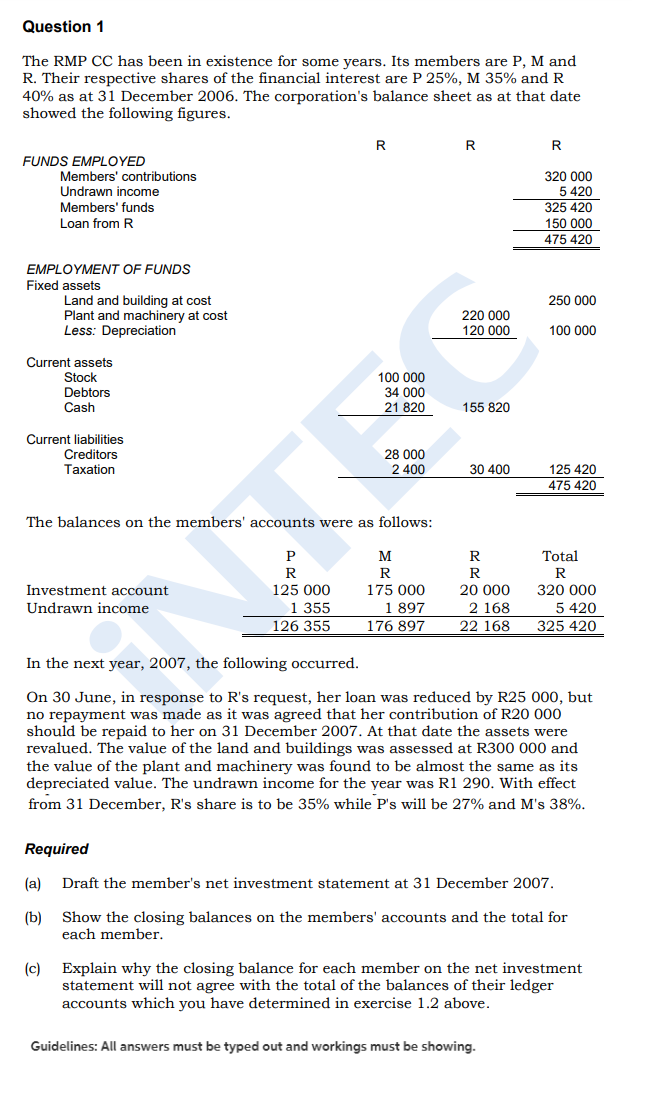

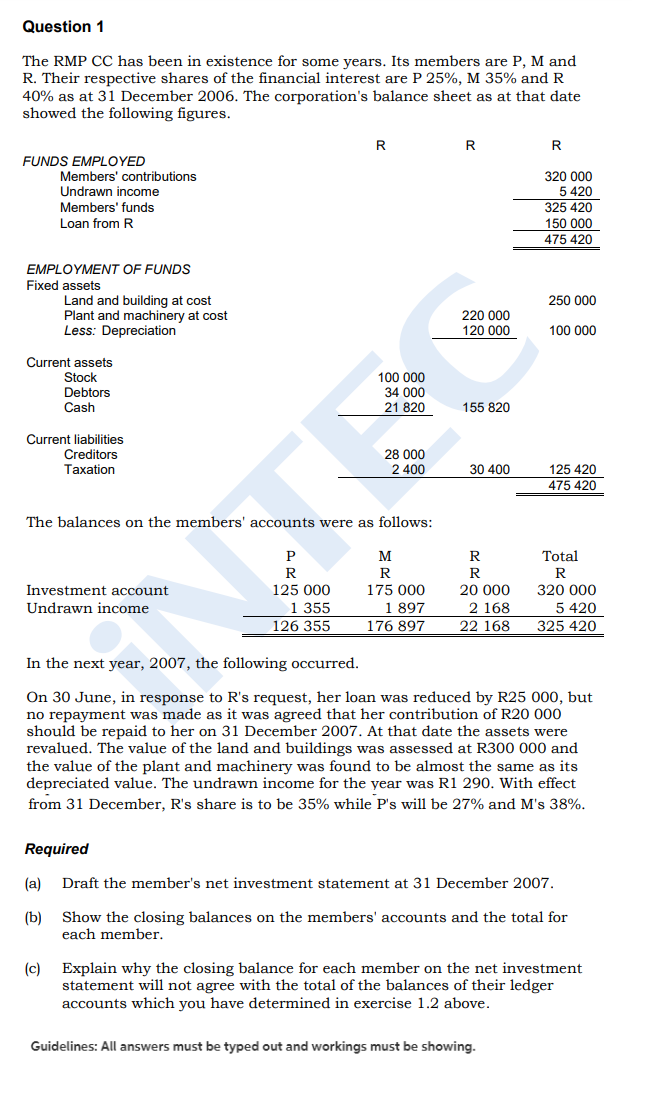

Question 1 The RMP CC has been in existence for some years. Its members are P, M and R. Their respective shares of the financial interest are P 25%, M 35% and R 40% as at 31 December 2006. The corporation's balance sheet as at that date showed the following figures. R R R FUNDS EMPLOYED Members' contributions Undrawn income Members' funds Loan from R 320 000 5420 325 420 150 000 475 420 EMPLOYMENT OF FUNDS Fixed assets Land and building at cost Plant and machinery at cost Less: Depreciation 250 000 220 000 120 000 100 000 Current assets Stock Debtors Cash 100 000 34 000 21 820 155 820 Current liabilities Creditors Taxation 28 000 2 400 30 400 125 420 475 420 The balances on the members' accounts were as follows: Investment account Undrawn income P R 125 000 1 355 126 355 M R 175 000 1 897 176 897 R R 20 000 2 168 22 168 Total R 320 000 5 420 325 420 In the next year, 2007, the following occurred. On 30 June, in response to R's request, her loan was reduced by R25 000, but no repayment was made as it was agreed that her contribution of R20 000 should be repaid to her on 31 December 2007. At that date the assets were revalued. The value of the land and buildings was assessed at R300 000 and the value of the plant and machinery was found to be almost the same as its depreciated value. The undrawn income for the year was R1 290. With effect from 31 December, R's share is to be 35% while P's will be 27% and M's 38%. Required (a) Draft the member's net investment statement at 31 December 2007. (b) Show the closing balances on the members' accounts and the total for each member. (c) Explain why the closing balance for each member on the net investment statement will not agree with the total of the balances of their ledger accounts which you have determined in exercise 1.2 above. Guidelines: All answers must