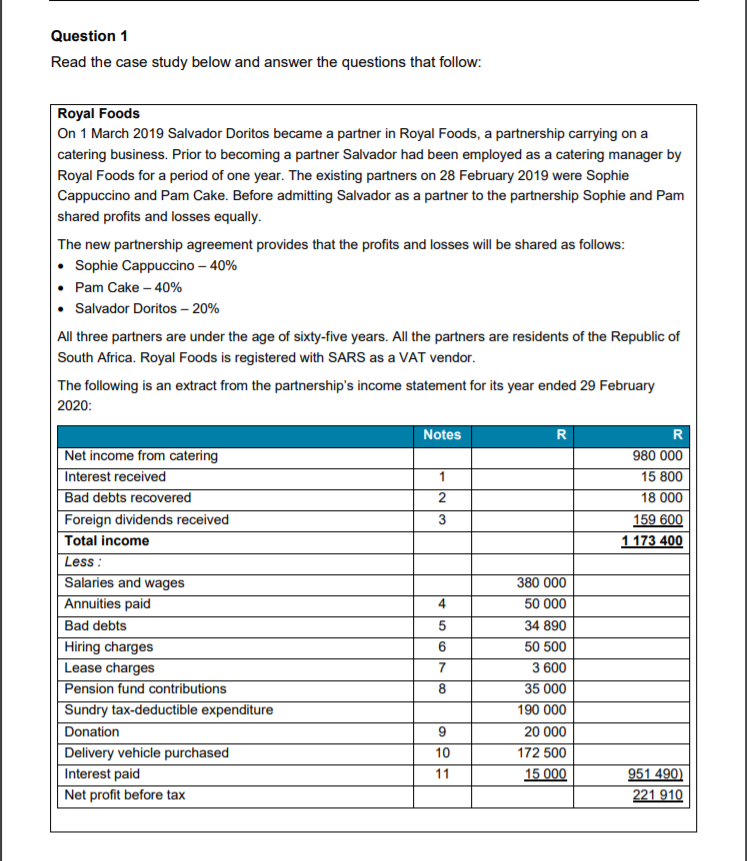

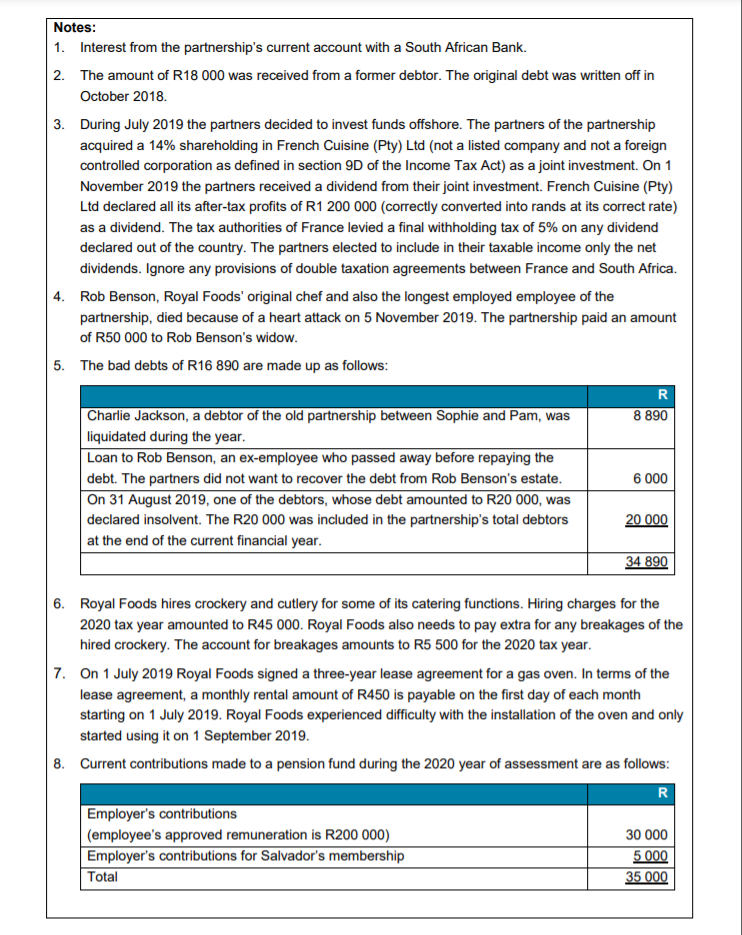

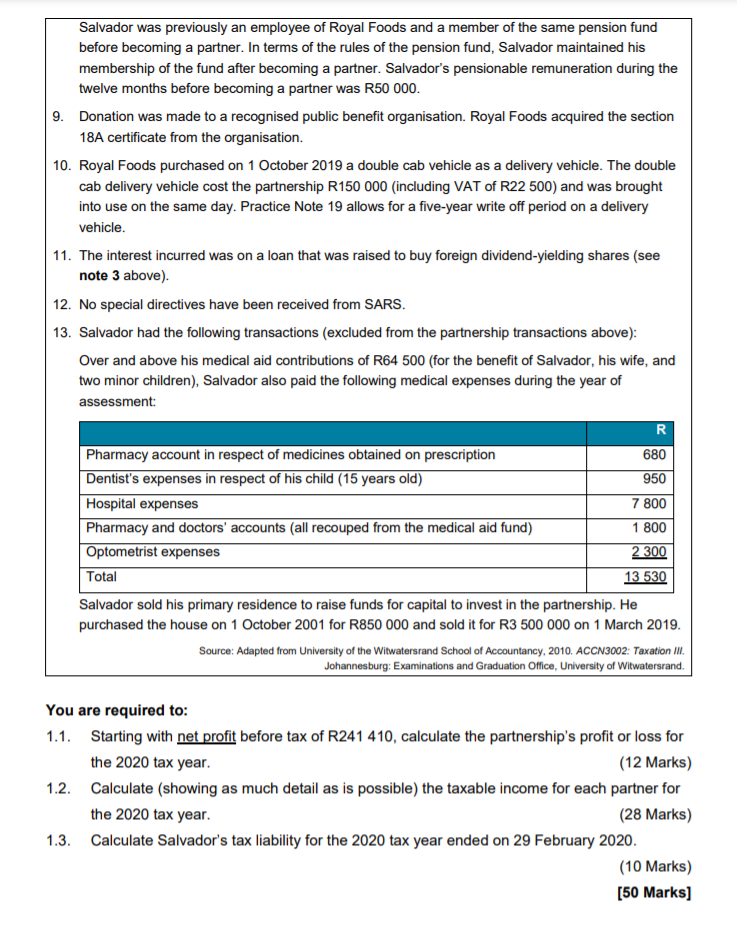

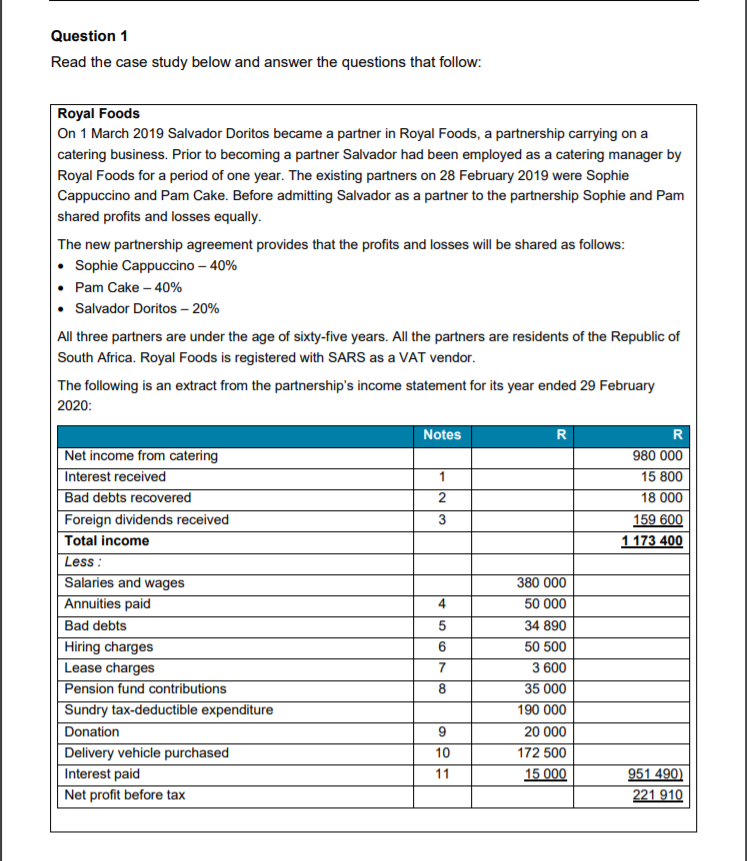

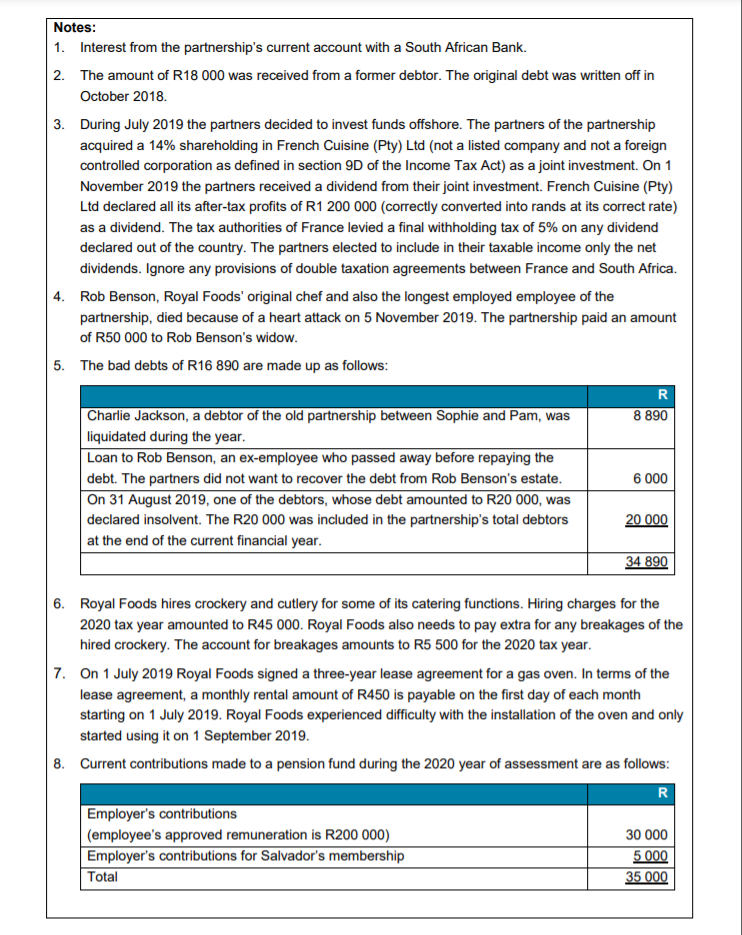

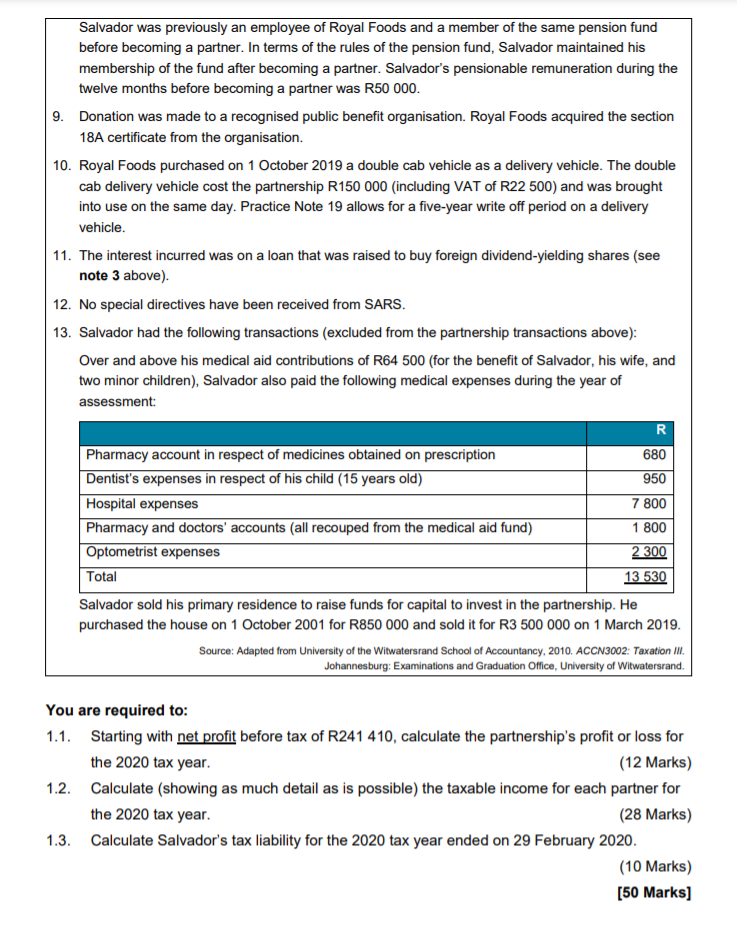

Question 1 Read the case study below and answer the questions that follow: Royal Foods On 1 March 2019 Salvador Doritos became a partner in Royal Foods, a partnership carrying on a catering business. Prior to becoming a partner Salvador had been employed as a catering manager by Royal Foods for a period of one year. The existing partners on 28 February 2019 were Sophie Cappuccino and Pam Cake. Before admitting Salvador as a partner to the partnership Sophie and Pam shared profits and losses equally. The new partnership agreement provides that the profits and losses will be shared as follows: Sophie Cappuccino - 40% Pam Cake -40% Salvador Doritos -20% All three partners are under the age of sixty-five years. All the partners are residents of the Republic of South Africa. Royal Foods is registered with SARS as a VAT vendor. The following is an extract from the partnership's income statement for its year ended 29 February 2020: Notes R R Net income from catering 980 000 Interest received 1 15 800 Bad debts recovered 2 18 000 Foreign dividends received 3 159 600 Total income 1 173 400 Less : Salaries and wages 380 000 Annuities paid 50 000 Bad debts 5 34 890 Hiring charges 50 500 Lease charges 3 600 Pension fund contributions 35 000 Sundry tax-deductible expenditure 190 000 Donation 9 20 000 Delivery vehicle purchased 10 172 500 Interest paid 11 15 000 951 490) Net profit before tax 221 910 4 6 7 8 Notes: 1. Interest from the partnership's current account with a South African Bank. 2. The amount of R18 000 was received from a former debtor. The original debt was written off in October 2018 3. During July 2019 the partners decided to invest funds offshore. The partners of the partnership acquired a 14% shareholding in French Cuisine (Pty) Ltd (not a listed company and not a foreign controlled corporation as defined in section 9D of the Income Tax Act) as a