Answered step by step

Verified Expert Solution

Question

1 Approved Answer

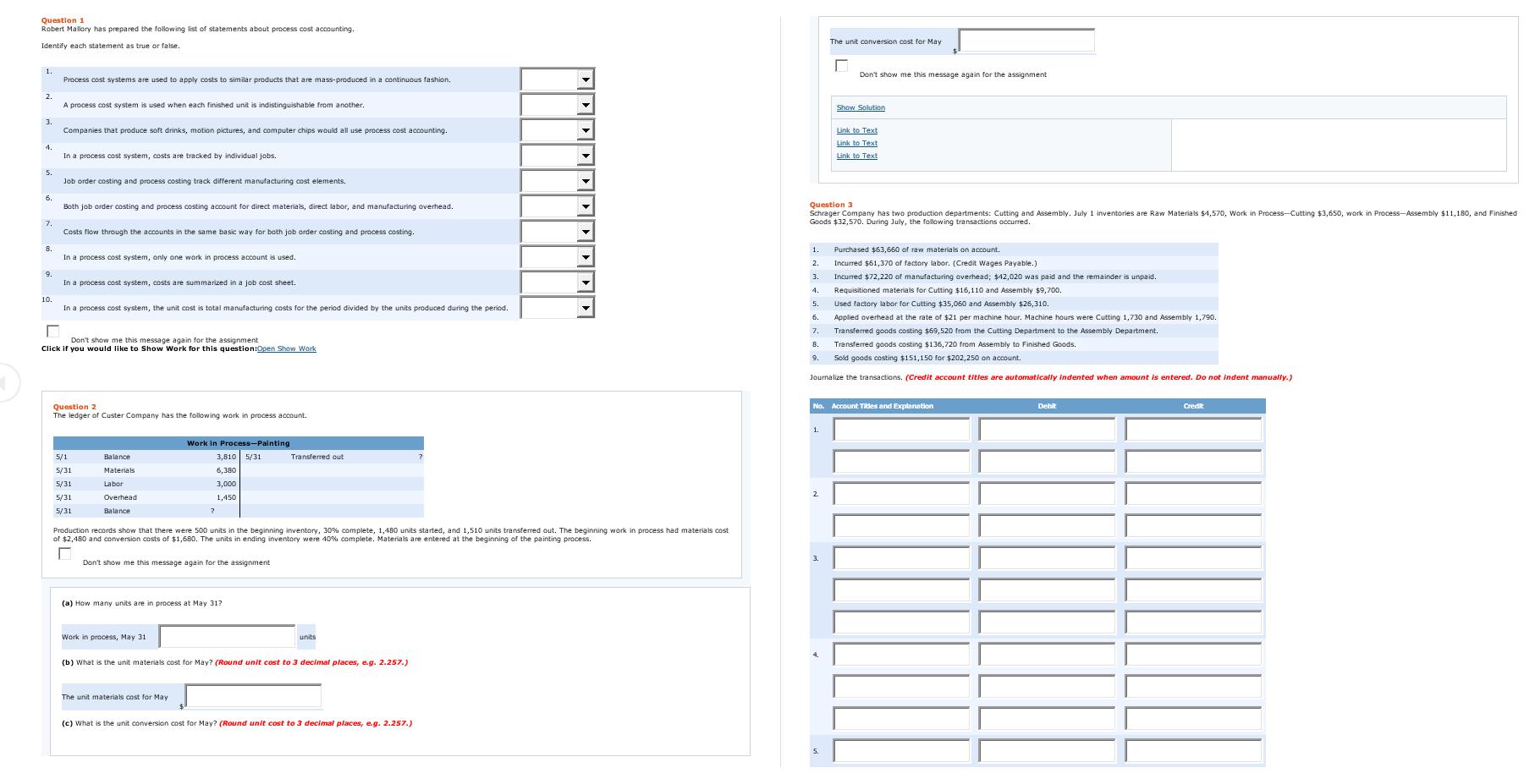

Question 1 Robert Mallory has prepared the following list of statements about process cost accounting. Identify each statement as true or false. 1. 8.

