Answered step by step

Verified Expert Solution

Question

1 Approved Answer

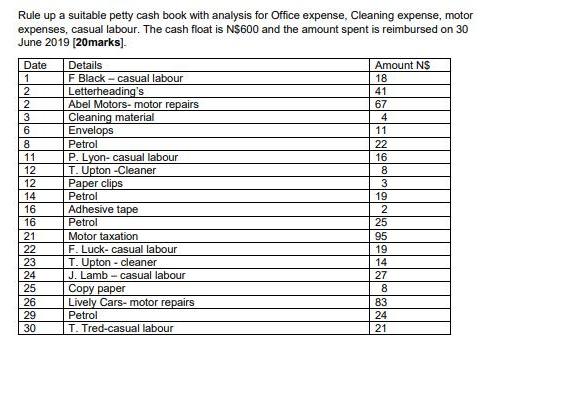

Rule up a suitable petty cash book with analysis for Office expense, Cleaning expense, motor expenses, casual labour. The cash float is Ns600 and

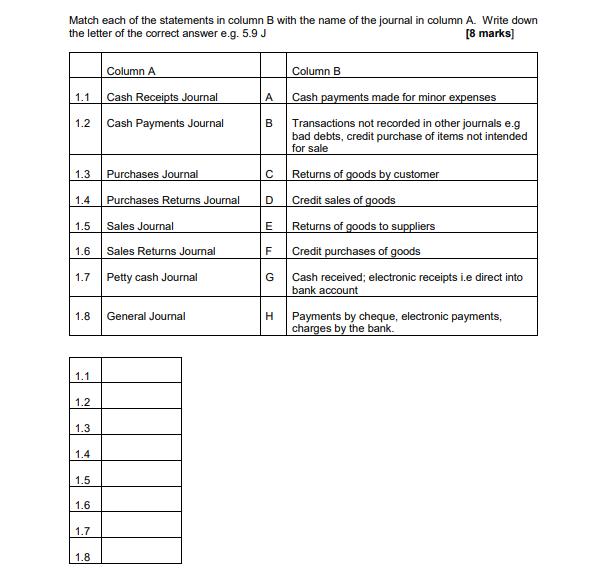

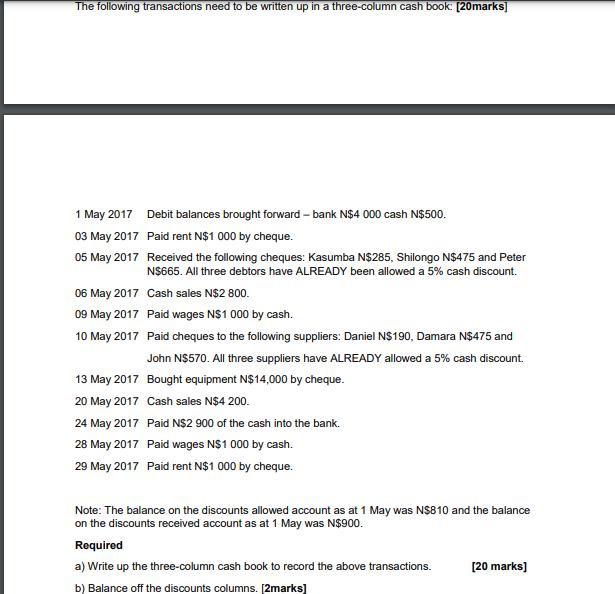

Rule up a suitable petty cash book with analysis for Office expense, Cleaning expense, motor expenses, casual labour. The cash float is Ns600 and the amount spent is reimbursed on 30 June 2019 [20marks). Amount N$ 18 Date Details F Black - casual labour Letterheading's Abel Motors- motor repairs Cleaning material Envelops 2 41 67 3 4 6 11 8 Petrol 22 P. Lyon- casual labour T. Upton -Cleaner Paper clips Petrol Adhesive tape Petrol 11 16 12 8 12 3 14 16 16 25 21 Motor taxation F. Luck- casual labour T. Upton - cleaner J. Lamb - casual labour Copy paper Lively Cars- motor repairs Petrol 22 19 23 14 24 27 25 8 26 83 29 24 30 T. Tred-casual labour 21 92599 Match each of the statements in column B with the name of the journal in column A. Write down the letter of the correct answer e.g. 5.9 J [8 marks] Column A Column B 1.1 Cash Receipts Journal Cash payments made for minor expenses 1.2 Cash Payments Journal B Transactions not recorded in other journals e.g bad debts, credit purchase of items not intended for sale Returns of goods by customer 1.3 Purchases Journal 1.4 Purchases Returns Journal D Credit sales of goods Sales Journal Returns of goods to suppliers 1.5 Sales Returns Journal Credit purchases of goods 1.6 F 1.7 Petty cash Journal G Cash received; electronic receipts i.e direct into bank account 1.8 General Journal H Payments by cheque, electronic payments, charges by the bank. 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 The following transactions need to be written up in a three-column cash book: [20marks] 1 May 2017 Debit balances brought forward - bank N$4 000 cash N$500. 03 May 2017 Paid rent N$1 000 by cheque. 05 May 2017 Received the following cheques: Kasumba N$285, Shilongo N$475 and Peter N$665. All three debtors have ALREADY been allowed a 5% cash discount. 06 May 2017 Cash sales N$2 800. 09 May 2017 Paid wages N$1 000 by cash. 10 May 2017 Paid cheques to the following suppliers: Daniel N$190, Damara N$475 and John N$570. All three suppliers have ALREADY allowed a 5% cash discount. 13 May 2017 Bought equipment N$14,000 by cheque. 20 May 2017 Cash sales N$4 200. 24 May 2017 Paid NS2 900 of the cash into the bank. 28 May 2017 Paid wages N$1 000 by cash. 29 May 2017 Paid rent N$1 000 by cheque. Note: The balance on the discounts allowed account as at 1 May was N$810 and the balance on the discounts received account as at 1 May was N$900. Required a) Write up the three-column cash book to record the above transactions. [20 marks) b) Balance off the discounts columns. [2marks]

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Petty cash book Cash Book for June 2019 DR CR Receipt Date Details Total Office Expense Cleaning Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started