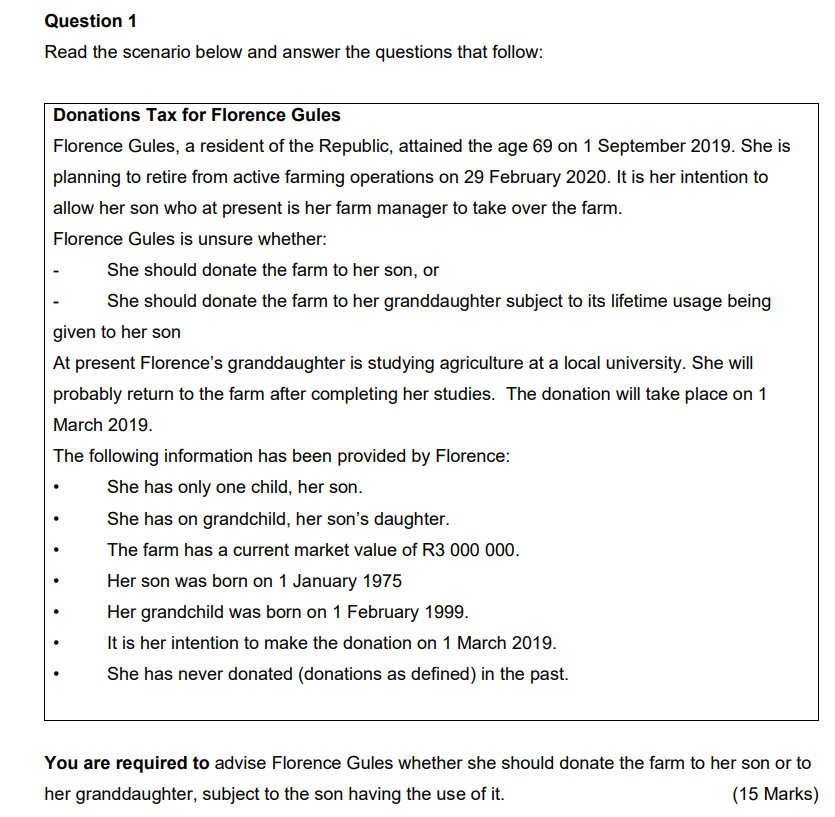

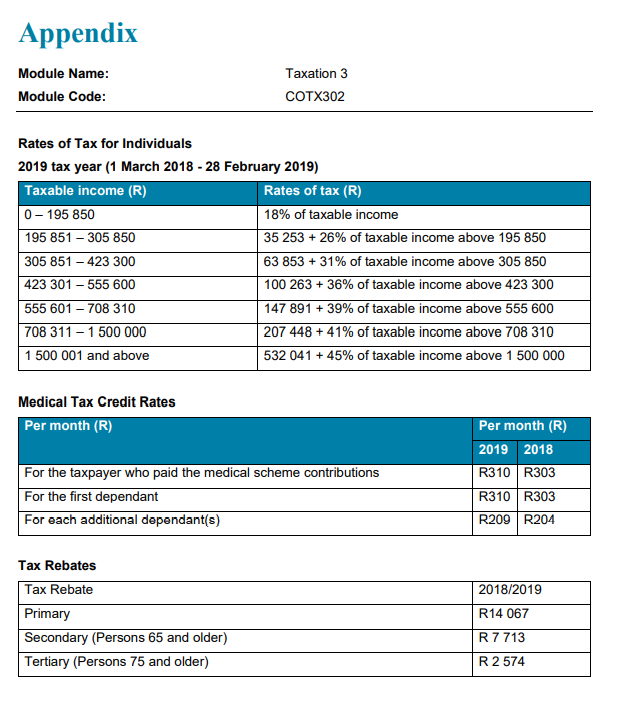

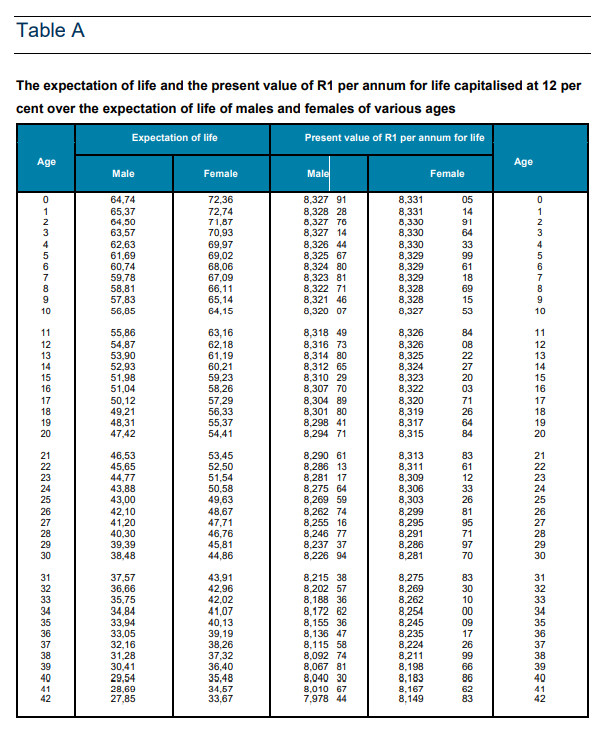

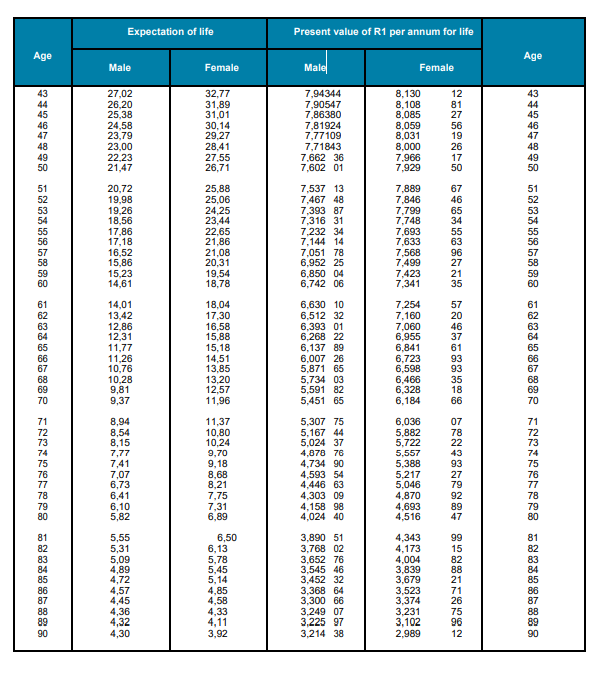

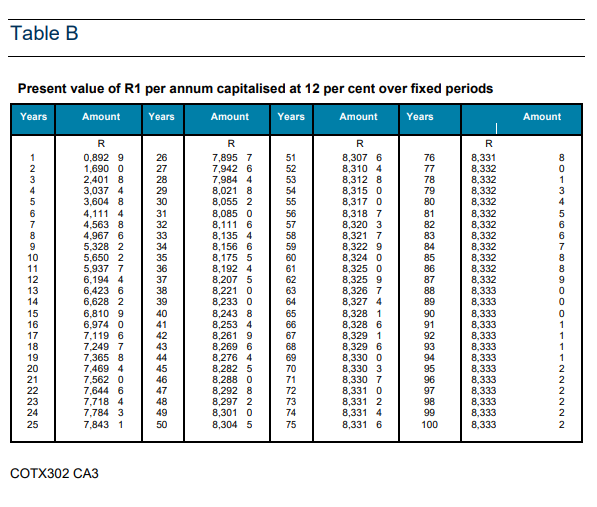

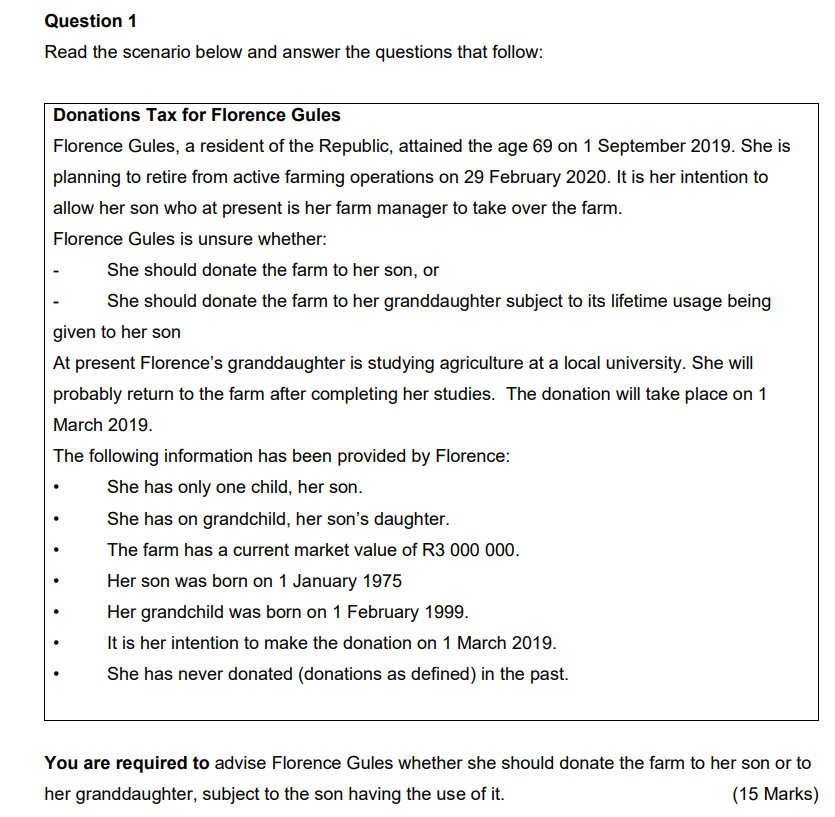

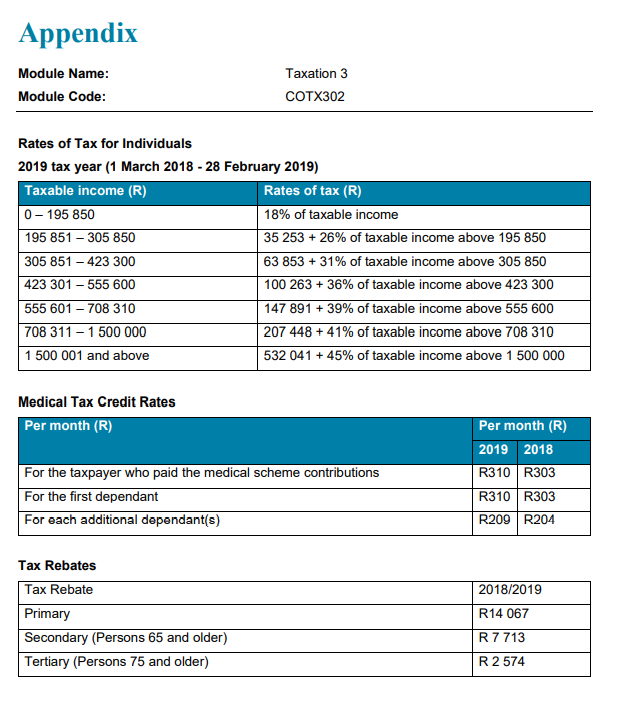

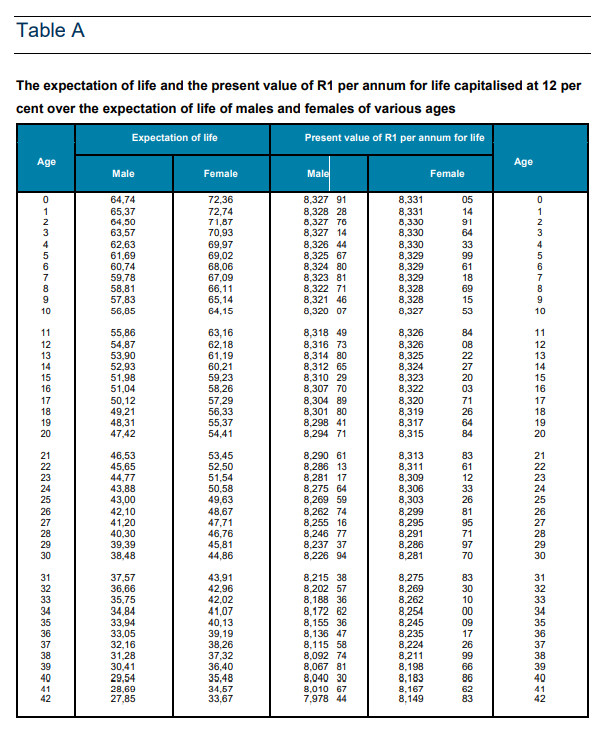

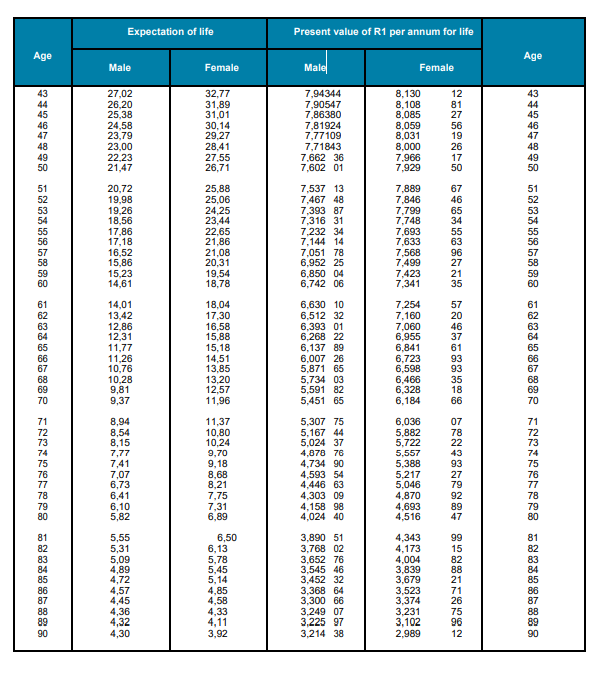

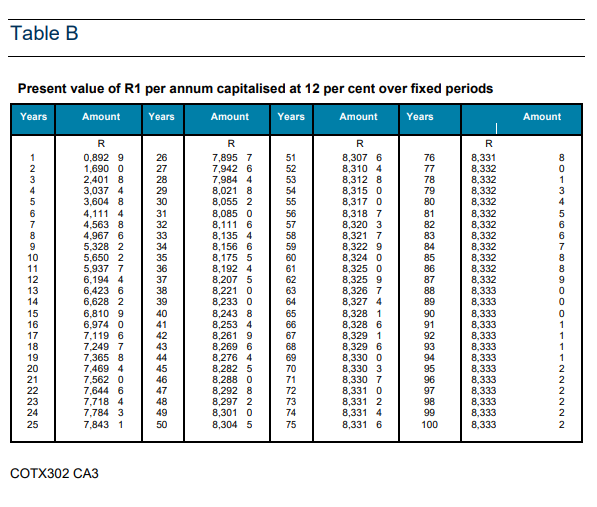

Question 1 Read the scenario below and answer the questions that follow: Donations Tax for Florence Gules Florence Gules, a resident of the Republic, attained the age 69 on 1 September 2019. She is planning to retire from active farming operations on 29 February 2020. It is her intention to allow her son who at present is her farm manager to take over the farm. Florence Gules is unsure whether: She should donate the farm to her son, or She should donate the farm to her granddaughter subject to its lifetime usage being given to her son At present Florence's granddaughter is studying agriculture at a local university. She will probably return to the farm after completing her studies. The donation will take place on 1 March 2019. The following information has been provided by Florence: She has only one child, her son. She has on grandchild, her son's daughter. The farm has a current market value of R3 000 000. Her son was born on 1 January 1975 Her grandchild was born on 1 February 1999. It is her intention to make the donation on 1 March 2019. She has never donated (donations as defined) in the past. You are required to advise Florence Gules whether she should donate the farm to her son or to her granddaughter, subject to the son having the use of it. (15 Marks) Appendix Module Name: Module