Answered step by step

Verified Expert Solution

Question

1 Approved Answer

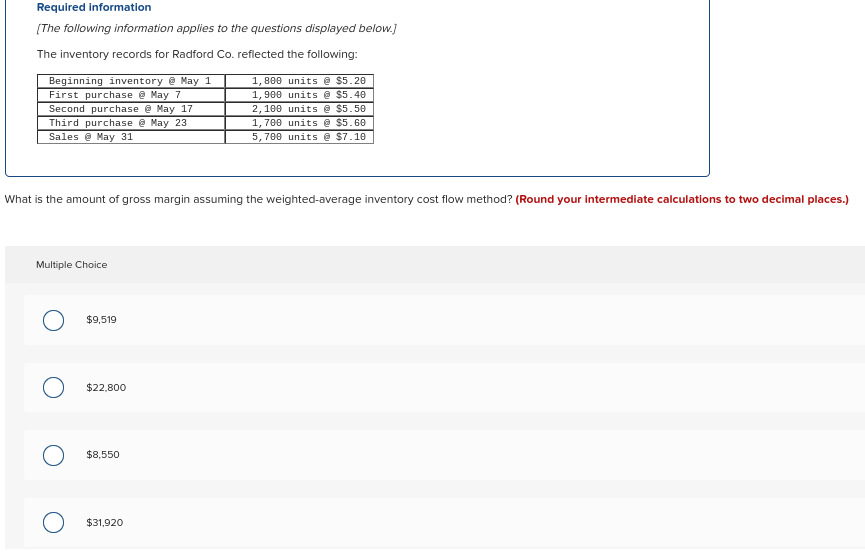

Question 1 Question 2 Question 3 Required information (The following information applies to the questions displayed below.) The inventory records for Radford Co. reflected the

