Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Suppose you believe that Florio Company's stock price is going to decline from its current level of $82.50 sometime during the next 5

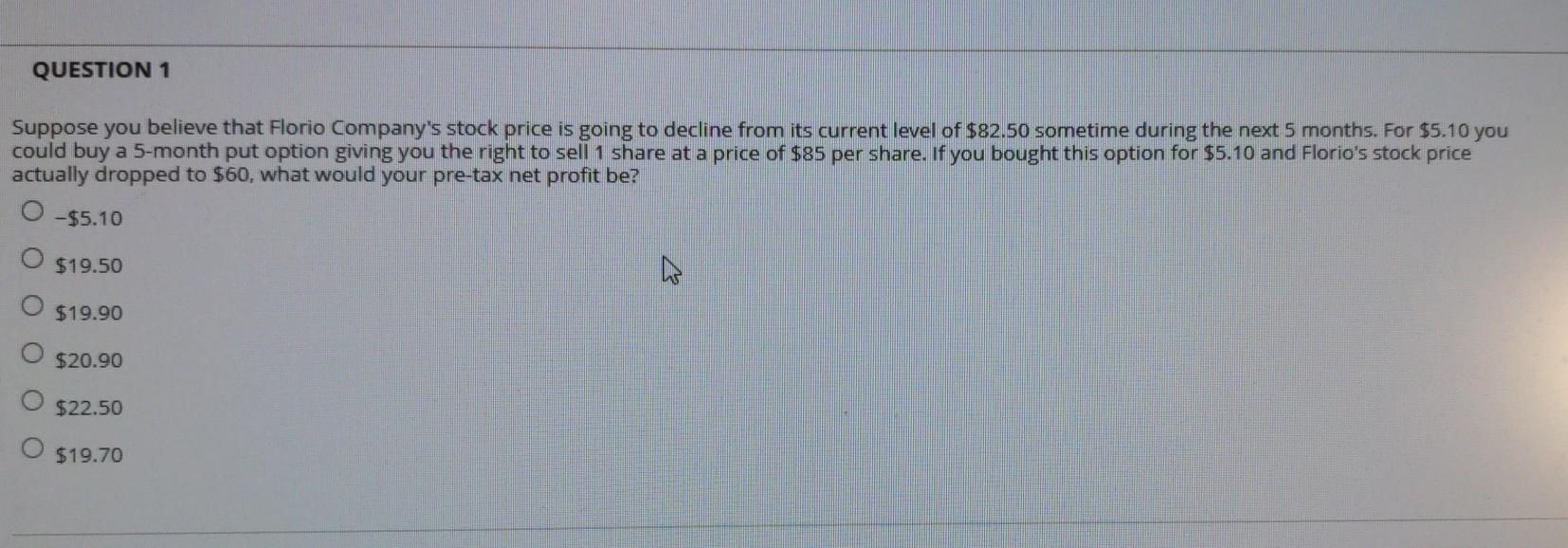

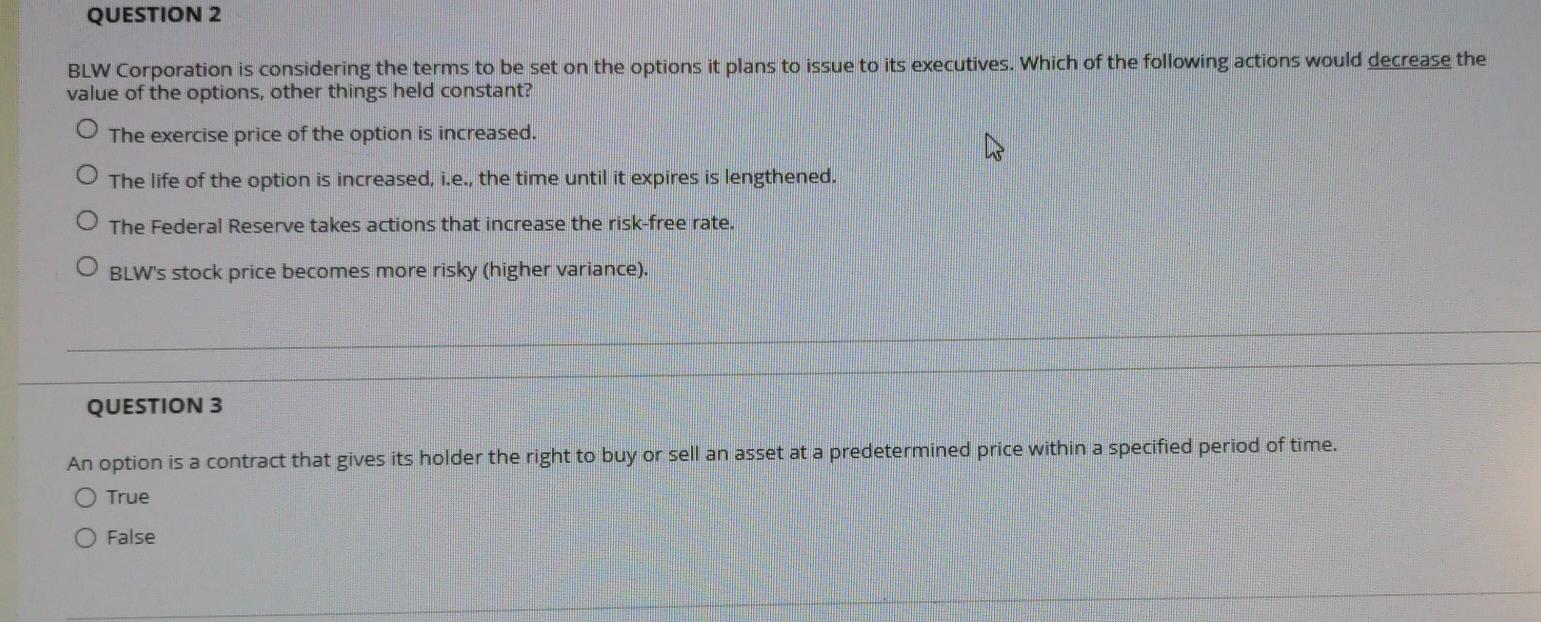

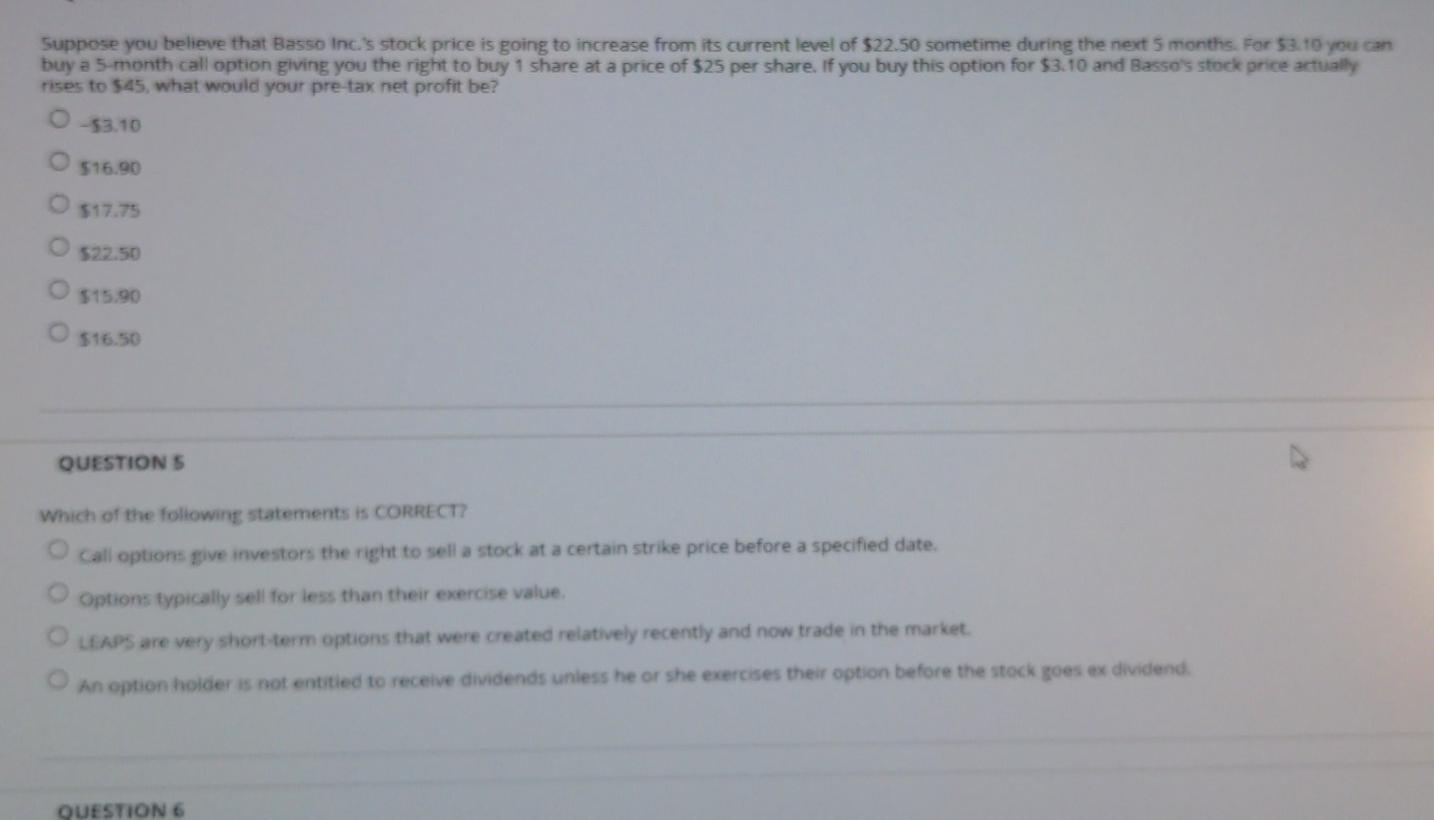

QUESTION 1 Suppose you believe that Florio Company's stock price is going to decline from its current level of $82.50 sometime during the next 5 months. For $5.10 you could buy a 5-month put option giving you the right to sell 1 share at a price of $85 per share. If you bought this option for $5.10 and Florio's stock price actually dropped to $60, what would your pre-tax net profit be? -$5.10 $19.50 $19.90 $20.90 $22.50 $19.70 QUESTION 2 BLW Corporation is considering the terms to be set on the options it plans to issue to its executives. Which of the following actions would decrease the value of the options, other things held constant? The exercise price of the option is