Code: Taxation 3 COTX302 Rates of Tax for Individuals 2019 tax year (1 March 2018 - 28 February 2019) Taxable income (R) Rates of tax (R) 0-195 850 18% of taxable income 195 851 - 305 850 35 253 + 26% of taxable income above 195 850 305 851 - 423 300 63 853 +31% of taxable income above 305 850 423 301 - 555 600 100 263 + 36% of taxable income above 423 300 555 601 - 708 310 147 891 + 39% of taxable income above 555 600 708 311 - 1 500 000 207 448 + 41% of taxable income above 708 310 1 500 001 and above 532 041 +45% of taxable income above 1 500 000 Medical Tax Credit Rates Per month (R) Per month (R) 2019 2018 R310 R303 For the taxpayer who paid the medical scheme contributions For the first dependant For each additional dependant(s) R310 R303 R209 R204 2018/2019 Tax Rebates Tax Rebate Primary Secondary (Persons 65 and older) Tertiary (Persons 75 and older) R14 067 R 7 713 R2 574 Table A The expectation of life and the present value of R1 per annum for life capitalised at 12 per cent over the expectation of life of males and females of various ages Expectation of life Present value of R1 per annum for life Age Female Female Age Male Male 64,74 65,37 64,50 63,57 62,63 61,69 60.74 59,78 58,81 57,83 56,85 72,36 72.74 71.87 70,93 69,97 69,02 68,06 67,09 66,11 65,14 64,15 8,327 91 8.328 28 8,327 76 8,327 14 8.326 44 8.325 67 8,324 80 8,323 81 8.322 71 8,321 46 8,320 07 8,331 8.331 8.330 8,330 8.330 8.329 8,329 8,329 8,328 8,328 8,327 05 14 91 64 33 99 61 18 69 15 53 3 4 5 7 8 9 10 55,86 54,87 53,90 52.93 51,98 51,04 50,12 49,21 48,31 47.42 63,16 62,18 61,19 60,21 59,23 58,26 57,29 56,33 55,37 54,41 8,318 49 8,316 73 8,314 80 8,312 65 8,310 29 8,307 70 8,304 89 8,301 80 8,298 41 8,294 71 8,326 8,326 