Answered step by step

Verified Expert Solution

Question

1 Approved Answer

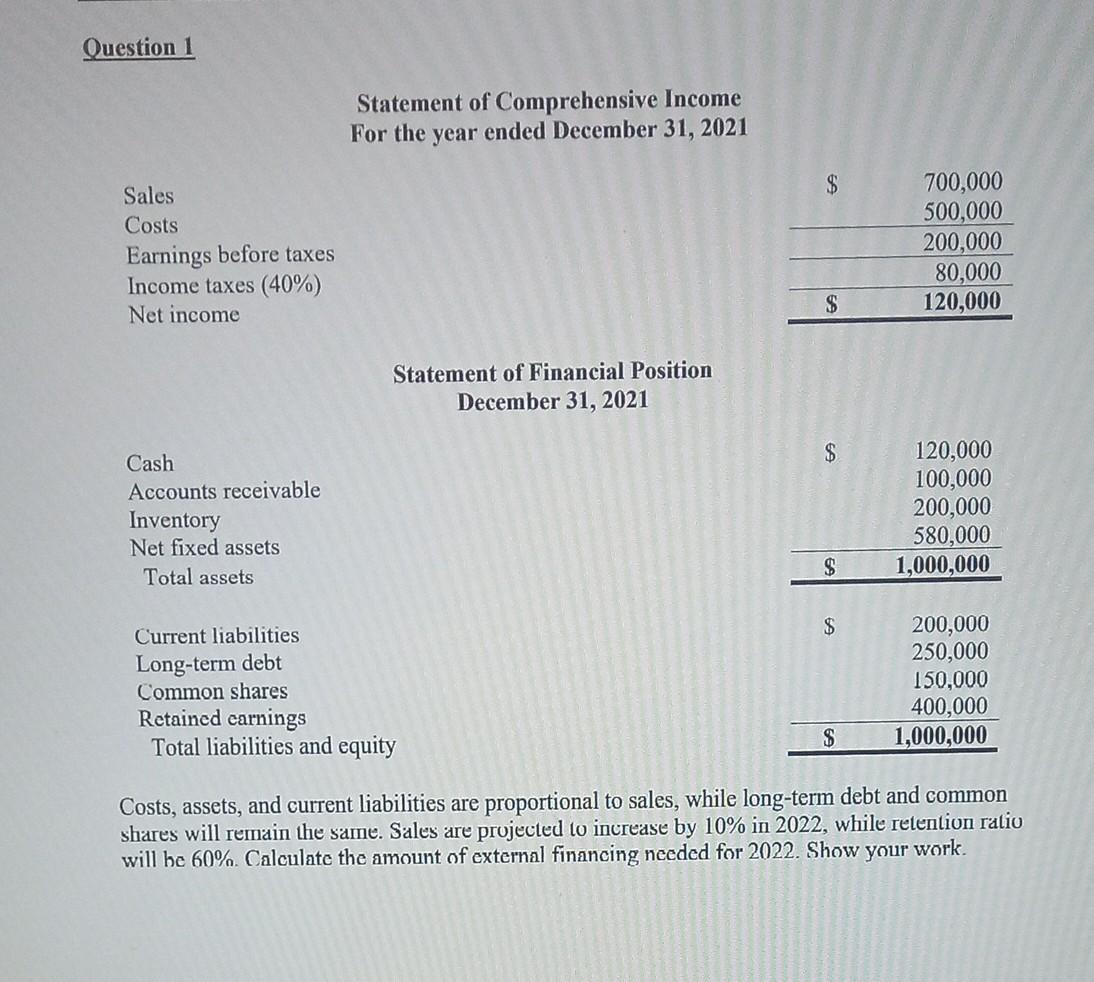

Question 1 Statement of Comprehensive Income For the year ended December 31, 2021 Sales Costs Earnings before taxes Income taxes (40%) Net income Statement of