increased. The life of the option is increased, i.e., the time until it expires is lengthened. The Federal Reserve takes actions that increase the risk-free rate. BLW's stock price becomes more risky (higher variance). QUESTION 3 An option a contract that gives its holder the right to buy or sell an asset at a predetermined price within a specified period of time. O True O False Suppose you believe that Basso Inc.'s stock price is going to increase from its current level of $22.50 sometime during the next 5 months. For $3.10 you can buy a 5-month call option giving you the right to buy 1 share at a price of $25 per share. If you buy this option for $3.10 and Basso's stock price actually rises to $45, what would your pre-tax net profit be? -53.10 $16.90 $17.75 522.50 $15.90 $16.50 QUESTIONS Which of the following statements is CORRECT? O call options give investors the right to sell a stock at a certain strike price before a specified date. Options typically sell for less than their exercise value. LEAPS are very short-term options that were created relatively recently and now trade in the market. An option holder is not entitled to receive dividends unless he or she exercises their option before the stock goes ex dividend QUESTION 6 QUESTION 5 Which of the following statements is CORRECT? O Call options give investors the right to sell a stock at a certain strike price before a specified date. Options typically sell for less than their exercise value. LEAPS are very short-term options that were created relatively recently and now trade in the market. An option holder is not entitled to receive dividends unless he or she exercises their option before the stock goes ex dividend. QUESTION 6 The exercise value is also called the strike price, but this term is generally used when discussing convertibles rather than financial options. O True False Click Save and Submit to save and submit. Click Save AZ Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started