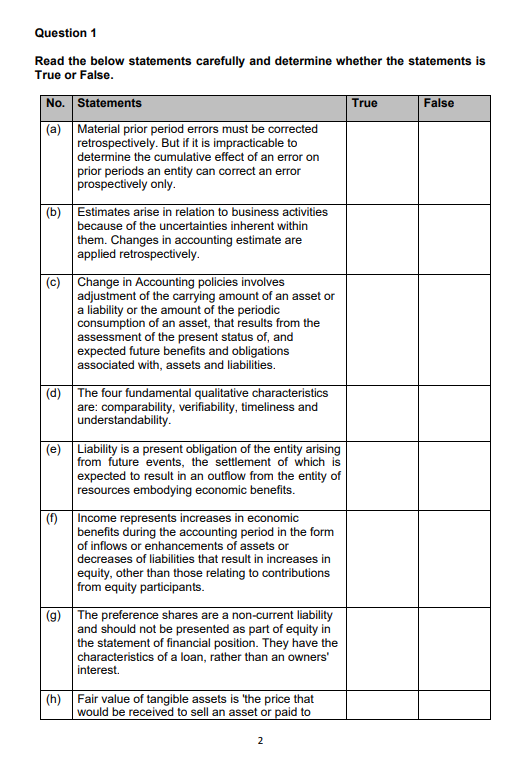

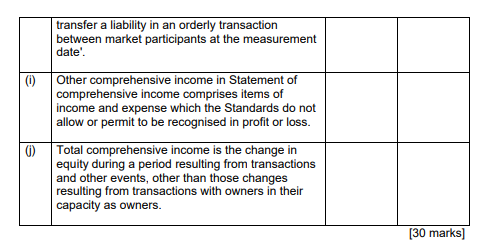

Question 1 Read the below statements carefully and determine whether the statements is True or False. No. Statements True False (a) Material prior period errors must be corrected retrospectively. But if it is impracticable to determine the cumulative effect of an error on prior periods an entity can correct an error prospectively only. (6) Estimates arise in relation to business activities because of the uncertainties inherent within them. Changes in accounting estimate are applied retrospectively. (c) Change in Accounting policies involves adjustment of the carrying amount of an asset or a liability or the amount of the periodic consumption of an asset, that results from the assessment of the present status of, and expected future benefits and obligations associated with, assets and liabilities. (d) The four fundamental qualitative characteristics are: comparability, verifiability, timeliness and understandability. (e) Liability is a present obligation of the entity arising from future events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. (6) Income represents increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. (9) The preference shares are a non-current liability and should not be presented as part of equity in the statement of financial position. They have the characteristics of a loan, rather than an owners' interest (h) Fair value of tangible assets is the price that would be received to sell an asset or paid to 2 transfer a liability in an orderly transaction between market participants at the measurement date! (0) Other comprehensive income in Statement of comprehensive income comprises items of income and expense which the Standards do not allow or permit to be recognised in profit or loss. Total comprehensive income is the change in equity during a period resulting from transactions and other events, other than those changes resulting from transactions with owners in their capacity as owners. 0) [30 marks)