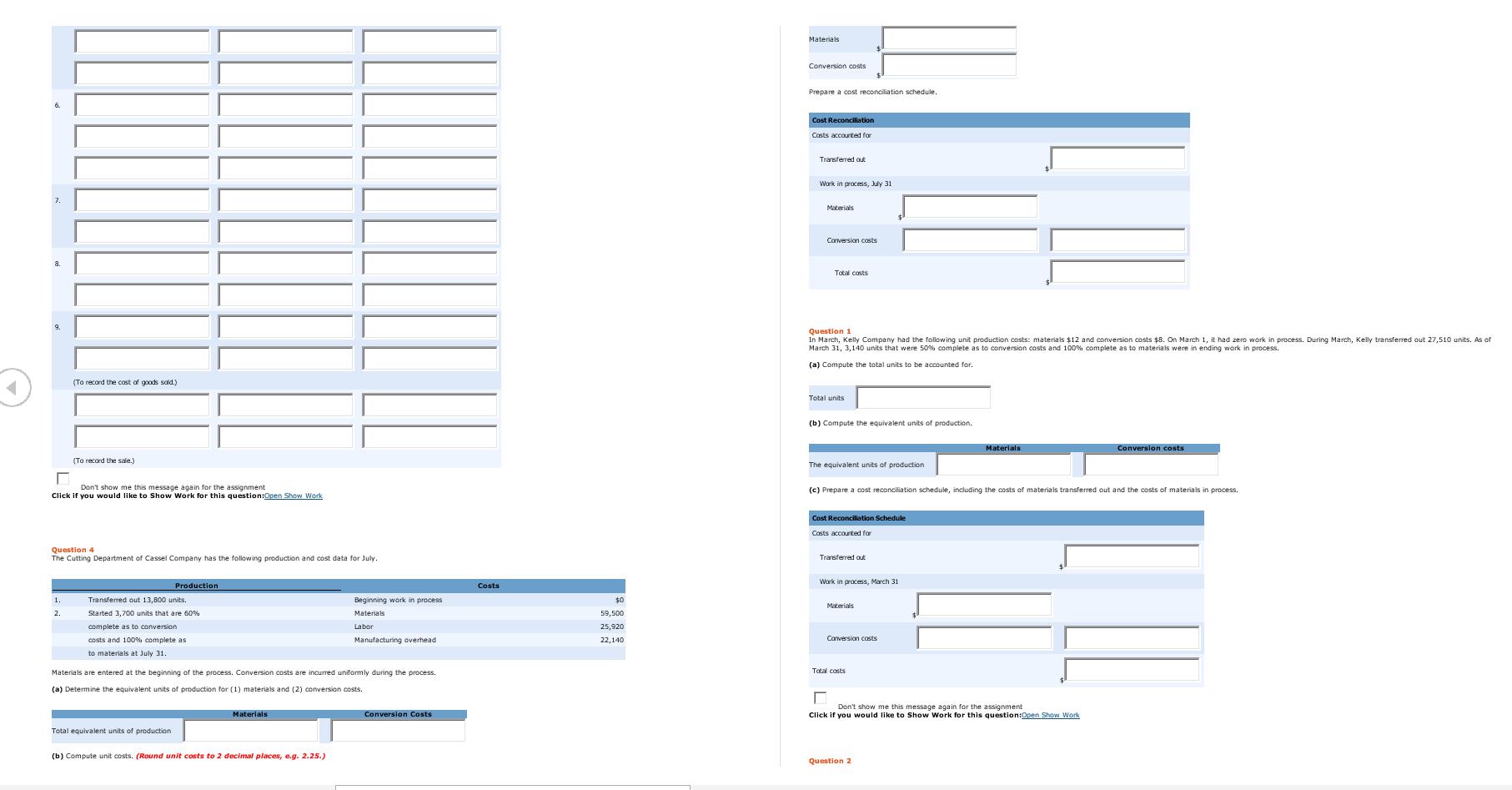

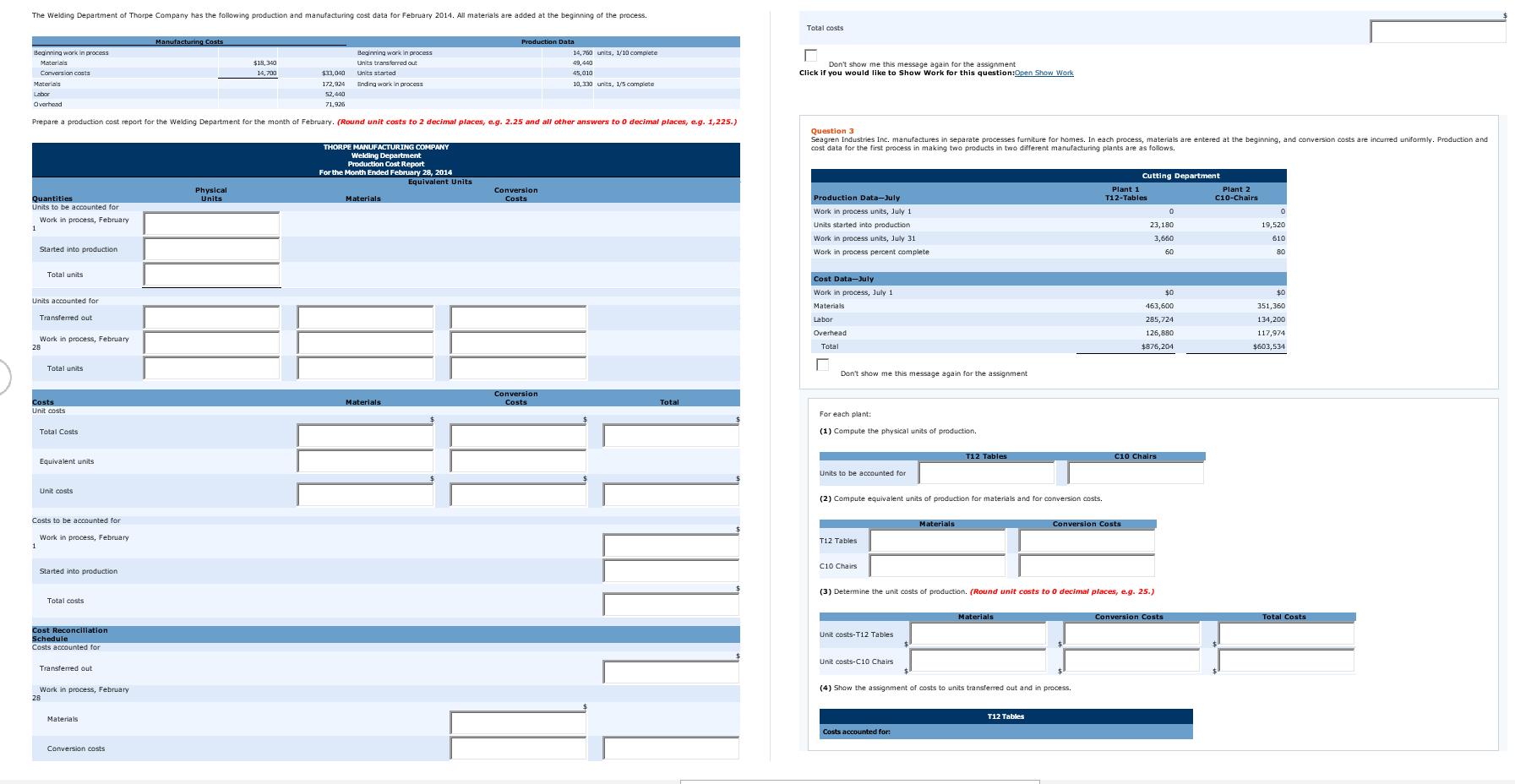

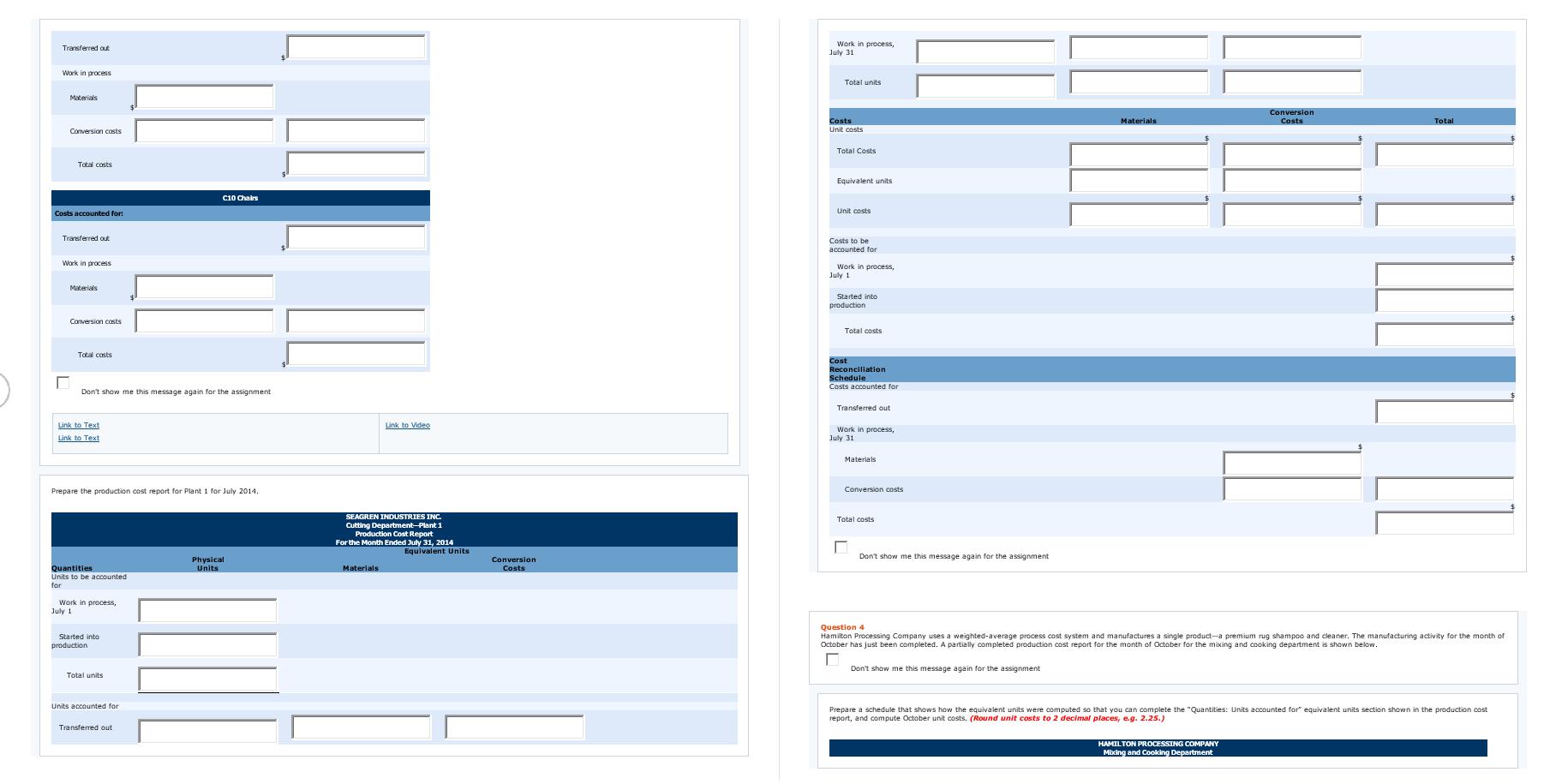

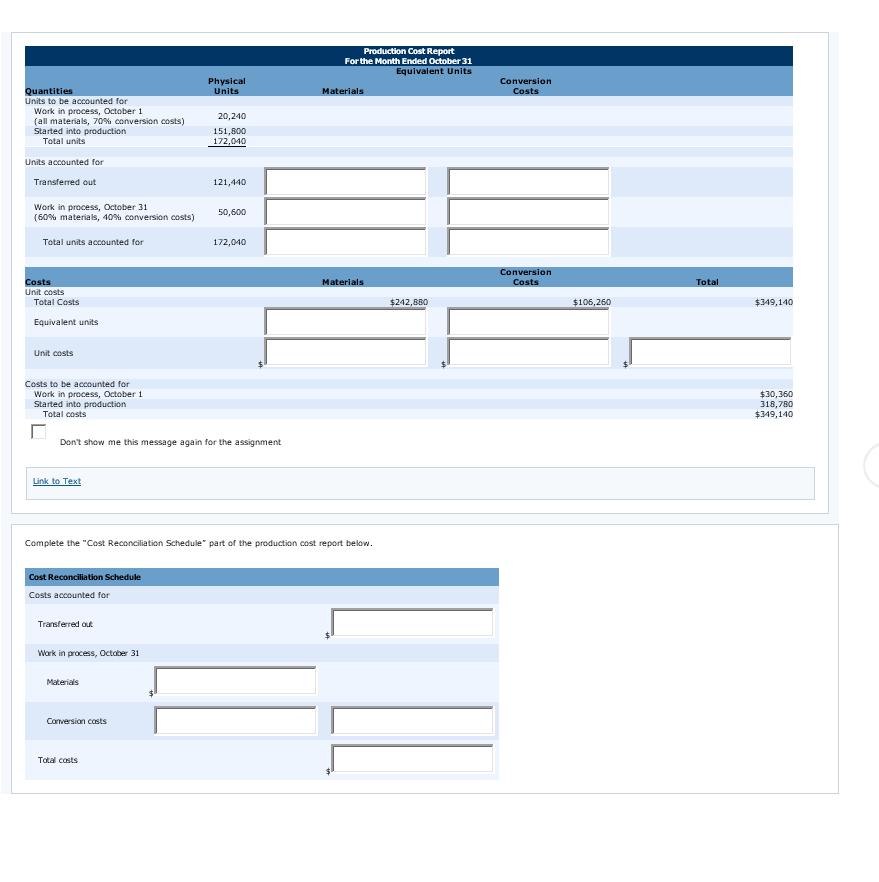

Question 1 Robert Mallory has prepared the following list of statements about process cost accounting. Identify each statement as true or false. 1. 8. 9 10. Process cost systems are used to apply costs. similar products that are mass-produced in a continuous fashion. A process cost system is used when each finished unit is indistinguishable from another. Companies that produce soft drinks, motion pictures, and computer chips would all use process cost accounting. In a process cost system, costs are tracked by individual jobs. Job order costing and process costing track different manufacturing cost elements. Both job order costing and process costing account for direct materials, direct labor, and manufacturing overhead. Costs flow through the accounts in the same basic way for both job order costing and process costing. In a process cost system, only one work in process account is used. In a process cost system, costs are summarized in a job cost sheet. In a process cost system, the unit cost is total manufacturing costs for the period divided by the units produced during the period. Don't show me this message again for the assignment Click if you would like to Show Work for this question:Open Show Work Question 2 The ledger of Custer Company has the following work process account. 5/1 5/31 5/31 5/31 5/31 Balance Materials Labor Overhead Balance Work in Process-Painting 3,810 5/31 6,380 3,000 1,450 Production records show that there were 500 units in the beginning inventory, 30% complete, 1,480 units started, and 1,510 units transferred out. The beginning work in process had materials cost of $2,480 and conversion costs of $1,680. The units