Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 The transactions of Samson Company for the month of March, 2023 are given below: a. Samson, owner, invested $100,750 cash in the

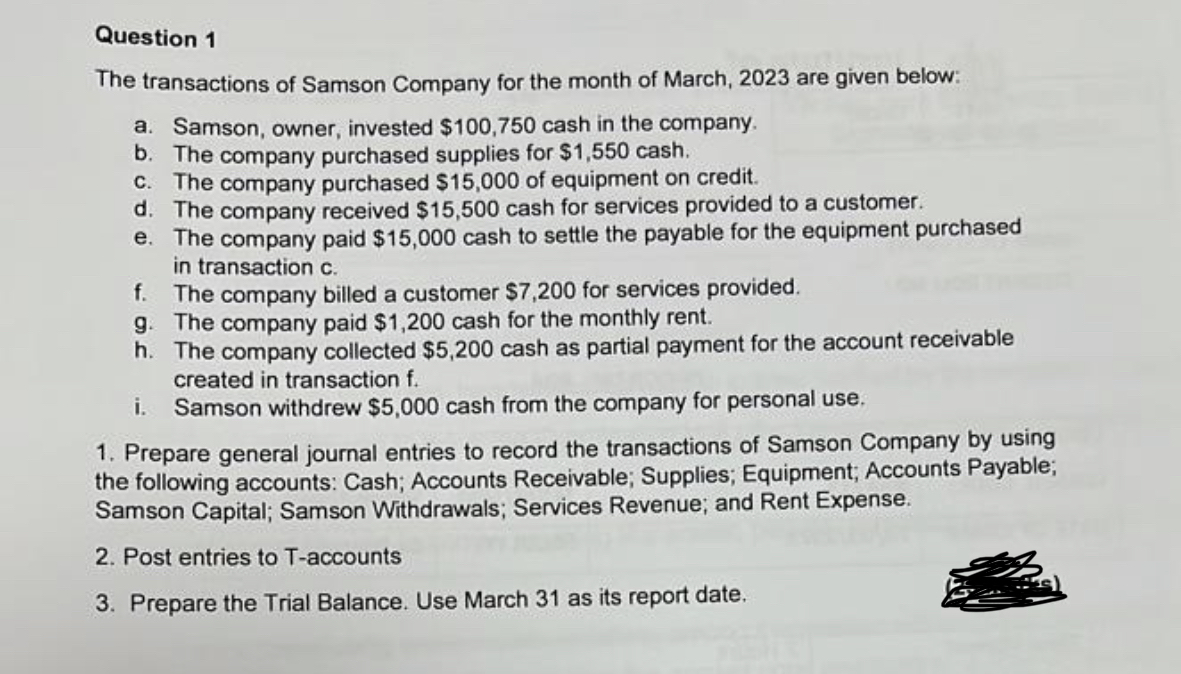

Question 1 The transactions of Samson Company for the month of March, 2023 are given below: a. Samson, owner, invested $100,750 cash in the company. b. The company purchased supplies for $1,550 cash. C. The company purchased $15,000 of equipment on credit. d. The company received $15,500 cash for services provided to a customer. e. The company paid $15,000 cash to settle the payable for the equipment purchased f. in transaction c. The company billed a customer $7,200 for services provided. g. The company paid $1,200 cash for the monthly rent. h. The company collected $5,200 cash as partial payment for the account receivable created in transaction f. i. Samson withdrew $5,000 cash from the company for personal use. 1. Prepare general journal entries to record the transactions of Samson Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Samson Capital; Samson Withdrawals; Services Revenue; and Rent Expense. 2. Post entries to T-accounts 3. Prepare the Trial Balance. Use March 31 as its report date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 General Journal Entries a Samson owner invested 100750 cash in the company Debit Cash 100750 Credit Samson Capital 100750 b The company purchased su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started