Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question (1) Stanley's Farm purchases a new electric generator from Power Supply Inc. The price paid by Stanley's Farm was $80,000 after benefitting from

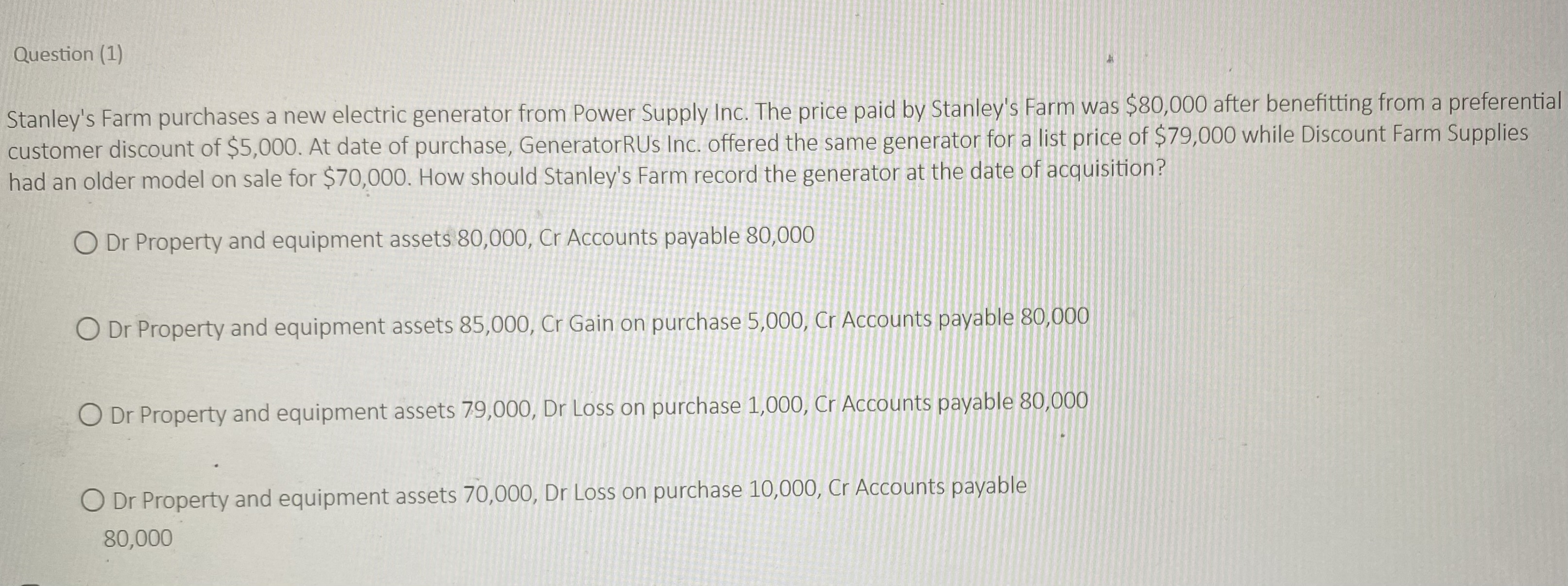

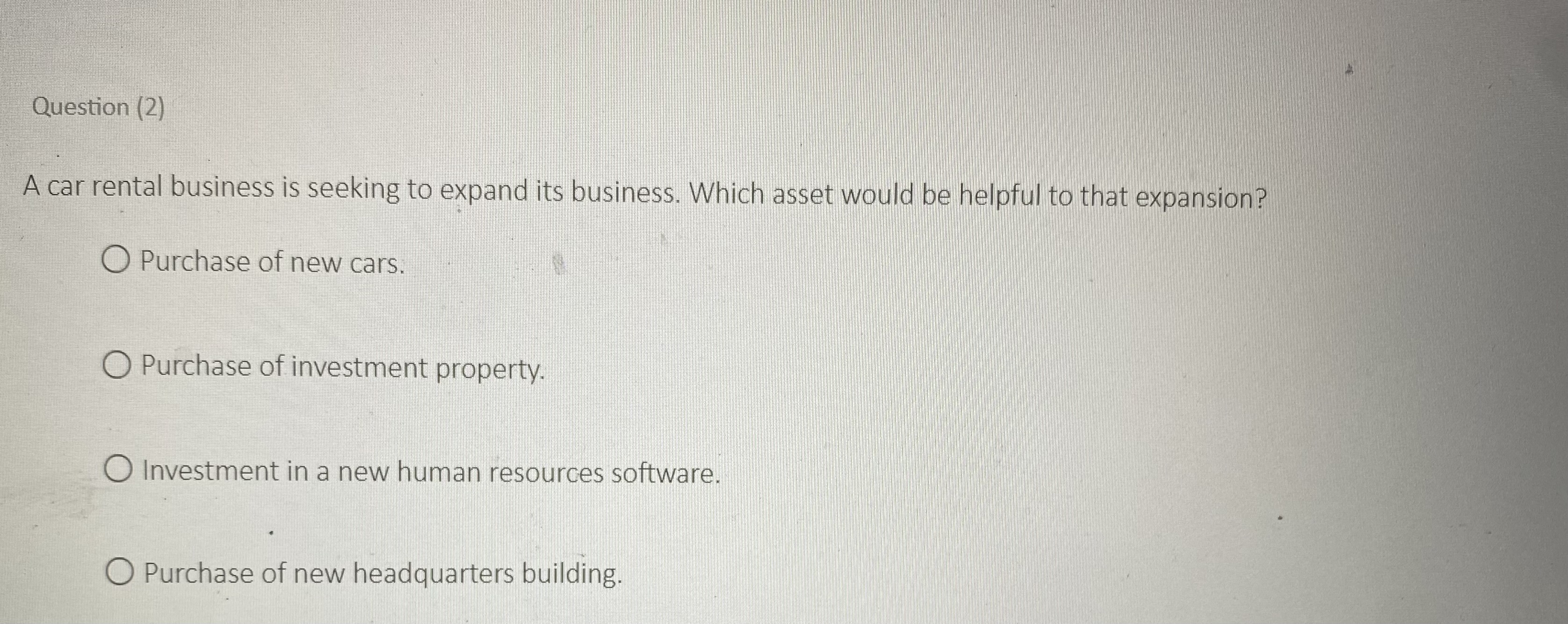

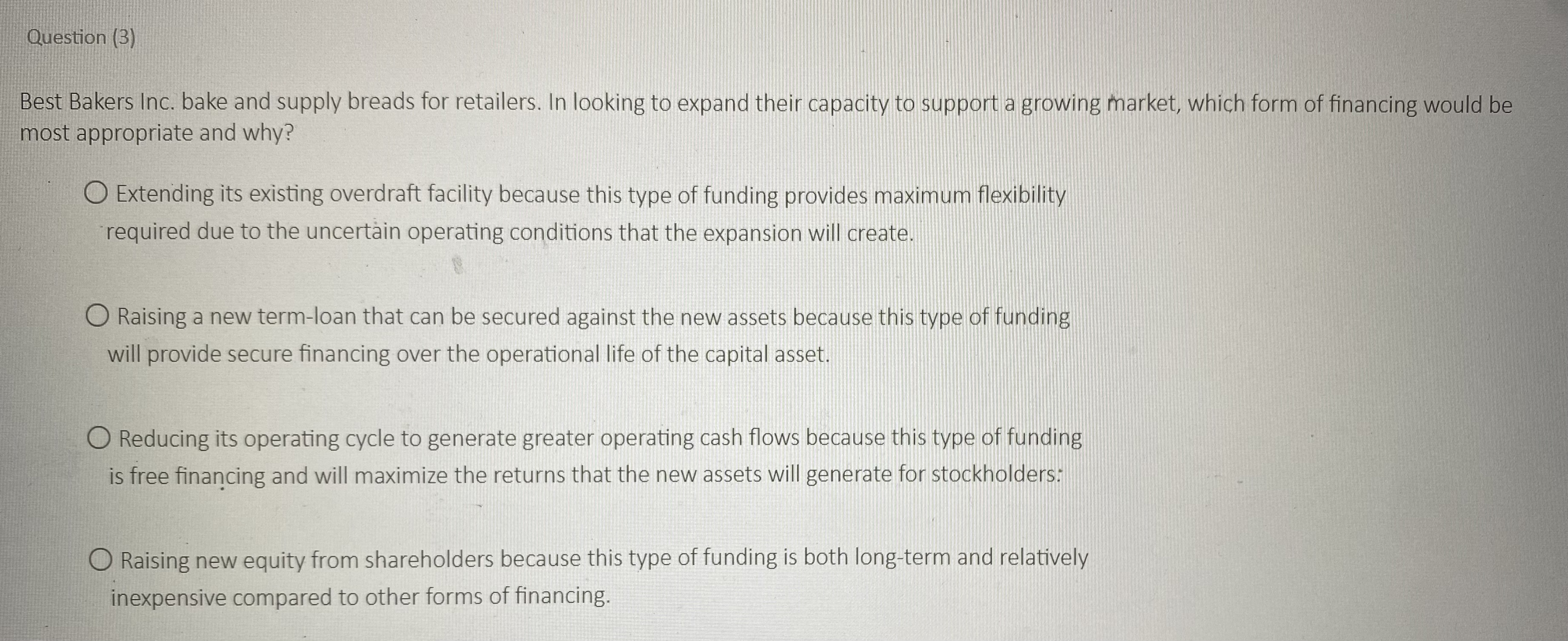

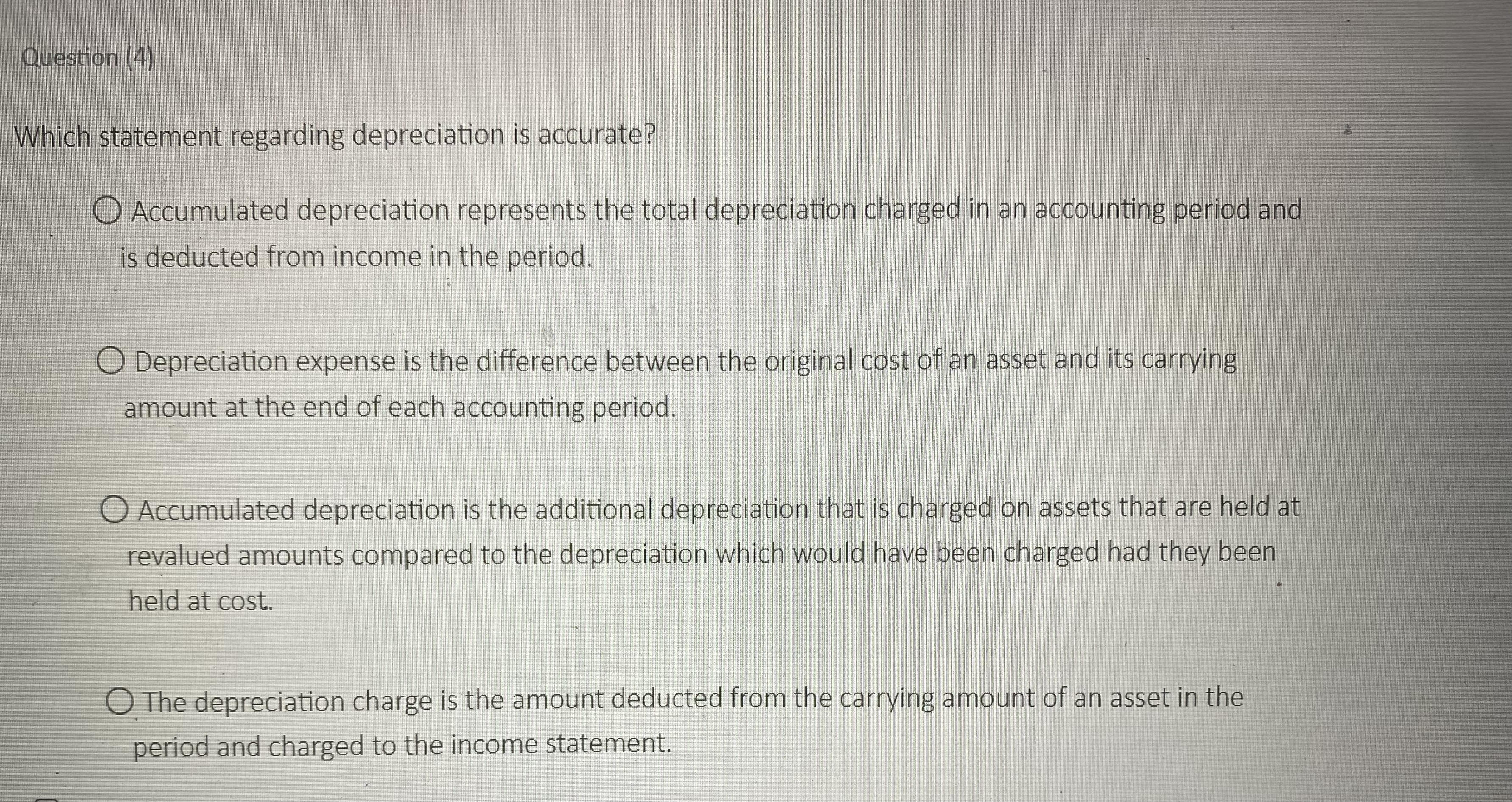

Question (1) Stanley's Farm purchases a new electric generator from Power Supply Inc. The price paid by Stanley's Farm was $80,000 after benefitting from a preferential customer discount of $5,000. At date of purchase, Generator RUs Inc. offered the same generator for a list price of $79,000 while Discount Farm Supplies had an older model on sale for $70,000. How should Stanley's Farm record the generator at the date of acquisition? O Dr Property and equipment assets 80,000, Cr Accounts payable 80,000 O Dr Property and equipment assets 85,000, Cr Gain on purchase 5,000, Cr Accounts payable 80,000 O Dr Property and equipment assets 79,000, Dr Loss on purchase 1,000, Cr Accounts payable 80,000 O Dr Property and equipment assets 70,000, Dr Loss on purchase 10,000, Cr Accounts payable 80,000 Question (2) A car rental business is seeking to expand its business. Which asset would be helpful to that expansion? O Purchase of new cars. O Purchase of investment property. O Investment in a new human resources software. O Purchase of new headquarters building. Question (3) Best Bakers Inc. bake and supply breads for retailers. In looking to expand their capacity to support a growing market, which form of financing would be most appropriate and why? O Extending its existing overdraft facility because this type of funding provides maximum flexibility required due to the uncertain operating