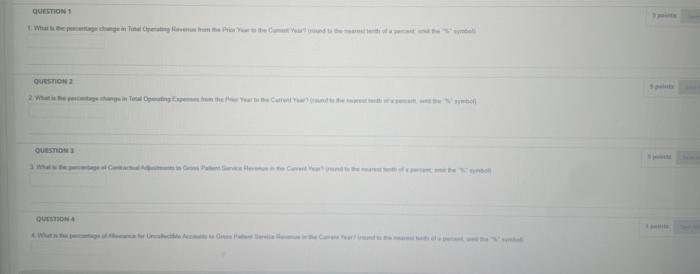

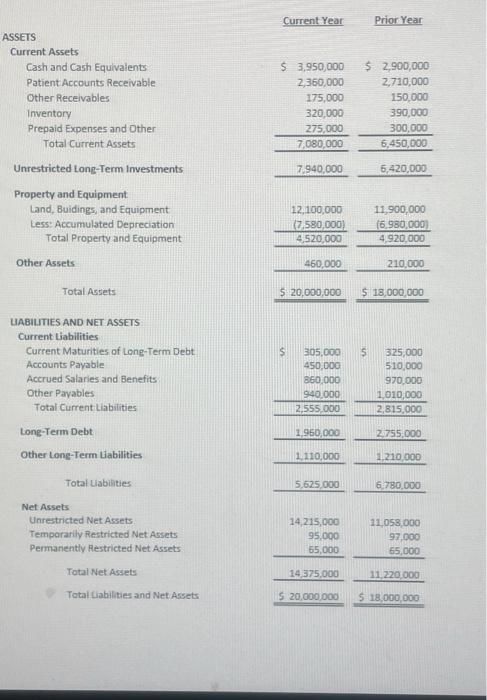

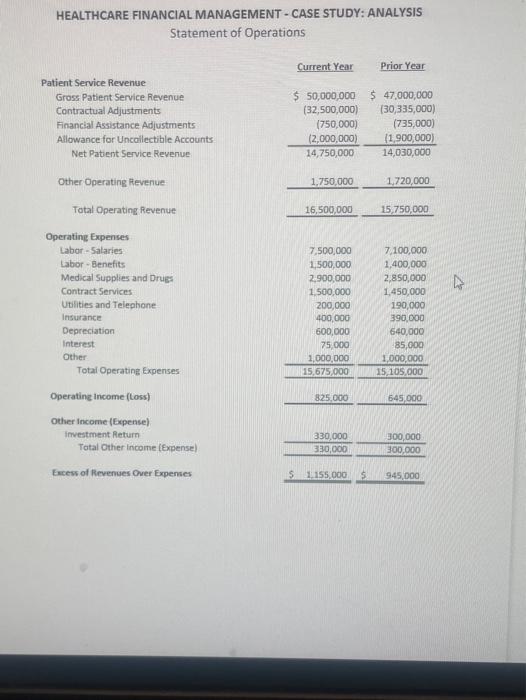

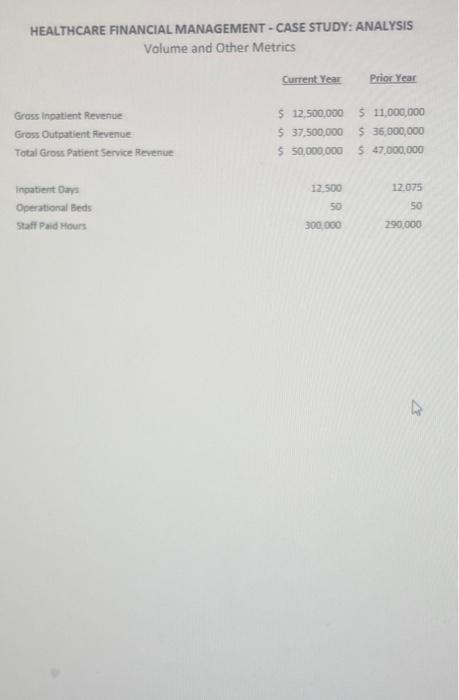

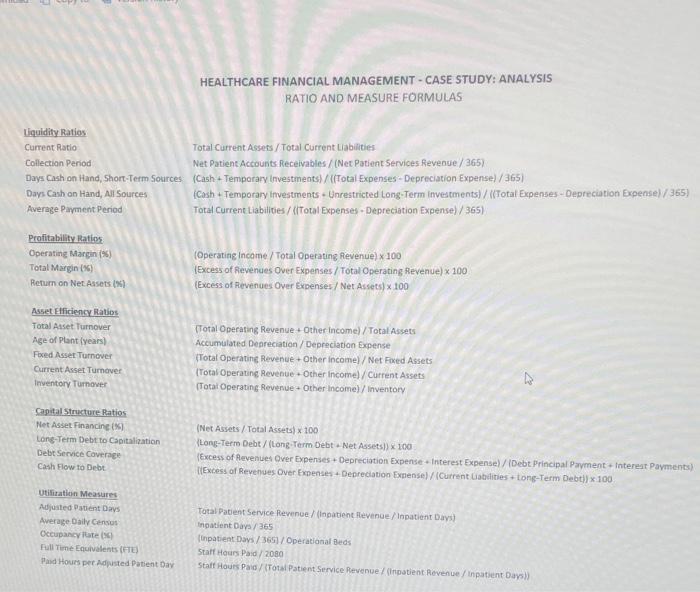

QUESTION 1 QUESTIONS QUESTIONS QUESTION Current Year Prior Year ASSETS Current Assets Cash and Cash Equivalents Patient Accounts Receivable Other Receivables Inventory Prepaid Expenses and other Total Current Assets Unrestricted Long-Term Investments Property and Equipment Land, Buidings, and Equipment Less: Accumulated Depreciation Total Property and Equipment $ 3,950,000 2,350,000 175,000 320,000 275,000 7,080,000 $ 2,900,000 2,710,000 150.000 390,000 300,000 6,450,000 7.940,000 6,420,000 12,100,000 (7.580,000) 4,520,000 11,900,000 16.980,000) 4,920,000 Other Assets 460,000 210,000 Total Assets $ 20,000,000 $ 18,000,000 $ S 305,000 450,000 860,000 940,000 2,555.000 325,000 510,000 970,000 1,010,000 2,815,000 1,950,000 2.755.000 LABILITIES AND NET ASSETS Current Liabilities Current Maturities of Long-Term Debt Accounts Payable Accrued Salaries and Benefits Other Payables Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Net Assets Unrestricted Net Assets Temporarily Restricted Net Assets Permanently Restricted Net Assets Total Net Assets Tatal Liabilities and Net Assets 1110,000 1.210.000 5.625.000 6,780,000 14 215,000 95,000 65,000 11.058.000 97.000 65,000 14,375,000 11 220 000 $ 20.000.000 $ 18,000,000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS Statement of Operations Current Year Prior Year Patient Service Revenue Gross Patient Service Revenue Contractual Adjustments Financial Assistance Adjustments Allowance for Uncollectible Accounts Net Patient Service Revenue $ 50,000,000 (32,500,000 (750,000) (2,000,000) 14,750,000 $ 47,000,000 (30,335,000) (735,000) (1,900,000) 14,030,000 Other Operating Revenue 1,750,000 1,720,000 Total Operating Revenue 16,500,000 15,750,000 Operating Expenses Labor - Salaries Labor - Benefits Medical Supplies and Drugs Contract Services Utilities and Telephone Insurance Depreciation Interest Other Total Operating Expenses Operating Income (Loss) Other Income (Expense) investment Return Total Other Income (Expense) Excess of evenes Over Expenses 7.500,000 1,500,000 2,900,000 1.500,000 200,000 400,000 600,000 75,000 1,000,000 15,675,000 7.100,000 1,400,000 2,850,000 1.450,000 190,000 390,000 640,000 85,000 