QUESTION 1:

QUESTION 2:

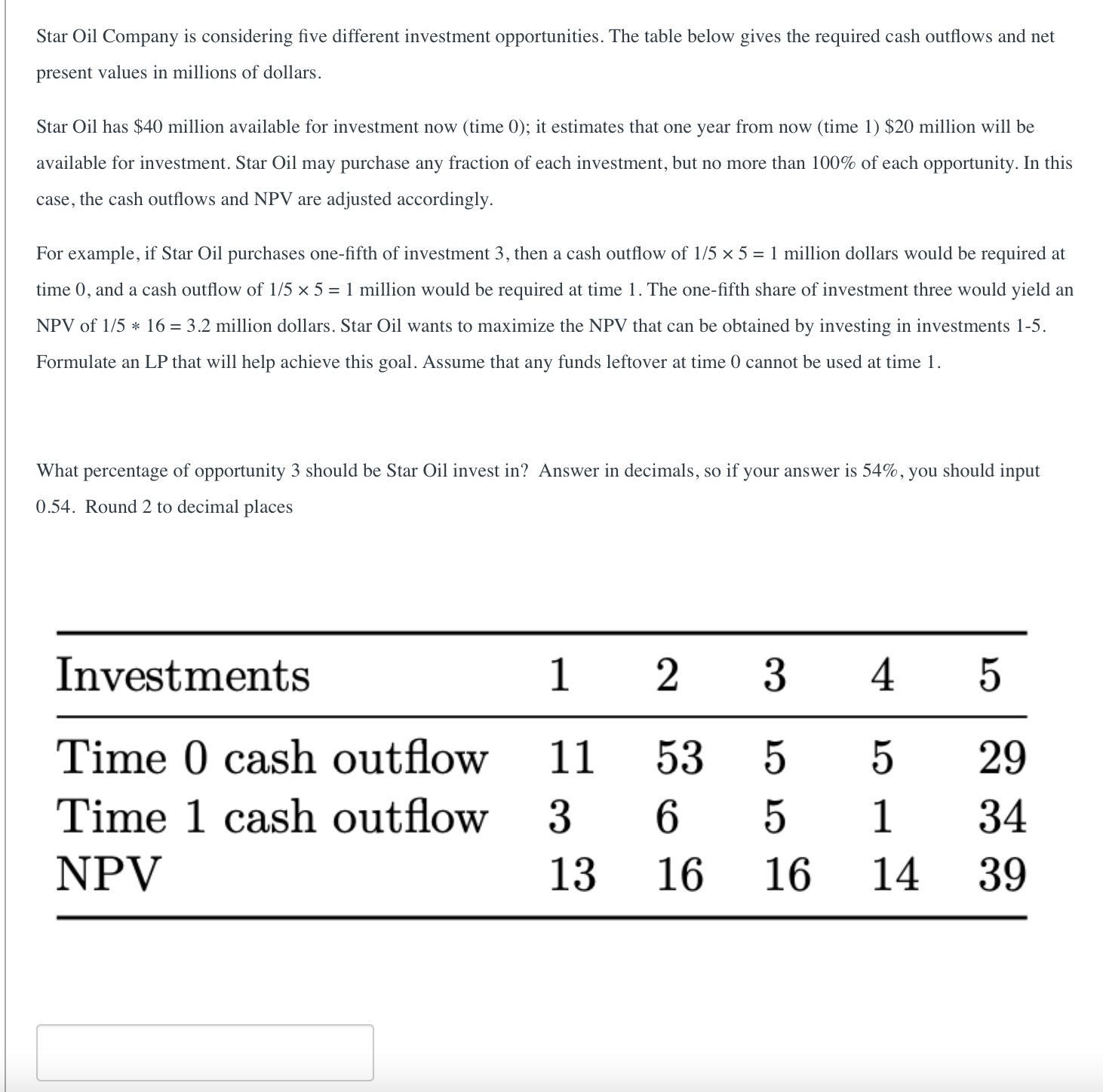

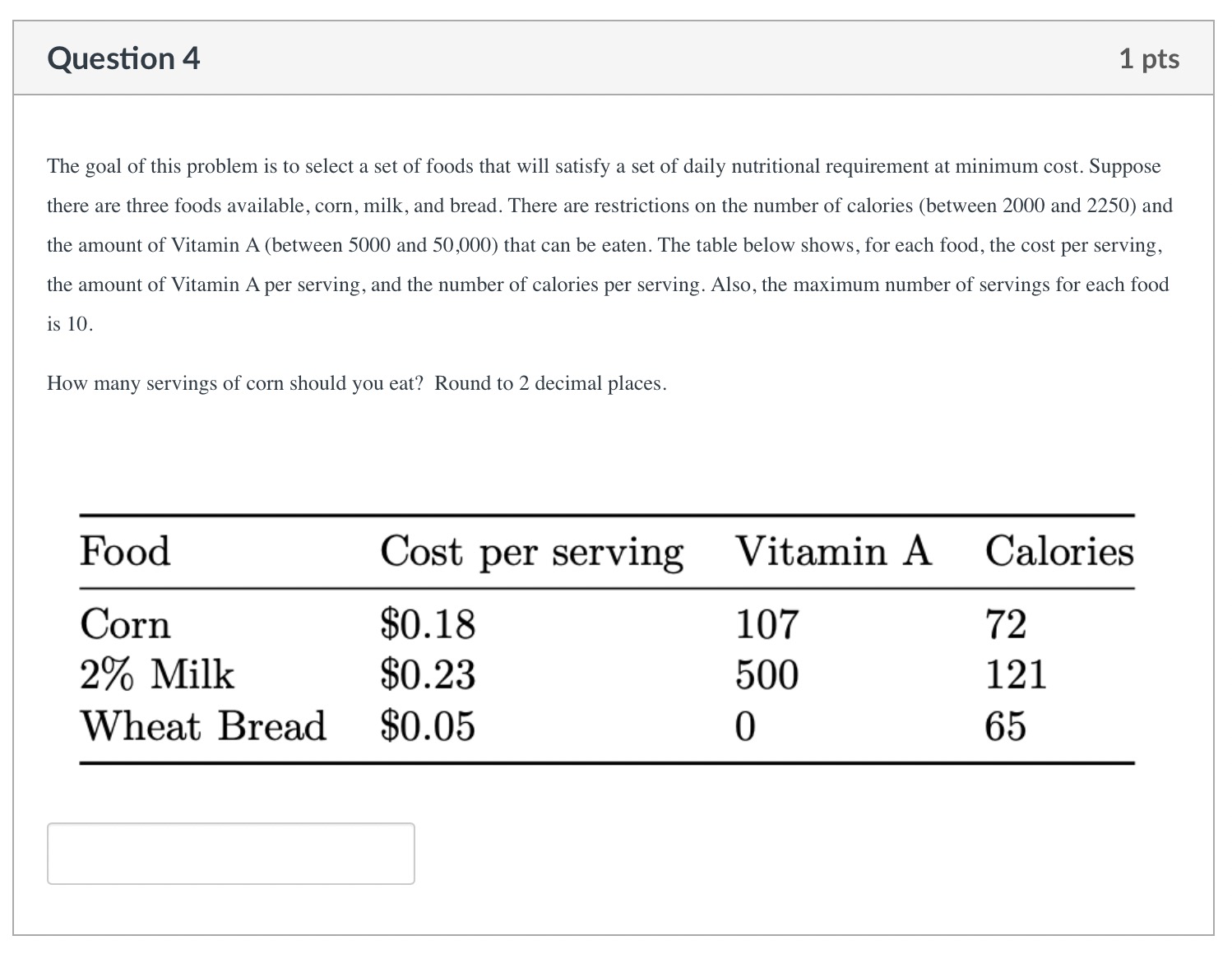

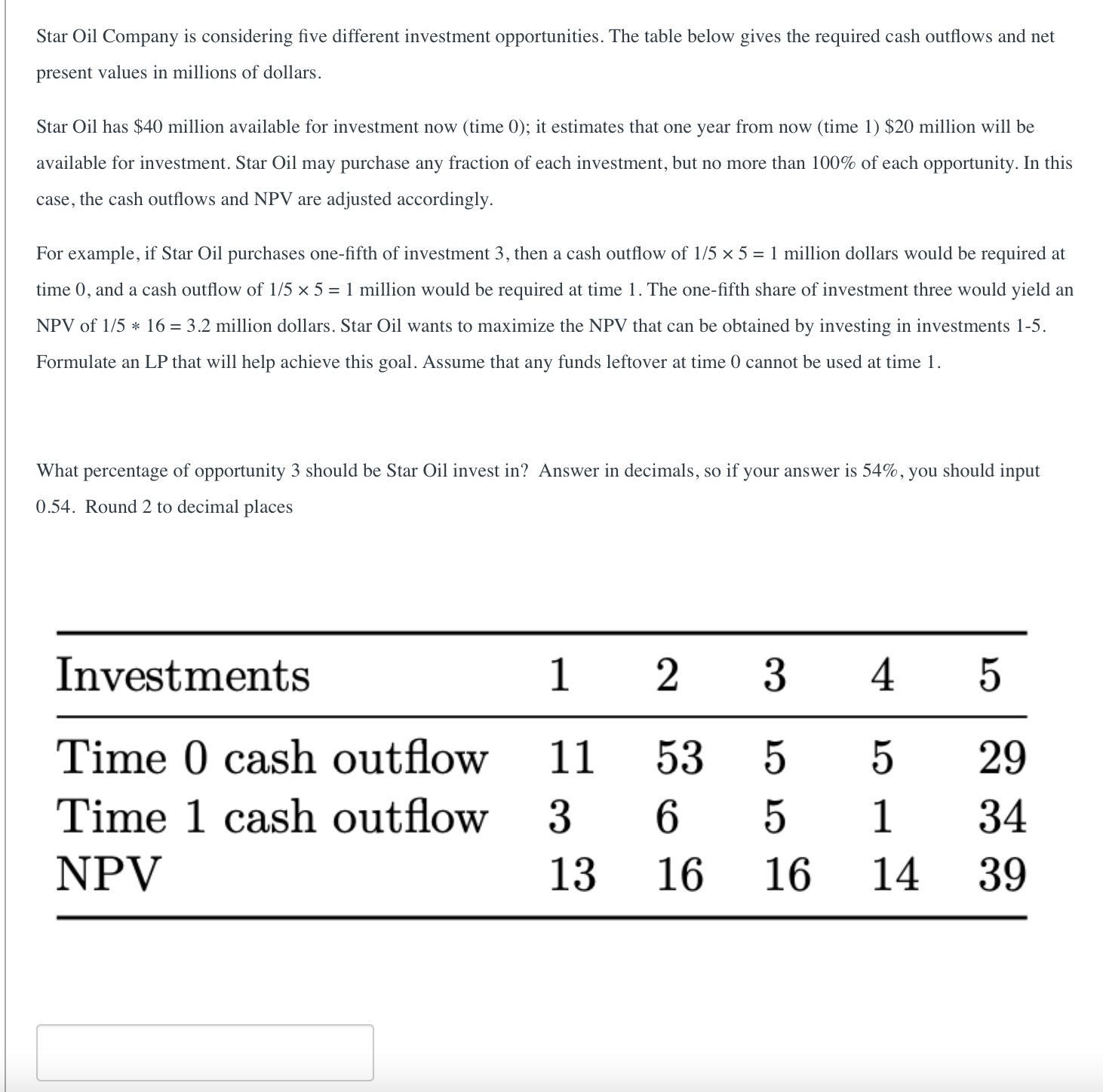

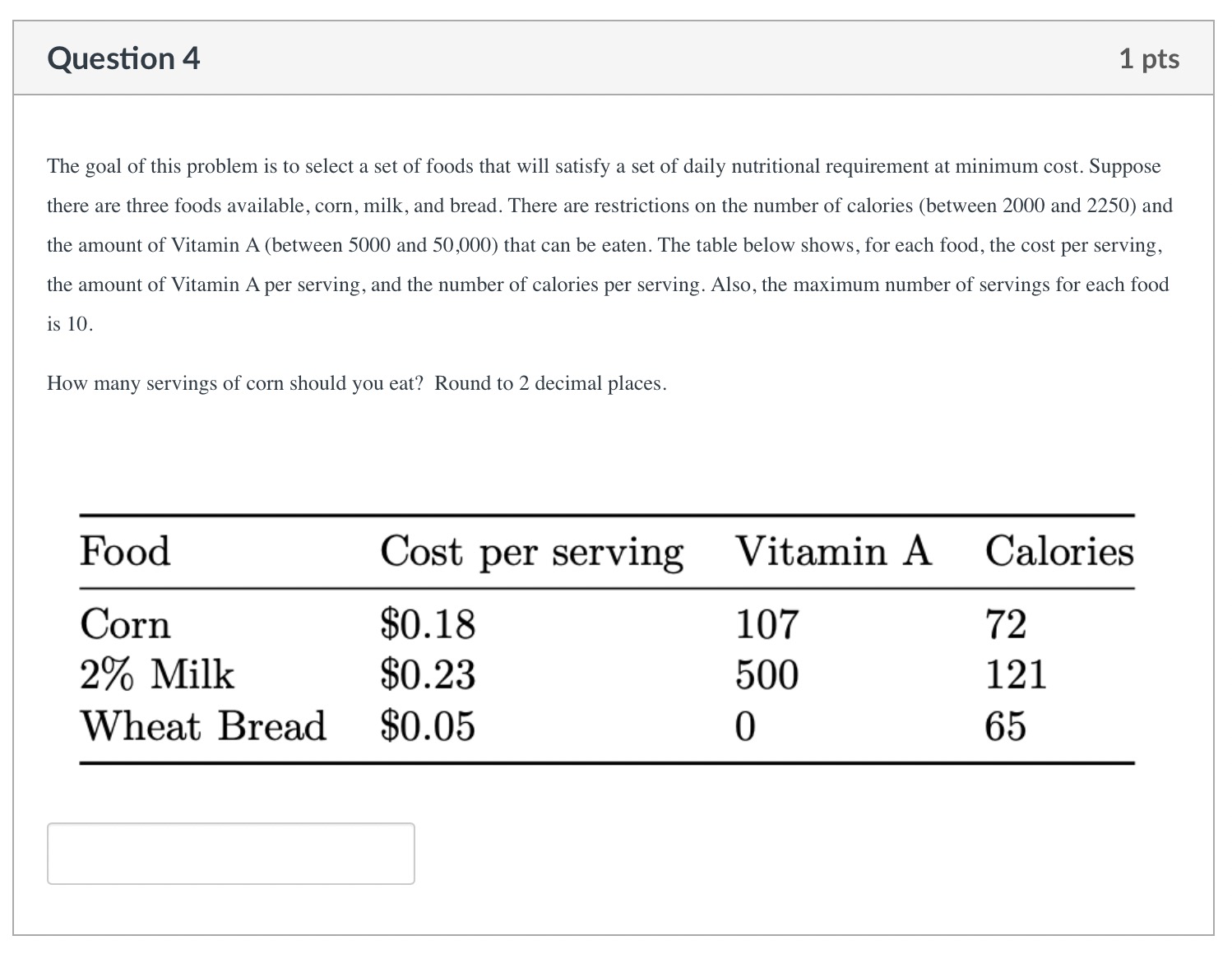

Star Oil Company is considering five different investment opportunities. The table below gives the required cash outflows and net present values in millions of dollars. Star Oil has $40 million available for investment now (time 0); it estimates that one year from now (time 1) \$20 million will be available for investment. Star Oil may purchase any fraction of each investment, but no more than 100% of each opportunity. In this case, the cash outflows and NPV are adjusted accordingly. For example, if Star Oil purchases one-fifth of investment 3, then a cash outflow of 1/55=1 million dollars would be required at time 0 , and a cash outflow of 1/55=1 million would be required at time 1 . The one-fifth share of investment