in ending inventory were 40% complete. Materials are entered at the beginning of the painting process. Don't show me this message again for the assignment (a) How many units are in process at May 31? Work in process, May 31 Transferred out The unit materials cost for May units (b) What is the unit materials cost for May? (Round unit cost to 3 decimal places, e.g. 2.257.) (c) What is the unit conversion cost for May? (Round unit cost to 3 decimal places, e.g. 2.257.) 1. 2 3. The unit conversion cost for May Question 3 Schrager Company has two production departments: Cutting and Assembly. July 1 inventories are Raw Materials $4,570, Work in Process-Cutting $3,650, work in Process-Assembly $11,180, and Finished Goods $32,570. During July, the following transactions occurred. Don't show me this message again for the assignment Purchased $63,660 of raw materials on account. Incurred $61,370 of factory labor. (Credit Wages Payable.) Incurred $72,220 of manufacturing overhead; $42,020 was paid and the remainder is unpaid. 4 Requisitioned materials for Cutting $16,110 and Assembly $9,700. 5. Used factory labor for Cutting $35,060 and Assembly $26,310. 6. Applied overhead at the rate of $21 per machine hour. Machine hours were Cutting 1,730 and Assembly 1,790. 7. Transferred goods costing $69,520 from the Cutting Department to the Assembly Department. 8. Transferred goods costing $136,720 from Assembly to Finished Goods. 9. Sold goods costing $151,150 for $202,250 on account. Journalize the transactions. (Credit account titles are automatically indented when amount entered. Do not indent manually.) 1. Show Solution 2. Link to Text Link to Text Link to Text No. Account Titles and Explanation Debit Credit (To record the cost of goods sold.) (To record the sale.) Don't show me this message again for the assignment Click if you would like to Show Work for this question:Open Show Work 1. 