1,000,000 15, 105.000 825.000 645,000 330,000 300,000 330,000 300,000 $ 1.155.000 945,000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS Volume and Other Metrics Current Year Prior Year Gross Inpatient Revenue Gross Outpatient Revenue Total Gross Patient Service Revenue $ 12,500,000 $ 37,500,000 $ 50,000 000 $ 11,000,000 $ 35,000,000 5 47,000,000 inpatient Days Operational Beds Staff Paid Hours 12.500 50 12.075 50 300.000 290 000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS RATIO AND MEASURE FORMULAS Liquidity Ratios Current Ratio Total Current Assets/Total Current Liabilities Collection Period Net Patient Accounts Receivables/ (Net Patient Services Revenue/365) Days Cash on Hand, Short-Term Sources (Cash + Temporary Investments)/([Total Expenses - Depreciation Expense)/365) Days Cash on Hand, All Sources (Cash + Temporary Investments - Unrestricted Long-Term investments /((Total Expenses - Depreciation Expense)/365) Average Payment Period Total Current Liabilities/ (Total Expenses - Depreciation Expense)/365) + Profitability Natios Operating Margin(95) Total Margin (%) Return on Net Assets (94 (Operating Income / Total Operating Revenue) x 100 (Excess of Revenues Over Expenses/Total Operating Revenue) x 100 (Excess of Revenues Over Expenses / Net Assets) x 100 Asset Efficiency Ratios Total Asset Turnover Age of Plant (years) Fixed Asset Turnover Current Asset Turnover Inventory Turnover (Total Operating Revenue + Other Income) / Total Assets Accumulated Depreciation / Depreciation Expense Total Operating Revenue + Other income) / Net Fixed Assets (Total Operating Revenue - Other Income) / Current Assets (Total Operating Revenue - Other Income) / Inventory Capital Structure Ratios Net Asset Financing Long-Term Debt to Capitalization Debt Service Coverage Cash Flow to Debt (Net Assets/Total Assets) * 100 (Long-Terre Debt /(Long Term Debt Net Assets]) x 100 (Excess of Revenues Over Expenses +Depreciation Expense. Interest Expense) /Debt Principal Payment Interest Payments) TlExcess of Revenues Over Expenses - Depreciation Extense) (Current Labdities Long-Term Debt) x 100 Utilisation Measures Adjusted patient Days Average Daily Census Occupancy late Full Tine Equivalents (TE) Paid Hours per Adjusted Patient Day Total Patient Service Revenue / (Impatient Revenue / Inpatient Days) Inpatient Days/365 Inpatient Days/3651/Operational Beds Stall