Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The sustainability manager is concerned about the long term sustainability implications of Deluxe Boxes on the environment and suggests changing to sustainable

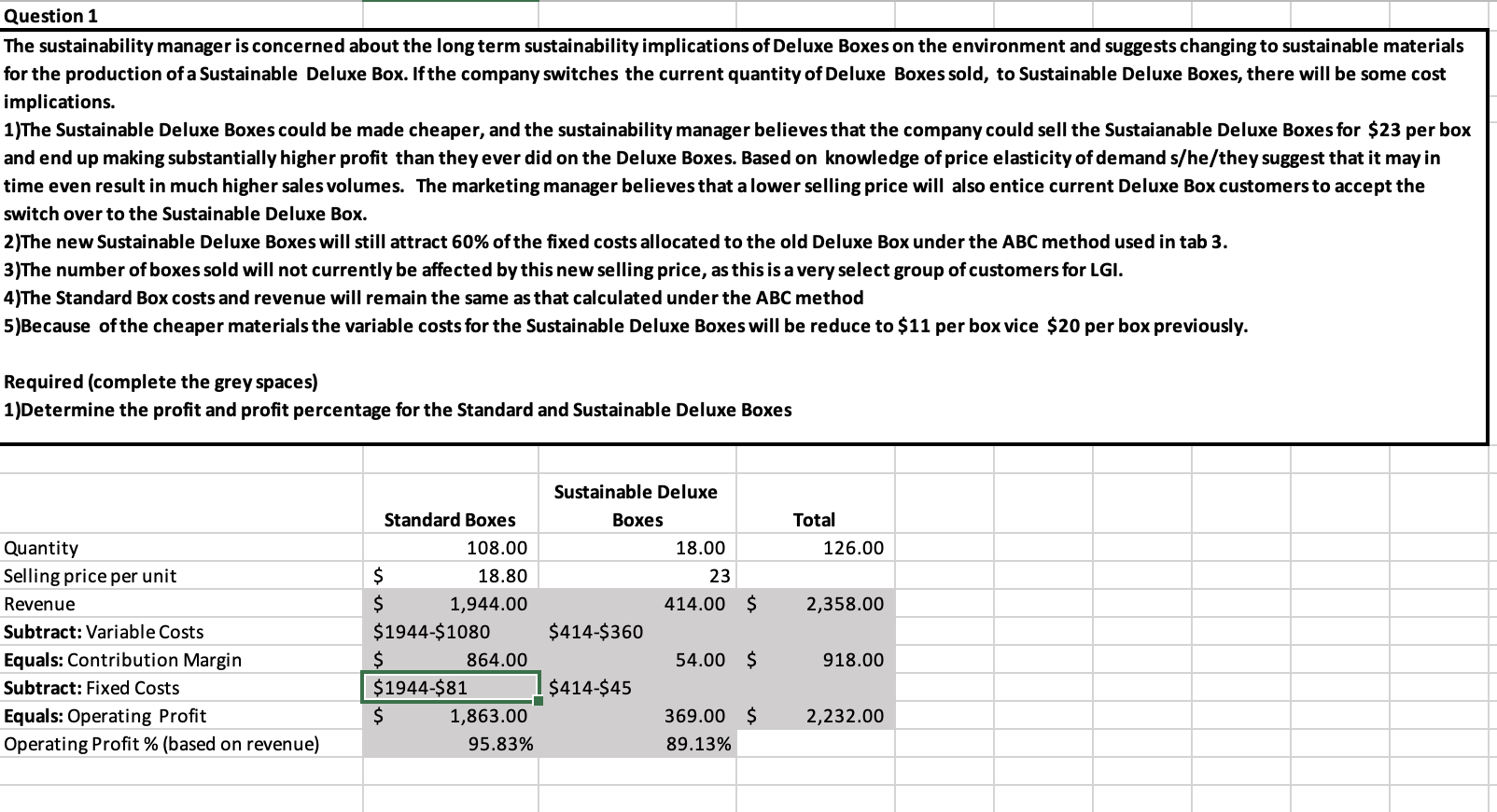

Question 1 The sustainability manager is concerned about the long term sustainability implications of Deluxe Boxes on the environment and suggests changing to sustainable materials for the production of a Sustainable Deluxe Box. If the company switches the current quantity of Deluxe Boxes sold, to Sustainable Deluxe Boxes, there will be some cost implications. 1)The Sustainable Deluxe Boxes could be made cheaper, and the sustainability manager believes that the company could sell the Sustainable Deluxe Boxes for $23 per box and end up making substantially higher profit than they ever did on the Deluxe Boxes. Based on knowledge of price elasticity of demand s/he/they suggest that it may in time even result in much higher sales volumes. The marketing manager believes that a lower selling price will also entice current Deluxe Box customers to accept the switch over to the Sustainable Deluxe Box. 2)The new Sustainable Deluxe Boxes will still attract 60% of the fixed costs allocated to the old Deluxe Box under the ABC method used in tab 3. 3)The number of boxes sold will not currently be affected by this new selling price, as this is a very select group of customers for LGI. 4)The Standard Box costs and revenue will remain the same as that calculated under the ABC method 5)Because of the cheaper materials the variable costs for the Sustainable Deluxe Boxes will be reduce to $11 per box vice $20 per box previously. Required (complete the grey spaces) 1)Determine the profit and profit percentage for the Standard and Sustainable Deluxe Boxes Sustainable Deluxe Standard Boxes Boxes Total Quantity 108.00 Selling price per unit $ Revenue $ 18.80 1,944.00 18.00 23 414.00 $ 126.00 2,358.00 Subtract: Variable Costs $1944-$1080 $414-$360 Equals: Contribution Margin $ 864.00 54.00 $ 918.00 Subtract: Fixed Costs $1944-$81 $414-$45 Equals: Operating Profit $ Operating Profit % (based on revenue) 1,863.00 95.83% 369.00 $ 89.13% 2,232.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started