Question 1

Questions 2

Question 3

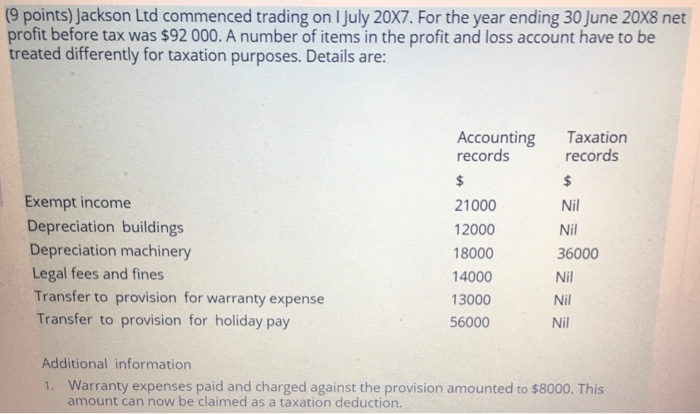

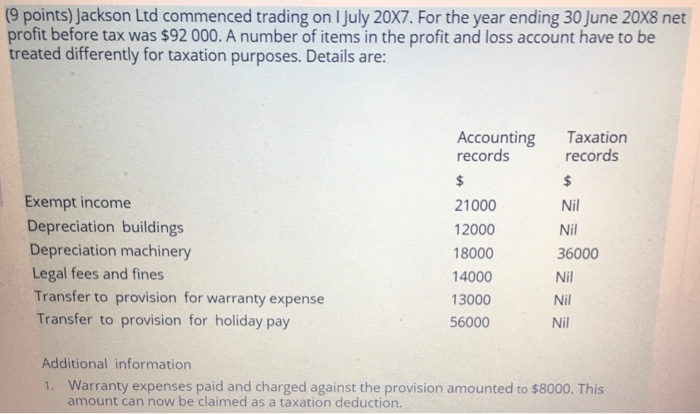

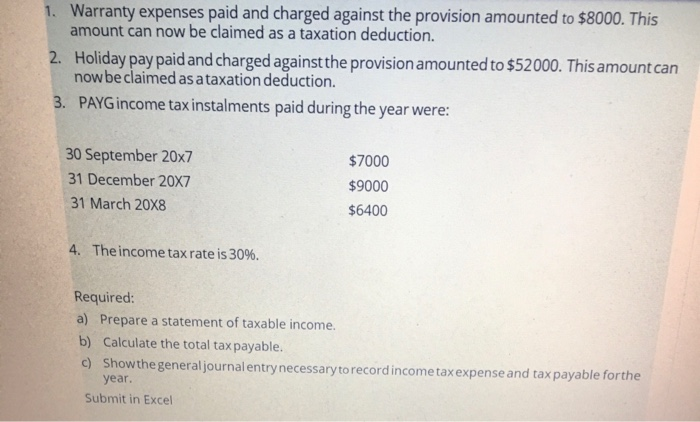

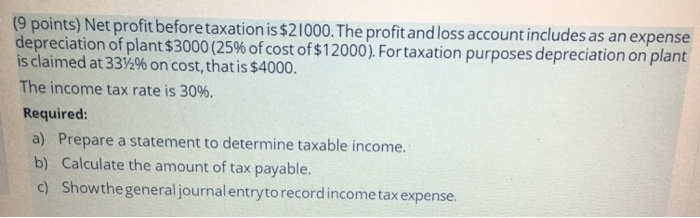

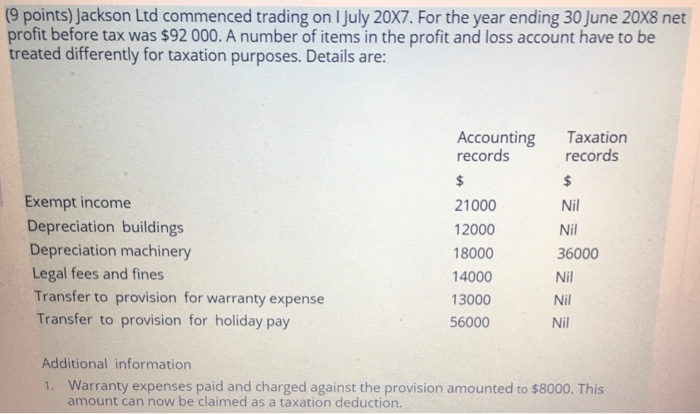

(9 points) Jackson Ltd commenced trading on 1 July 20X7. For the year ending 30 June 20X8 net profit before tax was $92000. A number of items in the profit and loss account have to be treated differently for taxation purposes. Details are: Accounting records Taxation records Exempt income Depreciation buildings Depreciation machinery Legal fees and fines Transfer to provision for warranty expense Transfer to provision for holiday pay 21000 12000 18000 14000 13000 56000 Nil Nil 36000 Nil Nil Nil Additional information 1. Warranty expenses paid and charged against the provision amounted to $8000. This amount can now be claimed as a taxation deduction. 1. Warranty expenses paid and charged against the provision amounted to $8000. This amount can now be claimed as a taxation deduction. Holiday pay paid and charged against the provision amounted to $52000. This amount can now be claimed as a taxation deduction. 3. PAYG income tax instalments paid during the year were: 30 September 20x7 31 December 20X7 31 March 20x8 $7000 $9000 $6400 4. The income tax rate is 30%. Required: a) Prepare a statement of taxable income. b) Calculate the total tax payable. c) Show the generaljournal entry necessary to record income tax expense and tax payable forthe year. Submit in Excel (9 points) Net profit before taxation is $49,000. A number of items in the profit and loss account have to be treated differently for taxation purposes. Details are: Accounting records Taxation records 8000 Entertainment expenses Nil Transfer to provision for long service leave 10000 Nil Depreciation of machinery 5000 7500 Required: a) Prepare a statement to determine taxable income. b) Calculate the amount of tax payable. c) Show the general journal entry to record income tax expense. Submit in Excel (9 points) Net profit before taxation is $21000. The profit and loss account includes as an expense depreciation of plant $3000 (25% of cost of $12000). For taxation purposes depreciation on plant is claimed at 33%2% on cost, that is $4000. The income tax rate is 30%. Required: a) Prepare a statement to determine taxable income. b) Calculate the amount of tax payable. c) Showthe general journal entry to recordincome tax expense