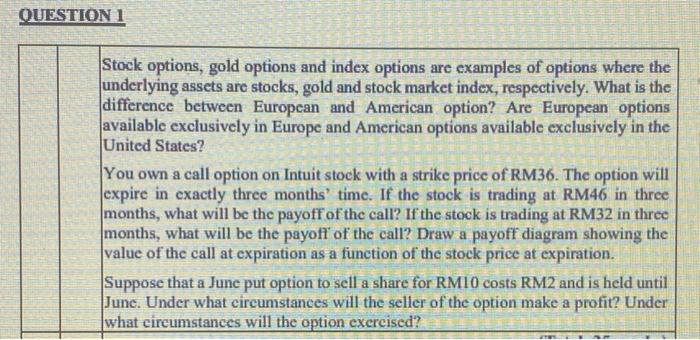

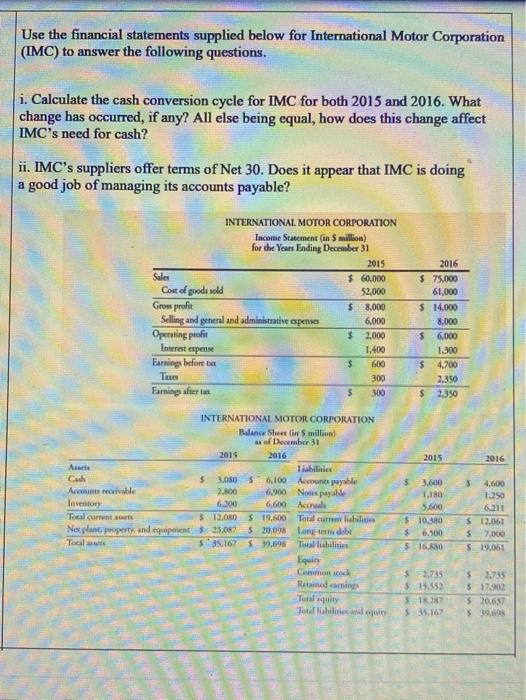

QUESTION 1 Stock options, gold options and index options are examples of options where the underlying assets are stocks, gold and stock market index, respectively. What is the difference between European and American option? Are European options available exclusively in Europe and American options available exclusively in the United States? You own a call option on Intuit stock with a strike price of RM36. The option will expire in exactly three months' time. If the stock is trading at RM46 in three months, what will be the payoff of the call? If the stock is trading at RM32 in three months, what will be the payoff' of the call? Draw a payoff diagram showing the value of the call at expiration as a function of the stock price at expiration. Suppose that a Junc put option to sell a share for RM10 costs RM2 and is held until June. Under what circumstances will the seller of the option make a profit? Under what circumstances will the option exercised? QUESTION Answer on these three senarios: Senario 1: Evaluate the essential trade-off' faced by government in designing regulation of public firms? Senario 2: Discuss the essential trade-off faced by goverment in designing regulation of public firms? Senario 3: Many of the provisions of the Sarbanes-Oxley Act of 2002 were aimed at auditors. How does this affect corporate governance? Critically analysis. QUESTION 3 Answer on these two senarios: Senario 1: You have decided to form a new start-up company developing applications for the iPhone. Give examples of the three distinct types of financial decisions you will need to make. 2 Senario 2: You are the CEO of a company and you are considering entering into an agreement to have your company buy another company. You think the price might be too high, but you will be the CEO of the combined, much larger, company. You know that when the company gets bigger, your pay and prestige will increase. What is the nature of the agency conflict here and how is it related to ethical considerations? Use the financial statements supplied below for International Motor Corporation (IMC) to answer the following questions. i. Calculate the cash conversion cycle for IMC for both 2015 and 2016. What change has occurred, if any? All else being equal, how does this change affect IMC's need for cash? ii. IMC's suppliers offer terms of Net 30. Does it appear that IMC is doing a good job of managing its accounts payable? INTERNATIONAL MOTOR CORPORATION Income Statement in Smilion) for the Year Ending December 31 2015 Sales $ 60.000 Cost of goods sold 52,000 Grow-profit $ 8.000 Selling and general and administrative pense 6,000 Operating profit $ 2,000 1,400 Farning before $ 600 Thes 300 Earning after 5 300 2016 $ 75.000 61,000 $ 14.000 8.000 $ 6,000 1.300 $ 4.700 2.350 $ 2350 Imeret opens 2015 2016 INTERNATIONAL MOTOR CORPORATION Balance Sheet in million of December 2015 2016 Alte liabilities Cade $ 3.080 6.100 Accounts payable Accounts receivable 2.800 6.900 Nous payable Inventory 6.600 Accruali Toal.cat $ 13,030 S 19.600 Total crisilities Nes plan property and equipment 25.087 $20.095 longte debe Tocal aus $35.167 $19.95 Thallillain Equiry Common sock Rimming Toque Toshilities and 3.600 1,180 5.000 $10.00 6.500 5 4.600 1.250 6211 $ 12.06 5 7.000 S 19,061 5 16.30 $ 3.733 $15.552 31 $35.16 $ 2,735 $ 17,902 $ 20,67 $19