be typed out and workings must be showing. Question 1 The RMP CC has been in existence for some years. Its members are P, M and R. Their respective shares of the financial interest are P 25%, M 35% and R 40% as at 31 December 2006. The corporation's balance sheet as at that date showed the following figures. R R R FUNDS EMPLOYED Members' contributions Undrawn income Members' funds Loan from R 320 000 5420 325 420 150 000 475 420 EMPLOYMENT OF FUNDS Fixed assets Land and building at cost Plant and machinery at cost Less: Depreciation 250 000 220 000 120 000 100 000 Current assets Stock Debtors Cash 100 000 34 000 21 820 155 820 Current liabilities Creditors Taxation 28 000 2 400 30 400 125 420 475 420 The balances on the members' accounts were as follows: Investment account Undrawn income P R 125 000 1 355 126 355 M R 175 000 1 897 176 897 R R 20 000 2 168 22 168 Total R 320 000 5 420 325 420 In the next year, 2007, the following occurred. On 30 June, in response to R's request, her loan was reduced by R25 000, but no repayment was made as it was agreed that her contribution of R20 000 should be repaid to her on 31 December 2007. At that date the assets were revalued. The value of the land and buildings was assessed at R300 000 and the value of the plant and machinery was found to be almost the same as its depreciated value. The undrawn income for the year was R1 290. With effect from 31 December, R's share is to be 35% while P's will be 27% and M's 38%. Required (a) Draft the member's net investment statement at 31 December 2007. (b) Show the closing balances on the members' accounts and the total for each member. (c) Explain why the closing balance for each member on the net investment statement will not agree with the total of the balances of their ledger accounts which you have determined in exercise 1.2 above. Guidelines: All answers must be typed out and workings must be showing