2. Question 4 The Cutting Department of Cassel Company has the following production and cost data for July. Production Transferred out 13,800 units. Started 3,700 units that are 60% complete as to conversion costs and 100% complete as to materials at July 31. Total equivalent units of production Materials are entered at the beginning of the process. Conversion costs are incurred uniformly during the process. (a) Determine the equivalent units of production for (1) materials and (2) conversion costs. Materials Beginning work in process Materials Labor (b) Compute unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) Manufacturing overhead Conversion Costs Costs $0 59,500 25,920 22,140 Materials Conversion costs Prepare a cost reconciliation schedule Cost Reconciliation Costs accounted for Transferred out Work in process, July 31. Materials Conversion costs Total costs Question 1 In March, Kelly Company had the following unit production costs: materials $12 and conversion costs $8. On March 1, it had zero work in process. During March, Kelly transferred out 27,510 units. As of March 31, 3,140 units that were 50% complete as to conversion costs and 100% complete as to materials were in ending work in process. (a) Compute the total units to be accounted for. Total units (b) Compute the equivalent units of production. The equivalent units of production Cost Reconciliation Schedule Costs accounted for (c) Prepare a cost reconciliation schedule, including the costs of materials transferred out and the costs of materials process. Transferred out Work in process, March 31 Materials Conversion costs Total costs Materials Don't show me this message again for the assignment Click if you would like to Show Work for this question:Open Show Work