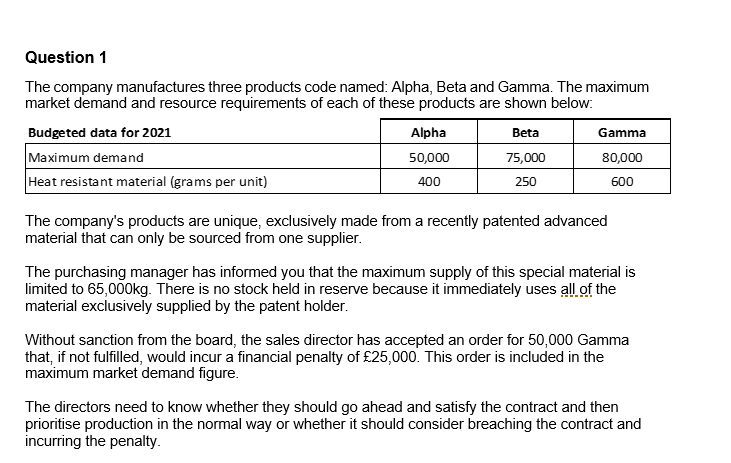

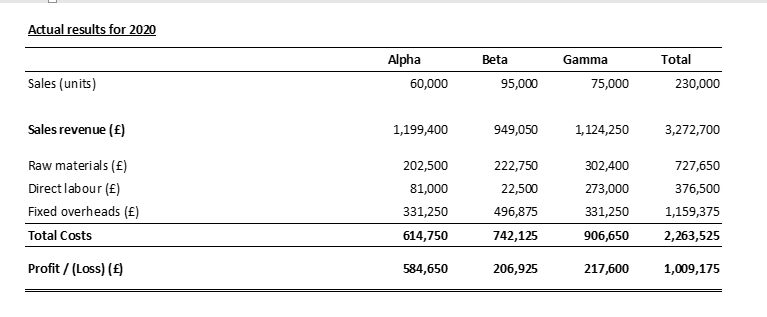

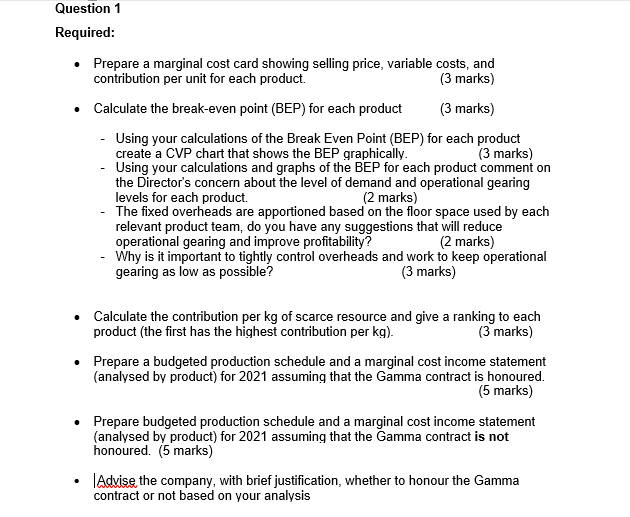

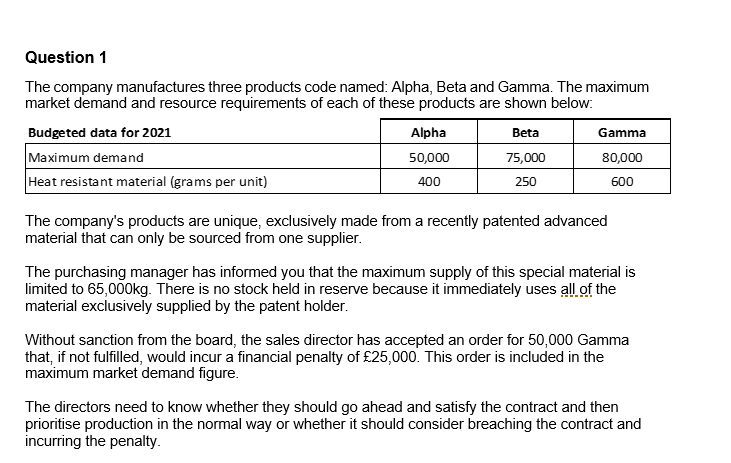

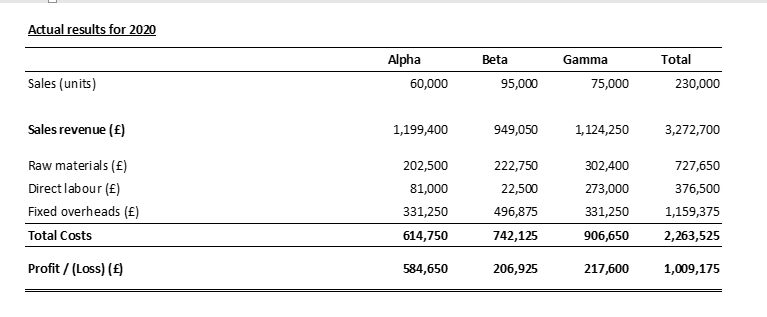

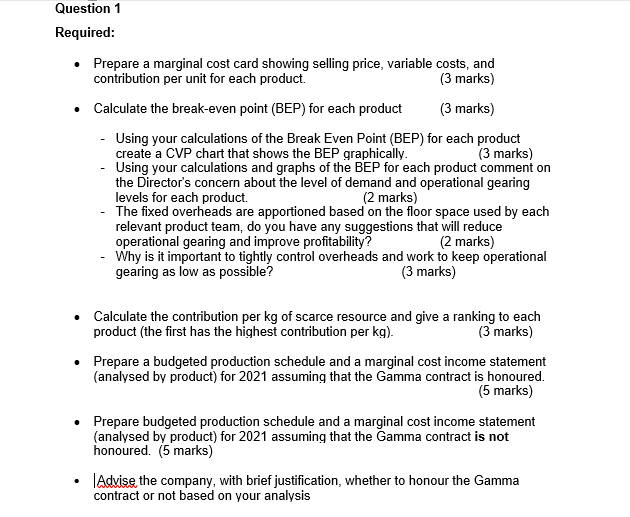

Question 1 The company manufactures three products code named: Alpha, Beta and Gamma. The maximum market demand and resource requirements of each of these products are shown below. Budgeted data for 2021 Alpha Beta Gamma Maximum demand 50,000 75,000 80,000 Heat resistant material (grams per unit) 400 600 250 The company's products are unique, exclusively made from a recently patented advanced material that can only be sourced from one supplier. The purchasing manager has informed you that the maximum supply of this special material is limited to 65,000kg. There is no stock held in reserve because it immediately uses all of the material exclusively supplied by the patent holder. Without sanction from the board, the sales director has accepted an order for 50,000 Gamma that, if not fulfilled, would incur a financial penalty of 25,000. This order is included in the maximum market demand figure. The directors need to know whether they should go ahead and satisfy the contract and then prioritise production in the normal way or whether it should consider breaching the contract and incurring the penalty. Actual results for 2020 Alpha 60,000 Beta 95,000 Gamma 75,000 Total 230,000 Sales (units) Sales revenue (E) 1,199,400 949,050 1,124,250 3,272,700 Raw materials () Direct labour () Fixed overheads (E) Total Costs 202,500 81,000 