Question

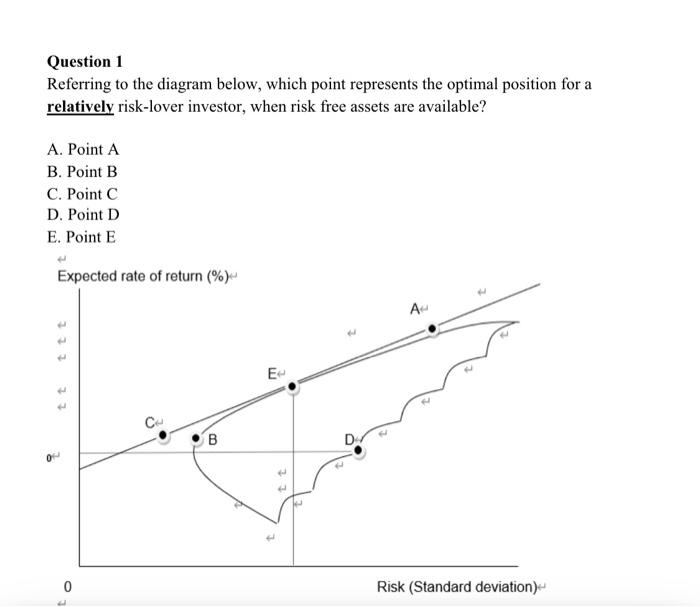

Question 1 Referring to the diagram below, which point represents the optimal position for a relatively risk-lover investor, when risk free assets are available? A.

