QUESTION . 1

QUESTION .2

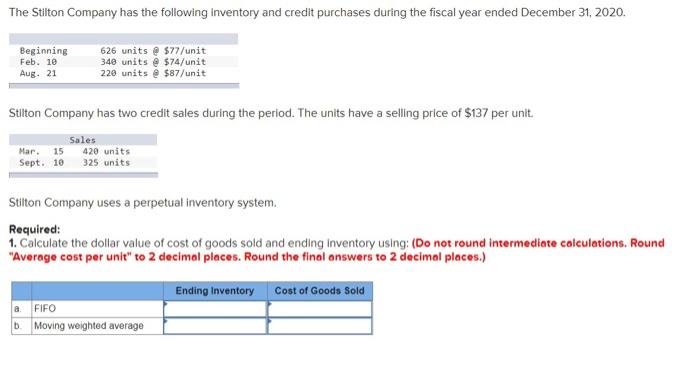

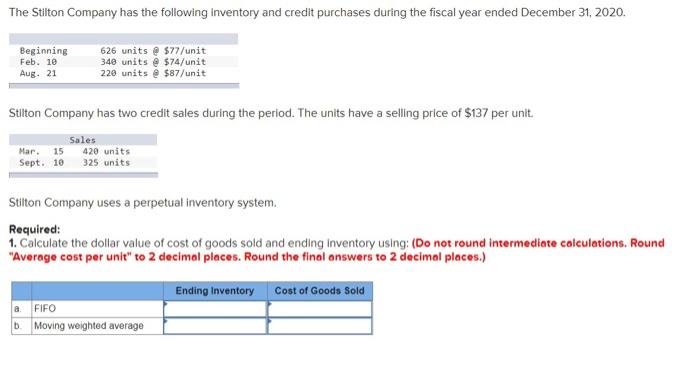

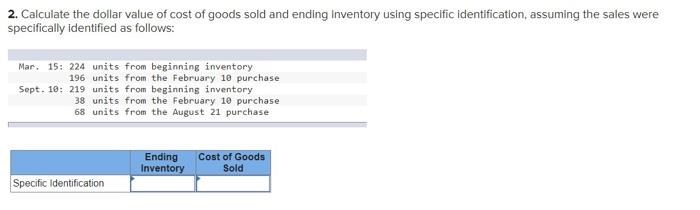

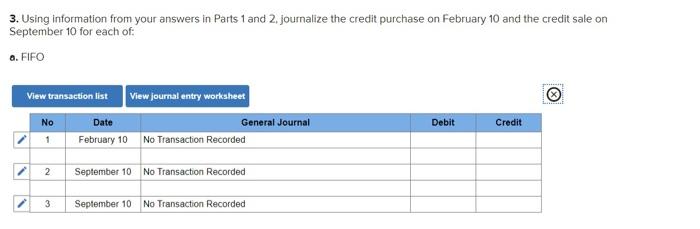

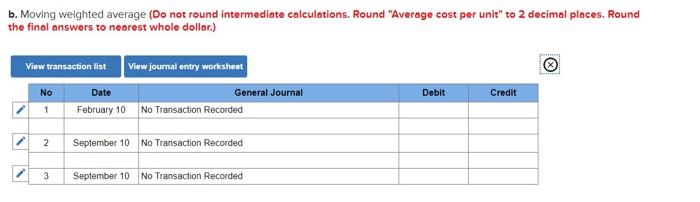

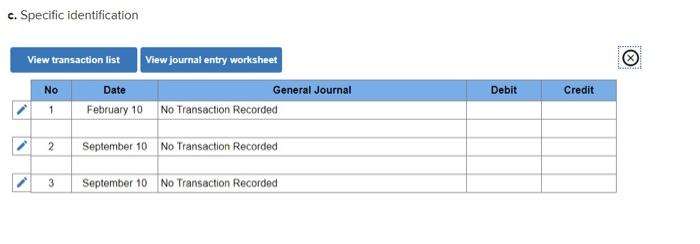

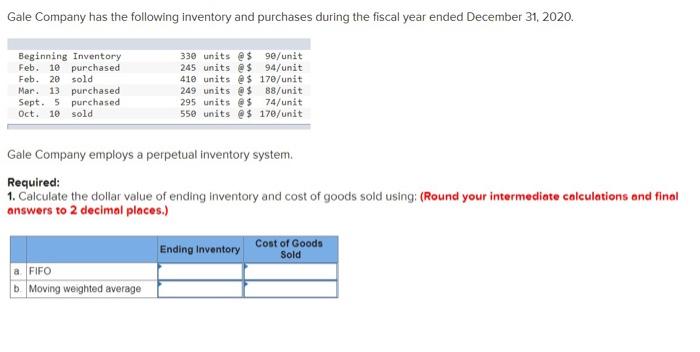

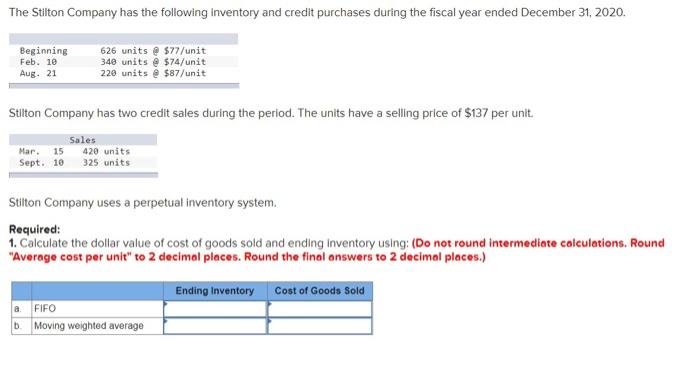

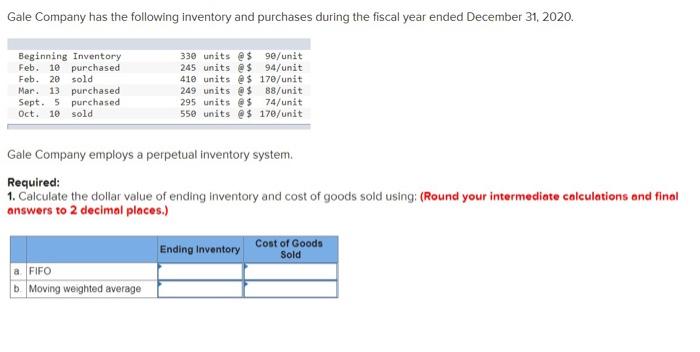

The Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2020. Beginning Feb. 10 Aug. 21 626 units @ $77/unit 340 units @ $74/unit 220 units @ $87/unit Stilton Company has two credit sales during the period. The units have a selling price of $137 per unit Sales Mar. 15 420 units Sept. 10 325 units Stilton Company uses a perpetual inventory system. Required: 1. Calculate the dollar value of cost of goods sold and ending inventory using: (Do not round intermediate calculations. Round "Average cost per unit" to 2 decimal places. Round the final answers to 2 decimal places.) Ending Inventory cost of Goods Sold a FIFO b. Moving weighted average 2. Calculate the dollar value of cost of goods sold and ending Inventory using specific identification, assuming the sales were specifically identified as follows: Mar. 15: 224 units from beginning inventory 196 units from the February 10 purchase Sept. 10: 219 units from beginning inventory 38 units from the February 10 purchase 68 units from the August 21 purchase Ending Inventory Cost of Goods Sold Specific Identification 3. Using information from your answers in Parts 1 and 2. journalize the credit purchase on February 10 and the credit sale on September 10 for each of: O. FIFO View