Answered step by step

Verified Expert Solution

Question

1 Approved Answer

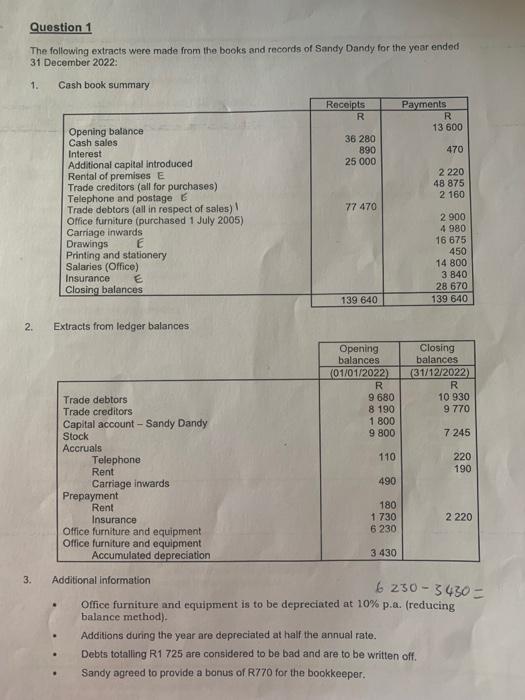

Question 1 The following extracts were made from the books and records of Sandy Dandy for the year ended 31 December 2022: Cash book summary

Question 1 The following extracts were made from the books and records of Sandy Dandy for the year ended 31 December 2022: Cash book summary 1. 2. 3. Opening balance Cash sales Interest Additional capital introduced Rental of premises E Trade creditors (all for purchases) Telephone and postage E Trade debtors (all in respect of sales) Office furniture (purchased 1 July 2005) Carriage inwards Drawings E Printing and stationery Salaries (Office) Insurance E Closing balances Extracts from ledger balances Trade debtors Trade creditors Capital account - Sandy Dandy Stock Accruals Telephone Rent Carriage inwards Prepayment Rent Insurance Office furniture and equipment Office furniture and equipment Accumulated depreciation Receipts R Additional information 36 280 890 25 000 77 470 139 640 Opening balances (01/01/2022) R 9 680 8 190 1 800 9 800 110 490 180 1 730 6 230 3 430 Payments R 13 600 470 Additions during the year are depreciated at half the annual rate. Debts totalling R1 725 are considered to be bad and are to be written off. Sandy agreed to provide a bonus of R770 for the bookkeeper. 2 220 48 875 2 160 2 900 4 980 16 675 450 14 800 3 840 28 670 139 640 Closing balances (31/12/2022) R 10 930 9 770 7 245 220 190 6230-3430 = Office furniture and equipment is to be depreciated at 10% p.a. (reducing balance method). 2 220

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started