Hours Paid / 2080 Staff Hours Paid / Total Patient Service Revenue/Inpatient Revenue / inpatient Days) QUESTION 1 QUESTIONS QUESTIONS QUESTION Current Year Prior Year ASSETS Current Assets Cash and Cash Equivalents Patient Accounts Receivable Other Receivables Inventory Prepaid Expenses and other Total Current Assets Unrestricted Long-Term Investments Property and Equipment Land, Buidings, and Equipment Less: Accumulated Depreciation Total Property and Equipment $ 3,950,000 2,350,000 175,000 320,000 275,000 7,080,000 $ 2,900,000 2,710,000 150.000 390,000 300,000 6,450,000 7.940,000 6,420,000 12,100,000 (7.580,000) 4,520,000 11,900,000 16.980,000) 4,920,000 Other Assets 460,000 210,000 Total Assets $ 20,000,000 $ 18,000,000 $ S 305,000 450,000 860,000 940,000 2,555.000 325,000 510,000 970,000 1,010,000 2,815,000 1,950,000 2.755.000 LABILITIES AND NET ASSETS Current Liabilities Current Maturities of Long-Term Debt Accounts Payable Accrued Salaries and Benefits Other Payables Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Net Assets Unrestricted Net Assets Temporarily Restricted Net Assets Permanently Restricted Net Assets Total Net Assets Tatal Liabilities and Net Assets 1110,000 1.210.000 5.625.000 6,780,000 14 215,000 95,000 65,000 11.058.000 97.000 65,000 14,375,000 11 220 000 $ 20.000.000 $ 18,000,000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS Statement of Operations Current Year Prior Year Patient Service Revenue Gross Patient Service Revenue Contractual Adjustments Financial Assistance Adjustments Allowance for Uncollectible Accounts Net Patient Service Revenue $ 50,000,000 (32,500,000 (750,000) (2,000,000) 14,750,000 $ 47,000,000 (30,335,000) (735,000) (1,900,000) 14,030,000 Other Operating Revenue 1,750,000 1,720,000 Total Operating Revenue 16,500,000 15,750,000 Operating Expenses Labor - Salaries Labor - Benefits Medical Supplies and Drugs Contract Services Utilities and Telephone Insurance Depreciation Interest Other Total Operating Expenses Operating Income (Loss) Other Income (Expense) investment Return Total Other Income (Expense) Excess of evenes Over Expenses 7.500,000 1,500,000 2,900,000 1.500,000 200,000 400,000 600,000 75,000 1,000,000 15,675,000 7.100,000 1,400,000 2,850,000 1.450,000 190,000 390,000 640,000 85,000 1,000,000 15, 105.000 825.000 645,000 330,000 300,000 330,000 300,000 $ 1.155.000 