Question 1

Question 2

Question 3

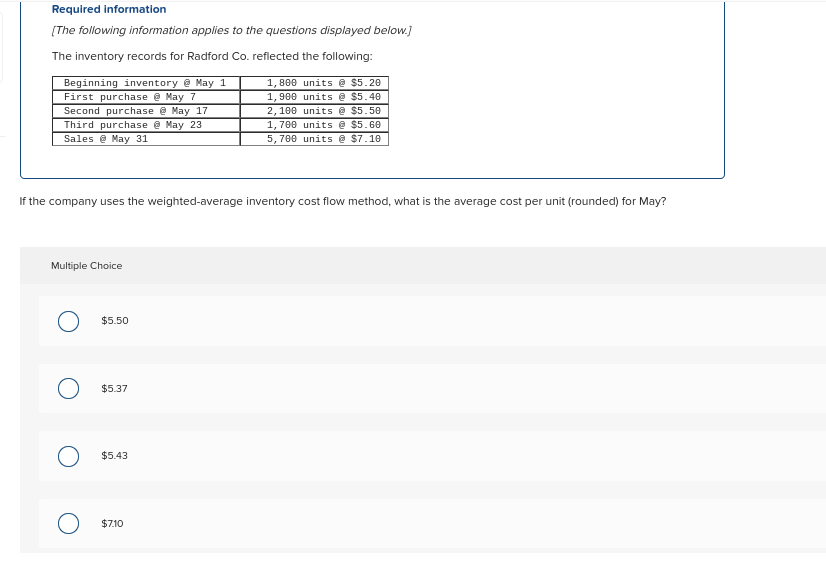

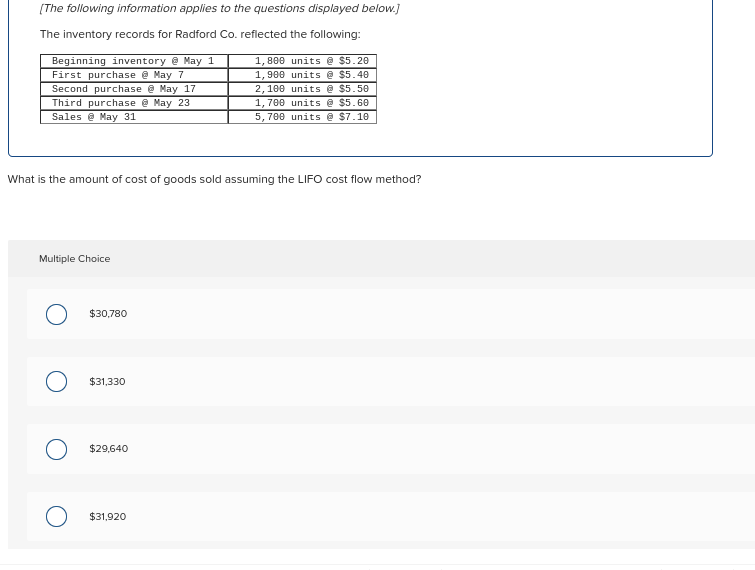

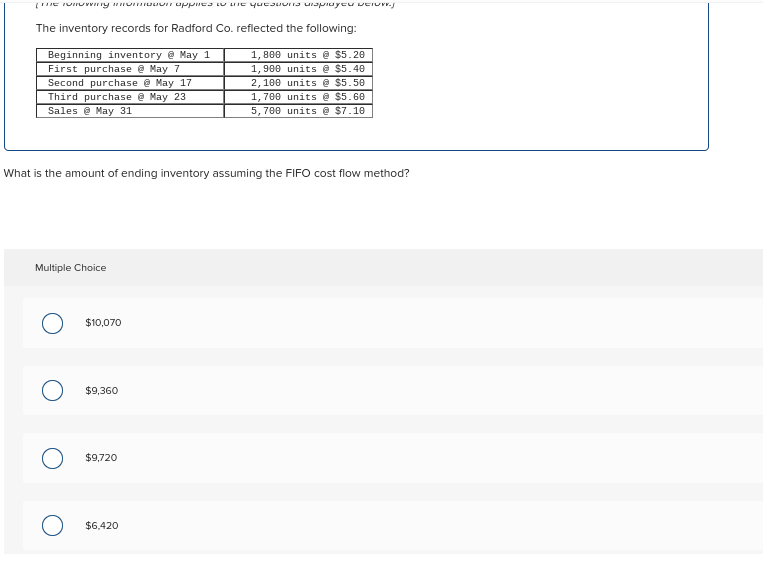

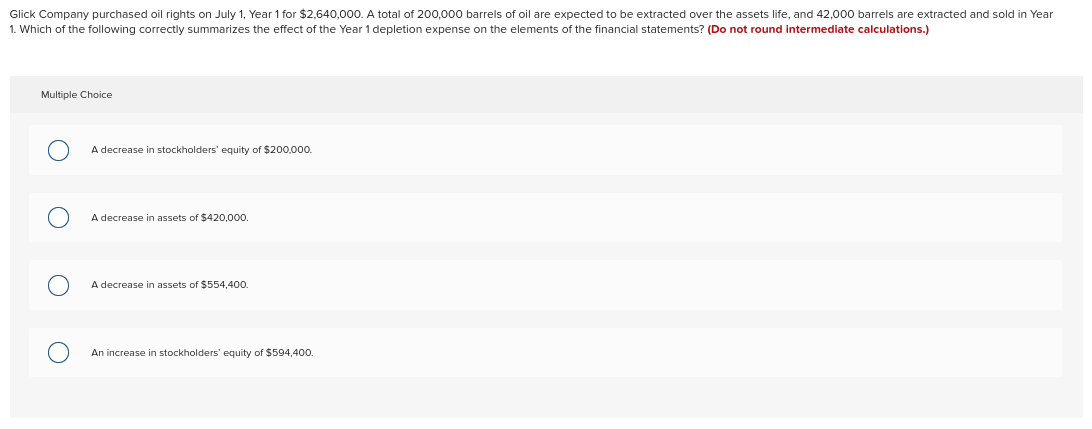

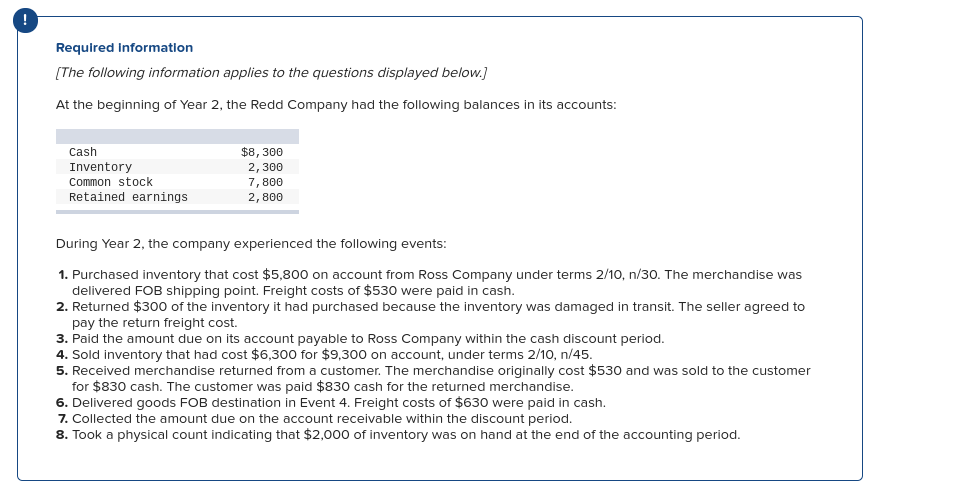

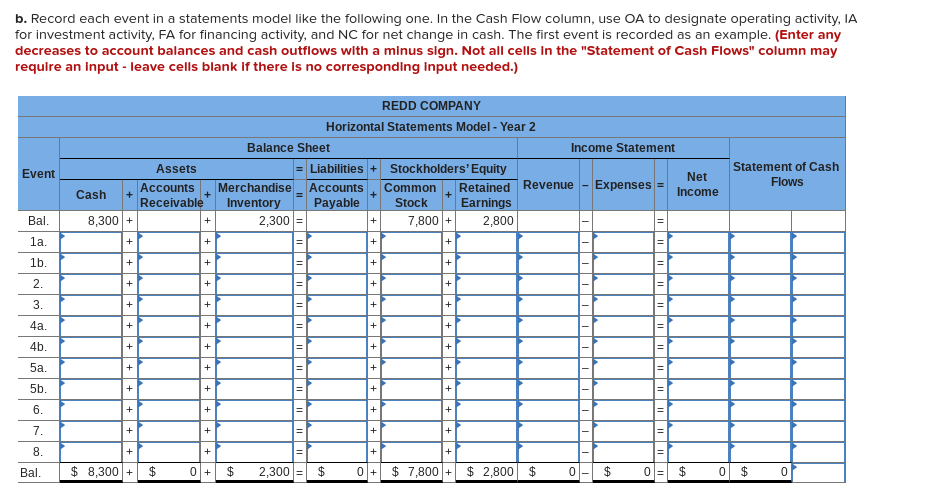

Required information (The following information applies to the questions displayed below.) The inventory records for Radford Co. reflected the following: Beginning inventory @ May 1 First purchase @ May 7 Second purchase @ May 17 Third purchase @ May 23 Sales @ May 31 1,800 units @ $5.20 1,900 units @ $5.40 2, 100 units @ $5.50 1,700 units @ $5.60 5,700 units @ $7.10 If the company uses the weighted-average inventory cost flow method, what is the average cost per unit (rounded) for May? Multiple Choice O $5.50 $5.37 $5.43 $7.10 The following information applies to the questions displayed below.) The inventory records for Radford Co. reflected the following: Beginning inventory @ May 1 First purchase @ May 7 Second purchase @ May 17 Third purchase @ May 23 Sales @ May 31 1,800 units @ $5.20 1,900 units @ $5.40 2, 100 units @ $5.50 1,700 units @ $5.60 5,700 units @ $7.10 What is the amount of cost of goods sold assuming the LIFO cost flow method? Multiple Choice $30,780 $31,330 $29,640 $31,920 HTC U virry TITULUI UPPIES LULE YUEJUURT Vispicycu verur. The inventory records for Radford Co. reflected the following: Beginning inventory @ May 1 First purchase @ May 7 Second purchase @ May 17 Third purchase @ May 23 Sales @ May 31 1,800 units @ $5.20 1,900 units @ $5.40 2,100 units @ $5.50 1,700 units @ $5.60 5,700 units @ $7.10 