Answered step by step

Verified Expert Solution

Question

1 Approved Answer

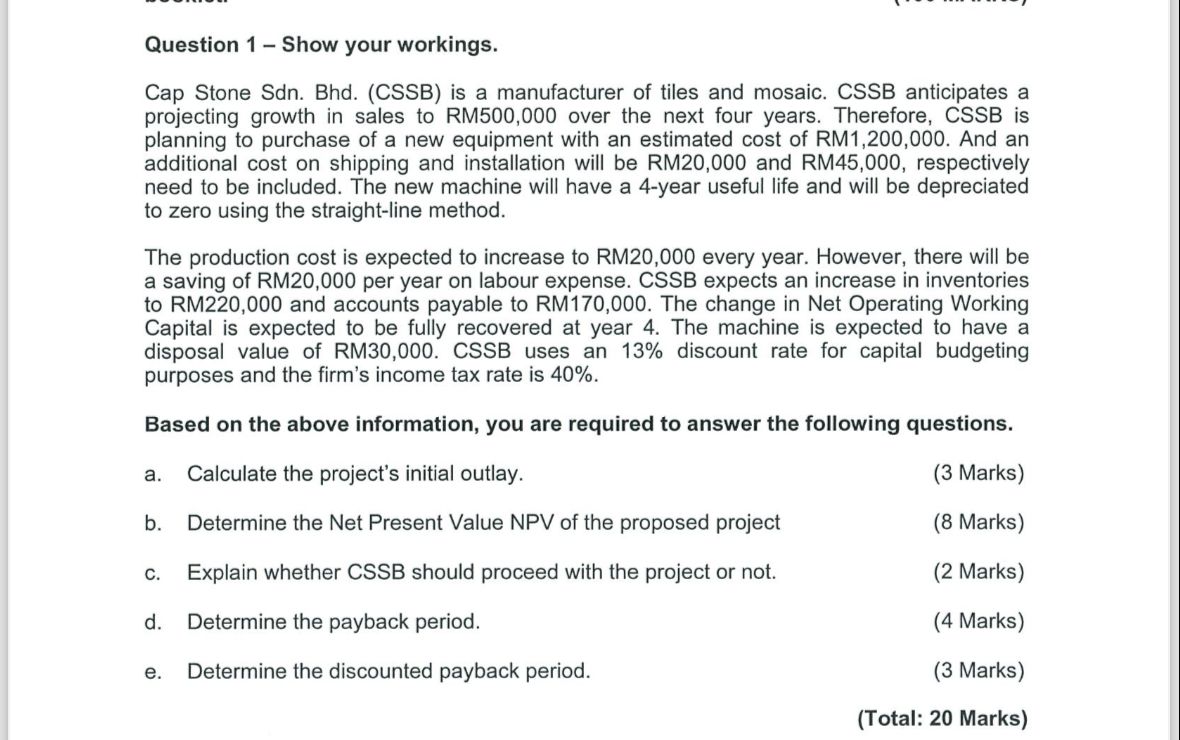

Question 1 - Show your workings. Cap Stone Sdn . Bhd . ( CSSB ) is a manufacturer of tiles and mosaic. CSSB anticipates a

Question Show your workings.

Cap Stone Sdn BhdCSSB is a manufacturer of tiles and mosaic. CSSB anticipates a

projecting growth in sales to RM over the next four years. Therefore, CSSB is

planning to purchase of a new equipment with an estimated cost of RM And an

additional cost on shipping and installation will be RM and RM respectively

need to be included. The new machine will have a year useful life and will be depreciated

to zero using the straightline method.

The production cost is expected to increase to RM every year. However, there will be

a saving of RM per year on labour expense. CSSB expects an increase in inventories

to RM and accounts payable to RM The change in Net Operating Working

Capital is expected to be fully recovered at year The machine is expected to have a

disposal value of RM CSSB uses an discount rate for capital budgeting

purposes and the firm's income tax rate is

Based on the above information, you are required to answer the following questions.

a Calculate the project's initial outlay.

Marks

b Determine the Net Present Value NPV of the proposed project

Marks

c Explain whether CSSB should proceed with the project or not.

Marks

d Determine the payback period.

Marks

e Determine the discounted payback period.

Marks

Total: Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started