Answered step by step

Verified Expert Solution

Question

1 Approved Answer

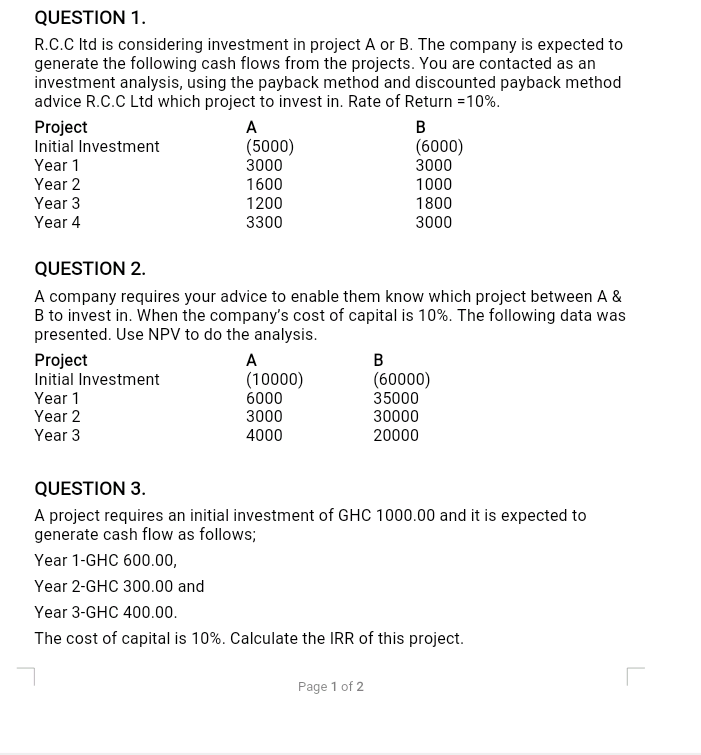

QUESTION 1. R.C.C Itd is considering investment in project A or B. The company is expected to generate the following cash flows from the projects.

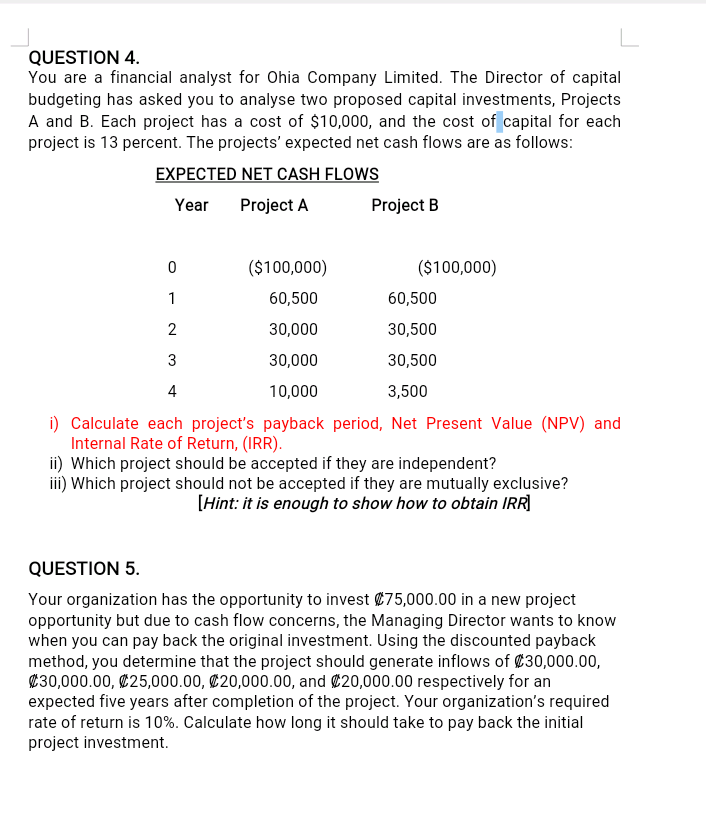

QUESTION 1. R.C.C Itd is considering investment in project A or B. The company is expected to generate the following cash flows from the projects. You are contacted as an investment analysis, using the payback method and discounted payback method advice R.C.C Ltd which project to invest in. Rate of Return = 10%. Project A B Initial Investment (5000) (6000) Year 1 3000 3000 Year 2 1600 1000 Year 3 1200 1800 Year 4 3300 3000 QUESTION 2. A company requires your advice to enable them know which project between A & B to invest in. When the company's cost of capital is 10%. The following data was presented. Use NPV to do the analysis. Project B Initial Investment (10000) (60000) Year 1 6000 35000 Year 2 3000 30000 Year 3 4000 20000 QUESTION 3. A project requires an initial investment of GHC 1000.00 and it is expected to generate cash flow as follows; Year 1-GHC 600.00, Year 2-GHC 300.00 and Year 3-GHC 400.00. The cost of capital is 10%. Calculate the IRR of this project. Page 1 of 2 QUESTION 4. You are a financial analyst for Ohia Company Limited. The Director of capital budgeting has asked you to analyse two proposed capital investments, Projects A and B. Each project has a cost of $10,000, and the cost of capital for each project is 13 percent. The projects' expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B 0 ($100,000) ($100,000) 1 60,500 60,500 2 30,000 30,500 3 30,000 30,500 4 10,000 3,500 i) Calculate each project's payback period, Net Present Value (NPV) and Internal Rate of Return, (IRR). ii) Which project should be accepted if they are independent? iii) Which project should not be accepted if they are mutually exclusive? [Hint: it is enough to show how to obtain IRR] QUESTION 5. Your organization has the opportunity to invest 75,000.00 in a new project opportunity but due to cash flow concerns, the Managing Director wants to know when you can pay back the original investment. Using the discounted payback method, you determine that the project should generate inflows of $30,000.00, 30,000.00, 25,000.00, 20,000.00, and 20,000.00 respectively for an expected five years after completion of the project. Your organization's required rate of return is 10%. Calculate how long it should take to pay back the initial project investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started