Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Student Services Incorporated (SSI) acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. It supplies clothing, records,

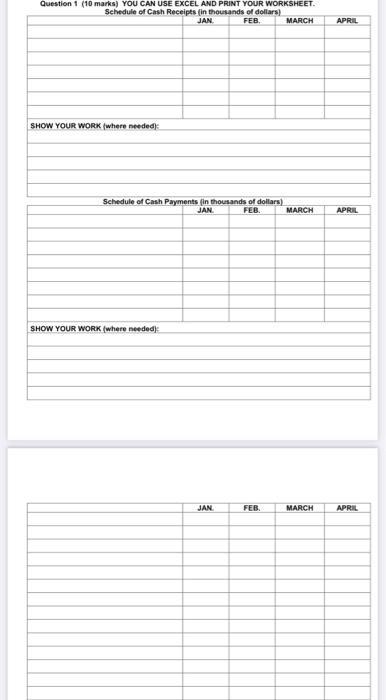

Student Services Incorporated (SSI) acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. It supplies clothing, records, and confectionary items. The company has a $75,000 line of credit available with a local bank, and it draws on its account in amounts of $5,000 at a time. [Thus, if it needs $5,001, it must borrow $10,000.] SSI has not drawn on the credit line yet. As at December 31, 2021, the firm had a cash balance of $7,000, which is the minimum balance that it wants to maintain. Any excess cash is used to repay the line of credit. [Ignore interest on the line of credit.] The following additional information is available. Actual Sales October 2021 November 2021 $75,000 December 2021 $40,000 Forecasted sales $100,000 $50,000 $30,000 $100,000 $70,000 $70,000 $100,000 January 2022 February 2022 March 2022 April 2022 May 2022 June 2022 Sales/Accounts Receivable: All sales are on credit and terms are net 30 days (1 month). From past experience 50 percent of the accounts are collected 1 month after the sale, 40 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale. Bad debts are negligible. Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month prior to sale. Purchases (units) are equal to 90% of next month's sales and the gross profit margin is 30%. Administrative Expense: The administrative expense is $4,000 per month (which includes $1,000 for depreciation expense) plus a bonus of 4 percent of sales realized during the last quarter of the calendar year. This bonus is paid in February of each year. Dividends: In March, $6,000 in dividends will be paid. Taxes: The tax rate is 40 percent. For the past year, $2,000 in taxes must be paid by January 15, and no other taxes are payable in the period January to April. Salaries: Wages and salaries amount to 15 percent of the monthly dollar sales or $12,000, whichever is greater. Capital Expenditures: The company will buy new fixed assets for $20,000 in January. These assets have a five-year life with no residual value. Prepare a schedule of cash receipts, a schedule of cash payments and a cash budget for the period January to April 2022. Question 1 (10 marks) YOU CAN USE EXEL AND PRINT YOUR WORKSHEET. Schedule of Cash Receipts (in thousands of dollars) JAN FEB. MARCH APRIL SHOW YOUR WORK (where needed) Schedule of Cash Payments (in thousands of dollars) JAN. FEB. MARCH APRIL SHOW YOUR WORK (where needed): JAN. FEB. MARCH APRIL

Step by Step Solution

★★★★★

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Schedule of cash receipts JAN FEB MARCH APRIL 20 cash sales 40 20 12 40 60 collecti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started