joint investment. On 1 November 2019 the partners received a dividend from their joint investment. French Cuisine (Pty) Ltd declared all its after-tax profits of R1 200 000 (correctly converted into rands at its correct rate) as a dividend. The tax authorities of France levied a final withholding tax of 5% on any dividend declared out of the country. The partners elected to include in their taxable income only the net dividends. Ignore any provisions of double taxation agreements between France and South Africa. 4. Rob Benson, Royal Foods' original chef and also the longest employed employee of the partnership, died because of a heart attack on 5 November 2019. The partnership paid an amount of R50 000 to Rob Benson's widow. 5. The bad debts of R16 890 are made up as follows: R Charlie Jackson, a debtor of the old partnership between Sophie and Pam, was 8 890 liquidated during the year. Loan to Rob Benson, an ex-employee who passed away before repaying the debt. The partners did not want to recover the debt from Rob Benson's estate. 6 000 On 31 August 2019, one of the debtors, whose debt amounted to R20 000, was declared insolvent. The R20 000 was included in the partnership's total debtors 20 000 at the end of the current financial year. 34 890 6. Royal Foods hires crockery and cutlery for some of its catering functions. Hiring charges for the 2020 tax year amounted to R45 000. Royal Foods also needs to pay extra for any breakages of the hired crockery. The account for breakages amounts to R5 500 for the 2020 tax year. 7. On 1 July 2019 Royal Foods signed a three-year lease agreement for a gas oven. In terms of the lease agreement, a monthly rental amount of R450 is payable on the first day of each month starting on 1 July 2019. Royal Foods experienced difficulty with the installation of the oven and only started using it on 1 September 2019. 