Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The following balances were extracted from the books of Yoji Itadori as at December 3 1 , 2 0 2 1 . He

Question

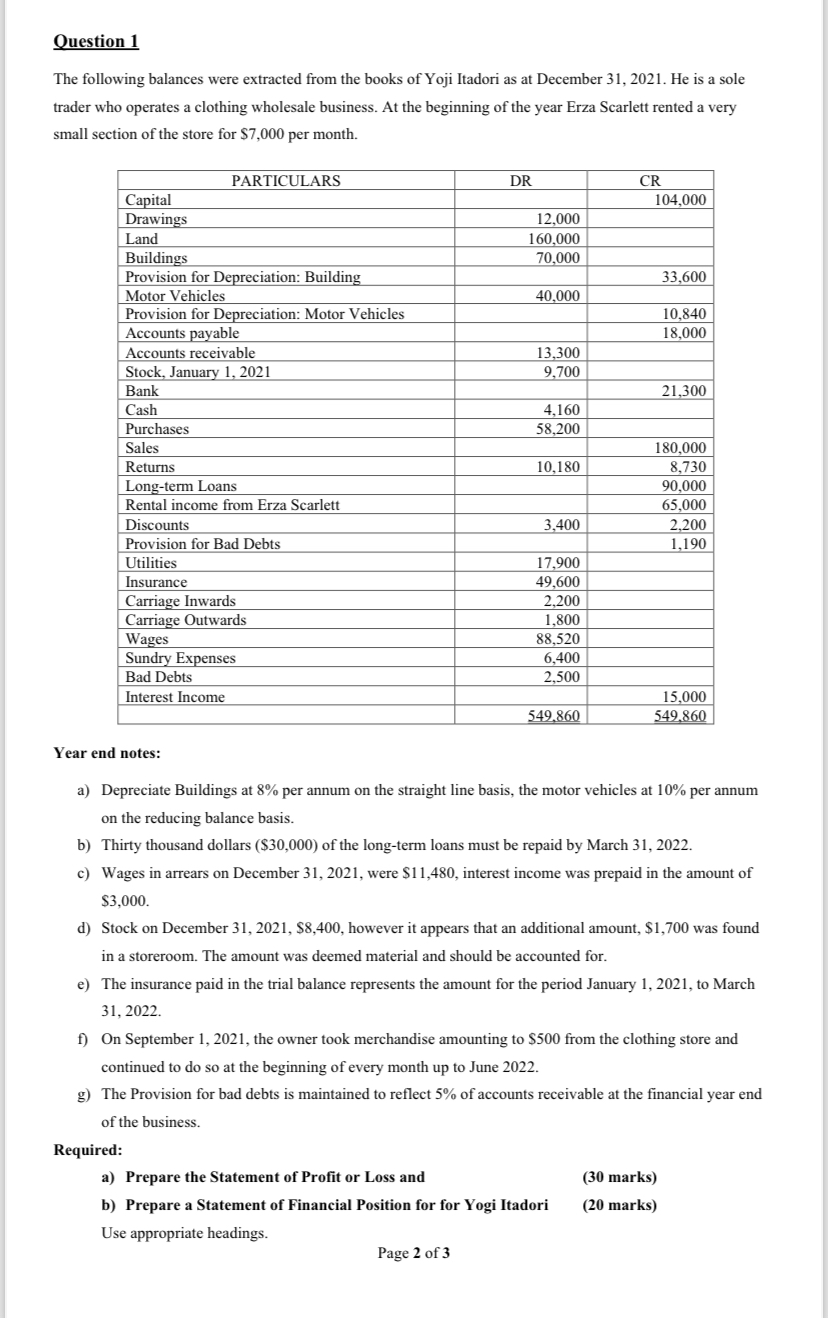

The following balances were extracted from the books of Yoji Itadori as at December He is a sole trader who operates a clothing wholesale business. At the beginning of the year Erza Scarlett rented a very small section of the store for $ per month.

tablePARTICULARSDRCRCapitalDrawingsLandBuildingsProvision for Depreciation: Building,Motor Vehicles,,Provision for Depreciation: Motor Vehicles,,Accounts payable,Accounts receivable,Stock January BankCashPurchasesSalesReturnsLongterm Loans,,Rental income from Erza Scarlett,DiscountsProvision for Bad Debts,UtilitiesInsuranceCarriage Inwards,Carriage Outwards,WagesSundry Expenses,Bad Debts,,Interest Income,

Year end notes:

a Depreciate Buildings at per annum on the straight line basis, the motor vehicles at per annum on the reducing balance basis.

b Thirty thousand dollars $ of the longterm loans must be repaid by March

c Wages in arrears on December were $ interest income was prepaid in the amount of $

d Stock on December $ however it appears that an additional amount, $ was found in a storeroom. The amount was deemed material and should be accounted for.

e The insurance paid in the trial balance represents the amount for the period January to March

f On September the owner took merchandise amounting to $ from the clothing store and continued to do so at the beginning of every month up to June

g The Provision for bad debts is maintained to reflect of accounts receivable at the financial year end of the business.

Required:

a Prepare the Statement of Profit or Loss and

b Prepare a Statement of Financial Position for for Yogi Itadori

Use appropriate headings.

marks

marks

Page of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started