8,325 8,324 8,323 8,322 8,320 8,319 8,317 8,315 84 08 22 27 20 03 71 26 64 84 11 12 13 14 15 16 17 18 19 20 46,53 45,65 44,77 43,88 43,00 42,10 41,20 40,30 39,39 38,48 53,45 52,50 51,54 50,58 49,63 48,67 47,71 46,76 45,81 44,86 8,290 61 8,286 13 8,281 17 8,275 64 8,269 59 8,262 74 8,255 16 8,246 77 8,237 37 8,226 94 8,313 8,311 8,309 8,306 8,303 8,299 8.295 8,291 8,286 8,281 83 61 12 33 26 81 95 71 97 70 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 37,57 36.66 35,75 34.84 33,94 33,05 32,16 31,28 30,41 29,54 28,60 27,85 43.91 42.96 42,02 41,07 40,13 39,19 38.26 37,32 36,40 35,48 34,57 33,67 8.215 38 8,202 57 8,188 36 8.172 62 8,155 36 8,136 47 8.115 58 8,092 74 8,067 81 8,040 30 8,010 67 7,978 44 8.275 8,269 8,262 8,254 8,245 8.235 8,224 8,211 8,198 8,183 8.167 8,149 83 30 10 00 09 17 26 99 66 86 62 83 31 32 33 34 35 36 37 38 39 40 41 42 Expectation of life Present value of R1 per annum for life Age Age Male Female Male! Female 43 43 44 45 46 47 48 49 50 27,02 26,20 25,38 24,58 23,79 23,00 22,23 21,47 32,77 31,89 31.01 30.14 29.27 28,41 27.55 26,71 7,94344 7,90547 7,86380 7,81924 7,77109 7,71843 7.662 36 7,602 01 8.130 8,108 8,085 8,059 8,031 8.000 7.966 7.929 12 81 27 56 19 26 17 50 45 46 47 48 49 50 51 52 53 51 52 53 20,72 19,98 19,26 18,56 17,86 17,18 16,52 15,86 15,23 14,61 25.88 25.06 24,25 23.44 2.65 21,86 21.08 20,31 19,54 18,78 7,537 13 7,467 48 7,393 87 7,316 31 7,232 34 7.144 14 7,051 78 6,952 25 6,850 04 6,742 06 7,889 7,846 7.799 7,748 7,693 7,633 7.568 7,499 7.423 7.341 67 46 65 34 55 63 96 27 21 35 57 59 60 60 61 61 62 63 64 65 66 67 68 69 70 14.01 13,42 12,86 12,31 11.77 11,26 10,76 10.28 9,81 9,37 18.04 17,30 16,58 15,88 15,18 14,51 13.85 13,20 12,57 11,96 6,630 10 6,512 32 