8. Current contributions made to a pension fund during the 2020 year of assessment are as follows: R Employer's contributions (employee's approved remuneration is R200 000) 30 000 Employer's contributions for Salvador's membership 5000 Total 35 000 Salvador was previously an employee of Royal Foods and a member of the same pension fund before becoming a partner. In terms of the rules of the pension fund, Salvador maintained his membership of the fund after becoming a partner. Salvador's pensionable remuneration during the twelve months before becoming a partner was R50 000. 9. Donation was made to a recognised public benefit organisation. Royal Foods acquired the section 18A certificate from the organisation. 10. Royal Foods purchased on 1 October 2019 a double cab vehicle as a delivery vehicle. The double cab delivery vehicle cost the partnership R150 000 (including VAT of R22 500) and was brought into use on the same day. Practice Note 19 allows for a five-year write off period on a delivery vehicle. 11. The interest incurred was on a loan that was raised to buy foreign dividend-yielding shares (see note 3 above). 12. No special directives have been received from SARS. 13. Salvador had the following transactions (excluded from the partnership transactions above): Over and above his medical aid contributions of R64 500 (for the benefit of Salvador, his wife, and two minor children), Salvador also paid the following medical expenses during the year of assessment: R Pharmacy account in respect of medicines obtained on prescription 680 Dentist's expenses in respect of his child (15 years old) 950 Hospital expenses 7 800 Pharmacy and doctors' accounts (all recouped from the medical aid fund) 1 800 Optometrist expenses 2 300 Total 13 530 Salvador sold his primary residence to raise funds for capital to invest in the partnership. He purchased the house on 1 October 2001 for R850 000 and sold it for R3 500 000 on 1 March 2019. Source: Adapted from University of the Witwatersrand School of Accountancy, 2010. ACCN3002: Taxation III. Johannesburg: Examinations and Graduation Office, University of Witwatersrand. You are required to: 1.1. Starting with net profit before tax of R241 410, calculate the partnership's profit or loss for the 2020 tax year (12 Marks) 1.2. Calculate (showing as much detail as is possible) the taxable income for each partner for the 2020 tax