Question 2 Conversion costs The Welding Department of Thorpe Company has the following production and manufacturing cost data for February 2014. All materials are added at the beginning of the process. Beginning work in process Materials Conversion costs Materials Labor Overhead Quantities Units to be accounted for Work in process, February Started into production Total units Units accounted for Transferred out Work in process, February 28 Total units Prepare a production cost report for the Welding Department for the month of February. (Round unit costs to 2 decimal places, e.g. 2.25 and all other answers to 0 decimal places, e.g. 1,225.) Costs Unit costs Total Costs Equivalent units Unit costs Costs to be accounted for Work in process, February Started into production Total costs Cost Reconciliation Schedule Costs accounted for Transferred out. Work in process, February 28 Materials Manufacturing Costs Conversion costs 91 Physical Units $18,340 $33,040 172,924 52,440 71,926 Beginning work in process Units transferred out Units started Ending work in process THORPE MANUFACTURING COMPANY Welding Department Production Cost Report For the Month Ended February 28, 2014 Materials Materials Production Data Equivalent Units Conversion Costs 14,760 units, 1/10 complete 49,440 45,010 10,330 units, 1/5 complete Conversion Costs Total Total costs Don't show me this message again for the assignment Click if you would like to Show Work for this question:Open Show Work Question 3 Seagren Industries Inc. manufactures in separate processes furniture for homes. In each process, materials are entered at the beginning, and conversion costs are incurred uniformly. Production and cost data for the first process in making two products in two different manufacturing plants are as follows. Production Data-July Work in process