6,393 01 6,268 22 6,137 89 6,007 26 5,871 65 5,734 03 5,591 82 5,451 65 7.254 7.160 7,060 6.955 6.841 6,723 6,598 6,468 6,328 6.184 57 20 46 37 61 93 93 35 18 66 71 71 72 73 74 75 76 8,94 8,54 8,15 7,77 7,41 7,07 6,73 6,41 6,10 5,82 11,37 10.80 10.24 9,70 9,18 8,68 8,21 7,75 7,31 5,307 75 5,167 44 5,024 37 4,878 76 4,734 90 4,593 54 4,446 63 4,303 09 4,158 98 4,024 40 6,036 5,882 5,722 5,557 5,388 5,217 5,046 4,870 4,693 4,516 07 78 22 43 93 27 79 92 89 47 74 75 76 77 78 79 80 78 79 80 6.89 81 82 83 84 85 86 87 88 89 90 5,55 5,31 5,09 4,89 4,72 4,57 4,45 4,36 4,32 4,30 6,50 6,13 5,78 5,45 5,14 4,85 4,58 4,33 4,11 3,92 3,890 51 3,768 02 3,652 76 3,545 46 3,452 32 3,368 64 3,300 66 3,249 07 3,225 97 3,214 38 4,343 4,173 4,004 3,839 3,679 3.523 3,374 3,231 3,102 2.989 99 15 82 88 21 71 26 75 96 12 81 82 83 84 85 86 89 90 Table B Present value of R1 per annum capitalised at 12 per cent over fixed periods Years Amount Years Amount Years Amount Years Amount 1 2 3 4 6 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 R 0,892 9 1,6900 2,401 8 3,0374 3,604 8 4,111 4 4,563 8 4.967 6 5,328 2 5,650 2 5,937 7 6,194 4 6,423 6 6,628 2 6,810 9 6.974 0 7,119 6 7,249 7 7,365 8 7.469 4 7,562 0 7,644 6 7.718 4 7,784 3 7,843 1 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 R 7,8957 7.942 6 7,984 4 8,021 8 8,055 2 8,085 0 8,111 6 8,135 4 8,156 6 8,175 5 8,1924 8,207 5 8,221 0 8,233 0 8,243 8 8,253 4 8,261 9 8,269 6 8,276 4 8,282 5 8,288 0 8,292 8 8,297 2 8,3010 8,304 5 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 R 8,307 6 8,310 4 8,312 8 8,315 0 8,317 0 8,318 7 8,320 3 8,321 7 8,322 9 8,324 0 8,325 0 8,325 9 8,326 7 8,327 4 8,328 1 8,328 6 8,329 1 8,329 6 8,330 0 8,330 3 8,330 7 8,331 0 8,331 2 8,331 4 