Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Superior Manufacturers has two departments: Welding and Assembly. The Welding department calculates its predetermined overhead absorption rate based on machine hours while the

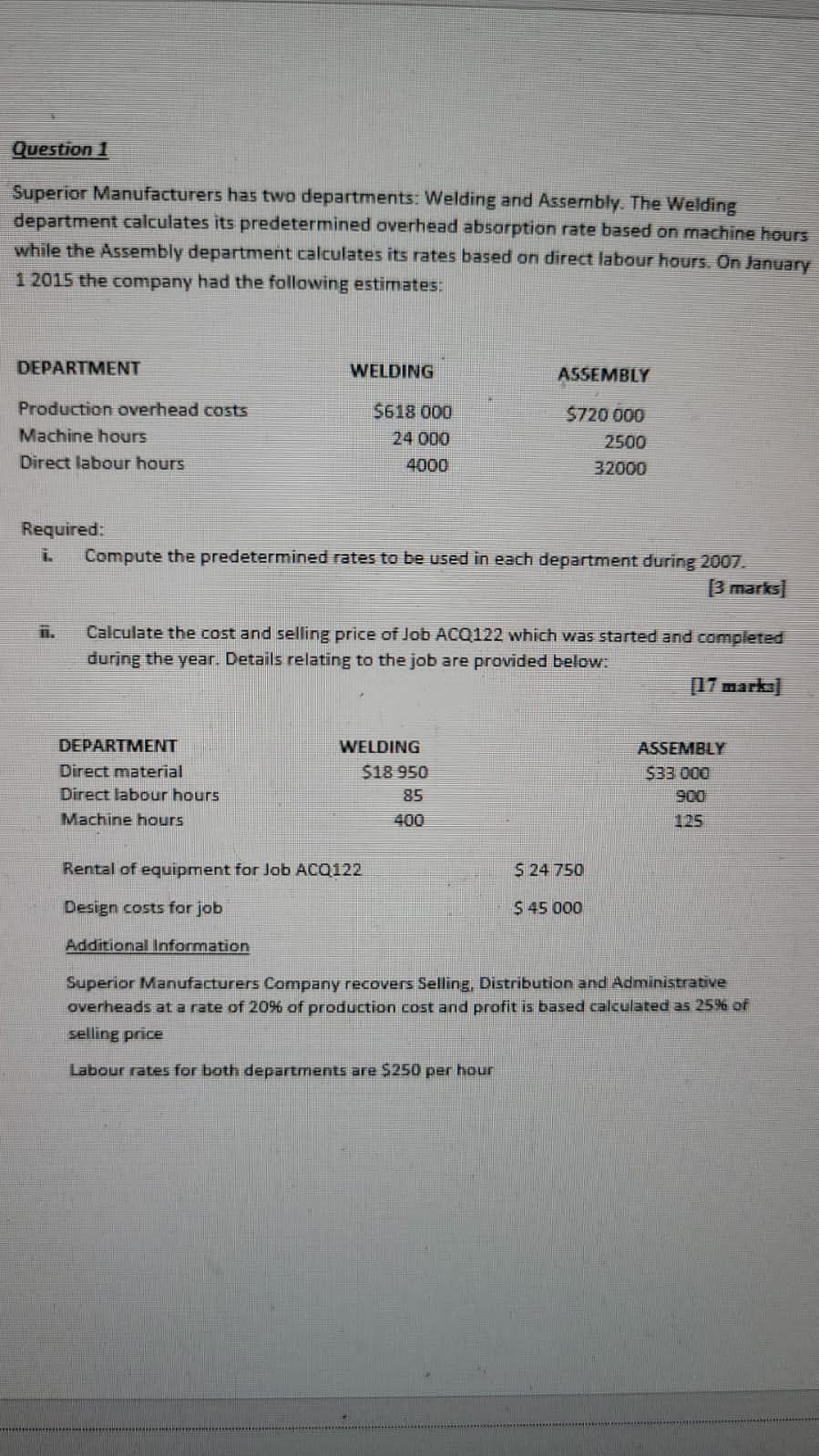

Question 1 Superior Manufacturers has two departments: Welding and Assembly. The Welding department calculates its predetermined overhead absorption rate based on machine hours while the Assembly department calculates its rates based on direct labour hours. On January 12015 the company had the following estimates: Required: i. Compute the predetermined rates to be used in each department during 2007. [3 marks] ii. Calculate the cost and selling price of Job ACQ122 which was started and completed during the year. Details relating to the job are provided below: [17 marka] Avorional intormation Superior Manufacturers Company recovers Selling, Distribution and Administrative overheads at a rate of 20% of production cost and profit is based calculated as 25% of selling price Labour rates for both departments are $250 per hour

Question 1 Superior Manufacturers has two departments: Welding and Assembly. The Welding department calculates its predetermined overhead absorption rate based on machine hours while the Assembly department calculates its rates based on direct labour hours. On January 12015 the company had the following estimates: Required: i. Compute the predetermined rates to be used in each department during 2007. [3 marks] ii. Calculate the cost and selling price of Job ACQ122 which was started and completed during the year. Details relating to the job are provided below: [17 marka] Avorional intormation Superior Manufacturers Company recovers Selling, Distribution and Administrative overheads at a rate of 20% of production cost and profit is based calculated as 25% of selling price Labour rates for both departments are $250 per hour Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started