What is the amount of ending inventory assuming the FIFO cost flow method? Multiple Choice $10,070 $9,360 $9,720 O $6,420 Required information {The following information applies to the questions displayed below.) The inventory records for Radford Co. reflected the following: Beginning inventory @ May 1 1,800 units @ $5.20 First purchase @ May 7 1,900 units @ $5.40 Second purchase @ May 17 2, 100 units @ $5.50 Third purchase @ May 23 1,700 units @ $5.60 Sales @ May 31 5,700 units @ $7.10 What is the amount of gross margin assuming the weighted-average inventory cost flow method? (Round your intermediate calculations to two decimal places.) Multiple Choice O $9,519 $22.800 $8,550 $31,920 Glick Company purchased oil rights on July 1, Year 1 for $2,640,000. A total of 200,000 barrels of oil are expected to be extracted over the assets life, and 42,000 barrels are extracted and sold in Year 1. Which of the following correctly summarizes the effect of the Year 1 depletion expense on the elements of the financial statements? (Do not round intermediate calculations.) Multiple Choice O A decrease in stockholders' equity of $200.000 O A decrease in assets of $420,000, A decrease in assets of $554,400 An increase stockholders' equity of $594,400. Required information (The following information applies to the questions displayed below.) At the beginning of Year 2, the Redd Company had the following balances in its accounts: Cash Inventory Common stock Retained earnings $8,300 2,300 7,800 2,800 During Year 2, the company experienced the following events: 1. Purchased inventory that cost $5,800 on account from Ross Company