Answered step by step

Verified Expert Solution

Question

1 Approved Answer

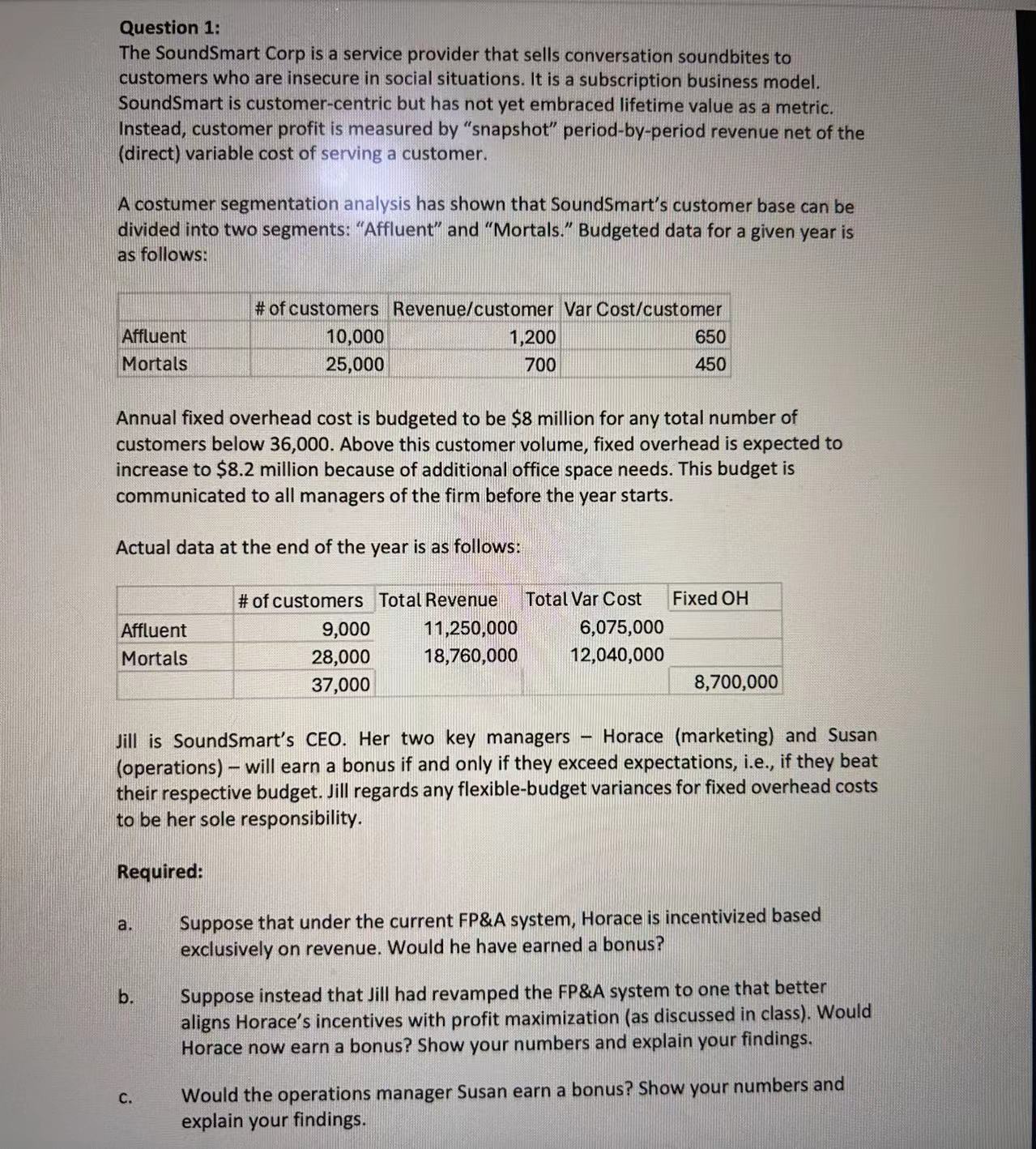

Question 1 : The SoundSmart Corp is a service provider that sells conversation soundbites to customers who are insecure in social situations. It is a

Question :

The SoundSmart Corp is a service provider that sells conversation soundbites to

customers who are insecure in social situations. It is a subscription business model.

SoundSmart is customercentric but has not yet embraced lifetime value as a metric.

Instead, customer profit is measured by "snapshot" periodbyperiod revenue net of the

direct variable cost of serving a customer.

A costumer segmentation analysis has shown that SoundSmart's customer base can be

divided into two segments: "Affluent" and "Mortals." Budgeted data for a given year is

as follows:

Annual fixed overhead cost is budgeted to be $ million for any total number of

customers below Above this customer volume, fixed overhead is expected to

increase to $ million because of additional office space needs. This budget is

communicated to all managers of the firm before the year starts.

Actual data at the end of the year is as follows:

Jill is SoundSmart's CEO. Her two key managers Horace marketing and Susan

operations will earn a bonus if and only if they exceed expectations, ie if they beat

their respective budget. Jill regards any flexiblebudget variances for fixed overhead costs

to be her sole responsibility.

Required:

a Suppose that under the current FP&A system, Horace is incentivized based

exclusively on revenue. Would he have earned a bonus?

b Suppose instead that Jill had revamped the FP&A system to one that better

aligns Horace's incentives with profit maximization as discussed in class Would

Horace now earn a bonus? Show your numbers and explain your findings.

c Would the operations manager Susan earn a bonus? Show your numbers and

explain your findings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started