conditions that the expansion will create. O Raising a new term-loan that can be secured against the new assets because this type of funding will provide secure financing over the operational life of the capital asset. O Reducing its operating cycle to generate greater operating cash flows because this type of funding is free financing and will maximize the returns that the new assets will generate for stockholders: O Raising new equity from shareholders because this type of funding is both long-term and relatively inexpensive compared to other forms of financing. Question (4) Which statement regarding depreciation is accurate? O Accumulated depreciation represents the total depreciation charged in an accounting period and is deducted from income in the period. O Depreciation expense is the difference between the original cost of an asset and its carrying amount at the end of each accounting period. O Accumulated depreciation is the additional depreciation that is charged on assets that are held at revalued amounts compared to the depreciation which would have been charged had they been held at cost. O The depreciation charge is the amount deducted from the carrying amount of an asset in the period and charged to the income statement. Question (5) Tea-Shop Inc. finance their new store leases using 2/3rd debt and 1/3rd equity. Which of these events would reduce the risk for the lending institution? O Reduction in costs of tea. C O Decrease in credit provided by suppliers. Decrease in store sales with a constant operating margin. O Increase in store maintenance costs. Question (6) Which scenario would be met through capital investment? O A business is trying to reduce disruption from stoppages to its machines by introducing a new maintenance