Answered step by step

Verified Expert Solution

Question

1 Approved Answer

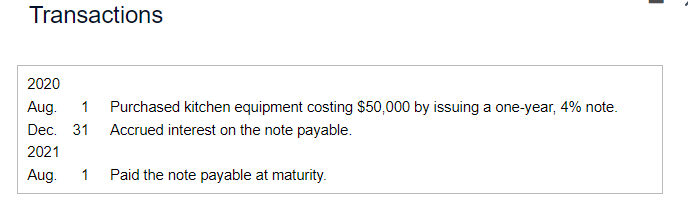

Question 1. Question 2. Transactions 2020 Aug. 1 Purchased kitchen equipment costing $50,000 by issuing a one-year, 4% note. Dec. 31 Accrued interest on the

Question 1.

Question 2.

Question 2.

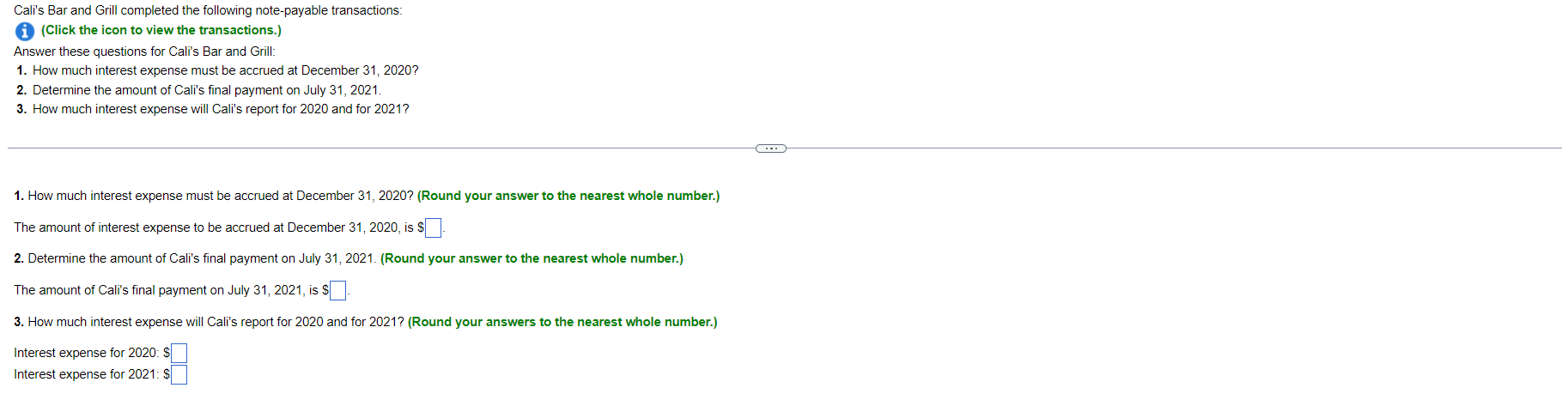

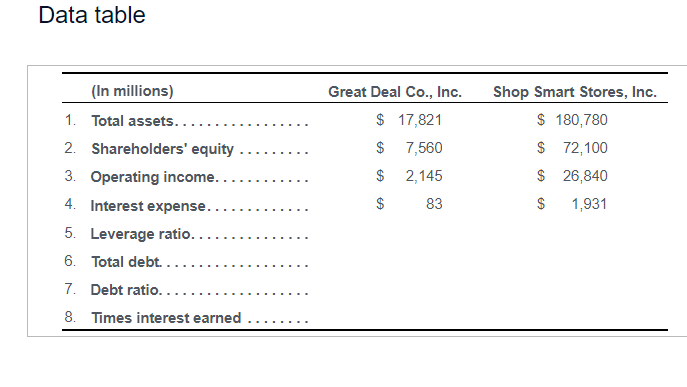

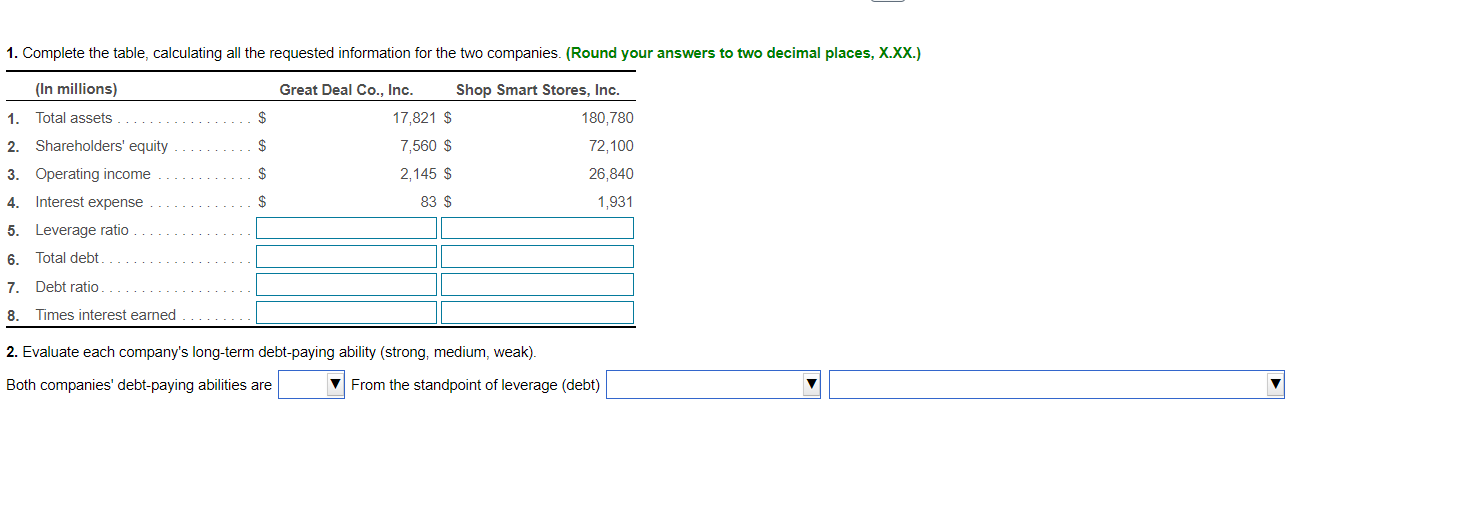

Transactions 2020 Aug. 1 Purchased kitchen equipment costing $50,000 by issuing a one-year, 4% note. Dec. 31 Accrued interest on the note payable. 2021 Aug. 1 Paid the note payable at maturity. Cali's Bar and Grill completed the following note-payable transactions: (Click the icon to view the transactions.) Answer these questions for Cali's Bar and Grill: 1. How much interest expense must be accrued at December 31,2020 ? 2. Determine the amount of Cali's final payment on July 31, 2021. 3. How much interest expense will Cali's report for 2020 and for 2021 ? 1. How much interest expense must be accrued at December 31, 2020? (Round your answer to the nearest whole number.) The amount of interest expense to be accrued at December 31,2020 , is $ 2. Determine the amount of Cali's final payment on July 31, 2021. (Round your answer to the nearest whole number.) The amount of Cali's final payment on July 31,2021 , is $ 3. How much interest expense will Cali's report for 2020 and for 2021 ? (Round your answers to the nearest whole number.) Interest expense for 2020: $ Interest expense for 2021: $ Data table 2. Evaluate each company's long-term debt-paying ability (strong, medium, weak). Both companies' debt-paying abilities are From the standpoint of leverage (debt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started