Question

Question 1: Suri Foods Inc. in a New Jersey based manufacturer of prepared, heat and serve Indian dishes for both the North American and European

Question 1: Suri Foods Inc. in a New Jersey based manufacturer of prepared, heat and serve Indian dishes for both the North American and European markets. It currently is earning an EBIT of $135 million. Its tax rate is 40.00% and it has a Weighted Cost of Capital of 18.00%. What is Suri Food's enterprise value?

Question 2:

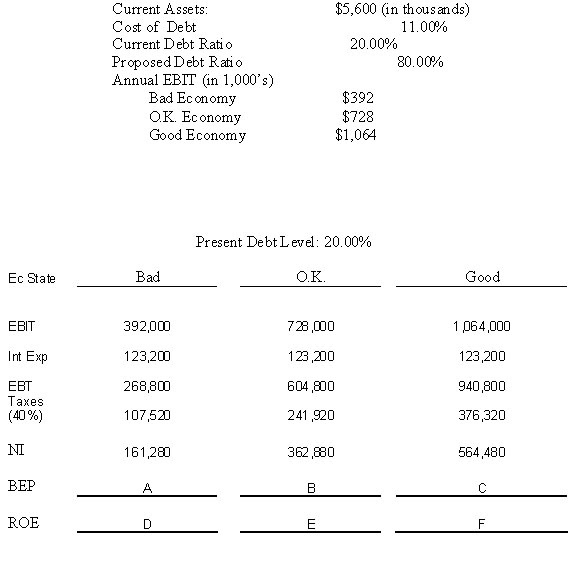

The above data describes certain features of Orfendi Ice Cream Inc., a small company that has developed a cult following as a sort of local Ben and Jerrys that supplies non-chain grocery stores and convenience stores with exotic ice cream flavors that can not be purchased elsewhere. It is a family owned company that has assets of $5.6 million and enjoys profits of around $362,000 per year. The core source of employment in the area is based on the aero space business which is highly cyclical but they have always managed to eke out a profit even in the worst of times. Recently a business consultant has advised them they are not getting the return on equity that might be expected from a firm of this kind and recommends that they increase their leverage. Below are data describing their current situation under different economic conditions. The scenario analysis follows.

Question 3:

In the tables above, the cell named 'A' should be,

In the table above, the cell labeled 'D' should be,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started