schedule. O A business is trying to reduce its receivable days by offering customers prompt payment discounts. O A business is trying to compete by acquiring new technology that will allow it to reduce its cost of production and decrease selling price. O A business is trying to reduce its financing requirement by reducing the number of suppliers it uses. Question (7) Delivanow is a parcel delivery company. Which of these assets would you expect to see included in Fixtures & Fittings? O Warehouse shelving and partition walls O Delivery vehicles O Hand held computerized parcel-tracking units O Plastic sacks to protect parcels in transit Question (8) Identify the statement that accurately describes why a transaction should be treated as a capital rather than an expense. O If the item is expected to be used and to generate income for more than 12 months then it should be treated as capital investment. O If the item costs over a certain amount of money (generally over $10,000) it will be treated as capital investment. O If the item will have a significant resale value after 12 months it will be treated as a capital investment. O If the item is not used immediately then it should be treated as a capital investment. Question (9) Which of these transactions would be defined as a capital investment? O Annual service costs relating to delivery vehicles. O Purchase of fuel to operate machinery. O Purchase of warehouse fixtures and fittings. PI O Purchase of finished goods to re-sell to customers. Question (10) Which statement accurately describes the capital investment cycle? O It refers to the length of time between start up of a business and the expected useful life of the main operating property used by the business. O It refers to the expected holding