Answered step by step

Verified Expert Solution

Question

1 Approved Answer

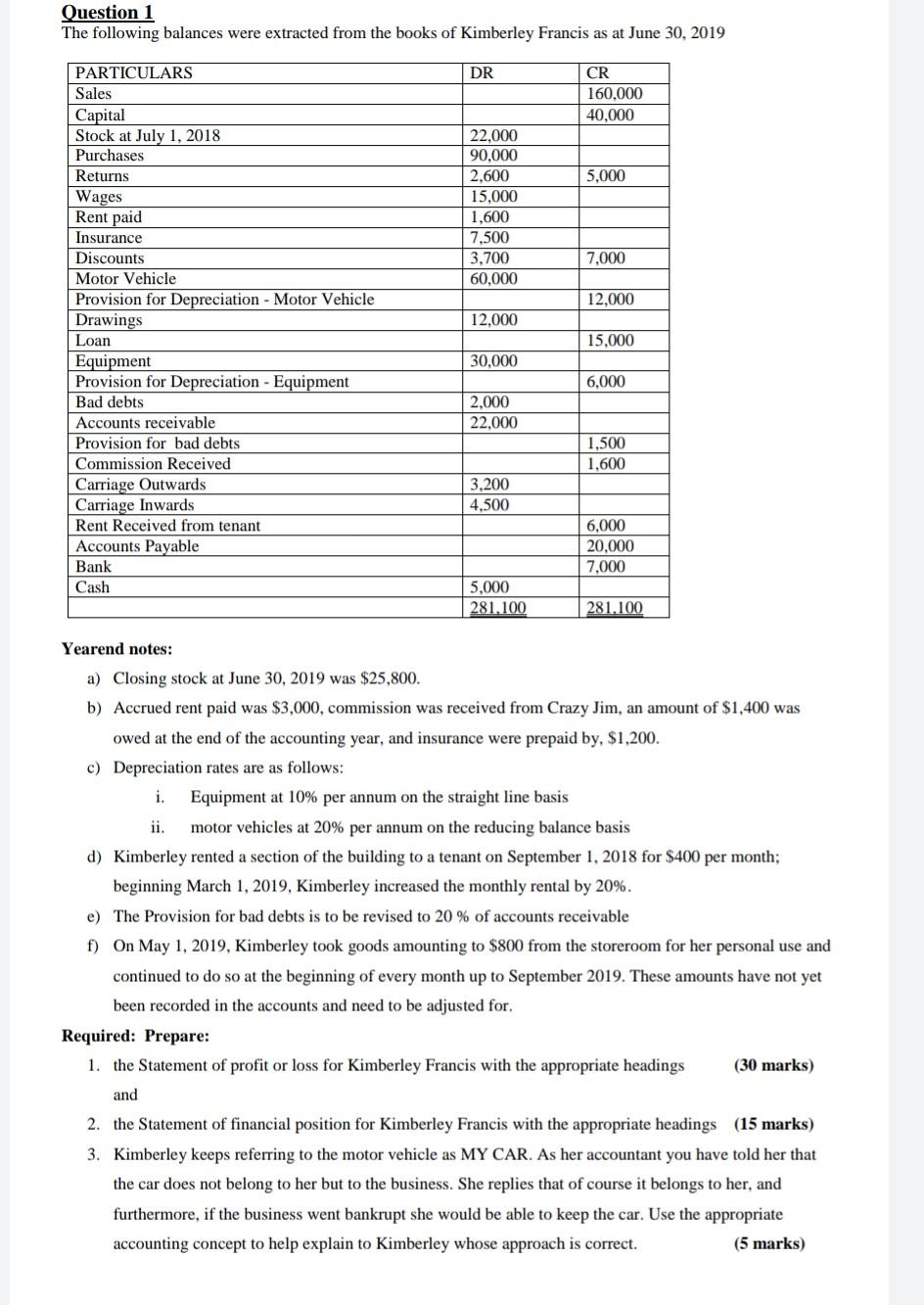

Question 1 The following balances were extracted from the books of Kimberley Francis as at June 30, 2019 DR PARTICULARS Sales Capital Stock at July

Question 1 The following balances were extracted from the books of Kimberley Francis as at June 30, 2019 DR PARTICULARS Sales Capital Stock at July 1, 2018 Purchases Returns CR 160,000 40,000 5,000 Wages Rent paid 22.000 90.000 2.600 15,000 1,600 7,500 3,700 60,000 7,000 12,000 12,000 15,000 30,000 6,000 Insurance Discounts Motor Vehicle Provision for Depreciation - Motor Vehicle Drawings Loan Equipment Provision for Depreciation - Equipment Bad debts Accounts receivable Provision for bad debts Commission Received Carriage Outwards Carriage Inwards Rent Received from tenant Accounts Payable Bank Cash 2.000 22,000 1,500 1.600 3,200 4,500 6,000 20,000 7.000 5.000 281.100 281.100 Yearend notes: a) Closing stock at June 30, 2019 was $25,800. b) Accrued rent paid was $3,000, commission was received from Crazy Jim, an amount of $1,400 was owed at the end of the accounting year, and insurance were prepaid by, $1,200. c) Depreciation rates are as follows: i. Equipment at 10% per annum on the straight line basis ii. motor vehicles at 20% per annum on the reducing balance basis d) Kimberley rented a section of the building to a tenant on September 1, for $400 per month; beginning March 1, 2019, Kimberley increased the monthly rental by 20%. e) The Provision for bad debts is to be revised to 20% of accounts receivable f) On May 1, 2019, Kimberley took goods amounting to $800 from the storeroom for her personal use and continued to do so at the beginning of every month up to September 2019. These amounts have not yet been recorded in the accounts and need to be adjusted for Required: Prepare: 1. the Statement of profit or loss for Kimberley Francis with the appropriate headings (30 marks) and 2. the Statement of financial position for Kimberley Francis with the appropriate headings (15 marks) 3. Kimberley keeps referring to the motor vehicle as MY CAR. As her accountant you have told her that the car does not belong to her but to the business. She replies that of course it belongs to her, and furthermore, if the business went bankrupt she would be able to keep the car. Use the appropriate accounting concept to help explain to Kimberley whose approach is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started