transaction list View journal entry worksheet Date General Journal February 10 No Transaction Recorded No Debit Credit 1 2 September 10 No Transaction Recorded 3 September 10 No Transaction Recorded b. Moving weighted average (Do not round intermediate calculations. Round "Average cost per unit" to 2 decimal places, Round the final answers to nearest whole dollar.) View transaction list View journal entry worksheet No Date General Journal 1 February 10 No Transaction Recorded Debit Credit 2 September 10 No Transaction Recorded 3 September 10 No Transaction Recorded c. Specific identification View transaction list View journal entry worksheet 1...! No Debit Credit Date General Journal February 10 No Transaction Recorded 1 2 September 10 No Transaction Recorded 3 September 10 No Transaction Recorded Gale Company has the following inventory and purchases during the fiscal year ended December 31, 2020. Beginning Inventory Feb. 10 purchased Feb. 20 sold Mar. 13 purchased Sept. 5 purchased Oct. 10 sold 330 units @ $ 90/unit 245 units @$ 94/unit 410 units $ 170/unit 249 units @ $ 88/unit 295 units @ $ 74/unit 550 units @ $ 170/unit Gale Company employs a perpetual inventory system Required: 1. Calculate the dollar value of ending Inventory and cost of goods sold using: (Round your intermediate calculations and final answers to 2 decimal places.) Ending Inventory Cost of Goods Sold a FIFO Moving weighted average 2. Using your calculations from Part 1, complete the following schedule: (Round your intermediate calculations and final answers to 2 decimal places.) FIFO Moving Weighted Average Sales Cost of goods sold Gross profit