8,331 6 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 R 8,331 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 NNNNNN OOO OOO OO OOR WOOD 1 1 1 48 49 50 COTX302 CA3 Question 1 Read the scenario below and answer the questions that follow: Donations Tax for Florence Gules Florence Gules, a resident of the Republic, attained the age 69 on 1 September 2019. She is planning to retire from active farming operations on 29 February 2020. It is her intention to allow her son who at present is her farm manager to take over the farm. Florence Gules is unsure whether: She should donate the farm to her son, or She should donate the farm to her granddaughter subject to its lifetime usage being given to her son At present Florence's granddaughter is studying agriculture at a local university. She will probably return to the farm after completing her studies. The donation will take place on 1 March 2019. The following information has been provided by Florence: She has only one child, her son. She has on grandchild, her son's daughter. The farm has a current market value of R3 000 000. Her son was born on 1 January 1975 Her grandchild was born on 1 February 1999. It is her intention to make the donation on 1 March 2019. She has never donated (donations as defined) in the past. You are required to advise Florence Gules whether she should donate the farm to her son or to her granddaughter, subject to the son having the use of it. (15 Marks) Appendix Module Name: Module Code: Taxation 3 COTX302 Rates of Tax for Individuals 2019 tax year (1 March 2018 - 28 February 2019) Taxable income (R) Rates of tax (R) 0-195 850 18% of taxable income 195 851 - 305 850 35 253 + 26% of taxable income above 195 850 305 851 - 423 300 63 853 +31% of taxable income above 305 850 423 301 - 555 600 100 263 + 36% of taxable income above 423 300 555 601 - 708 310 147 891 + 39% of taxable income above 555 600 708 311 - 1 500 000 207 448 + 41% of taxable income above 708 310 1 500 001 and above 532 041 +45% of taxable income above 1 500 000 Medical Tax Credit Rates Per month (R) Per month (R) 2019 2018 R310 R303 For the taxpayer who paid the medical scheme contributions For the first dependant For each additional dependant(s) R310 R303 R209 R204 2018/2019 Tax Rebates Tax Rebate Primary Secondary (Persons 65 and older) Tertiary (Persons 75 and older) R14 067 R 7 713 R2 574 Table A The expectation of life and the present value of R1 per annum for life capitalised at 12 per cent over the expectation of life of males and females of various ages Expectation of life Present value of R1 per annum for life Age Female Female Age Male Male 64,74 65,37 64,50 63,57 62,63 61,69 60.74 59,78 58,81 57,83 56,85 72,36 72.74 71.87 70,93 69,97 69,02 68,06 67,09 66,11 65,14 64,15 8,327 91 8.328 28 8,327 76 8,327 14 8.326 44 8.325 67 8,324 80 8,323 81 8.322 71 8,321 46 8,320 07 8,331 8.331 8.330 8,330 8.330 8.329 8,329 8,329 8,328 8,328 8,327 05 14 91 64 33 99 61 18 69 15 53 3 4 5 7 8 9 10 55,86 54,87 53,90 52.93 51,98 51,04 50,12 49,21 48,31 47.42 63,16 62,18 61,19 60,21 59,23 58,26 57,29 56,33 55,37 54,41 8,318 49 8,316 73 8,314 80 8,312 65 8,310 29 8,307 70 8,304 89 8,301 80 8,298 41 8,294 71 8,326 8,326 8,325 8,324 8,323 8,322 8,320 8,319 8,317 8,315 84 08 22 27 20 03 71 26 64 84 11 12 13 14 15 16 17 18 19 20 46,53 45,65 44,77 43,88 43,00 42,10 41,20 40,30 39,39 38,48 53,45 52,50 51,54 50,58 49,63 48,67 47,71 46,76 45,81 44,86 8,290 61 8,286 