year. (28 Marks) 1.3. Calculate Salvador's tax liability for the 2020 tax year ended on 29 February 2020. (10 Marks) [50 Marks] Question 1 Read the case study below and answer the questions that follow: Royal Foods On 1 March 2019 Salvador Doritos became a partner in Royal Foods, a partnership carrying on a catering business. Prior to becoming a partner Salvador had been employed as a catering manager by Royal Foods for a period of one year. The existing partners on 28 February 2019 were Sophie Cappuccino and Pam Cake. Before admitting Salvador as a partner to the partnership Sophie and Pam shared profits and losses equally. The new partnership agreement provides that the profits and losses will be shared as follows: Sophie Cappuccino - 40% Pam Cake -40% Salvador Doritos -20% All three partners are under the age of sixty-five years. All the partners are residents of the Republic of South Africa. Royal Foods is registered with SARS as a VAT vendor. The following is an extract from the partnership's income statement for its year ended 29 February 2020: Notes R R Net income from catering 980 000 Interest received 1 15 800 Bad debts recovered 2 18 000 Foreign dividends received 3 159 600 Total income 1 173 400 Less : Salaries and wages 380 000 Annuities paid 50 000 Bad debts 5 34 890 Hiring charges 50 500 Lease charges 3 600 Pension fund contributions 35 000 Sundry tax-deductible expenditure 190 000 Donation 9 20 000 Delivery vehicle purchased 10 172 500 Interest paid 11 15 000 951 490) Net profit before tax 221 910 4 6 7 8 Notes: 1. Interest from the partnership's current account with a South African Bank. 2. The amount of R18 000 was received from a former debtor. The original debt was written off in October 2018 3. During July 2019 the partners decided to invest funds offshore. The partners of the partnership acquired a 14% shareholding in French Cuisine (Pty) Ltd (not a listed company and not a foreign controlled corporation as defined in section 9D of the Income Tax Act) as a joint investment. On 1 November 2019 the partners received a dividend from their joint investment. French Cuisine (Pty) Ltd