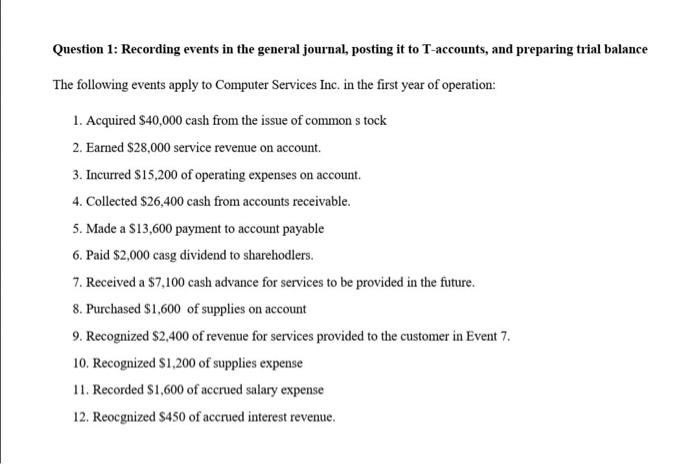

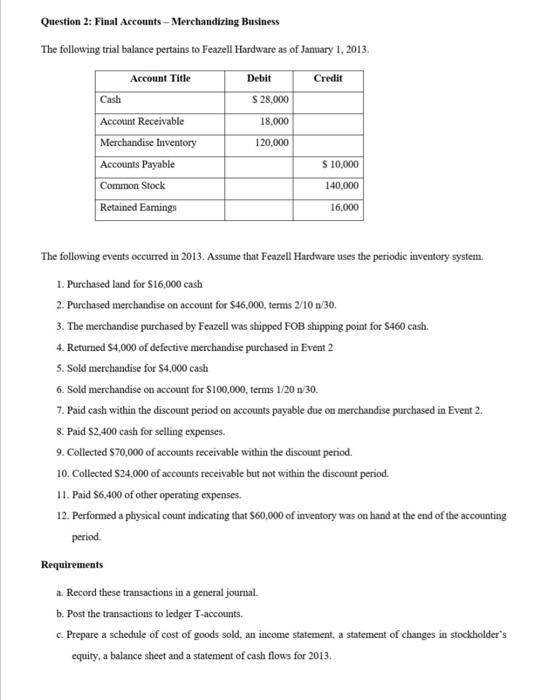

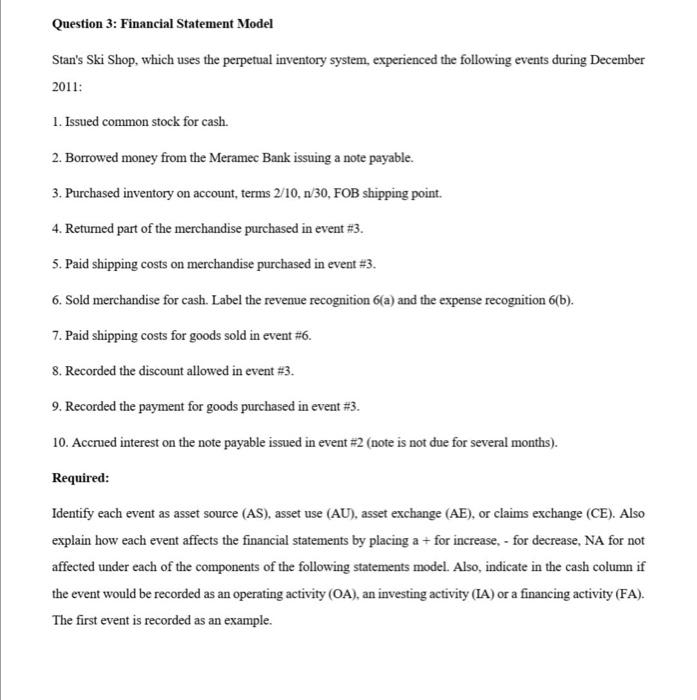

Question 1: Recording events in the general journal, posting it to T-accounts, and preparing trial balance The following events apply to Computer Services Inc. in the first year of operation: 1. Acquired $40,000 cash from the issue of common stock 2. Earned $28,000 service revenue on account. 3. Incurred $15,200 of operating expenses on account. 4. Collected $26,400 cash from accounts receivable. 5. Made a $13,600 payment to account payable 6. Paid $2,000 casg dividend to sharehodlers. 7. Received a $7,100 cash advance for services to be provided in the future. 8. Purchased $1,600 of supplies on account 9. Recognized $2,400 of revenue for services provided to the customer in Event 7. 10. Recognized $1,200 of supplies expense 11. Recorded $1,600 of accrued salary expense 12. Reocgnized $450 of accrued interest revenue. Question 2: Final Accounts - Merchandizing Business The following trial balance pertains to Feazell Hardware as of January 1, 2013. Debit Credit $ 28,000 18.000 Account Title Cash Account Receivable Merchandise Inventory Accounts Payable Common Stock Retained Earnings 120.000 $ 10.000 140,000 16,000 The following events occurred in 2013. Assume that Feazell Hardware uses the periodic inventory system 1. Purchased land for S16,000 cash 2. Purchased merchandise on account for S46,000, terms 2/10 1/30. 3. The merchandise purchased by Feazell was shipped FOB shipping point for S460 cash. 4. Returned 54,000 of defective merchandise purchased in Event 2 5. Sold merchandise for $4,000 cash 6. Sold merchandise on account for $100,000, terms 1/20/30. 7. Paid cash within the discount period on accounts payable due on merchandise purchased in Event 2. 8. Paid S2,400 cash for selling expenses. 9. Collected $70,000 of accounts receivable within the discount period. 10. Collected $24.000 of accounts receivable but not within the discount period. 11. Paid $6,400 of other operating expenses. 12. Performed a physical count indicating that $60,000 of inventory was on hand at the end of the accounting period Requirements a. Record these transactions in a general journal. b. Post the transactions to ledger T-accounts. c. Prepare a schedule of cost of goods sold, an income statement, a statement of changes in stockholder's equity, a balance sheet and a statement of cash flows for 2013. Question 3: Financial Statement Model Stan's Ski Shop, which uses the perpetual inventory system, experienced the following events during December 2011: 1. Issued common stock for cash. 2. Borrowed money from the Meramec Bank issuing a note payable. 3. Purchased inventory on account, terms 2/10, 1/30, FOB shipping point. 4. Returned part of the merchandise purchased in event #3. 5. Paid shipping costs on merchandise purchased in event #3. 6. Sold merchandise for cash. Label the revenue recognition 6(a) and the expense recognition 6(b). 7. Paid shipping costs for goods sold in event #6. 8. Recorded the discount allowed in event #3. 9. Recorded the payment for goods purchased in event #3. 10. Accrued interest on the note payable issued in event #2 (note is not due for several months). Required: Identify each event as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects the financial statements by placing a + for increase - for decrease, NA for not affected under each of the components of the following statements model. Also, indicate in the cash column if the event would be recorded as an operating activity (OA), an investing activity (IA) or a financing activity (FA). The first event is recorded as an example