13 8,281 17 8,275 64 8,269 59 8,262 74 8,255 16 8,246 77 8,237 37 8,226 94 8,313 8,311 8,309 8,306 8,303 8,299 8.295 8,291 8,286 8,281 83 61 12 33 26 81 95 71 97 70 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 37,57 36.66 35,75 34.84 33,94 33,05 32,16 31,28 30,41 29,54 28,60 27,85 43.91 42.96 42,02 41,07 40,13 39,19 38.26 37,32 36,40 35,48 34,57 33,67 8.215 38 8,202 57 8,188 36 8.172 62 8,155 36 8,136 47 8.115 58 8,092 74 8,067 81 8,040 30 8,010 67 7,978 44 8.275 8,269 8,262 8,254 8,245 8.235 8,224 8,211 8,198 8,183 8.167 8,149 83 30 10 00 09 17 26 99 66 86 62 83 31 32 33 34 35 36 37 38 39 40 41 42 Expectation of life Present value of R1 per annum for life Age Age Male Female Male! Female 43 43 44 45 46 47 48 49 50 27,02 26,20 25,38 24,58 23,79 23,00 22,23 21,47 32,77 31,89 31.01 30.14 29.27 28,41 27.55 26,71 7,94344 7,90547 7,86380 7,81924 7,77109 7,71843 7.662 36 7,602 01 8.130 8,108 8,085 8,059 8,031 8.000 7.966 7.929 12 81 27 56 19 26 17 50 45 46 47 48 49 50 51 52 53 51 52 53 20,72 19,98 19,26 18,56 17,86 17,18 16,52 15,86 15,23 14,61 25.88 25.06 24,25 23.44 2.65 21,86 21.08 20,31 19,54 18,78 7,537 13 7,467 48 7,393 87 7,316 31 7,232 34 7.144 14 7,051 78 6,952 25 6,850 04 6,742 06 7,889 7,846 7.799 7,748 7,693 7,633 7.568 7,499 7.423 7.341 67 46 65 34 55 63 96 27 21 35 57 59 60 60 61 61 62 63 64 65 66 67 68 69 70 14.01 13,42 12,86 12,31 11.77 11,26 10,76 10.28 9,81 9,37 18.04 17,30 16,58 15,88 15,18 14,51 13.85 13,20 12,57 11,96 6,630 10 6,512 32 6,393 01 6,268 22 6,137 89 6,007 26 5,871 65 5,734 03 5,591 82 5,451 65 7.254 7.160 7,060 6.955 6.841 6,723 6,598 6,468 6,328 6.184 57 20 46 37 61 93 93 35 18 66 71 71 72 73 74 75 76 8,94 8,54 8,15 7,77 7,41 7,07 6,73 6,41 6,10 5,82 11,37 10.80 