under terms 2/10, n/30. The merchandise was delivered FOB shipping point. Freight costs of $530 were paid in cash. 2. Returned $300 of the inventory it had purchased because the inventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period. 4. Sold inventory that had cost $6,300 for $9,300 on account, under terms 2/10, n/45. 5. Received merchandise returned from a customer. The merchandise originally cost $530 and was sold to the customer for $830 cash. The customer was paid $830 cash for the returned merchandise. 6. Delivered goods FOB destination in Event 4. Freight costs of $630 were paid in cash. 7. Collected the amount due on the account receivable within the discount period. 8. Took a physical count indicating that $2,000 of inventory was on hand at the end of the accounting period. b. Record each event in a statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. The first event is recorded as an example. (Enter any decreases to account balances and cash outflows with a minus sign. Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed.) Event Assets Accounts Receivable REDD COMPANY Horizontal Statements Model - Year 2 Balance Sheet Income Statement = Liabilities + Stockholders'Equity Net Merchandise Accounts Common Retained Revenue Expenses = Inventory Income Payable Stock Earnings 2,300 7,800 + 2,800 Statement of Cash Flows Cash + + Bal. 8,300 + + + la. + + + + 1b. + + + + + 2. + + 3. + + + 4a. + + + 4b. + + + 5a. + + + + + + + + + + + + + 5b. + 6. + 7. + + + + + + + + + + 8. + Bal. $ 8,300 + $ 0 + $ 2,300 $ 0 + $ 7,800 + $ 2,800 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started