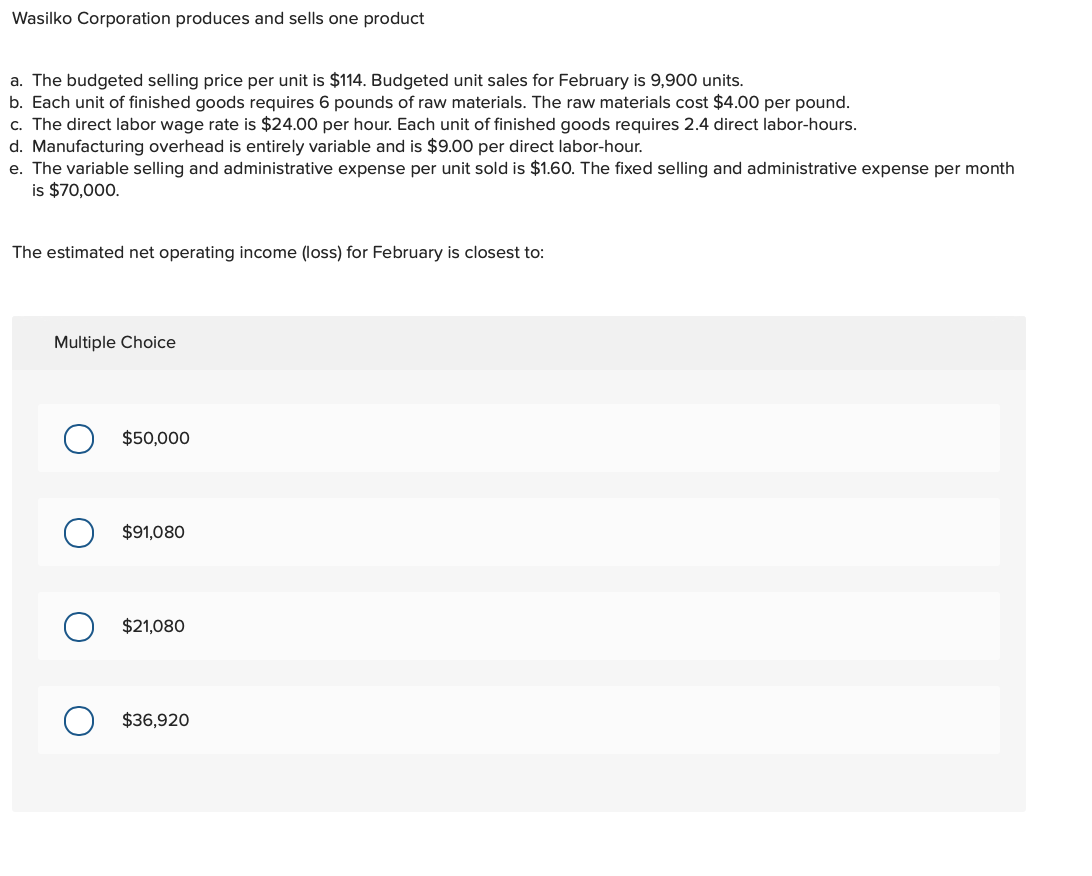

The manufacturing overhead budget at Foshay Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 7,100 direct labor-hours will be required in May. The variable overhead rate is $8.80 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $132,770 per month, which includes depreciation of $24,870. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for May should be: Multiple Choice $8.80 $27.50 $24.00 O $18.70 Schuepfer Incorporated bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 2,100 units are planned to be sold in March. The variable selling and administrative expense is $4.60 per unit. The budgeted fixed selling and administrative expense is $35,710 per month, which includes depreciation of $3,600 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be: Multiple Choice $45,370 $41,770 O $32,110 $9,660 Bux Corporation produces and sells one product. In November it expects to sell 10,600 units of this product. The company's variable selling and administrative expense is $3.70 per unit sold and its fixed selling and administrative expense is $50,000 per month. The estimated selling and administrative expense for November is closest to: Multiple Choice $50,000 $89,220 $59,480 $39,220 Wasilko Corporation produces and sells one product a. The budgeted selling price per unit is $114. Budgeted unit sales for February is 9,900 units. b. Each unit of finished goods requires 6 pounds of raw materials. The raw materials cost $4.00 per pound. c. The direct labor wage rate is $24.00 per hour. Each unit of finished goods requires 2.4 direct labor-hours. d. Manufacturing overhead is entirely variable and is $9.00 per direct labor-hour. e. The variable selling and administrative expense per unit sold is $1.60. The fixed selling and administrative expense per month is $70,000. The estimated net operating income (loss) for February is closest to: Multiple Choice $50,000 $91,080 $21,080 $36,920 Sedita Incorporated is working on its cash budget for July. The budgeted beginning cash balance is $24,000. Budgeted cash receipts total $196,000 and budgeted cash disbursements total $195,000. The desired ending cash balance is $41,000. The excess (deficiency) of cash available over disbursements for July will be: Multiple Choice $25,000 $23,000 $1,000 $220,000 Sparks Corporation has a cash balance of $16,500 on April 1. The company must maintain a minimum cash balance of $13,500. During April, expected cash receipts are $63,000. Cash disbursements during the month are expected to total $74,500. Ignoring interest payments, during April the company will need to borrow: Multiple Choice $8,500 $5,000 $13,500 $11,500

QUESTION 2.

QUESTION 2.  QUESTION 3.

QUESTION 3.  QUESTION 4.

QUESTION 4.  QUESTION 5.

QUESTION 5.