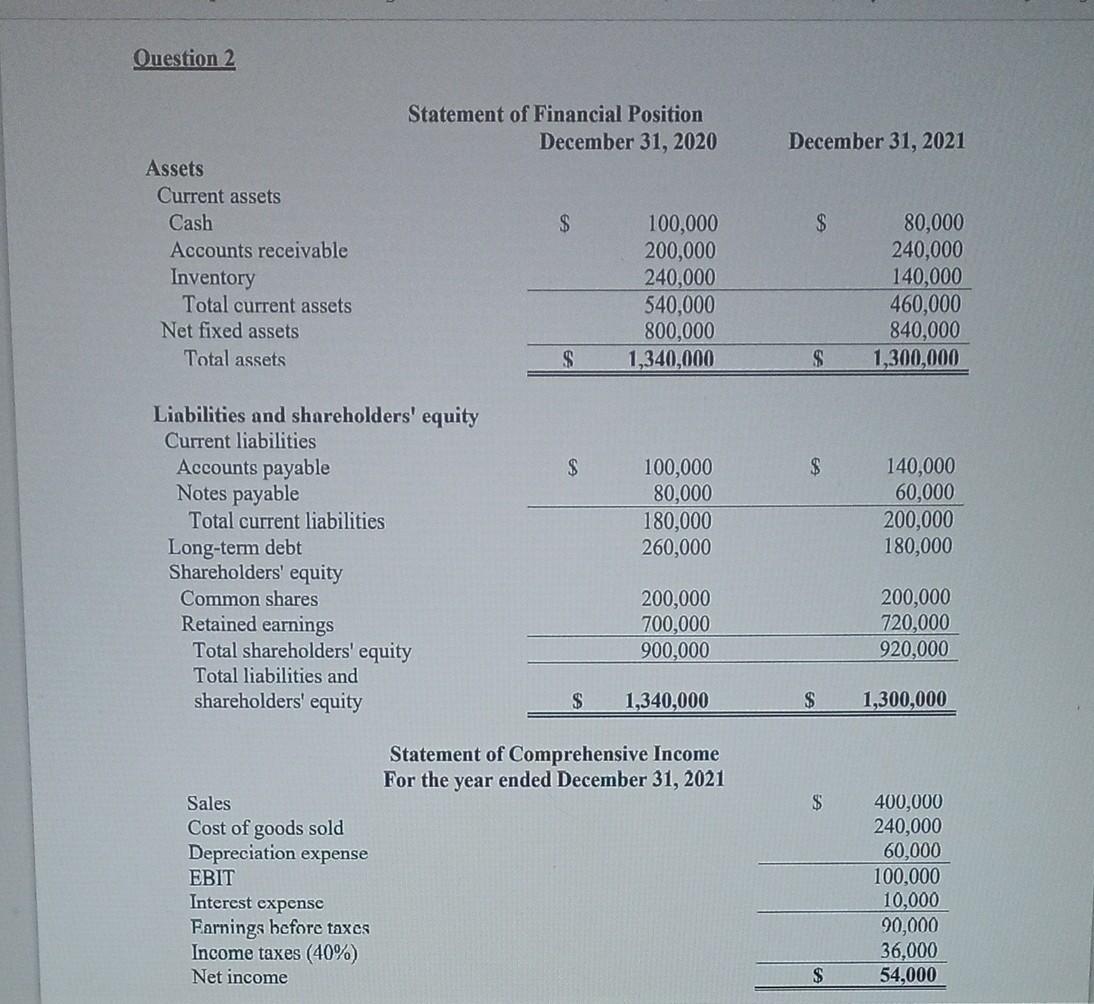

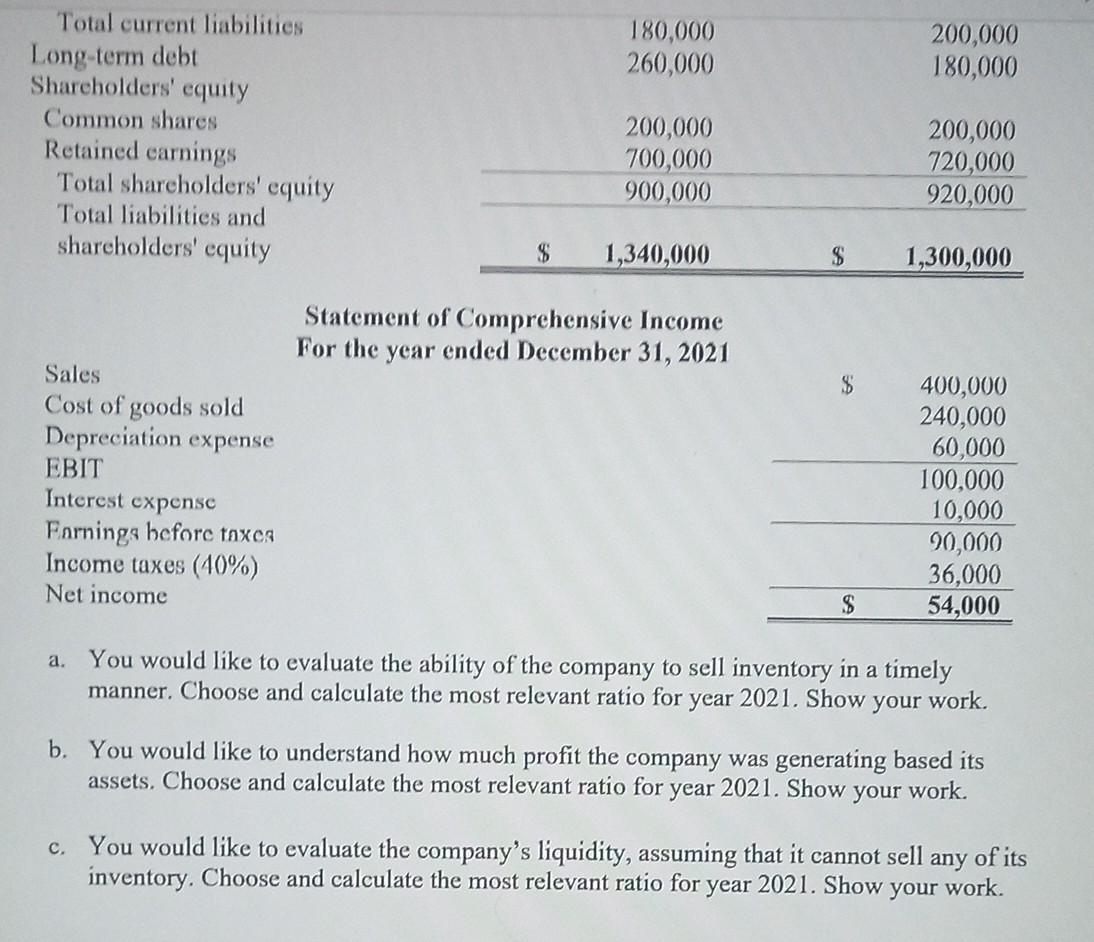

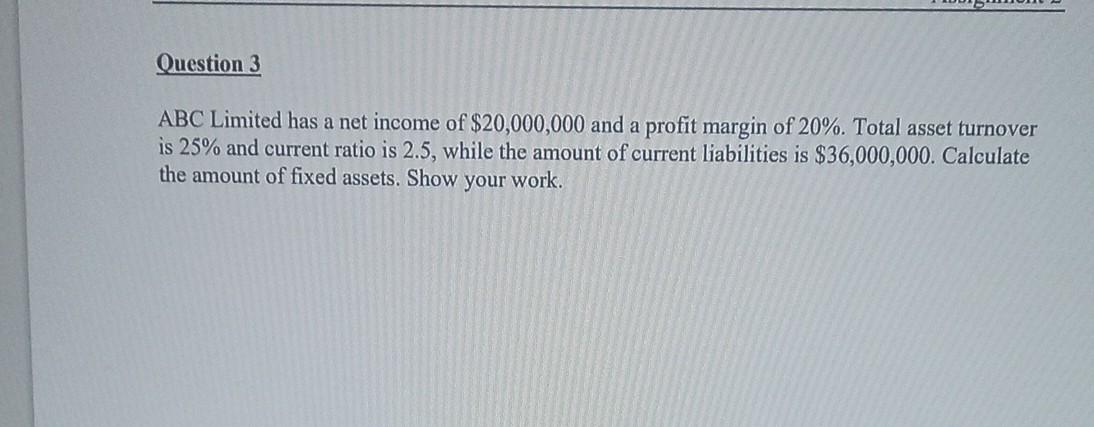

Question 1 Statement of Comprehensive Income For the year ended December 31, 2021 Sales Costs Earnings before taxes Income taxes (40%) Net income Statement of Financial Position December 31, 2021 Cash Accounts receivab Inventory Net fixed assets Total assets Current liabilities Long-term debt Common shares Retained earnings Total liabilities and equity Costs, assets, and current liabilities are proportional to sales, while long-term debt and common shares will remain the same. Sales are projected to increase by 10% in 2022 , while retention ratio will be 60%. Calculate the amount of external financing needed for 2022 . Show your work. Ouestion 2 a. You would like to evaluate the ability of the company to sell inventory in a timely manner. Choose and calculate the most relevant ratio for year 2021. Show your work. b. You would like to understand how much profit the company was generating based its assets. Choose and calculate the most relevant ratio for year 2021. Show your work. c. You would like to evaluate the company's liquidity, assuming that it cannot sell any of its inventory. Choose and calculate the most relevant ratio for year 2021. Show your work. ABC Limited has a net income of $20,000,000 and a profit margin of 20%. Total asset turnover is 25% and current ratio is 2.5, while the amount of current liabilities is $36,000,000. Calculate the amount of fixed assets. Show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started