Question

QUESTION 1 Read the information below and answer the following questions INFORMATION The following statement of comprehensive income for the financial year ended 31 December

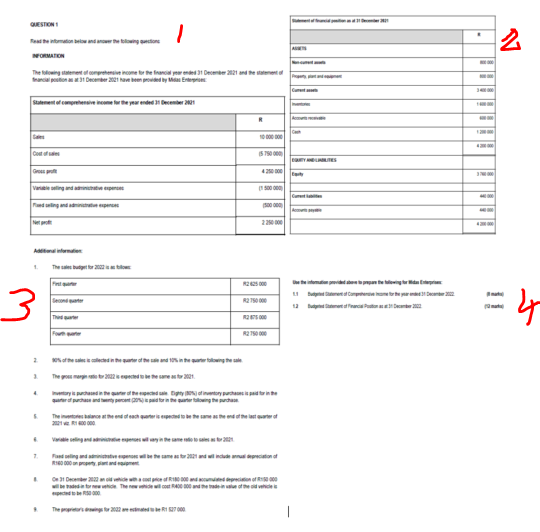

QUESTION 1 Read the information below and answer the following questions INFORMATION The following statement of comprehensive income for the financial year ended 31 December 2021 and the statement of financial position as at 31 December 2021 have been provided by Midas Enterprises: Statement of comprehensive income for the year ended 31 December 2021 R Sales 10 000 000 Cost of sales (5 750 000) Gross profit 4 250 000 Variable selling and administrative expenses (1 500 000) Fixed selling and administrative expenses (500 000) Net profit 2 250 000 Statement of financial position as at 31 December 2021 R ASSETS Non-current assets 800 000 Property, plant and equipment 800 000 Current assets 3 400 000 Inventories 1 600 000 Accounts receivable 600 000 Cash 1 200 000 4 200 000 EQUITY AND LIABILITIES Equity 3 760 000 Current liabilities 440 000 Accounts payable 440 000 4 200 000 Additional information: 1. The sales budget for 2022 is as follows: First quarter R2 625 000 Second quarter R2 750 000 Third quarter R2 875 000 Fourth quarter R2 750 000 2. 90% of the sales is collected in the quarter of the sale and 10% in the quarter following the sale. 3. The gross margin ratio for 2022 is expected to be the same as for 2021. 4. Inventory is purchased in the quarter of the expected sale. Eighty (80%) of inventory purchases is paid for in the quarter of purchase and twenty percent (20%) is paid for in the quarter following the purchase. 5. The inventories balance at the end of each quarter is expected to be the same as the end of the last quarter of 2021 viz. R1 600 000. 6. Variable selling and administrative expenses will vary in the same ratio to sales as for 2021. 7. Fixed selling and administrative expenses will be the same as for 2021 and will include annual depreciation of R160 000 on property, plant and equipment. 8. On 31 December 2022 an old vehicle with a cost price of R180 000 and accumulated depreciation of R150 000 will be traded-in for new vehicle. The new vehicle will cost R400 000 and the trade-in value of the old vehicle is expected to be R50 000. 9. The proprietors drawings for 2022 are estimated to be R1 527 000. 10. The cash balance must be calculated (balancing figure).

Use the information provided above to prepare the following for Midas Enterprises: 1.1 Budgeted Statement of Comprehensive Income for the year ended 31 December 2022. (8 marks) 1.2 Budgeted Statement of Financial Position as at 31 December 2022. (12 marks)

QUESTION Read the information below and now the following question INFORMATION The following statement of comprehensive income for the financial year ended 31 December 2121 and the statement of fancial position as at 31 December 2021 have been provided by Mante Statement of comprehensive income for the year ended 31 December 201 Cost of Gross prof Variable selling and administrative expense 3 2 3 6 deling and ad 4. 7. The budget for 2002 Second quarter Third quarter 1 for 201 Valengd expenses R The gross margin 20 4. Inventory is purchased in the quarter of the expected sale Eighty (80%) of inventory purchased the quarter of purchase and enty percent (20%) is paid for in the quarter following the purchase 10000000 (5750000) The po 2022 are eated to be R1 527 000 4250 000 (1 500 000) (500 000 R2 750 000 The ice at the end of each quarter is expected to be the same as the end of the last quarter of 2021 400 000 8 On 31 December 2022 an old vehicle with a cost price of R180 000 and accumulated depreciation of 5000 will be add for The new trade-in value of the civi ETY AND LATES Earty I 000 4300000 2 = 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started