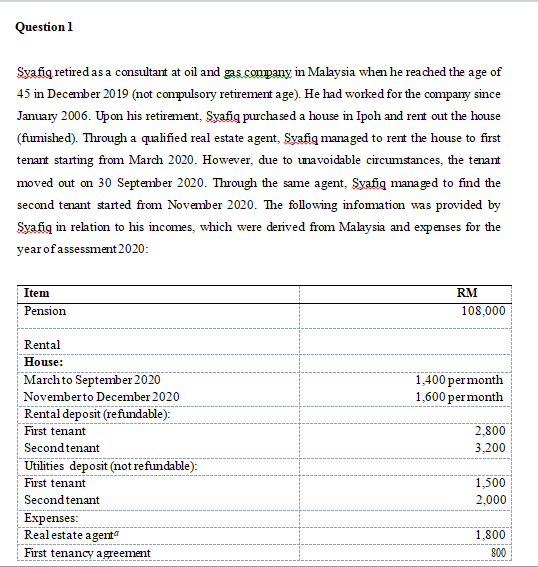

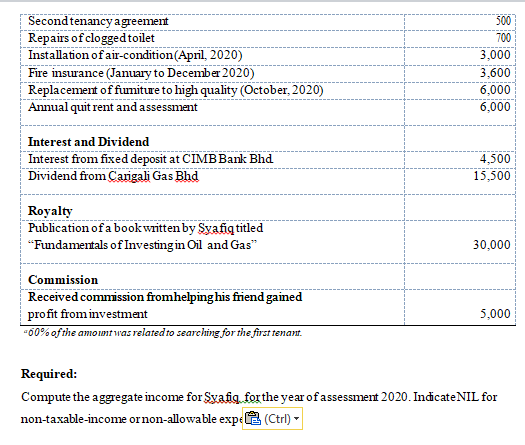

Question 1 Syafiq retired as a consultant at oil and as company in Malaysia when he reached the age of 45 in December 2019 (not compulsory retirement age). He had worked for the company since January 2006. Upon his retirement, Syafiq purchased a house in Ipoh and rent out the house (fuunished). Through a qualified real estate agent, Syafiq managed to rent the house to first tenart starting from March 2020. However, due to unavoidable circumstances, the tenant moved out on 30 September 2020. Through the same agent, Syafiq managed to find the second tenant started from November 2020. The following infomation was provided by Syafiq in relation to his incomes, which were derived from Malaysia and expenses for the year of assessment 2020: Item Pension RM 108,000 Rental 1,400 per month 1,600 per month 2.800 3.200 House: Marchto September 2020 Novemberto December 2020 Rental deposit (refundable): First tenant Second tenant Utilities deposit (not refundable): First tenant Second tenant Expenses: Real estate agenta First tenancy agreement 1,500 2,000 1.800 800 Second tenancy agreement Repairs of clogged toilet Installation of air-condition(April, 2020) Fire insurance (January to December 2020) Replacement of fiuniture to high quality (October, 2020) Annual quit rent and assessment 500 700 3,000 3,600 6,000 6,000 Interest and Dividend Interest from fixed deposit at CIMB Bank Bhd Dividend from Carigali Gas Bhd 4,500 15,500 Royalty Publication of a book written by Syafiq titled "Fundamentals of Investing in Oil and Gas 30,000 Commission Received commission fromhelping his friend gained profit from investment -60% of the amount was related to searching for the first tenant. 5,000 Required: Compute the aggregate income for Syafiq for the year of assessment 2020. Indicate NIL for non-taxable income or non-allowable exp (Ctrl) - Question 1 Syafiq retired as a consultant at oil and as company in Malaysia when he reached the age of 45 in December 2019 (not compulsory retirement age). He had worked for the company since January 2006. Upon his retirement, Syafiq purchased a house in Ipoh and rent out the house (fuunished). Through a qualified real estate agent, Syafiq managed to rent the house to first tenart starting from March 2020. However, due to unavoidable circumstances, the tenant moved out on 30 September 2020. Through the same agent, Syafiq managed to find the second tenant started from November 2020. The following infomation was provided by Syafiq in relation to his incomes, which were derived from Malaysia and expenses for the year of assessment 2020: Item Pension RM 108,000 Rental 1,400 per month 1,600 per month 2.800 3.200 House: Marchto September 2020 Novemberto December 2020 Rental deposit (refundable): First tenant Second tenant Utilities deposit (not refundable): First tenant Second tenant Expenses: Real estate agenta First tenancy agreement 1,500 2,000 1.800 800 Second tenancy agreement Repairs of clogged toilet Installation of air-condition(April, 2020) Fire insurance (January to December 2020) Replacement of fiuniture to high quality (October, 2020) Annual quit rent and assessment 500 700 3,000 3,600 6,000 6,000 Interest and Dividend Interest from fixed deposit at CIMB Bank Bhd Dividend from Carigali Gas Bhd 4,500 15,500 Royalty Publication of a book written by Syafiq titled "Fundamentals of Investing in Oil and Gas 30,000 Commission Received commission fromhelping his friend gained profit from investment -60% of the amount was related to searching for the first tenant. 5,000 Required: Compute the aggregate income for Syafiq for the year of assessment 2020. Indicate NIL for non-taxable income or non-allowable exp (Ctrl)