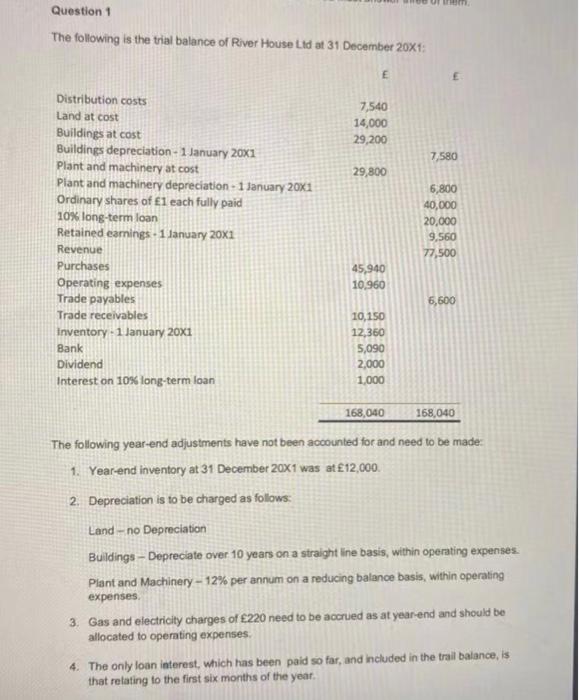

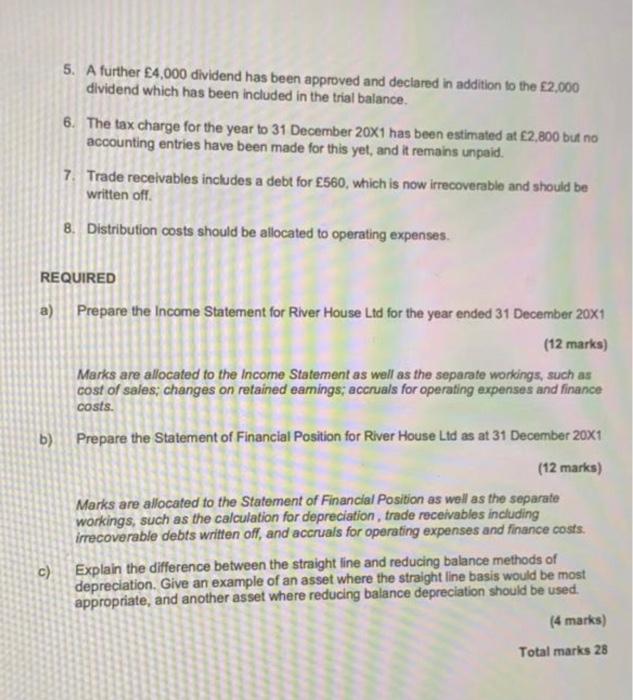

Question 1 The following is the trial balance of River House Lid at 31 December 20X1: E 7,540 14,000 29,200 7,580 29,800 Distribution costs Land at cost Buildings at cost Buildings depreciation - 1 January 20X1 Plant and machinery at cost Plant and machinery depreciation - 1 January 20X1 Ordinary shares of 1 each fully paid 10% long-term loan Retained earnings - 1 January 20X1 Revenue Purchases Operating expenses Trade payables Trade receivables inventory - 1 January 20X1 Bank Dividend Interest on 10% long-term loan 6,800 40,000 20,000 9,560 77,500 45,940 10.960 5,600 10,150 12,360 5,090 2,000 1,000 168,040 168,040 The following year-end adjustments have not been accounted for and need to be made: 1. Year-end inventory at 31 December 20X 1 was at 12,000 2. Depreciation is to be charged as follows: Land -no Depreciation Buildings - Depreciate over 10 years on a straight line basis, within operating expenses. Plant and Machinery - 12% per annum on a reducing balance basis, within operating expenses 3. Gas and electricity charges of 220 need to be accrued as at year-end and should be allocated to operating expenses 4. The only loan interest, which has been paid so far, and included in the trail balance, is that relating to the first six months of the year. 5. A further 4,000 dividend has been approved and declared in addition to the 2,000 dividend which has been included in the trial balance 6. The tax charge for the year to 31 December 20X1 has been estimated at 2,800 but no accounting entries have been made for this yet, and it remains unpaid. 7. Trade receivables includes a debt for 560, which is now irrecoverable and should be written off 8. Distribution costs should be allocated to operating expenses. REQUIRED a) Prepare the Income Statement for River House Ltd for the year ended 31 December 20X1 (12 marks) Marks are allocated to the Income Statement as well as the separate workings, such as cost of sales, changes on retained earnings; accruals for operating expenses and finance costs. b) Prepare the Statement of Financial Position for River House Ltd as at 31 December 20x1 (12 marks) Marks are allocated to the Statement of Financial Position as well as the separate workings, such as the calculation for depreciation, trade receivables including irrecoverable debts written off, and accruals for operating expenses and finance costs. c) Explain the difference between the straight line and reducing balance methods of depreciation. Give an example of an asset where the straight line basis would be most appropriate, and another asset where reducing balance depreciation should be used. (4 marks) Total marks 28