three would yield an NPV of 1/516=3.2 million dollars. Star Oil wants to maximize the NPV that can be obtained by investing in investments 15. Formulate an LP that will help achieve this goal. Assume that any funds leftover at time 0 cannot be used at time 1. What percentage of opportunity 3 should be Star Oil invest in? Answer in decimals, so if your answer is 54\%, you should input 0.54 . Round 2 to decimal places The goal of this problem is to select a set of foods that will satisfy a set of daily nutritional requirement at minimum cost. Suppose there are three foods available, corn, milk, and bread. There are restrictions on the number of calories (between 2000 and 2250) and the amount of Vitamin A (between 5000 and 50,000) that can be eaten. The table below shows, for each food, the cost per serving, the amount of Vitamin A per serving, and the number of calories per serving. Also, the maximum number of servings for each food is 10 . How many servings of corn should you eat? Round to 2 decimal places. Star Oil Company is considering five different investment opportunities. The table below gives the required cash outflows and net present values in millions of dollars. Star Oil has $40 million available for investment now (time 0); it estimates that one year from now (time 1) \$20 million will be available for investment. Star Oil may purchase any fraction of each investment, but no more than 100% of each opportunity. In this case, the cash outflows and NPV are adjusted accordingly. For example, if Star Oil purchases one-fifth of investment 3, then a cash outflow of 1/55=1 million dollars would be required at time 0 , and a cash outflow of 1/55=1 million would be required at time 1 . The one-fifth share of investment three would yield an NPV of 1/516=3.2 million dollars. Star Oil wants to maximize the NPV that can be obtained by investing in investments 15. Formulate an LP that will help achieve this goal. Assume that any funds leftover at time 0 cannot be used at time 1. What percentage of opportunity 3 should be Star Oil invest in? Answer in decimals, so if your answer is 54\%, you should input 0.54 . Round 2 to decimal places The goal of this problem is to select a set of foods that will satisfy a set of daily nutritional requirement at minimum cost. Suppose there are three foods available, corn, milk, and bread. There are restrictions on the number of calories (between 2000 and 2250) and the amount of Vitamin A (between 5000 and 50,000) that can be eaten. The table below shows, for each food, the cost per serving, the amount of Vitamin A per serving, and the number of calories per serving. Also, the maximum number of servings for each food is 10 . How many servings of corn should you eat? Round to 2 decimal places