declared all its after-tax profits of R1 200 000 (correctly converted into rands at its correct rate) as a dividend. The tax authorities of France levied a final withholding tax of 5% on any dividend declared out of the country. The partners elected to include in their taxable income only the net dividends. Ignore any provisions of double taxation agreements between France and South Africa. 4. Rob Benson, Royal Foods' original chef and also the longest employed employee of the partnership, died because of a heart attack on 5 November 2019. The partnership paid an amount of R50 000 to Rob Benson's widow. 5. The bad debts of R16 890 are made up as follows: R Charlie Jackson, a debtor of the old partnership between Sophie and Pam, was 8 890 liquidated during the year. Loan to Rob Benson, an ex-employee who passed away before repaying the debt. The partners did not want to recover the debt from Rob Benson's estate. 6 000 On 31 August 2019, one of the debtors, whose debt amounted to R20 000, was declared insolvent. The R20 000 was included in the partnership's total debtors 20 000 at the end of the current financial year. 34 890 6. Royal Foods hires crockery and cutlery for some of its catering functions. Hiring charges for the 2020 tax year amounted to R45 000. Royal Foods also needs to pay extra for any breakages of the hired crockery. The account for breakages amounts to R5 500 for the 2020 tax year. 7. On 1 July 2019 Royal Foods signed a three-year lease agreement for a gas oven. In terms of the lease agreement, a monthly rental amount of R450 is payable on the first day of each month starting on 1 July 2019. Royal Foods experienced difficulty with the installation of the oven and only started using it on 1 September 2019. 8. Current contributions made to a pension fund during the 2020 year of assessment are as follows: R Employer's contributions (employee's approved remuneration is R200 000) 30 000 Employer's contributions for Salvador's membership 5000 Total 35 000 Salvador was previously an employee of Royal Foods and a member of the same pension fund before becoming a partner. In terms of the rules of the pension fund, Salvador maintained his membership of the fund after becoming a partner. Salvador's pensionable remuneration during the twelve months before becoming a partner was R50 000. 