units, July 1 Units started into production: Work in process units, July 31 Work in process percent complete Cost Data-July www.co Work in process, July 1 Materials Labor Overhead Total Don't show me this message again for the assignment For each plant: (1) Compute the physical units Units to be accounted for T12 Tables (2) Compute equivalent units of production for materials and for conversion costs. C10 Chairs Unit costs-T12 Tables production. Unit costs-C10 Chairs T12 Tables Materials Costs accounted for: Materials (4) Show the assignment of costs to units transferred out and in process. (3) Determine the unit costs of production. (Round unit costs to 0 decimal places, e.g. 25.) T12 Tables Cutting Department Plant 1 T12-Tables Conversion Costs 23,180 3,660 60 C10 Chairs $0 463,600 285,724 126,880 $876,204 0 Conversion Costs Plant 2 C10-Chairs 19,520 610 80 351,360 134,200 117,974 $603,534 Total Costs Transferred out Work in process Materials Conversion costs Total costs Costs accounted for: Transferred out Work in process Materials Conversion costs Total costs Link to Text Link to Text Don't show me this message again for the assignment July 1 Prepare the production cost report for Plant 1 for July 2014. Quantities Units to be accounted Work in process, Started into production Total units C10 Chairs Units accounted for Transferred out Physical Units Link to Video SEAGREN INDUSTRIES INC. Cutting Department Plant 1 Production Cost Report For the Month Ended July 31, 2014 Equivalent Units Materials Conversion Costs Work in process, July 31 Total units Costs Unit costs Total Costs Equivalent units Unit costs Costs to be accounted for Work in process, July 1 Started into production Total costs Cost Reconciliation Schedule Costs accounted for Transferred out Work in process, July 31 Materials Conversion costs