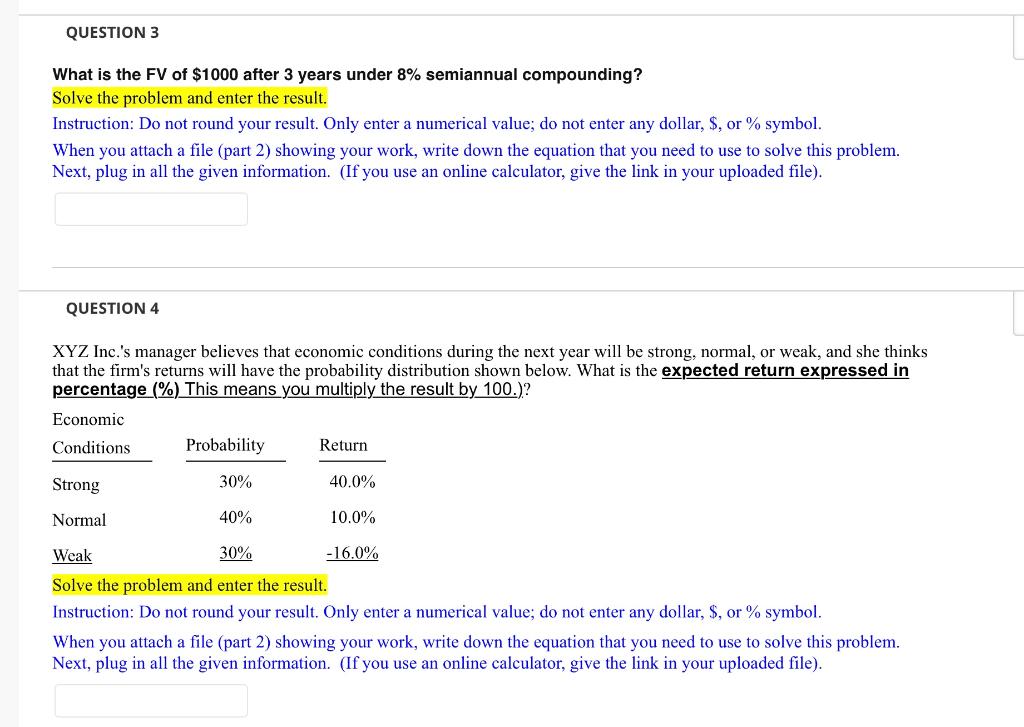

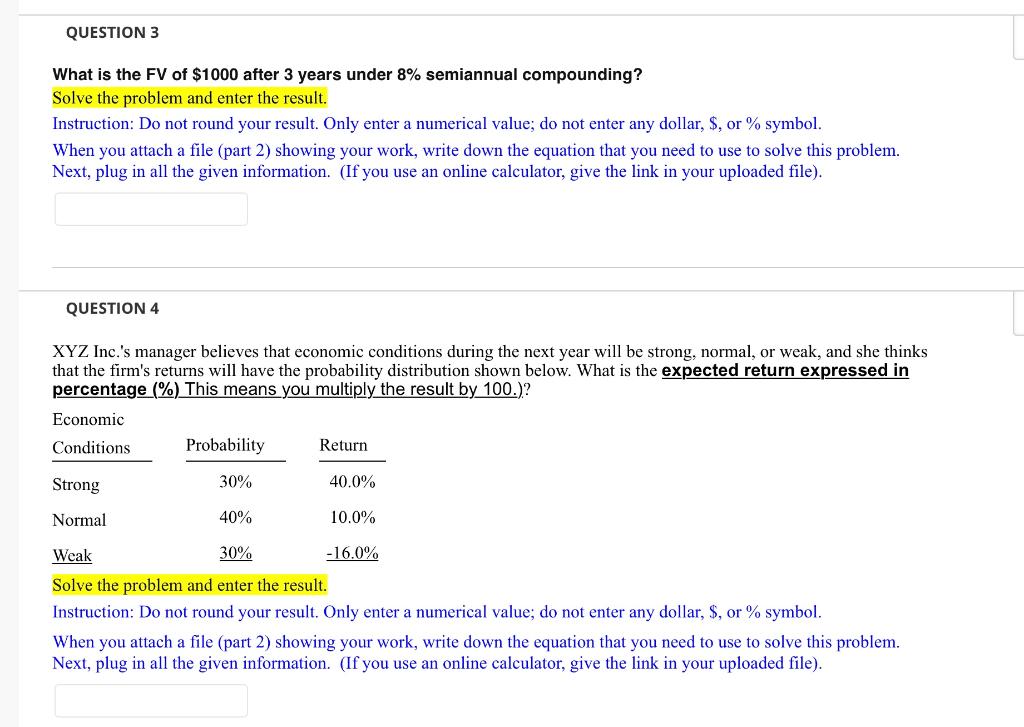

QUESTION 1 Suppose you have $850 and plan to purchase a 5-year certificate of deposit (CD) that pays 3.5% interest, compounded annually. How much will you have when the CD matures? Solve the problem and enter the result. Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 2 What is the present value of a security that will pay $20,000 in 10 years if securities of equal risk pay 4% annually? Solve the problem and enter the result. Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 3 What is the FV of $1000 after 3 years under 8% semiannual compounding? Solve the problem and enter the result. Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 4 XYZ Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What is the expected return expressed in percentage (%) This means you multiply the result by 100.)? Economic Conditions Probability 30% 40% Weak 30% Solve the problem and enter the result. Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. Strong Normal Return 40.0% 10.0% -16.0% When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file)