331,250 614,750 222,750 22,500 496,875 742,125 302,400 273,000 331,250 906,650 727,650 376,500 1,159,375 2,263,525 Profit /(Loss) (6) 584,650 206,925 217,600 1,009,175 Question 1 Required: Prepare a marginal cost card showing selling price, variable costs, and contribution per unit for each product. (3 marks) Calculate the break-even point (BEP) for each product (3 marks) - Using your calculations of the Break Even Point (BEP) for each product create a CVP chart that shows the BEP graphically. (3 marks) Using your calculations and graphs of the BEP for each product comment on the Director's concern about the level of demand and operational gearing levels for each product. (2 marks) - The fixed overheads are apportioned based on the floor space used by each relevant product team, do you have any suggestions that will reduce operational gearing and improve profitability? (2 marks) - Why is it important to tightly control overheads and work to keep operational gearing as low as possible? (3 marks) Calculate the contribution per kg of scarce resource and give a ranking to each product (the first has the highest contribution per kg). (3 marks) Prepare a budgeted production schedule and a marginal cost income statement (analysed by product) for 2021 assuming that the Gamma contract is honoured. (5 marks) Prepare budgeted production schedule and a marginal cost income statement (analysed by product) for 2021 assuming that the Gamma contract is not honoured. (5 marks) |Advise the company, with brief justification, whether to honour the Gamma contract or not based on your analysis