Total costs Don't show me this message again for the assignment Materials Conversion Costs Total Question 4 Hamilton Processing Company uses a weighted-average process cost system and manufactures a single product-a premium rug shampoo and cleaner. The manufacturing activity for the month of October has just been completed. A partially completed production cost report for the month of October for the mixing and cooking department is shown below. Don't show me this message again for the assignment HAMILTON PROCESSING COMPANY Mixing and Cooking Department Prepare a schedule that shows how the equivalent units were computed so that you can complete the "Quantities: Units accounted for equivalent units section shown in the production cost report, and compute October unit costs. (Round unit costs to 2 decimal places, e.g. 2.25.) Quantities Units to be accounted for Work in process, October 1 (all materials, 70% conversion costs) Started into production Total units Units accounted for Transferred out Work in process, October 31 (60% materials, 40% conversion costs) Total units accounted for Costs Unit costs Total Costs Equivalent units Unit costs Costs to be accounted for Work in process, October 1 Started into production Total costs Link to Text Cost Reconciliation Schedule Costs accounted for Transferred out Don't show me this message again for the assignment Work in process, October 31 Materials Physical Units Conversion costs 20,240 151,800 172,040 Total costs 121,440 50,600 Complete the "Cost Reconciliation Schedule" part of the production cost report below. 172,040 Production Cost Report For the Month Ended October 31 Equivalent Units Materials Materials $242,880 Conversion Costs Conversion Costs $106,260 Total $349,140 $30,360 318,780 $349,140

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started