period for investments in property that are held primarily for rental purposes or capital gains. O It refers to the process of continuous investment of surplus operating funds into long-term financial assets such as bonds and equities. O It refers to the cycles of acquisition, use and disposal of fixed assets, which can vary in length depending upon the nature and use of the fixed assets. Question (11) Which statements is correct in relation to Loan to Value ratios (LTV)? O The LTV should be above 1 at the beginning of the loan and below 1 at the end of the loan. O The LTV should be less than 1 throughout the term of the loan. O The LTV should be below 1 at the beginning of the loan and above 1 at the end of the loan. O The LTV should be greater than 1 throughout the term of the loan. Question (12) Tea-Shop Inc. are purchasing 10-year leases on 5 new stores to be run as specialist tea outlets and cafes, costing $30m. The shops are expected to generate annual net operating cash flow (before financing) of $1M each. Tea-Shop have approached you for a loan of $20m to help finance the purchases. Which combination of loan term and interest rate would be most suited to this transaction? O 12-year term loan at 8% pa with annual repayments (including interest) of $2.7M. O 14-year term loan at 8% with annual repayments (including interest) of $2.4M. O 4-year term loan at 8% with annual repayments (including interest) of $6.0M. O 8-year term loan at 8% with annual repayments (including interest) of $3.5M.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The correct answer is Dr Property and equipment assets 80000 Cr Accounts payable 80000 This is because Stanleys Farm should record the ge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started