945,000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS Volume and Other Metrics Current Year Prior Year Gross Inpatient Revenue Gross Outpatient Revenue Total Gross Patient Service Revenue $ 12,500,000 $ 37,500,000 $ 50,000 000 $ 11,000,000 $ 35,000,000 5 47,000,000 inpatient Days Operational Beds Staff Paid Hours 12.500 50 12.075 50 300.000 290 000 HEALTHCARE FINANCIAL MANAGEMENT - CASE STUDY: ANALYSIS RATIO AND MEASURE FORMULAS Liquidity Ratios Current Ratio Total Current Assets/Total Current Liabilities Collection Period Net Patient Accounts Receivables/ (Net Patient Services Revenue/365) Days Cash on Hand, Short-Term Sources (Cash + Temporary Investments)/([Total Expenses - Depreciation Expense)/365) Days Cash on Hand, All Sources (Cash + Temporary Investments - Unrestricted Long-Term investments /((Total Expenses - Depreciation Expense)/365) Average Payment Period Total Current Liabilities/ (Total Expenses - Depreciation Expense)/365) + Profitability Natios Operating Margin(95) Total Margin (%) Return on Net Assets (94 (Operating Income / Total Operating Revenue) x 100 (Excess of Revenues Over Expenses/Total Operating Revenue) x 100 (Excess of Revenues Over Expenses / Net Assets) x 100 Asset Efficiency Ratios Total Asset Turnover Age of Plant (years) Fixed Asset Turnover Current Asset Turnover Inventory Turnover (Total Operating Revenue + Other Income) / Total Assets Accumulated Depreciation / Depreciation Expense Total Operating Revenue + Other income) / Net Fixed Assets (Total Operating Revenue - Other Income) / Current Assets (Total Operating Revenue - Other Income) / Inventory Capital Structure Ratios Net Asset Financing Long-Term Debt to Capitalization Debt Service Coverage Cash Flow to Debt (Net Assets/Total Assets) * 100 (Long-Terre Debt /(Long Term Debt Net Assets]) x 100 (Excess of Revenues Over Expenses +Depreciation Expense. Interest Expense) /Debt Principal Payment Interest Payments) TlExcess of Revenues Over Expenses - Depreciation Extense) (Current Labdities Long-Term Debt) x 100 Utilisation Measures Adjusted patient Days Average Daily Census Occupancy late Full Tine Equivalents (TE) Paid Hours per Adjusted Patient Day Total Patient Service Revenue / (Impatient Revenue / Inpatient Days) Inpatient Days/365 Inpatient Days/3651/Operational Beds Stall Hours Paid / 2080 Staff Hours Paid / Total Patient Service Revenue/Inpatient Revenue / inpatient Days)