Answered step by step

Verified Expert Solution

Question

1 Approved Answer

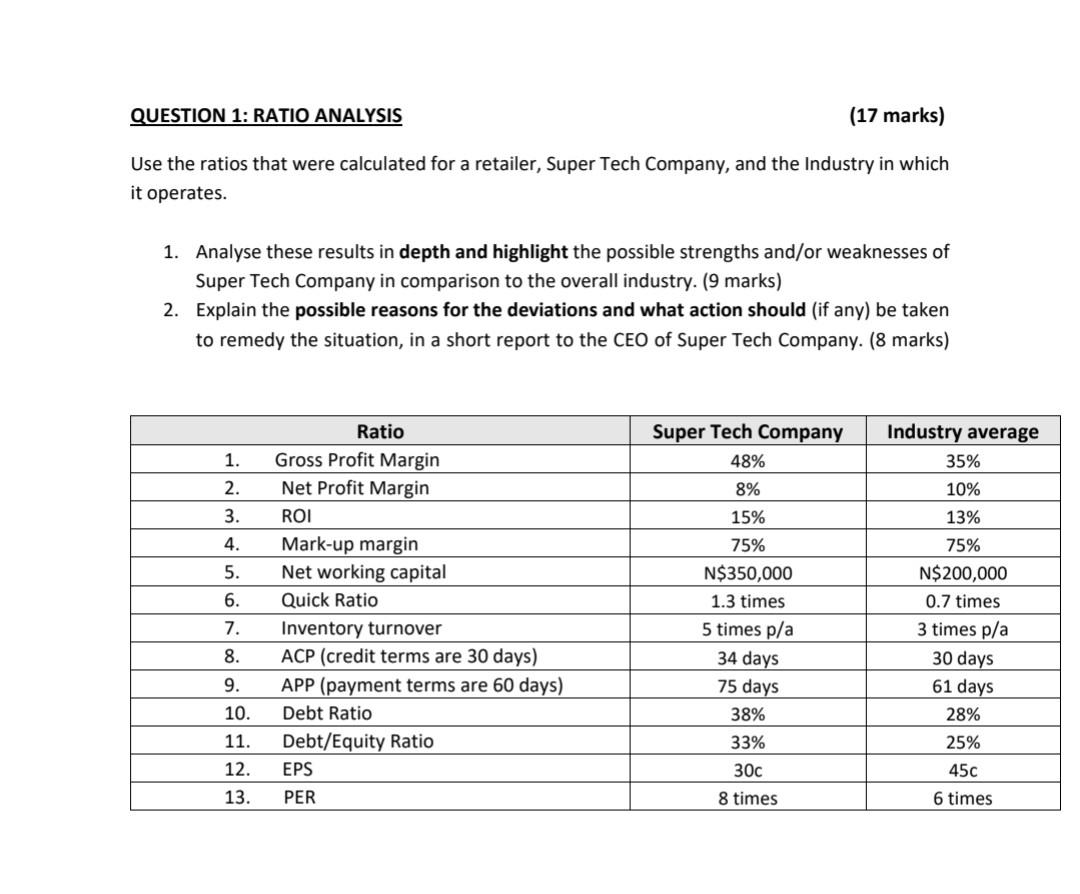

QUESTION 1: RATIO ANALYSIS (17 marks) Use the ratios that were calculated for a retailer, Super Tech Company, and the Industry in which it

QUESTION 1: RATIO ANALYSIS (17 marks) Use the ratios that were calculated for a retailer, Super Tech Company, and the Industry in which it operates. 1. Analyse these results in depth and highlight the possible strengths and/or weaknesses of Super Tech Company in comparison to the overall industry. (9 marks) 2. Explain the possible reasons for the deviations and what action should (if any) be taken to remedy the situation, in a short report to the CEO of Super Tech Company. (8 marks) Ratio 1. Gross Profit Margin 2. Net Profit Margin 3. ROI 4. Mark-up margin 5. Net working capital 6. Quick Ratio 7. Inventory turnover 8. ACP (credit terms are 30 days) 9. 10. Debt Ratio 11. 12. EPS 13. PER APP (payment terms are 60 days) Debt/Equity Ratio Super Tech Company 48% Industry average 35% 8% 10% 15% 13% 75% 75% N$350,000 1.3 times 5 times p/a N$200,000 0.7 times 3 times p/a 34 days 30 days 75 days 61 days 38% 28% 33% 25% 30c 45c 8 times 6 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started