10.24 9,70 9,18 8,68 8,21 7,75 7,31 5,307 75 5,167 44 5,024 37 4,878 76 4,734 90 4,593 54 4,446 63 4,303 09 4,158 98 4,024 40 6,036 5,882 5,722 5,557 5,388 5,217 5,046 4,870 4,693 4,516 07 78 22 43 93 27 79 92 89 47 74 75 76 77 78 79 80 78 79 80 6.89 81 82 83 84 85 86 87 88 89 90 5,55 5,31 5,09 4,89 4,72 4,57 4,45 4,36 4,32 4,30 6,50 6,13 5,78 5,45 5,14 4,85 4,58 4,33 4,11 3,92 3,890 51 3,768 02 3,652 76 3,545 46 3,452 32 3,368 64 3,300 66 3,249 07 3,225 97 3,214 38 4,343 4,173 4,004 3,839 3,679 3.523 3,374 3,231 3,102 2.989 99 15 82 88 21 71 26 75 96 12 81 82 83 84 85 86 89 90 Table B Present value of R1 per annum capitalised at 12 per cent over fixed periods Years Amount Years Amount Years Amount Years Amount 1 2 3 4 6 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 R 0,892 9 1,6900 2,401 8 3,0374 3,604 8 4,111 4 4,563 8 4.967 6 5,328 2 5,650 2 5,937 7 6,194 4 6,423 6 6,628 2 6,810 9 6.974 0 7,119 6 7,249 7 7,365 8 7.469 4 7,562 0 7,644 6 7.718 4 7,784 3 7,843 1 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 R 7,8957 7.942 6 7,984 4 8,021 8 8,055 2 8,085 0 8,111 6 8,135 4 8,156 6 8,175 5 8,1924 8,207 5 8,221 0 8,233 0 8,243 8 8,253 4 8,261 9 8,269 6 8,276 4 8,282 5 8,288 0 8,292 8 8,297 2 8,3010 8,304 5 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 R 8,307 6 8,310 4 8,312 8 8,315 0 8,317 0 8,318 7 8,320 3 8,321 7 8,322 9 8,324 0 8,325 0 8,325 9 8,326 7 8,327 4 8,328 1 8,328 6 8,329 1 8,329 6 8,330 0 8,330 3 8,330 7 8,331 0 8,331 2 8,331 4 8,331 6 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 R 8,331 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,332 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 8,333 NNNNNN OOO OOO OO OOR WOOD 1 1 1 48 49 50 COTX302 CA3