9. Donation was made to a recognised public benefit organisation. Royal Foods acquired the section 18A certificate from the organisation. 10. Royal Foods purchased on 1 October 2019 a double cab vehicle as a delivery vehicle. The double cab delivery vehicle cost the partnership R150 000 (including VAT of R22 500) and was brought into use on the same day. Practice Note 19 allows for a five-year write off period on a delivery vehicle. 11. The interest incurred was on a loan that was raised to buy foreign dividend-yielding shares (see note 3 above). 12. No special directives have been received from SARS. 13. Salvador had the following transactions (excluded from the partnership transactions above): Over and above his medical aid contributions of R64 500 (for the benefit of Salvador, his wife, and two minor children), Salvador also paid the following medical expenses during the year of assessment: R Pharmacy account in respect of medicines obtained on prescription 680 Dentist's expenses in respect of his child (15 years old) 950 Hospital expenses 7 800 Pharmacy and doctors' accounts (all recouped from the medical aid fund) 1 800 Optometrist expenses 2 300 Total 13 530 Salvador sold his primary residence to raise funds for capital to invest in the partnership. He purchased the house on 1 October 2001 for R850 000 and sold it for R3 500 000 on 1 March 2019. Source: Adapted from University of the Witwatersrand School of Accountancy, 2010. ACCN3002: Taxation III. Johannesburg: Examinations and Graduation Office, University of Witwatersrand. You are required to: 1.1. Starting with net profit before tax of R241 410, calculate the partnership's profit or loss for the 2020 tax year (12 Marks) 1.2. Calculate (showing as much detail as is possible) the taxable income for each partner for the 2020 tax year. (28 Marks) 1.3. Calculate Salvador's tax liability for the 2020 tax year ended on 29 February 2020. (10 Marks) [50 Marks]