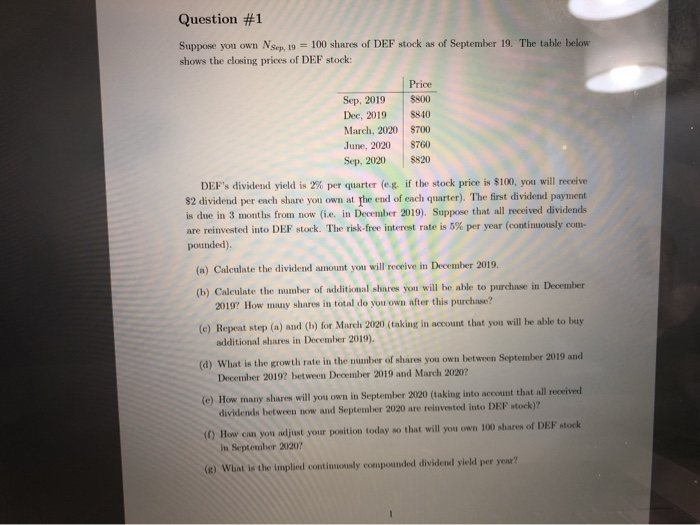

Question #1 Suppose you own NSep, 19 = 100 shares of DEF stock as of September 19. The table below shows the closing prices of DEF stock: Price

Sep, 2019 $800

Dec, 2019 $840

March, 2020 $700

June, 2020 $760

Sep, 2020 $820 DEFs dividend yield is 2% per quarter (e.g. if the stock price is $100, you will receive $2 dividend per each share you own at the end of each quarter). The rst dividend payment is due in 3 months from now (i.e. in December 2019). Suppose that all received dividends are reinvested into DEF stock. The risk-free interest rate is 5% per year (continuously compounded). (a) Calculate the dividend amount you will receive in December 2019. (b) Calculate the number of additional shares you will be able to purchase in December 2019? How many shares in total do you own after this purchase? (c) Repeat step (a) and (b) for March 2020 (taking in account that you will be able to buy additional shares in December 2019). (d) What is the growth rate in the number of shares you own between September 2019 and December 2019? between December 2019 and March 2020? (e) How many shares will you own in September 2020 (taking into account that all received dividends between now and September 2020 are reinvested into DEF stock)? (f) How can you adjust your position today so that will you own 100 shares of DEF stock in September 2020? (g) What is the implied continuously compounded dividend yield per year?

Question #1 Suppose you own NSep, 19 = 100 shares of DEF stock as of September 19. The table below shows the closing prices of DEF stock: Price Sep, 2019 Dec, 2019 March, 2020 June, 2020 Sep, 2020 8800 8840 $700 8760 8820 DEF's dividend yield is 2% per quarter (e. if the stock price is $100, you will receive 82 dividend per each share you own at the end of each quarter). The first dividend payment is due in 3 months from now (ie, in December 2019). Suppose that all received dividends are reinvested into DEF stock. The risk-free interest rate is 5% per year (continuously com- pounded) (a) Calculate the dividend amount you will receive in December 2019. (b) Calculate the mmber of additional shres you will be able to purchase in December 2019? How many shares in total do you own after this purchase? (c) Repeat step (w) and (b) for March 2020 (taking in account that you will be able to buy additional shares in December 2019). (a) What is the growth rate in the number of shares you own between September 2010 and December 2019? between December 2019 and March 20207 (c) How many shares will you own in September 2020 (taking into account that all received dividends between now and September 2020 are reinvested into DEF stock)? (0) How can you adjust your position today so that will you own 100 shares of DEF stock In September 20207 (e) What is the implied continuously compounded dividend yield per year? Question #1 Suppose you own NSep, 19 = 100 shares of DEF stock as of September 19. The table below shows the closing prices of DEF stock: Price Sep, 2019 Dec, 2019 March, 2020 June, 2020 Sep, 2020 8800 8840 $700 8760 8820 DEF's dividend yield is 2% per quarter (e. if the stock price is $100, you will receive 82 dividend per each share you own at the end of each quarter). The first dividend payment is due in 3 months from now (ie, in December 2019). Suppose that all received dividends are reinvested into DEF stock. The risk-free interest rate is 5% per year (continuously com- pounded) (a) Calculate the dividend amount you will receive in December 2019. (b) Calculate the mmber of additional shres you will be able to purchase in December 2019? How many shares in total do you own after this purchase? (c) Repeat step (w) and (b) for March 2020 (taking in account that you will be able to buy additional shares in December 2019). (a) What is the growth rate in the number of shares you own between September 2010 and December 2019? between December 2019 and March 20207 (c) How many shares will you own in September 2020 (taking into account that all received dividends between now and September 2020 are reinvested into DEF stock)? (0) How can you adjust your position today so that will you own 100 shares of DEF stock In September 20207 (e) What is the implied continuously compounded dividend yield per year