Question 1 Referring to the diagram below, which point represents the optimal position for a relatively risk-lover investor, when risk free assets are available? A. Point A B. Point B C. Point C D. Point D E. Point E Question 2 Mr T is going to invest in a two-share portfolio. You are given the following details of the two shares he is considering. He wishes to invest equal amounts in both shares. Share F Share G Returns 10 % 12 % Standard deviation 8 % 9.7 % The correlation coefficient between the two shares is 0.215. What is the expected risk and return of the investors portfolio? Return Standard deviation A. 11% 8.5% B. 11% 4.96% C. 13.5 % 11.1% D. 11% 6.92% E. 16.0 % 7.1 % Question 3. Mr Windle bought shares in Tate plc at the start of the year for 4.25. The year-end share price was 4.98 and he received a dividend per share of 20p. Tate plc has an equity beta of 1.57, return on FTSE-100 index is estimated to be 6% and the risk-free rate of return is 3%. By how much has his investment under-performed or over-performed? A. Under-performed by 14.7% B. Under-performed by 12.6% C. Under-performed by 10.2% D. Over-performed by 12.6% E. Over-performed by 14.7% Question 4. Which of the following option is not an assumption of the Capital Asset Pricing Model (CAPM): A. Investors Hold Diversified Portfolios. B. Single Period Transaction Horizon. C. Borrowing and Lending at the Risk-free Rate. D. Capital markets are perfectly efficient. E. Investors have heterogenous belief. Question 5. Toft plc is currently reviewing its capital structure in the run up to raising new finance for an investment project. The company currently has the following capital structure. Book value () 10% bonds (redeemable in five years) 600,000 Ordinary equity shares (2 nominal value) 200,000 The estimated return on FTSE-100 is 0.15, companys beta is 1.12 return on the one-month treasury bill is 3% and the company bonds are trading at 95 per 100 nominal. The current share price is 4.16 and the corporation tax is 30%. What is the companys current cost of capital before the new bank loans are raised? A. 0.112 B. 0.124. C. 0.176 D. 0.105 E. 0.115 Question 6. Which of the following regarding Modigliani-Miller (MM) theory is true? A. The Modigliani Miller theorem, or the MM theory, is known for profits. B. We assume the firm is experiencing losses for the MM theory. C. Under MM Theory Proposition 1, we can find an optimal capital structure. D. In practice, the capital structure and the use of leverage by companies can be influenced by many factors. E. Under MM Theory Proposition 1, the value of unlevered firm should be changed if the company has raised debt to replace the same value of equity. Question 7 Bolt plc is considering the following investment project: 000 Present value of sales income 7,700 Present value of variable costs 3,500 Present value of contribution 4,200 Initial investment 3,400 Net present value of investment 800 To make the NPV zero, how much would the initial investment have to change by? A 10.4% B 19.0% C 20.1% D 22.9% E 23.5% Question 8 Which statement about risk and investment appraisal is incorrect? A Risk increases with the length of a project B Risk-adjusted hurdle rates can be used to allow for the risk of a project C Risk can be allowed for in a project by lengthening the pay-back period D Probability analysis can be used to allow for the risk of different economic conditions E While sensitivity analysis doesnt directly imbed risk in the appraisal process it is helpful for identifying key variables Question 9 Rare plc plans to buy Cabs plc. The current distributable earnings of Cabs plc is 6m. Rare estimates that it will be able to grow future earnings of Cabs by 5% per annum. It is proposing to use an earnings yield of 9% in the valuation of Cabs. Using the Earnings Yield method, what value will Rare put on Cabs? A 66.7m B 85.2m C 113.2m D 150.2m E 157.5m Question 10 IIV plc have just announced a dividend of 20 pence. In the past the dividends of the company have increased at a rate of 7% per annum. If the current ex-dividend share price is 2.89, what is the rate of return shareholders require on their shares? A 11.5% B 12.1% C 13.9% D 14.4% E 15.0% Question 11 Mr Williamson is reviewing the performance of one of the shares in his portfolio. He bought shares in Smods plc a year ago for 3.57 (ex-div). Over the year Smods paid a dividend of 21p and the share price currently stands at 3.89 (ex-div). Smod's equity beta is 1.2. The yield on short-date Treasury Bills over the year has been 2.3% and the Equity Risk Premium (ERP) is estimated to be 3.9%. Using the CAPM, what has been the performance of Smod's share over the last year? A 7.2% under-performance B 5.4% over-performance C 7.8% over-performance D 11.7% over- performance E 18.1% over-performance Question 12 Which of the following statements, relating to the implications of applying CAPM to pricing shares, is/are true? (1) Investors calculating the required rate of return of a security will only consider unsystematic risk to be relevant, as systematic risk can be eradicated by portfolio diversification. (2) Incorrectly priced securities will be seen to plot off the Security Market Line. (3) Shares with high levels of systematic risk are expected, on average, to yield a higher rate of return due to the higher risk. A None of the above B (1) only C (1) and (2) D (2) and (3) E All of the above Question 13 Two companies, Moon plc and Landingz plc, are in the same line of business. Moon plc is financed entirely by equity and has a cost of equity is 12% cent. If we assume a world consistent with Miller and Modiglianis first paper on capital structure, what will be Landingz plc's cost of equity if it is financed 30% by a 6% bank loan and 70% by equity? Ignore tax. A 6.0% B 10.8% C 12.0% D 14.6% E 16.1% Question 14 Which of the following statements about lease finance is incorrect? A Finance leases allow the company taking the lease to enjoy most of the risks and rewards of ownership B Operating leases provide the company with opportunities for off-balance sheet financing C Operating leases tend to be longer term than financial leases D Lease payments are tax deductible E Operational leases allow companies to avoid the risk of obsolescence Question 15 An investor is considering whether to buy shares in Blake plc or warrants in the company. Blake plc's current share price is 2.68. The warrant has a duration of one year and allows the purchase of 10 Blake shares at an exercise price of 3.50. The cost of the warrant is 3.20. The share price for Blake is 4.20 in a year's time. Assuming Blake plc paid no dividend over this period, what are the corresponding returns for buying Blake's shares and warrants on Blake's shares? Return on shares Return on the option A 36% 119% B 36% 219% C 45% 119% D 57% 119% E 57% 219%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started